Terra’s Bitcoin Gambit: Key to Decentralized Stablecoin Success?

March 23, 2022

Read Time 14 MIN

Please note that VanEck may have a position(s) in the digital asset(s) described below.

Terra’s move to back its stablecoin with Bitcoin reserves is a major step towards decoupling the algorithmic stablecoin from its fiat anchor.

We have previously described three vectors for crypto asset allocation, which in total may sum to 15% in aggressive portfolios. We have encountered family offices allocating thusly:

- Bitcoin as a store of value (1-5% allocation alongside or instead of gold)

- Tokens as growth tech, a fundamental hedge to Web 2.0 (1-5% allocation)

- Income from lending stablecoins and other crypto (1-5% allocation)

Putting this 15% allocation in perspective, consider the size of the U.S. money market funds industry: 312 funds hold $5T in customer funds.1 15% “market share” for crypto would imply a total stablecoin market cap of $750B vs. the current $183B (95% of which is held in the top 20 stablecoins)—and that’s just the U.S.2 How would we get there? We believe three broad themes will catalyze this market share shift: 1) Regulatory treatment of competing “instant” payment rails, such as CashApp and PayPal, should be harmonized with “stablecoin” oversight, given the fundamental similarities of the business models (fig 1). 2) Merchant acceptance of stablecoins will grow dramatically (especially in emerging markets), driven by not only decentralized finance (DeFi) but also mainstream web3 applications such as NFT-enabled ticketing, gaming and social messaging, and importantly, physical goods and services; and 3) Algorithmic stablecoins, whose code promises derivative exposure to another asset or basket of assets, may finally find some measure of success. In fact, these catalysts are all connected.

On the regulatory front, VanEck has proposed that custodial stablecoin sponsors like USDC and Tether be allowed to voluntarily subject themselves to SEC oversight, similar to a fund operating under the Investment Company Act of 1940.3 This would mean that the SEC would oversee the safekeeping and valuation of some stablecoin assets. Practically speaking, those who opt in would likely be the most plain-vanilla stablecoin sponsors who back their coins 1x1 with dollars or gold in a vault. Disclosure of this nature is simple and doesn’t reveal trade secrets. In periods of volatility or risk-off, investors might flock to these registered coins, allowing the market to price the value of oversight. In any case, “fintech” payment rails such as PayPal provide similar disclosure as Tether already. Take a look at how each holds their customer funds.4 Which do you think is safer?

Fig. 1. PayPal vs. Tether: Which Is Safer?

| Customer Funds (USD millions) |

Paypal | Tether |

| Cash, cash equivalent | $ 17,805 | $ 65,881 |

| 49% | 84% | |

| Available-for-sale debt securities | $ 18,336 | $ 7,771 |

| 51% | 10% | |

| Other (digital assets) | $ - | $ 5,023 |

| 0% | 6% | |

| Total | $ 36,141 | $ 78,676 |

Source: Paypal filings (12/2021), Tether consolidated reserves report (12/2021).

Unfortunately, the proposed regulatory frameworks for stablecoins generally ignore the intricacies of “algorithmic” or quasi-pegged stablecoins, whose digital assets are backed by what the crypto-asset task force of the European Central Bank (ECB) calls “the expectation of its future market value”.5 These protocols continue to proliferate, albeit with generally poor performance (fig. 2), but they are not “funds” or “banks” in any classic sense. The primary risks associated with them are 1) the worthiness of the underlying securities (though not necessarily via direct counterparty risk, as many are priced using data “oracles” rather than via swaps) 2) the fidelity of the underlying code, and 3) the stickiness of the community. But forcing algorithmic stablecoin “sponsors” to register as banks doesn’t help with any of these, since many of them are merely open-source smart contract platforms that don’t actually make loans. Nor would forcing algorithmic stablecoin protocols to obtain a banking charter help with money laundering concerns—even regulated U.S. funds don’t know the names of the underlying owners and thus aren’t subject to AML/KYC oversight. This lack of knowledge generally extends to algorithmic stablecoins and indeed all open-source blockchain protocols. (Tether and USDC are not open-source. They are walled gardens, which is why they are able to enforce sanctions.)

