How to Set Up Your Crypto Wallet

April 06, 2022

Read Time 2 MIN

Please note that VanEck holds a position in Ethereum.

Learn how to create your crypto wallet to receive the newly launched VanEck Community NFT.

VanEck recently launched its VanEck Community NFT. Owning the VanEck Community NFT comes with many benefits and utility that will be announced over time. Some benefits may include invitations to exclusive NFT holder networking parties and engagements, as well as the opportunity for select investors to get a first look at investment and research opportunities.

This blog is written to help you create a crypto wallet, which you will use for receiving and securing a VanEck Community NFT, and to show ownership of this NFT for future utility and exclusive offers.

What is a crypto wallet? If you don’t know the answer to this, learn more about the basics of crypto wallets and the difference between hot and cold wallets.

Once you’re ready, follow the below steps on how to download and set up your very own crypto wallet by using the Trust Wallet app on your mobile.

Step By Step Crypto Wallet Setup

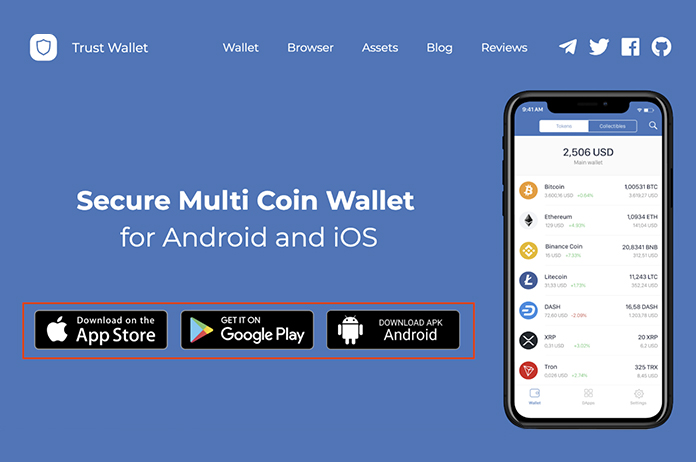

Step 1) Visit www.trustwallet.com and select the mobile device app store for your respective device to download the most recent version of the wallet.

Trust Wallet Download

Source: Trust Wallet download.

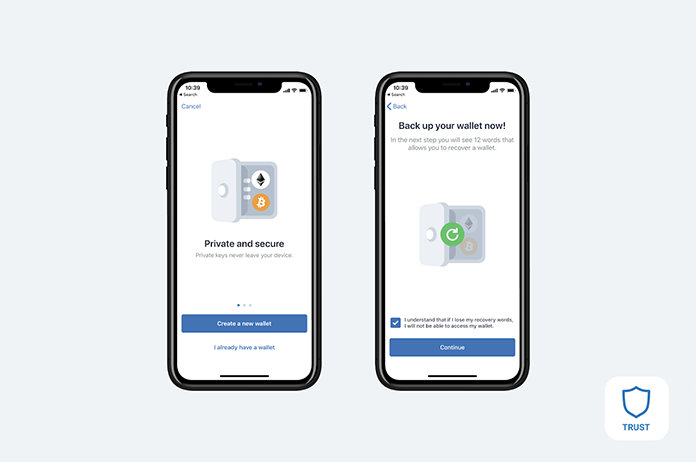

Step 2) Once you’ve downloaded the app, select “Create New Wallet”. You will be presented with your seed words. Seed words are your private key, which will be used to restore your wallet if needed in the future. Keep these words safe and private. It’s best to write these down, so do not take a screen shot. Each word will be entirely lower case and must be entered in the correct order if attempting to restore your wallet.

Create Your Crypto Wallet

Source: Trust Wallet.

