Moat Index Review: Value Is In, Facebook Is Out

September 23, 2020

Read Time 4 MIN

The Morningstar® Wide Moat Focus IndexSM (the “Index”) completed its quarterly review on Friday, September 18, 2020. The first quarter and second quarter reviews saw more significant changes to the index, as its process of identifying attractively priced wide moat companies was more noteworthy during and following the market turbulence of earlier this year. Notable in this quarter’s review is the continuation of several of the key trends of the year. Here are our main takeaways from the latest rebalance.

Unfriended: Facebook Removed from Moat Index

The Index’s shift from big tech formally began in June and took one step further last week as Facebook (FB) was removed from the Index. Facebook’s stock price premium to Morningstar’s assessment of its fair value signaled an opportunity to lock in gains relative to other opportunities in the wide moat universe.

Facebook has notably been an index member off and on since its IPO in May 2012 and has a track record of supporting Index returns during those periods. With the volatility big tech has faced in recent weeks, time will tell if Facebook rejoins the Index in the future. For now, the only big tech names in the Index remain Amazon (AMZN) and Microsoft (MSFT), which together account for just over 2% weighting at present. This compares to a combined weighting of more than 22% in the S&P 500 Index for Facebook, Apple, Amazon, Netflix, Google and Microsoft. The steady increase in stock prices for many of these stocks recently is bringing them at or above fair value, according to Morningstar, and there simply remain too many other attractively valued opportunities in the U.S. wide moat universe.

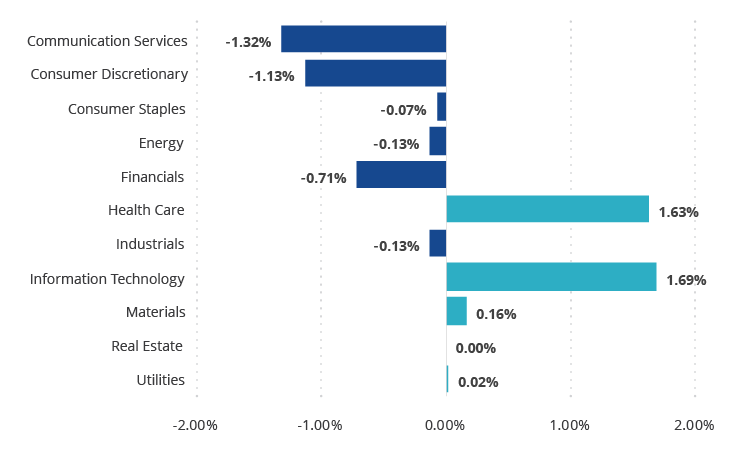

Modest Sector Shifts

Despite the removal of Facebook, the tech sector saw a slight increase in weight following the September review. Health care, a long-time overweight, also saw a slight increase in its exposure, while those gains resulted in similar reductions to communications services, consumer discretionary and financials.

Five Sectors Account for Minor Repositioning of Moat Index

As of 9/21/2020

Source: Morningstar. Changes in sector weightings from 9/18/2020 to 9/21/2020 displayed above.

The decreases in consumer discretionary and communications services are logical to see as they are two of the top performing sectors in the U.S. market in 2020. Tech is far and away the top performing sector in the market this year, yet interestingly, the Index’s tech exposure increased modestly. This is due mainly to an increase in semiconductor exposure, which has underperformed the broader tech sector this year. Applied Materials (AMAT) saw its position increased during the review and new entrant Lam Research Corp. (LRCX) was added following a recent economic moat rating upgrade from narrow to wide moat earlier this year. Cost advantages and intangible assets drive LRCX’s wide economic moat, according to Morningstar. Its research and development cost advantages over smaller peers and intangible assets related to equipment design from service contracts and customer collaboration leave LRCX well-positioned relative to competition in the chip manufacturing industry. It is an industry leader in the dry etch process and a prominent player in the deposition segment. Both of these processes combined are critical to chip fabricating.

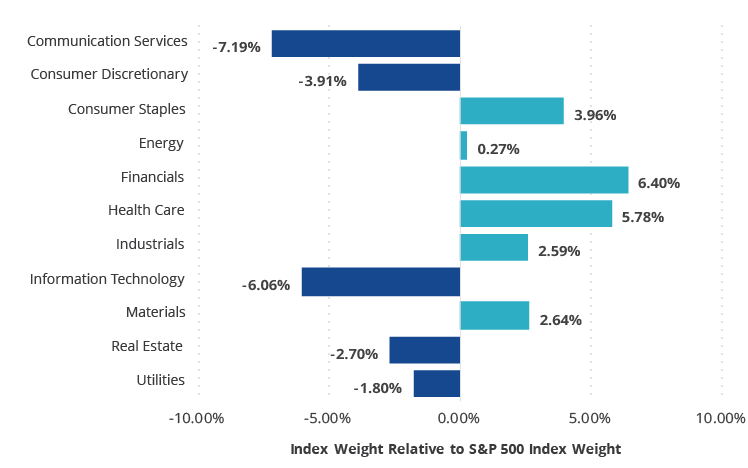

Nike (NKE) and Facebook (FB) drove the consumer discretionary and communication services sector weighting lower as they both became too rich to remain in the Index. Over and underweights relative to the S&P 500 Index that have been in place for much of the year remain.