Fig. 2. Non-custodial Stablecoins: Successes and Failures

| Name | Ticker | Peak Market Cap (millions) | Down from ATH | Comments |

| Successes | ||||

| Terra USD | UST | $15,206 | 0% | Fastest-growing and now largest algorithmic stablecoin, surpassing DAI in marketcap in Q4 2021. |

| UXD | UXD | $20 | 0% | First algorithmic stablecoin on Solana. |

| Frax | FRX | $2,921 | -3% | Hybrid stablecoin partially backed by collateral and algorithmically stabilized. |

| Dai | DAI | $10,380 | -5% | Oldest operating algorithmic stablecoin. |

| FlexUSD | FLEXUSD | $531 | -62% | Peg has held, continues to generate yield. Success story. |

| Failures | ||||

| Ampleforth | AMPL | $687 | -70% | “Re-base” token promises constant ownership % of outstanding market cap. Volatility has subsided a bit. |

| Wonderland | TIME | $2,083 | -98% | Founder hired an anonymous convicted felon as treasury manager. Bank run after users found out. |

| OlympusDAO | OHM | $4,356 | -98% | Large holders sell-off. |

| Dynamic Set Dollar | DSD | $243 | -99% | Not dynamic enough. |

| GYRO | GYRO | $96 | -99% | Sentiment decline after OHM and TIME failure. Bank run. |

| Empty Set Dollar | ESD | $560 | -99% | Empty indeed. |

| KlimaDAO | KLIMA | $1 | -100% | Sentiment decline after OHM and TIME failure. Bank run. |

| IRON | TITAN | N/A | -100% | Dump by large holders caused bank run, which also caused smart contract malfunctions. |

| Basis Cash | BAC | $93 | -100% | Not even a basis point remains. |

| Based Money | BASED | $75 | -100% | Obviously not based. |

Source: VanEck research, Messari as of March 17, 2022.

Amidst the generally disappointing performance shown above, several non-custodial stablecoins have nevertheless found considerable success in the market recently. MakerDao’s Dai and Terra’s UST reached a combined $25B in market cap on March 17, close to their all-time highs.6 As a point of further definition, non-custodial stablecoins like UST and Dai rely on a mix of market incentives, arbitrage opportunities, automated smart contracts, and reserve token adjustments to attempt to maintain a stable peg.

Fig. 3. Three Types of Stablecoins

| Type | Token Examples | Description |

| Custodial stablecoins | USDC, Tether | Backed by a centralized entity who holds an “equivalent” in dollars and so on. The tokens are essentially IOUs which are redeemable at the point of origin. |

| Over-collateralized debt stablecoins | Dai | Similar to custodial coins in that they are backed by a currency, but that currency can be a volatile digital currency like ETH. To protect the peg, users who wish to mint Dai have to collateralize 150%+ of the Dai they wish to receive, locking it into a CDP (collateralized debt position). The protocol facilitates liquidation of borrowers to protect the peg. |

| Algorithmic stablecoins | Terra UST | May employ a wide array of mechanisms to retain their peg ranging from bond purchases to partial collateralization to programmatic contraction and expansion of money supply (or some combination of all of above). |

Imagine the whole Terra economy as two pools: one for the Terra (the stablecoin suite including UST) and one for LUNA (the Terra protocol’s native staking token, which absorbs the price volatility of the stablecoins). To maintain the price of the UST stablecoin, the LUNA supply pool adds to or subtracts from UST supply. Users burn LUNA to mint UST and burn UST to mint LUNA. The protocol’s “market module” algorithm enables swaps between various stablecoin denominations, and between UST and LUNA, always at $1 worth of value.7 Price stability is achieved through arbitrage activity against the protocol’s “Constant Product” market-making algorithm, which ensures liquidity for Terra/Luna swaps and enforces swap fees (35bps Tobin tax and 50bps minimum spread) to defend against pricing delays and reward network participants.8

