Ethereum Competitors and the Race to Innovate

August 10, 2021

Read Time 10 MIN

VanEck assumes no liability for the content of any linked third-party site, and/or content hosted on external sites.

Key takeaways:

- Ethereum begins "buying back stock". Current yield = ~1.5%.

- Encrypted chat: AAPL's recent announcement may accelerate decentralized chat.

- "Smart contract protocols" - how to quantify the threat from Ethereum's competitors.

- Cardano: launches smart contract capability this month.

- Solana: head-to-head vs. Nasdaq.

"Your ability to learn faster than your competition is your only sustainable advantage." - Aries de Gues, "The Living Company"

"It can already be used for pay-to-send e-mail. The send dialog is resizeable and you can enter as long of a message as you like. It's sent directly when it connects. The recipient double clicks on the transaction to see the full message. If someone famous is getting more e-mail than they can read, but would still like to have a way for fans to contact them, they could set up Bitcoin and give out the IP address on their website. 'Send X bitcoins to my priority hotline at this IP and I'll read the message personally.'" - Satoshi Nakamoto

"What we are solving ... is that you have an artist with a crypto key, and fans with crypto keys. We are just guaranteeing that they can talk to each other, that there is no interference. That’s it. The token itself is just there to prevent spam in this super-connected world. It’s kind of a science fiction thing we are building. If that exists, what else is possible in this world?" - Anatoly Yakovenko, Solana CEO. June 18, 2021

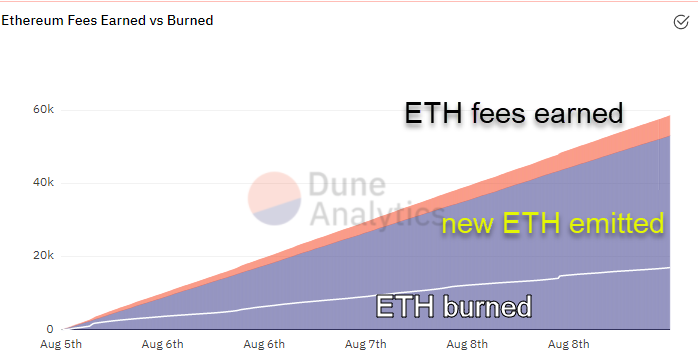

Ethereum prices are up more than 20% as of 8/9/2021 since the introduction of a new pricing mechanism, EIP-1559, that promises to make the protocol's notoriously volatile "gas" prices a bit more predictable, and introduces a "burning" of transaction fees akin to a corporation that buys back stock in order to boost earnings per share. In the first 24 hours, EIP-1559 was responsible for the early retirement of 4,700 ETH1, $13M at current exchange rates. If that pace were maintained, $4.8B would be returned to stakeholders over the next year, equivalent to a 1.5% "buyback yield" at ETH's current market cap of $312B.2