Financials and Health Care Remain Top Overweights in Moat Index

As of 9/21/2020

Source: Morningstar.

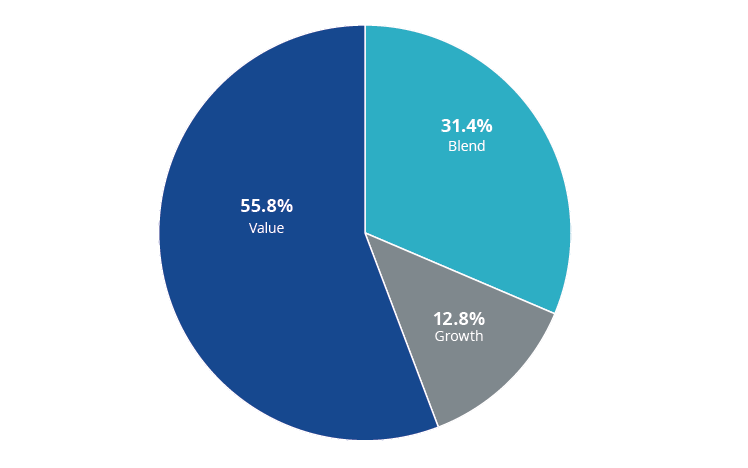

Moat Index Style: Value Over Growth

The Index’s style exposure to growth companies remains low relative to historical averages. At times in the past when growth exposure has decreased, much of that decrease was offset by “core” or “blend” exposure, which are companies that exhibit characteristics of both value and growth. Now the Index is skewed more heavily to value companies and has one of its highest exposures to value historically.

Value Exposure in Moat Index at All Time Highs

Morningstar Wide Moat Focus Index as of 9/21/2020

Source: Morningstar.

The last time the Index had anywhere near this level of exposure to value companies was in mid-2018, shortly before the so-called “tech wreck” that coincided with the breakdown of U.S./China trade negotiations in the fourth quarter and subsequent market selloff led by tech stocks. Prior to 2018, the Index has never had as much as 50% exposure to value companies.

You can view full Index review results here.

VanEck Vectors Morningstar Wide ETF (MOAT) seeks to replicate as closely as possible, before fees and expenses the price and yield performance of the Morningstar Wide Moat Focus Index.

For further reading:

Follow Us

Important Disclosures

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results, are valid as of the date of this communication and subject to change without notice. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

This commentary is not intended as a recommendation to buy or to sell any of the sectors or securities mentioned herein. Holdings will vary for the MOAT ETF and its corresponding Index. For a complete list of holdings in the ETF, please click here: https://www.vaneck.com/etf/equity/moat/holdings/.

An investor cannot invest directly in an index. Returns reflect past performance and do not guarantee future results. Results reflect the reinvestment of dividends and capital gains, if any. Certain indices may take into account withholding taxes. Index returns do not represent Fund returns. The Index does not charge management fees or brokerage expenses, nor does the Index lend securities, and no revenues from securities lending were added to the performance shown.

Fair value estimate: the Morningstar analyst's estimate of what a stock is worth.

Price/Fair Value: ratio of a stock's trading price to its fair value estimate.

The Morningstar® Wide Moat Focus IndexSM was created and is maintained by Morningstar, Inc. Morningstar, Inc. does not sponsor, endorse, issue, sell, or promote the VanEck Vectors Morningstar Wide Moat ETF and bears no liability with respect to that ETF or any security. Morningstar® is a registered trademark of Morningstar, Inc. Morningstar® Wide Moat Focus IndexSM is a service mark of Morningstar, Inc.

The Morningstar® Wide Moat Focus IndexSM consists of U.S. companies identified as having sustainable, competitive advantages and whose stocks are attractively priced, according to Morningstar.

Effective June 20, 2016, Morningstar implemented several changes to the Morningstar Wide Moat Focus Index construction rules. Among other changes, the index increased its constituent count from 20 stocks to at least 40 stocks and modified its rebalance and reconstitution methodology. These changes may result in more diversified exposure, lower turnover and longer holding periods for index constituents than under the rules in effect prior to this date.