Until recently, Terra stablecoins were backed only by its own collateral (i.e., LUNA itself), along with market trust in Terra’s market module, which enables users to always trade $1 worth of LUNA for 1 UST and vice versa. Some of that trust derives from faith in Terra’s aggressive founder Do Kwon, a former developer at Microsoft and Apple who studied computer science at Stanford. Terra’s stablecoin model contrasts with the debt-based algo stablecoin pioneered by MakerDao. The Dai stablecoin can be minted by depositing external assets such as USDC, ETH, etc. into a smart contract, but must be over-collateralized (generally 150%) with assets that can be auto-liquidated if their value declines below a certain level.9 UST is therefore more capital efficient and can grow more quickly than Dai, but also has higher tail risk because it is 1x1 backed by LUNA (20% of LUNA issuance has been allocated to “stability reserves” to help maintain the peg).10 Dai, on the other hand, is at least 1.5x over-collateralized with a mix of assets (59% USDC, 21% ETH at last count). Dai needs a good interest rate algorithm, which may break if USDC and ETH collapsed suddenly; UST needs continuous LUNA ecosystem net inflows or it risks an asset-specific death spiral. And yet look at figure 3: UST volatility is now lower than Dai’s.

Fig. 4. Stablecoin Volatility Role Reversal: Dai vs. UST Annualized Daily Volatility

Source: Messari, VanEck. Data as of 3/17/2022.

The most tangible catalyst for the role reversal was the February $1B private token sale by LUNA’s nonprofit foundation, aimed at establishing a decentralized Bitcoin-denominated foreign reserve fund so that Terra stablecoins can be redeemable in Bitcoin and not only LUNA. Do Kwon later elaborated that UST’s Bitcoin reserves will eventually reach $10B, designed to ensure that the price of the stablecoins remain pegged to their fiat counterparts during sharp selloffs in crypto markets.11 As he explained in a Twitter “Spaces” on March 18: “At any given time you can trade in $1 worth Bitcoin and get $1 UST, and then you can trade in $1 UST for slightly less than $1 worth of Bitcoin. This preserves the property that this reserve will only be actively traded against when UST is off-peg to the downside, but it also preserves the property that as UST supply grows, the size of the Bitcoin reserves will grow linearly with it.”12 By giving UST holders the right to redeem for $1 worth of Bitcoin rather than only by minting new LUNA, it is possible that Terra has found an end-run around the “zero terminal value” argument made by most algo stablecoins bears. (fig. 4).

Fig. 5. “Death Spiral” Mitigated?

LUNA community members and investors have embraced the move, and LUNA has performed by far the best among large-cap cryptocurrency in the last three months, rising 55% in the 30 days ending March 17 to reach $33B, surpassing Solana’s $29B.13 And yet in order to believe that the ecosystem will be sustainable, we must ask the obvious question: What good is all this UST if it cannot be used to buy goods and services? Eventually the liquidity will leave, and in a rout, UST would break before Bitcoin, say the bears. On that point, remember the first paragraph of this piece: Three conditions are necessary to support $800B+ in stablecoin assets. One of them is “merchant” acceptance. For example, Dai is accepted by most DeFi apps such as Uniswap and Aave. Those are merchants of a sort, but only of financial services. There are also a number charities, blockchain games and debit card partnerships that accept Dai.14 But since Terra is a layer 1 blockchain with a wider array of stablecoin choices and decentralized applications (dapps), it can grow its liquidity with less volatility, more consistently, and without resorting to the 7,000%+ APYs that eventually brought ruin to prior algo stablecoin offerings like OHM.15