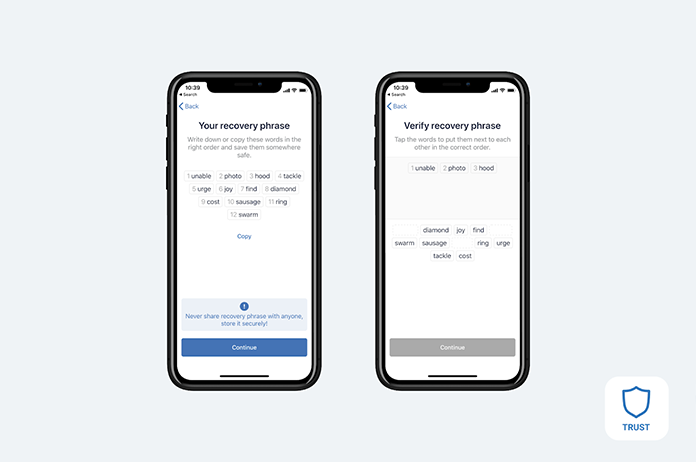

Step 3) Select your seed words in the correct order that they were given to you to verify that you have recorded your seed phrase correctly.

Crypto Wallet Seed Words

Source: Trust Wallet.

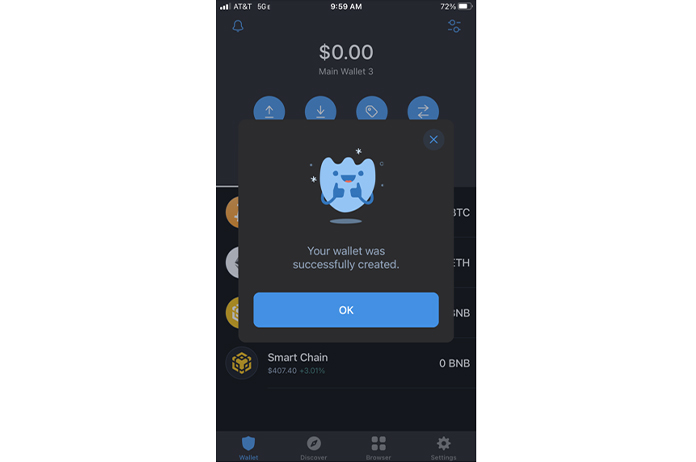

Step 4) You have successfully created a wallet! Now Select “OK”.

Crypto Wallet Created

Source: Trust Wallet.

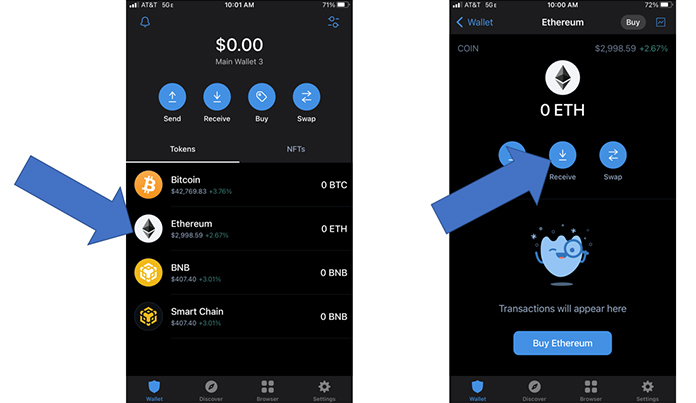

Step 5) Now we need to get the Ethereum Public Address for your newly created wallet so that VanEck knows where to send your NFT. To find and copy this address, first select Ethereum from the list provided, then choose “Receive”.

Receive Ethereum in Your Crypto Wallet

Source: Trust Wallet.