The S&P 500® Index is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Van Eck Associates Corporation. Copyright © 2020 S&P Dow Jones Indices LLC, a division of S&P Global, Inc., and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC. For more information on any of S&P Dow Jones Indices LLC’s indices please visit www.spdji.com. S&P® is a registered trademark of S&P Global and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC. Neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors make any representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector that it purports to represent and neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors shall have any liability for any errors, omissions, or interruptions of any index or the data included therein.

An investment in the VanEck Vectors Morningstar Wide Moat ETF (MOAT®) may be subject to risks which include, among others, investing in equity securities, consumer discretionary, financials, health care, industrials and information technology sectors, medium-capitalization companies, market, operational, index tracking, authorized participant concentration, no guarantee of active trading market, trading issues, passive management, fund shares trading, premium/discount risk and liquidity of fund shares, non-diversified, and concentration risks, which may make these investments volatile in price or difficult to trade. Medium-capitalization companies may be subject to elevated risks.

Investing involves substantial risk and high volatility, including possible loss of principal. An investor should consider a Fund's investment objective, risks, charges and expenses carefully before investing. To obtain a prospectus and summary prospectus for VanEck Funds and VanEck Vectors ETFs, which contain this and other information, call 800.826.2333 or visit vaneck.com. Please read the prospectus and summary prospectus for VanEck Funds and VanEck Vectors ETFs carefully before investing.

Related Funds

Important Disclosures

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results, are valid as of the date of this communication and subject to change without notice. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

This commentary is not intended as a recommendation to buy or to sell any of the sectors or securities mentioned herein. Holdings will vary for the MOAT ETF and its corresponding Index. For a complete list of holdings in the ETF, please click here: https://www.vaneck.com/etf/equity/moat/holdings/.

An investor cannot invest directly in an index. Returns reflect past performance and do not guarantee future results. Results reflect the reinvestment of dividends and capital gains, if any. Certain indices may take into account withholding taxes. Index returns do not represent Fund returns. The Index does not charge management fees or brokerage expenses, nor does the Index lend securities, and no revenues from securities lending were added to the performance shown.

Fair value estimate: the Morningstar analyst's estimate of what a stock is worth.

Price/Fair Value: ratio of a stock's trading price to its fair value estimate.

The Morningstar® Wide Moat Focus IndexSM was created and is maintained by Morningstar, Inc. Morningstar, Inc. does not sponsor, endorse, issue, sell, or promote the VanEck Vectors Morningstar Wide Moat ETF and bears no liability with respect to that ETF or any security. Morningstar® is a registered trademark of Morningstar, Inc. Morningstar® Wide Moat Focus IndexSM is a service mark of Morningstar, Inc.

The Morningstar® Wide Moat Focus IndexSM consists of U.S. companies identified as having sustainable, competitive advantages and whose stocks are attractively priced, according to Morningstar.

Effective June 20, 2016, Morningstar implemented several changes to the Morningstar Wide Moat Focus Index construction rules. Among other changes, the index increased its constituent count from 20 stocks to at least 40 stocks and modified its rebalance and reconstitution methodology. These changes may result in more diversified exposure, lower turnover and longer holding periods for index constituents than under the rules in effect prior to this date.

The S&P 500® Index is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Van Eck Associates Corporation. Copyright © 2020 S&P Dow Jones Indices LLC, a division of S&P Global, Inc., and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC. For more information on any of S&P Dow Jones Indices LLC’s indices please visit www.spdji.com. S&P® is a registered trademark of S&P Global and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC. Neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors make any representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector that it purports to represent and neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors shall have any liability for any errors, omissions, or interruptions of any index or the data included therein.

An investment in the VanEck Vectors Morningstar Wide Moat ETF (MOAT®) may be subject to risks which include, among others, investing in equity securities, consumer discretionary, financials, health care, industrials and information technology sectors, medium-capitalization companies, market, operational, index tracking, authorized participant concentration, no guarantee of active trading market, trading issues, passive management, fund shares trading, premium/discount risk and liquidity of fund shares, non-diversified, and concentration risks, which may make these investments volatile in price or difficult to trade. Medium-capitalization companies may be subject to elevated risks.

Investing involves substantial risk and high volatility, including possible loss of principal. An investor should consider a Fund's investment objective, risks, charges and expenses carefully before investing. To obtain a prospectus and summary prospectus for VanEck Funds and VanEck Vectors ETFs, which contain this and other information, call 800.826.2333 or visit vaneck.com. Please read the prospectus and summary prospectus for VanEck Funds and VanEck Vectors ETFs carefully before investing.