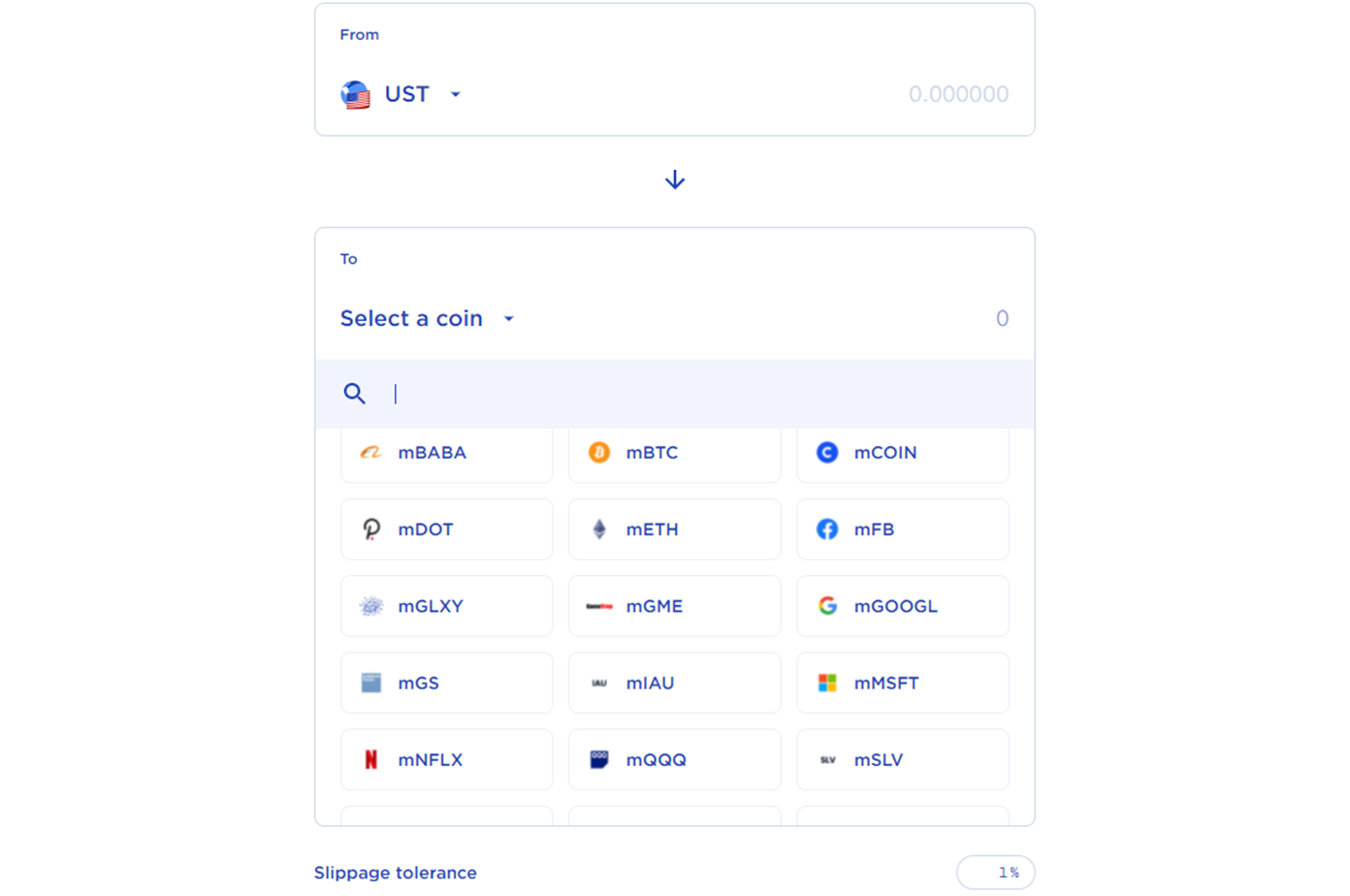

Merchant acceptance is happening several additional ways on Terra to soak up the UST whose market cap has ballooned from $3B to $15B since November.16 First, in addition to the USD stablecoin, LUNA also runs a suite of other algorithmic, fiat-pegged stablecoins, which allow for instantaneous cross-border value transfer at fees ranging from 10bps to 200bps depending on the underlying liquidity of the pair. (Fees are denominated in LUNA, which are burned to create a deflationary anchor on token issuance. LUNA is also burned every time a market participant buys UST.)17 This multi-fiat functionality is useful for cross-border commerce in emerging markets such as in ASEAN. Terra stablecoin holders can then invest their coins on LUNA-supported dapps such as Mirror (a synthetic assets platform which allows access to U.S. “stocks”, see fig. 5), and Anchor (a decentralized lending and borrowing protocol powered by a diversified stream of staking rewards along with interest from borrowers, currently paying a double-digit APY).18 Mongolian taxi drivers have reportedly been accepting Mongolian Terra stablecoins since 2020, and MLB’s Washington Nationals are considering encouraging stadium merchants to accept UST as part of Terra’s 5-year, $40M sponsorship agreement.19 In South Korea, Terra’s “Chai” payments gateway onboards merchants integrated with Apple Pay and Android, though data here are limited. Terra has similar ambitions for the “Alice”-branded payment gateway in the U.S., but with the SEC subpoenaing Do Kwon for documents on Mirror and his lawyers claiming no jurisdiction, it may be prudent to discount U.S. market potential.20 Indeed, major U.S. exchanges like Coinbase still do not offer institutional custody of the coins.

Fig. 6. Swapping Stablecoins for Synthetic Stocks on Terra’s “Mirror” Protocol

It is notable that Terra comes out of South Korea, long a leader in online gaming, esports, and crypto. In March this analyst had the pleasure to meet Kwan-Ho Park, CEO of Wemade (112040 KS, mkt cap $3B). Wemade is a South Korean game developer that has expanded aggressively into blockchain games and now hosts seven crypto-based games, each with their own token along with a native token WEMIX, which boasts a $500M circulating market cap.21 According to Park, play-to-earn blockchain games currently generate 1% of firm-wide revenues, but may reach 