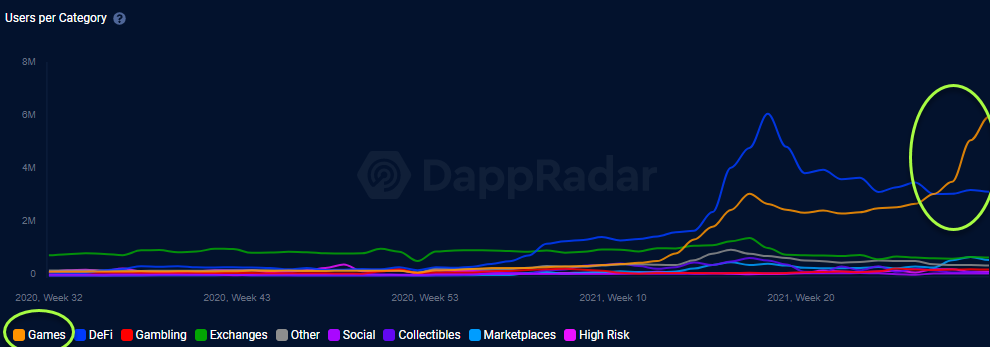

The pricing change is part of a series of upgrades that the Ethereum protocol is rolling out over the course of 2021-2022, which promises an effective 200-fold increase in network capacity, according to VanEck research, but starts with August 5's deflationary jolt to the network. Had EIP-1559 been in effect during 2019-2021, Ethereum's inflation rate would have been less than half its actual inflation rate during the last two years, according to research by CoinMetrics. Thus the algorithm adjustment represents a value transfer from miners, who tend to sell quickly to pay their operating costs, to all Ethereum stakeholders via this burning rebate. And yet, while ETH bulls, including yours truly, are cheering the successful execution, risk remains: to the extent that EIP-1559 reduces liquid ETH supply before Ethereum can ship its new capacity increase ("shard chains sometime in 2022"3), it's possible that network "gas" pricing spikes anew, choking off the economic viability of lower-value transactions such as gaming-based micropayments and NFTs, which have taken off in recent weeks. For now though, the NFT and gaming traction has continued post EIP-1559. During the 24 hours ending August 5 following the pricing change, NFT platforms OpenSea and COVIDPunks, along with play-to-earn game Axie Infinity represented 19% of all gas spent on the network vs. Uniswap, Tether and Metamask (key DeFi enablers) combining for 18%.4 Axie Infinity total secondary sales have now surpassed $1B, according to Cryptoslam.io.

Source: Dune Analytics, as of 8/9/2021.

Smart Contract Users by Application Type

Source: Dappradar, as of 8/6/2021. Y axis: millions.

Top 10 Crypto Collectible Rankings (sales volume all-time)

Source: Cryptoslam.io, as of 8/9/2021.

But while on-time transition to EIP-1559 de-risks the ETH story somewhat and represents a critical step in the path to a $2T market valuation, it is also worth noting that EIP-1559 represents only Ethereum's eighth product update since 20165, a large contrast to Google who changes its algorithm more than 1,000 times per year, according to Semrush, a search optimization company6. For bears who doubt that a decentralized network can arrive at community consensus frequently enough to ship product updates as rapidly as a more hierarchical corporation like Google might respond to customer requests, this math doesn't lie. It's the reason why we have included the first quote at the top of this piece.