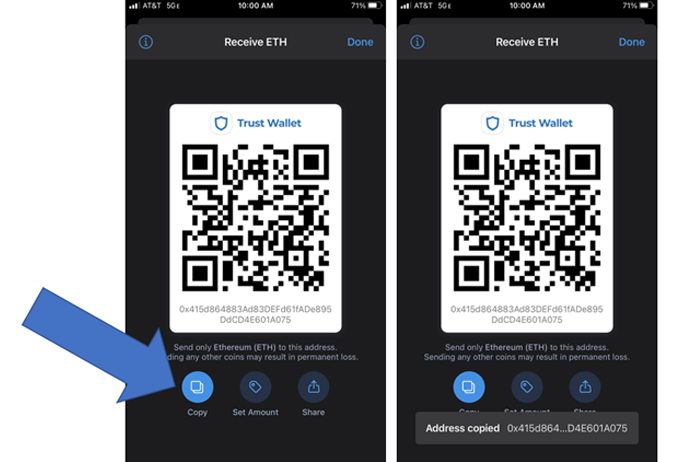

Step 6) Choose “Copy”, to successfully copy your Ethereum Address. This is the address where we will send the NFT. Please share this address within the VanEck NFT submission form.

Copy Your Ethereum Address

Source: Trust Wallet.

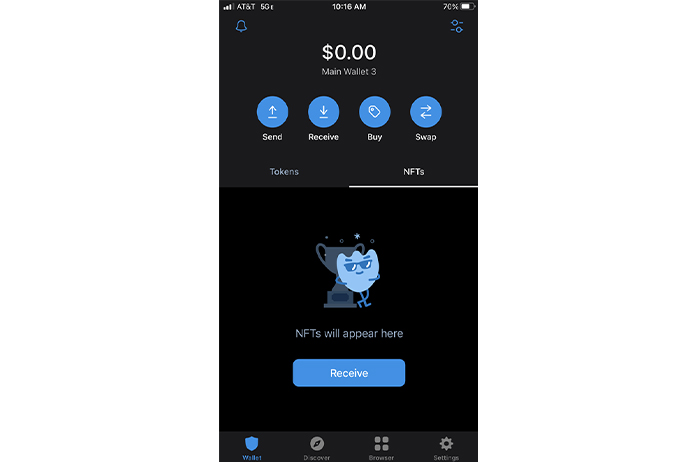

Upon receiving the NFT, it will appear in this section of the wallet. Now you are ready to own the VanEck Community NFT.

NFT in Your Crypto Wallet

Source: Trust Wallet.

As a reminder, keep those seed words secure and private. Do not share them with anyone else, as they represent ownership of the assets within.

Learn more about buying NFTs.

To receive more Digital Assets insights, sign up in our subscription center.

© Van Eck Securities Corporation, a wholly-owned subsidiary of Van Eck Associates Corporation.

IMPORTANT DISCLOSURES

Source: How to create your wallet with Trust Wallet.

This is not an offer to buy or sell, or a solicitation of any offer to buy or sell any of the cryptocurrencies mentioned herein. The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Information provided by third-party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as of the date of this communication and are subject to change without notice. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

Cryptocurrency is a digital representation of value that functions as a medium of exchange, a unit of account, or a store of value, but it does not have legal tender status. Cryptocurrencies are sometimes exchanged for U.S. dollars or other currencies around the world, but they are not generally backed or supported by any government or central bank. Their value is completely derived by market forces of supply and demand, and they are more volatile than traditional currencies. The value of cryptocurrency may be derived from the continued willingness of market participants to exchange fiat currency for cryptocurrency, which may result in the potential for permanent and total loss of value of a particular cryptocurrency should the market for that cryptocurrency disappear. Cryptocurrencies are not covered by either FDIC or SIPC insurance. Legislative and regulatory changes or actions at the state, federal, or international level may adversely affect the use, transfer, exchange, and value of cryptocurrency.

Investing in cryptocurrencies comes with a number of risks, including volatile market price swings or flash crashes, market manipulation, and cybersecurity risks. In addition, cryptocurrency markets and exchanges are not regulated with the same controls or customer protections available in equity, option, futures, or foreign exchange investing. There is no assurance that a person who accepts a cryptocurrency as payment today will continue to do so in the future.