50% by the end of the year with 20 games in development. Park said WEMIX will migrate its mainnet from smart contract platform Klaytn to an Ethereum Virtual Machine (EVM) compatible chain later this year, making it even easier to swap value among open metaverse platforms while essentially retaining the “status” players have earned in a different game. Wemade stock trades on roughly 7x trailing revenues, relatively cheap compared to most layer 1 blockchains and some gaming platforms like Axie Infinity (AXS).22 Separately in Korean metaverse developments, as part of a $25M funding round at a $500M valuation, blockchain gaming platform C2X said it will build games in cooperation with South Korean game developer Com2Us (078340 KS, mkt cap $1B). FTX, Jump Crypto, and Animoca Brands all participated in C2X, who will build their platform on the Terra chain.23 Blockchain gamers now outnumber DeFi users on-chain by a ratio of more than 2-1, and fun new games represent another important real-world use case for Terra’s UST holders.24 Meanwhile South Korea’s new President Yoon Suk-yeol, elected in March, has promised to prolong favorable crypto taxes and reinvigorate the ICO (initial coin offering) market, although play-to-earn games remain illegal in the country.25

Returning to the intersection of stablecoins and merchant acceptance, so critical to our bull case for crypto, we must note the following story, which stunned observers this month: AMC Entertainment, the biggest cinema chain in the world, announced it would purchase 22% of Nevada-based gold and silver mining company Hycroft Mining Holdings. Describing the deal, AMC CEO Adam Aron touted his expertise handling retail investors and sourcing liquidity.26 AMC already accepts Bitcoin and Ethereum and has run several NFT campaigns. Physical movie theaters may face even more structural pressure post-COVID, given content distribution changes.27 Some years from now, it’s not hard for this analyst to imagine a chain of esports-enabled AMC theater venues, KYC required upon entry, in which a gold-backed AMC stablecoin forms the medium of exchange. For perspective, the largest gold-pegged stablecoin PAX Gold only has a $600M market cap vs. the largest physically backed gold ETF at $57B.28 Even Japanese trading giant Mitsui is reportedly planning to issue a gold-backed cryptocurrency.29 Maybe AMC is looking at Terra’s stablecoin suite with some envy.