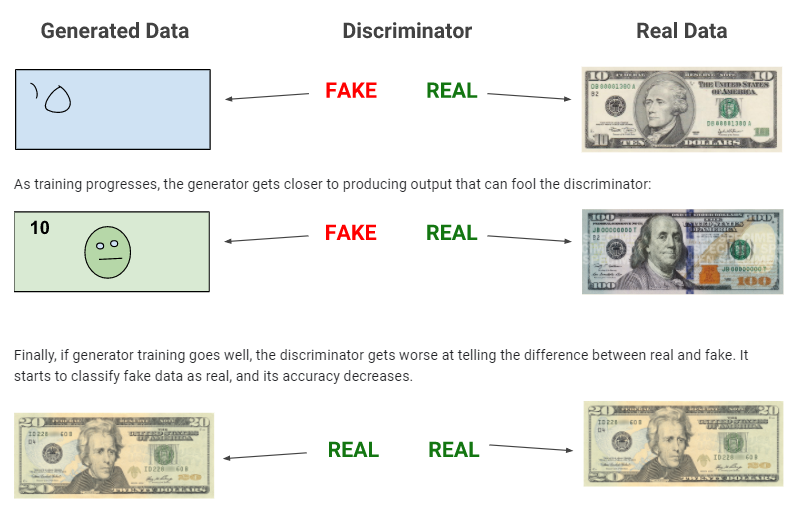

And yet there are two very important equalizing factors to this seemingly slow pace of innovation in the back-end code. The first is accessibility. While every independent would-be Google Play developer must adapt his code to satisfy Android's rules and editorial discretion, developers on Ethereum are free to build whatever they want without discrimination (or paying 30% away). We can see one potential worrying evolution in Google/Apple's walled garden approach in the news last week that Apple will launch new software7 that can analyze photos stored in a user's iCloud account for explicit images of children and then report those instances to relevant authorities. Apple's technology uses a neural hashing algorithm that essentially cracks the iPhone's encryption, long a major "ask" by law enforcement.8 But while Apple certainly intends to put this technology to good use in its early iteration, like other Web 2.0 algorithms, "these systems rely on a database of problematic media hashes that you, as a consumer, can't review," wrote Matthew Green, professor of cryptology at John's Hopkins University, on Twitter in response to Apple's announcement. Combine this opacity with the technology's potential vulnerability to black-box attacks by so-called generative adversarial networks (GANs)9, and we may end up with sabotage and false positives that introduce information chaos and destroy the reputations of innocent people. Blockchain-based networks, thanks to their pseudonymous and open-source nature, don't face this risk. Already, decentralized encrypted chat platforms are proliferating in an attempt to circumvent corporate surveillance: DChat, Minds, Crypviser, ySign, Moxtra, and Element, to name just a few. Messaging protocols could be one of the killer dApps of Web 3.0.

What is a "generative adversarial network?"

Given a training set, this technique learns to generate new data with the same statistics as a training set. For example, a GAN trained on photographs can generate new photographs that look authentic to human observers. GANs have also been used to fool license plate readers on toll-roads. Nefarious actors could employ the technique to confuse centralized databases such as Apple's.