Investors should conduct extensive research into the legitimacy of each individual cryptocurrency, including its platform, before investing. The features, functions, characteristics, operation, use and other properties of the specific cryptocurrency may be complex, technical, or difficult to understand or evaluate. The cryptocurrency may be vulnerable to attacks on the security, integrity or operation, including attacks using computing power sufficient to overwhelm the normal operation of the cryptocurrency’s blockchain or other underlying technology. Some cryptocurrency transactions will be deemed to be made when recorded on a public ledger, which is not necessarily the date or time that a transaction may have been initiated.

- Investors must have the financial ability, sophistication and willingness to bear the risks of an investment and a potential total loss of their entire investment in cryptocurrency.

- An investment in cryptocurrency is not suitable or desirable for all investors.

- Cryptocurrency has limited operating history or performance.

- Fees and expenses associated with a cryptocurrency investment may be substantial.

There may be risks posed by the lack of regulation for cryptocurrencies and any future regulatory developments could affect the viability and expansion of the use of cryptocurrencies. Investors should conduct extensive research before investing in cryptocurrencies.

Information provided by Van Eck is not intended to be, nor should it be construed as financial, tax or legal advice. It is not a recommendation to buy or sell an interest in cryptocurrencies.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.

Related Funds

© Van Eck Securities Corporation, a wholly-owned subsidiary of Van Eck Associates Corporation.

IMPORTANT DISCLOSURES

Source: How to create your wallet with Trust Wallet.

This is not an offer to buy or sell, or a solicitation of any offer to buy or sell any of the cryptocurrencies mentioned herein. The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Information provided by third-party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as of the date of this communication and are subject to change without notice. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

Cryptocurrency is a digital representation of value that functions as a medium of exchange, a unit of account, or a store of value, but it does not have legal tender status. Cryptocurrencies are sometimes exchanged for U.S. dollars or other currencies around the world, but they are not generally backed or supported by any government or central bank. Their value is completely derived by market forces of supply and demand, and they are more volatile than traditional currencies. The value of cryptocurrency may be derived from the continued willingness of market participants to exchange fiat currency for cryptocurrency, which may result in the potential for permanent and total loss of value of a particular cryptocurrency should the market for that cryptocurrency disappear. Cryptocurrencies are not covered by either FDIC or SIPC insurance. Legislative and regulatory changes or actions at the state, federal, or international level may adversely affect the use, transfer, exchange, and value of cryptocurrency.

Investing in cryptocurrencies comes with a number of risks, including volatile market price swings or flash crashes, market manipulation, and cybersecurity risks. In addition, cryptocurrency markets and exchanges are not regulated with the same controls or customer protections available in equity, option, futures, or foreign exchange investing. There is no assurance that a person who accepts a cryptocurrency as payment today will continue to do so in the future.

Investors should conduct extensive research into the legitimacy of each individual cryptocurrency, including its platform, before investing. The features, functions, characteristics, operation, use and other properties of the specific cryptocurrency may be complex, technical, or difficult to understand or evaluate. The cryptocurrency may be vulnerable to attacks on the security, integrity or operation, including attacks using computing power sufficient to overwhelm the normal operation of the cryptocurrency’s blockchain or other underlying technology. Some cryptocurrency transactions will be deemed to be made when recorded on a public ledger, which is not necessarily the date or time that a transaction may have been initiated.

- Investors must have the financial ability, sophistication and willingness to bear the risks of an investment and a potential total loss of their entire investment in cryptocurrency.

- An investment in cryptocurrency is not suitable or desirable for all investors.

- Cryptocurrency has limited operating history or performance.

- Fees and expenses associated with a cryptocurrency investment may be substantial.

There may be risks posed by the lack of regulation for cryptocurrencies and any future regulatory developments could affect the viability and expansion of the use of cryptocurrencies. Investors should conduct extensive research before investing in cryptocurrencies.

Information provided by Van Eck is not intended to be, nor should it be construed as financial, tax or legal advice. It is not a recommendation to buy or sell an interest in cryptocurrencies.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.