Our investment conclusion with Terra has been complicated by the fact that one of our fund custodians does not support LUNA coins. In addition, we have not found a decent source to track fees generated on the Terra network, though this is also true for some early stage layer 1 chains in our benchmark. We also wonder if the chain isn’t particularly vulnerable to SEC enforcement. Still, these excuses do not negate our biggest emotion, which is regret for missing this coin. We applaud Do Kwon and the Terra team for de-risking their ecosystem considerably with the biggest Bitcoin gambit of 2022, contrite for our miscue. LUNA has grown to a 15% weight in the MVIS CryptoCompare Smart Contract Leaders Index, which we find notable given our asset allocation framework and the fact that Terra is the only decentralized stablecoin platform among the layer 1 chains. Net-net, we are small LUNA buyers, though underweight.

To receive more Digital Assets insights, sign up in our subscription center.

Follow Us

DISCLOSURES

Important Information Regarding Cryptocurrencies

VanEck assumes no liability for the content of any linked third-party site, and/or content hosted on external sites.

The information herein represents the opinion of the author(s), an employee of the advisor, but not necessarily those of VanEck. The cryptocurrencies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment or strategy will depend on an investor’s individual circumstances and objectives.

This material has been prepared for informational purposes only and is not an offer to buy or sell or a solicitation of any offer to buy or sell any cryptocurrencies, or to participate in any trading strategy. Past performance is no guarantee of future results.

Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results, are valid as of the date of this communication and subject to change without notice. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. VanEck does not guarantee the accuracy of third party data. References to specific securities and their issuers or sectors are for illustrative purposes only.

Cryptocurrency is a digital representation of value that functions as a medium of exchange, a unit of account, or a store of value, but it does not have legal tender status. Cryptocurrencies are sometimes exchanged for U.S. dollars or other currencies around the world, but they are not generally backed or supported by any government or central bank. Their value is completely derived by market forces of supply and demand, and they are more volatile than traditional currencies. The value of cryptocurrency may be derived from the continued willingness of market participants to exchange fiat currency for cryptocurrency, which may result in the potential for permanent and total loss of value of a particular cryptocurrency should the market for that cryptocurrency disappear. Cryptocurrencies are not covered by either FDIC or SIPC insurance. Legislative and regulatory changes or actions at the state, federal, or international level may adversely affect the use, transfer, exchange, and value of cryptocurrency.

Investing in cryptocurrencies, such as Bitcoin, comes with a number of risks, including volatile market price swings or flash crashes, market manipulation, and cybersecurity risks. In addition, cryptocurrency markets and exchanges are not regulated with the same controls or customer protections available in equity, option, futures, or foreign exchange investing. There is no assurance that a person who accepts a cryptocurrency as payment today will continue to do so in the future.

Investors should conduct extensive research into the legitimacy of each individual cryptocurrency, including its platform, before investing. The features, functions, characteristics, operation, use and other properties of the specific cryptocurrency may be complex, technical, or difficult to understand or evaluate. The cryptocurrency may be vulnerable to attacks on the security, integrity or operation, including attacks using computing power sufficient to overwhelm the normal operation of the cryptocurrency’s blockchain or other underlying technology. Some cryptocurrency transactions will be deemed to be made when recorded on a public ledger, which is not necessarily the date or time that a transaction may have been initiated.

- Investors must have the financial ability, sophistication and willingness to bear the risks of an investment and a potential total loss of their entire investment in cryptocurrency.

- An investment in cryptocurrency is not suitable or desirable for all investors.

- Cryptocurrency has limited operating history or performance.

- Fees and expenses associated with a cryptocurrency investment may be substantial.

There may be risks posed by the lack of regulation for cryptocurrencies and any future regulatory developments could affect the viability and expansion of the use of cryptocurrencies. Investors should conduct extensive research before investing in cryptocurrencies.