Source: Google machine learning class

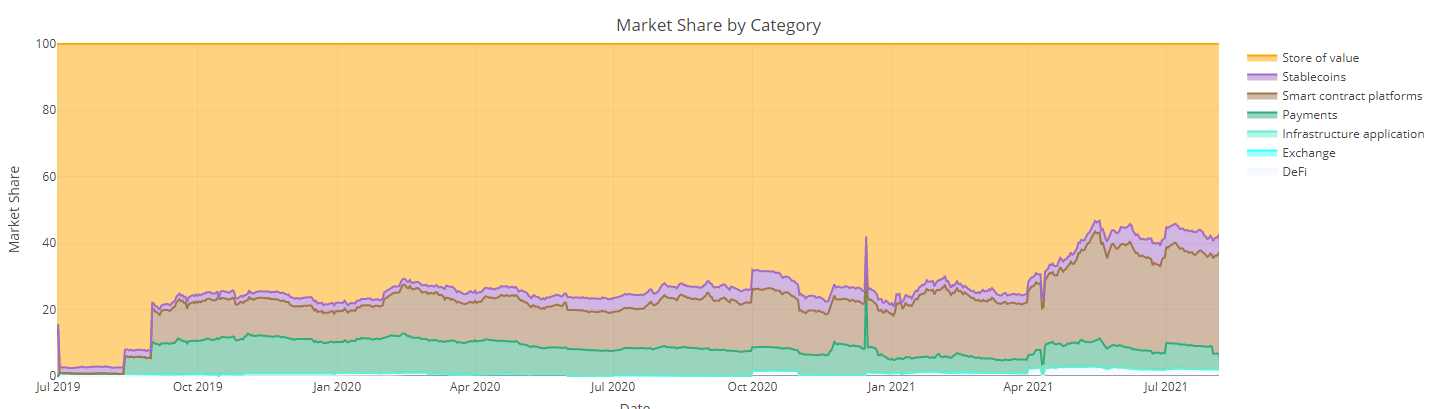

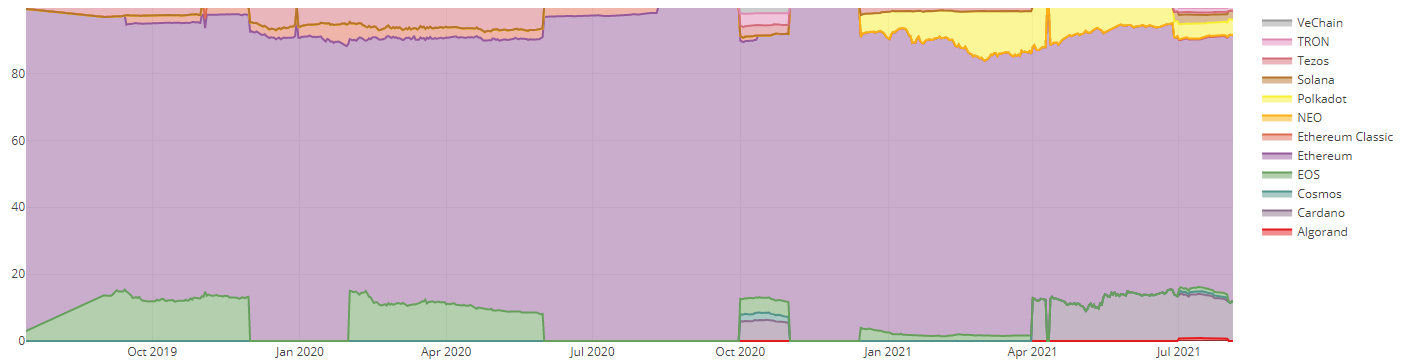

The second factor mitigating the slower pace of core back-end code innovation on the Ethereum network vs. Web 2.0 purveyors is the sheer proliferation of competing "layer 1" smart contract platforms that promise lower costs and higher throughput than ETH. Among the top 50 coins by market cap, VanEck sees some half dozen with the track record, size and community engagement to perhaps someday rival Ethereum, or at least to turbocharge adoption of decentralized applications by offering users more choice of platforms on top of which to build. As an illustration of this, the below chart shows the market share of all smart contract platforms as a percentage of total crypto market cap, which now exceeds 27%, up from 14% at the beginning of 2021. Meanwhile Ethereum accounts for 80% of this "smart contract" category, down 800bps over the same period as new entrants gain traction.

Source: Cryptocompare, VanEck. Data as of 7/30/2021.

Smart Contract "Market Cap" Share by Coin

Source: Cryptocompare, VanEck. Data as of 7/30/2021.

The research process to analyze and evaluate these competing smart contract platforms is hardly objective. Market-based guideposts such as market cap and trading volume embed an implied valuation ("price-to-sales"), which the underlying fundamentals (as measured by the number of transactions and the average value of each transaction on each protocol) occasionally contradict. For example, Cardano, a blockchain protocol which plans to release smart contract functionality this month10, ranks 8/10 on quantitative measurements of historical network performance, but 2/10 on social engagement, according to a VanEck research. And yet the market has bid the Cardano coin (ticker: ADA) to a $44B valuation in anticipation of a successful launch, based on technical projections put forth by Cardano and the pedigree of its founder Charles Hoskinson, a co-founder of Ethereum. The reality is, nobody knows how the code will run until it is live.

| Smart-contract platform valuation technique |

Data required | Positives | Negatives |

| Market-based | Market cap, average daily value traded | Respects efficient market hypothesis | Backward-looking |

| Usage | # of transactions, # of users, avg. value of transactions | Rewards successful execution and customer acquisition | Backward-looking |

| Technological capabilities | Theoretical network throughput & cost structure; degree of “decentralization” | Forward-looking | Opaque, depends on execution |

| Developer traction | Github commits, # of developers engaged in protocol projects | Key determinant of project success | Hard to measure, prone to manipulation, requires multiple assumptions (identify correct Github repositories etc) |

| Social relevance | Subreddit & Twitter followers, size of Discord server, etc. | Key determinant of project success | Prone to manipulation; requires multiple assumptions |

