Peak Inflation = Peak Rates?

July 26, 2022

Read Time 2 MIN

Brazil Inflation, Frontloading

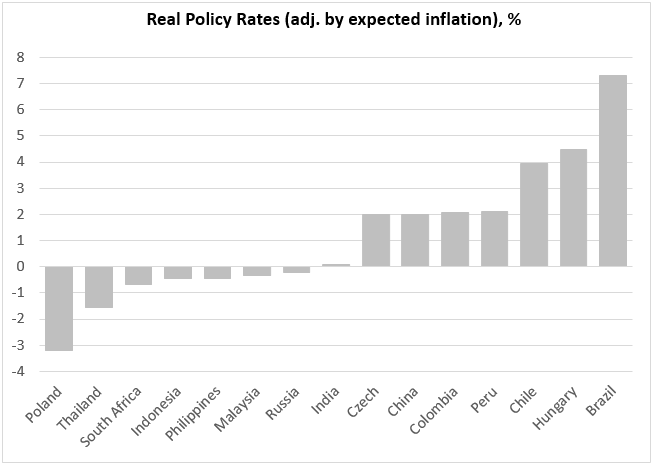

Moderating mid-month inflation in Brazil gave us hope that peak-inflation might actually be real. Headline inflation eased a tiny bit more than expected to 11.39% year-on-year – an encouraging sign for the consensus expectations that see inflation falling to 8.5% by the end of the year and further to 6% in 12 months. For this scenario to materialize, it is important that (a) the inflation diffusion index continues to go down, and (b) the government does not get carried away by its fiscal successes and stops expanding its spending plans. If this happens, Brazil would have by far the highest real policy rate among major emerging markets (EM) (see chart below), which should give it plenty of space to finish its tightening cycle in September, and maybe start thinking about rate cuts sometime in 2023.

EM Real Policy Rates

The most incredible point about the chart below is not Brazil’s sky-high real policy rate, but that it is followed by Hungary, which until recently was among EM policy laggards. And it was duly punished by the market, having posted the second worst local debt return so far this year (in the J.P. Morgan’s GBI-EM Index). But if you have the same inflation as in Brazil (11.7% year-on-year), perhaps your central bank should adopt Brazil’s response function – which means aggressively frontloading rate hikes. Hungary did not disappoint today, raising its policy rate by 100bps more (after a double punch of +185bps and +200bps). So, Hungary’s policy rate is now in double digits for the first time since the global financial crisis of 2008/09 – and, as we just said, the real policy rate adjusted by expected inflation is now the second highest in EM. This created a significant policy cushion, but it’s absolutely critical to proceed with fiscal adjustment, as spending got a bit out of control in the run up to the elections.

Terminal Rates in DM

The notion of peak rates features prominently in developed markets (DM) discussions as well. Today’s weaker than expected Conference Board consumer confidence index in the U.S. raised additional concerns about the Q3 growth headwinds – right in the run up to the U.S. Federal Reserve’s (Fed’s) meeting tomorrow. The expectation (measured by the Fed Funds Futures) is still for a 75bps rate hike, but the market sees no additional hikes after December. A series of downside activity surprises in the Eurozone – and negative headlines about the Russian gas exports’ disruptions – depressed the market expectations for the European Central Bank (ECB), which is now expected to take a pause after March 2023. Stay tuned!

Chart at a Glance: Real Policy Rates in EM – Some Central Banks Get It

Source: VanEck Research; Bloomberg LP

Follow Us

PMI – Purchasing Managers’ Index: economic indicators derived from monthly surveys of private sector companies. A reading above 50 indicates expansion, and a reading below 50 indicates contraction; ISM – Institute for Supply Management PMI: ISM releases an index based on more than 400 purchasing and supply managers surveys; both in the manufacturing and non-manufacturing industries; CPI – Consumer Price Index: an index of the variation in prices paid by typical consumers for retail goods and other items; PPI – Producer Price Index: a family of indexes that measures the average change in selling prices received by domestic producers of goods and services over time; PCE inflation – Personal Consumption Expenditures Price Index: one measure of U.S. inflation, tracking the change in prices of goods and services purchased by consumers throughout the economy; MSCI – Morgan Stanley Capital International: an American provider of equity, fixed income, hedge fund stock market indexes, and equity portfolio analysis tools; VIX – CBOE Volatility Index: an index created by the Chicago Board Options Exchange (CBOE), which shows the market's expectation of 30-day volatility. It is constructed using the implied volatilities on S&P 500 index options.; GBI-EM – JP Morgan’s Government Bond Index – Emerging Markets: comprehensive emerging market debt benchmarks that track local currency bonds issued by Emerging market governments; EMBI – JP Morgan’s Emerging Market Bond Index: JP Morgan's index of dollar-denominated sovereign bonds issued by a selection of emerging market countries; EMBIG - JP Morgan’s Emerging Market Bond Index Global: tracks total returns for traded external debt instruments in emerging markets.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. This is not an offer to buy or sell, or a solicitation of any offer to buy or sell any of the securities mentioned herein. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Certain information may be provided by third-party sources and, although believed to be reliable, it has not been independently verified and its accuracy or completeness cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as the date of this communication and are subject to change. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

Investing in international markets carries risks such as currency fluctuation, regulatory risks, economic and political instability. Emerging markets involve heightened risks related to the same factors as well as increased volatility, lower trading volume, and less liquidity. Emerging markets can have greater custodial and operational risks, and less developed legal and accounting systems than developed markets.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future performance.

PMI – Purchasing Managers’ Index: economic indicators derived from monthly surveys of private sector companies. A reading above 50 indicates expansion, and a reading below 50 indicates contraction; ISM – Institute for Supply Management PMI: ISM releases an index based on more than 400 purchasing and supply managers surveys; both in the manufacturing and non-manufacturing industries; CPI – Consumer Price Index: an index of the variation in prices paid by typical consumers for retail goods and other items; PPI – Producer Price Index: a family of indexes that measures the average change in selling prices received by domestic producers of goods and services over time; PCE inflation – Personal Consumption Expenditures Price Index: one measure of U.S. inflation, tracking the change in prices of goods and services purchased by consumers throughout the economy; MSCI – Morgan Stanley Capital International: an American provider of equity, fixed income, hedge fund stock market indexes, and equity portfolio analysis tools; VIX – CBOE Volatility Index: an index created by the Chicago Board Options Exchange (CBOE), which shows the market's expectation of 30-day volatility. It is constructed using the implied volatilities on S&P 500 index options.; GBI-EM – JP Morgan’s Government Bond Index – Emerging Markets: comprehensive emerging market debt benchmarks that track local currency bonds issued by Emerging market governments; EMBI – JP Morgan’s Emerging Market Bond Index: JP Morgan's index of dollar-denominated sovereign bonds issued by a selection of emerging market countries; EMBIG - JP Morgan’s Emerging Market Bond Index Global: tracks total returns for traded external debt instruments in emerging markets.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. This is not an offer to buy or sell, or a solicitation of any offer to buy or sell any of the securities mentioned herein. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Certain information may be provided by third-party sources and, although believed to be reliable, it has not been independently verified and its accuracy or completeness cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as the date of this communication and are subject to change. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

Investing in international markets carries risks such as currency fluctuation, regulatory risks, economic and political instability. Emerging markets involve heightened risks related to the same factors as well as increased volatility, lower trading volume, and less liquidity. Emerging markets can have greater custodial and operational risks, and less developed legal and accounting systems than developed markets.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future performance.