1 SEC Money Market Fund Information, Feb. 2022, https://www.sec.gov/files/mmf-statistics-2022-02_1.pdf.

2 Messari, as of 3/15/2022.

3 “What the government’s recommendations for stablecoins got wrong, and how to do better,” by Jan van Eck, Barron’s, Feb. 9, 2022.

4 Paypal filings, 12/31/2021; Tether quarterly filings, 12/31/2021.

5 “The inherent fragility of algorithmic stableoins,” Wake Forest Law Review, October 2021.

6 Messari, as of 3/17/2022.

7 Terra website.

8 Terra website.

9 “The Maker Protocol: MakerDAO’s Multi-collateral Dai system” white paper.

10 Delphi Digital research, 3/17/2022.

11 Do Kwon Twitter account, 3/14/2022.

12 Do Kwon on Twitter “Spaces,” 3/18/2022.

13 Messari, 3/17/2022.

14 MakerDao website.

15 “OlympusDAO might be the future of money (or it might be a ponzi).” Coindesk, 12/5/2021.

16 Messari, 3/17/2022.

17 Terra website.

18 “Polychain, Arca propose Anchor protocol yield cut.” 3/11/2022.

19 Terra Twitter account 12/12/2019; “Washington Nationals to ‘explore’ Terra’s UST stablecoin in DAO-approved partnership deal,” 2/9/2022.

20 “Terraform Labs hits back at SEC: ‘No jurisdiction over Do Kwon.’” 12/20/2021.

21 Interview with CEO; Bloomberg as of 3/17/2022.

22 TokenTerminal, Bloomberg consensus as of 3/17/2022.

23 Bloomberg as of 3/17/2022; “C2X announces $25M funding round led by FTX Ventures.” Press release, 3/18/2022.

24 Dappradar as of 3/17/2022.

25 “South Korea’s incoming president vows big cryptocurrency push.” Nikkei News, 3/15/2022.

26 “AMC Entertainment Holdings announces significant investment, buying 22% of Hycroft Mining.” Press release, 3/15/2022.

27 “Cinema owners say simultaneous streaming has become a scourge.” FT, 11/12/2021.

28 Messari, as of 3/20/2022.

29 “Mitsui & Co. to issue cryptocurrency linked to gold prices.” Nikkei News, 2/4/2022.

Information provided by Van Eck is not intended to be, nor should it be construed as financial, tax or legal advice. It is not a recommendation to buy or sell an interest in cryptocurrencies.

Related Funds

DISCLOSURES

Important Information Regarding Cryptocurrencies

VanEck assumes no liability for the content of any linked third-party site, and/or content hosted on external sites.

The information herein represents the opinion of the author(s), an employee of the advisor, but not necessarily those of VanEck. The cryptocurrencies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment or strategy will depend on an investor’s individual circumstances and objectives.

This material has been prepared for informational purposes only and is not an offer to buy or sell or a solicitation of any offer to buy or sell any cryptocurrencies, or to participate in any trading strategy. Past performance is no guarantee of future results.

Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results, are valid as of the date of this communication and subject to change without notice. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. VanEck does not guarantee the accuracy of third party data. References to specific securities and their issuers or sectors are for illustrative purposes only.

Cryptocurrency is a digital representation of value that functions as a medium of exchange, a unit of account, or a store of value, but it does not have legal tender status. Cryptocurrencies are sometimes exchanged for U.S. dollars or other currencies around the world, but they are not generally backed or supported by any government or central bank. Their value is completely derived by market forces of supply and demand, and they are more volatile than traditional currencies. The value of cryptocurrency may be derived from the continued willingness of market participants to exchange fiat currency for cryptocurrency, which may result in the potential for permanent and total loss of value of a particular cryptocurrency should the market for that cryptocurrency disappear. Cryptocurrencies are not covered by either FDIC or SIPC insurance. Legislative and regulatory changes or actions at the state, federal, or international level may adversely affect the use, transfer, exchange, and value of cryptocurrency.