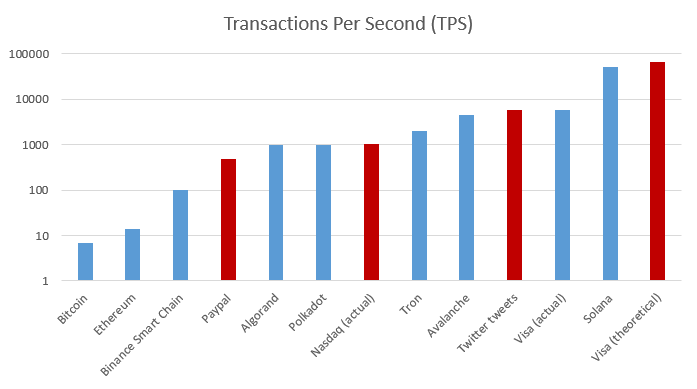

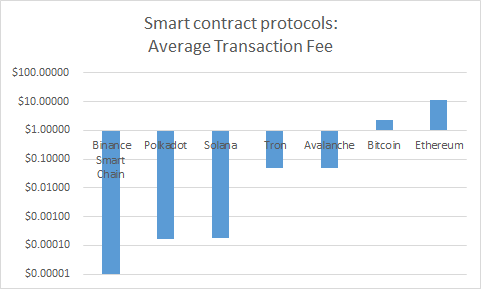

Solana, a smart-contract platform that promises an absurd 50,000 transactions per second11, presents another challenge. Although the protocol says it has processed a whopping 23B transactions since early May (more transactions than all layer one protocols combined since inception), Solana does so with extremely low fees, which raises questions about the prospects for monetization. According to SOL CEO Anatoly Yakovenko, who worked on TDMA radio technology at Qualcomm before founding Solana in 2017, the protocol's unique "proof of history" consensus-building algorithm may eventually support more than 700K transactions per second, fast enough to trade regulated, tokenized securities representing nearly any asset class in the world simultaneously, with the entire order book on the blockchain. In that regard SOL presents a theoretically compelling alternative both to decentralized exchanges such as Uniswap (which processes 100-200K transactions per day using automatic market maker (AMM) software that matches liquidity peer-to-peer but can't support limit orders)12, and even possibly to regulated central order-book exchanges such as Nasdaq, which currently charges $600K/month for an enterprise data license and between $2.5-7.5K/month for a direct ethernet connection.13 Participants on the SOL network would pay no fees for data, as long as their hardware meets certain specs available to all. Also, remember that Nasdaq is proposing diversity quotas14 and other restrictions on would-be listed companies, which tokenized securities trading on a decentralized exchange might avoid, as decentralization makes preferred access impossible. Thus, given the scope of the innovation, that Solana ranks relatively low (so far) on social relevance, transaction fees, and developer traction vs. some older layer 1 chains should probably be discounted as and if its technology is de-risked. That Solana is well-capitalized, having just raised $314M in June, and is backed by well-capitalized exchange FTX, which recently raised $900M of its own to fund acquisitions and expansion in the U.S, is also a consideration.15

Sources: Protocol white papers, Coinmetrics, SEC data, company filings, VanEck research. Data as of 8/6/2021.

Conclusions

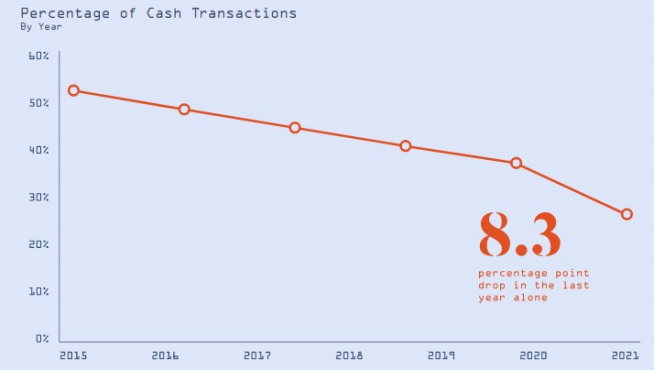

As cash transactions continue to decline in proportion, and crypto-enabled wallets continue to take market share from banks, consumers will increasingly encounter a range of smart contract platforms and decentralized apps on which to perform transactions ranging from large-scape financial settlement (Bitcoin) to encrypted chat, low-value NFTs, music file sharing, securities trading, and lots in-between. The successful roll-out of Ethereum's new pricing model represents a major step forward in bringing additional transparency and a more inclusive economic model to the largest smart contract platform. However, in the absence of capacity increases, which don't arrive until 2022, ETH could struggle to hold market share vs. competing smart contract protocols that promise faster throughput at lower prices. The research process to analyze these competitors requires many subjective assumptions. Stay tuned here for more details as we refine them.