Investing in cryptocurrencies, such as Bitcoin, comes with a number of risks, including volatile market price swings or flash crashes, market manipulation, and cybersecurity risks. In addition, cryptocurrency markets and exchanges are not regulated with the same controls or customer protections available in equity, option, futures, or foreign exchange investing. There is no assurance that a person who accepts a cryptocurrency as payment today will continue to do so in the future.

Investors should conduct extensive research into the legitimacy of each individual cryptocurrency, including its platform, before investing. The features, functions, characteristics, operation, use and other properties of the specific cryptocurrency may be complex, technical, or difficult to understand or evaluate. The cryptocurrency may be vulnerable to attacks on the security, integrity or operation, including attacks using computing power sufficient to overwhelm the normal operation of the cryptocurrency’s blockchain or other underlying technology. Some cryptocurrency transactions will be deemed to be made when recorded on a public ledger, which is not necessarily the date or time that a transaction may have been initiated.

- Investors must have the financial ability, sophistication and willingness to bear the risks of an investment and a potential total loss of their entire investment in cryptocurrency.

- An investment in cryptocurrency is not suitable or desirable for all investors.

- Cryptocurrency has limited operating history or performance.

- Fees and expenses associated with a cryptocurrency investment may be substantial.

There may be risks posed by the lack of regulation for cryptocurrencies and any future regulatory developments could affect the viability and expansion of the use of cryptocurrencies. Investors should conduct extensive research before investing in cryptocurrencies.

1 SEC Money Market Fund Information, Feb. 2022, https://www.sec.gov/files/mmf-statistics-2022-02_1.pdf.

2 Messari, as of 3/15/2022.

3 “What the government’s recommendations for stablecoins got wrong, and how to do better,” by Jan van Eck, Barron’s, Feb. 9, 2022.

4 Paypal filings, 12/31/2021; Tether quarterly filings, 12/31/2021.

5 “The inherent fragility of algorithmic stableoins,” Wake Forest Law Review, October 2021.

6 Messari, as of 3/17/2022.

7 Terra website.

8 Terra website.

9 “The Maker Protocol: MakerDAO’s Multi-collateral Dai system” white paper.

10 Delphi Digital research, 3/17/2022.

11 Do Kwon Twitter account, 3/14/2022.

12 Do Kwon on Twitter “Spaces,” 3/18/2022.

13 Messari, 3/17/2022.

14 MakerDao website.

15 “OlympusDAO might be the future of money (or it might be a ponzi).” Coindesk, 12/5/2021.

16 Messari, 3/17/2022.

17 Terra website.

18 “Polychain, Arca propose Anchor protocol yield cut.” 3/11/2022.

19 Terra Twitter account 12/12/2019; “Washington Nationals to ‘explore’ Terra’s UST stablecoin in DAO-approved partnership deal,” 2/9/2022.

20 “Terraform Labs hits back at SEC: ‘No jurisdiction over Do Kwon.’” 12/20/2021.

21 Interview with CEO; Bloomberg as of 3/17/2022.

22 TokenTerminal, Bloomberg consensus as of 3/17/2022.

23 Bloomberg as of 3/17/2022; “C2X announces $25M funding round led by FTX Ventures.” Press release, 3/18/2022.

24 Dappradar as of 3/17/2022.

25 “South Korea’s incoming president vows big cryptocurrency push.” Nikkei News, 3/15/2022.

26 “AMC Entertainment Holdings announces significant investment, buying 22% of Hycroft Mining.” Press release, 3/15/2022.

27 “Cinema owners say simultaneous streaming has become a scourge.” FT, 11/12/2021.

28 Messari, as of 3/20/2022.

29 “Mitsui & Co. to issue cryptocurrency linked to gold prices.” Nikkei News, 2/4/2022.

Information provided by Van Eck is not intended to be, nor should it be construed as financial, tax or legal advice. It is not a recommendation to buy or sell an interest in cryptocurrencies.