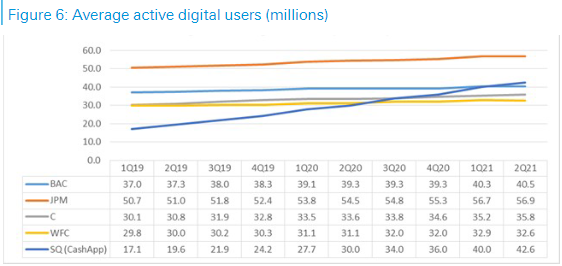

Source: SQ.

Source: Company Data, Deutsche Bank estimates. Data as of 8/1/2021.

- BAC Consumer Banking segment active digital banking users.

- JPM Consumer & Community Banking active digital customers.

- 3C Global Consumer Banking – Retail Banking active digital customers.

- WFC digital active customers.

- SQ Cash App monthly transacting actives; 2021 figure is DB estimate.

Follow Us

DISCLOSURES

1 Source: https://ultrasound.money/, as of 8:30am 8/6/2021.

2 Source: CoinMarketCap, VanEck.

3 Source: Ethereum.org.

4 Source: Etherscan as of 8/9/2021

5 Source: Ethereum.org.

6 Source: Semrush.

7 Source: The Wall Street Journal.

8 Source: U.S. Department of Justice.

9 Source: Towards Data Science.

10 Source: Cardano.

11 Source: Solana CEO interview.

12 Source: Uniswap Protocol.

13 Source: Nasdaq website.

14 Source: The Wall Street Journal.

15 Source: The Wall Street Journal.

VanEck assumes no liability for the content of any linked third-party site, and/or content hosted on external sites.

The information herein represents the opinion of the author(s), but not necessarily those of VanEck, and these opinions may change at any time and from time to time. Non-VanEck proprietary information contained herein has been obtained from sources believed to be reliable, but not guaranteed. VanEck does not guarantee the accuracy of third party data. Not intended to be a forecast of future events, a guarantee of future results or investment advice. Historical performance is not indicative of future results. Current data may differ from data quoted. Any graphs shown herein are for illustrative purposes only. Not a recommendation to buy or to sell any of the cryptocurrencies mentioned herein.

References to specific securities and their issuers or sectors are for illustrative purposes only.

Cryptocurrency is a digital representation of value that functions as a medium of exchange, a unit of account, or a store of value, but it does not have legal tender status. Cryptocurrencies are sometimes exchanged for U.S. dollars or other currencies around the world, but they are not generally backed or supported by any government or central bank. Their value is completely derived by market forces of supply and demand, and they are more volatile than traditional currencies. The value of cryptocurrency may be derived from the continued willingness of market participants to exchange fiat currency for cryptocurrency, which may result in the potential for permanent and total loss of value of a particular cryptocurrency should the market for that cryptocurrency disappear. Cryptocurrencies are not covered by either FDIC or SIPC insurance. Legislative and regulatory changes or actions at the state, federal, or international level may adversely affect the use, transfer, exchange, and value of cryptocurrency.

Investing in cryptocurrencies comes with a number of risks, including volatile market price swings or flash crashes, market manipulation, and cybersecurity risks. In addition, cryptocurrency markets and exchanges are not regulated with the same controls or customer protections available in equity, option, futures, or foreign exchange investing. There is no assurance that a person who accepts a cryptocurrency as payment today will continue to do so in the future.

Investors should conduct extensive research into the legitimacy of each individual cryptocurrency, including its platform, before investing. The features, functions, characteristics, operation, use and other properties of the specific cryptocurrency may be complex, technical, or difficult to understand or evaluate. The cryptocurrency may be vulnerable to attacks on the security, integrity or operation, including attacks using computing power sufficient to overwhelm the normal operation of the cryptocurrency’s blockchain or other underlying technology. Some cryptocurrency transactions will be deemed to be made when recorded on a public ledger, which is not necessarily the date or time that a transaction may have been initiated.

- Investors must have the financial ability, sophistication and willingness to bear the risks of an investment and a potential total loss of their entire investment in cryptocurrency.

- An investment in cryptocurrency is not suitable or desirable for all investors.

- Cryptocurrency has limited operating history or performance.

- Fees and expenses associated with a cryptocurrency investment may be substantial.

There may be risks posed by the lack of regulation for cryptocurrencies and any future regulatory developments could affect the viability and expansion of the use of cryptocurrencies. Investors should conduct extensive research before investing in cryptocurrencies.

Information provided by Van Eck is not intended to be, nor should it be construed as financial, tax or legal advice. It is not a recommendation to buy or sell an interest in cryptocurrencies.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.

Related Funds

DISCLOSURES

1 Source: https://ultrasound.money/, as of 8:30am 8/6/2021.

2 Source: CoinMarketCap, VanEck.

3 Source: Ethereum.org.

4 Source: Etherscan as of 8/9/2021

5 Source: Ethereum.org.

6 Source: Semrush.

7 Source: The Wall Street Journal.

8 Source: U.S. Department of Justice.

9 Source: Towards Data Science.

10 Source: Cardano.

11 Source: Solana CEO interview.

12 Source: Uniswap Protocol.

13 Source: Nasdaq website.

14 Source: The Wall Street Journal.

15 Source: The Wall Street Journal.

VanEck assumes no liability for the content of any linked third-party site, and/or content hosted on external sites.

The information herein represents the opinion of the author(s), but not necessarily those of VanEck, and these opinions may change at any time and from time to time. Non-VanEck proprietary information contained herein has been obtained from sources believed to be reliable, but not guaranteed. VanEck does not guarantee the accuracy of third party data. Not intended to be a forecast of future events, a guarantee of future results or investment advice. Historical performance is not indicative of future results. Current data may differ from data quoted. Any graphs shown herein are for illustrative purposes only. Not a recommendation to buy or to sell any of the cryptocurrencies mentioned herein.

References to specific securities and their issuers or sectors are for illustrative purposes only.

Cryptocurrency is a digital representation of value that functions as a medium of exchange, a unit of account, or a store of value, but it does not have legal tender status. Cryptocurrencies are sometimes exchanged for U.S. dollars or other currencies around the world, but they are not generally backed or supported by any government or central bank. Their value is completely derived by market forces of supply and demand, and they are more volatile than traditional currencies. The value of cryptocurrency may be derived from the continued willingness of market participants to exchange fiat currency for cryptocurrency, which may result in the potential for permanent and total loss of value of a particular cryptocurrency should the market for that cryptocurrency disappear. Cryptocurrencies are not covered by either FDIC or SIPC insurance. Legislative and regulatory changes or actions at the state, federal, or international level may adversely affect the use, transfer, exchange, and value of cryptocurrency.

Investing in cryptocurrencies comes with a number of risks, including volatile market price swings or flash crashes, market manipulation, and cybersecurity risks. In addition, cryptocurrency markets and exchanges are not regulated with the same controls or customer protections available in equity, option, futures, or foreign exchange investing. There is no assurance that a person who accepts a cryptocurrency as payment today will continue to do so in the future.

Investors should conduct extensive research into the legitimacy of each individual cryptocurrency, including its platform, before investing. The features, functions, characteristics, operation, use and other properties of the specific cryptocurrency may be complex, technical, or difficult to understand or evaluate. The cryptocurrency may be vulnerable to attacks on the security, integrity or operation, including attacks using computing power sufficient to overwhelm the normal operation of the cryptocurrency’s blockchain or other underlying technology. Some cryptocurrency transactions will be deemed to be made when recorded on a public ledger, which is not necessarily the date or time that a transaction may have been initiated.

- Investors must have the financial ability, sophistication and willingness to bear the risks of an investment and a potential total loss of their entire investment in cryptocurrency.

- An investment in cryptocurrency is not suitable or desirable for all investors.

- Cryptocurrency has limited operating history or performance.

- Fees and expenses associated with a cryptocurrency investment may be substantial.

There may be risks posed by the lack of regulation for cryptocurrencies and any future regulatory developments could affect the viability and expansion of the use of cryptocurrencies. Investors should conduct extensive research before investing in cryptocurrencies.

Information provided by Van Eck is not intended to be, nor should it be construed as financial, tax or legal advice. It is not a recommendation to buy or sell an interest in cryptocurrencies.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.