Place Your Bets: Sports Wagering Exits the Shadows

February 05, 2020

Read Time 1 MIN

Super Bowl LIV was this past Sunday, and with it, sports betting had a winning day. The American Gaming Association estimated that $6.8 billion in bets were made on the game, between the Kansas City Chiefs and San Francisco 49ers.1 Sports betting has skyrocketed since May 14, 2018, when the U.S. government repealed the ban on sports gambling.

A Market with Great Expectations

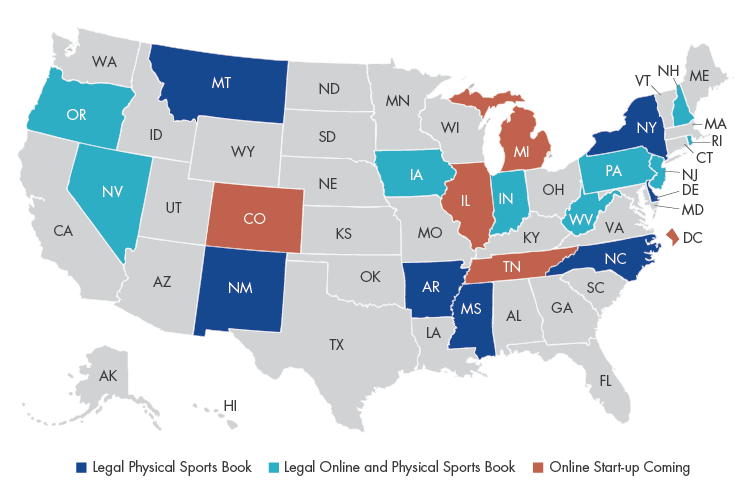

The gambling market is huge, with up to $150 billion wagered illegally on sports every year in the U.S.2 According to Morgan Stanley analyst Thomas Allen, sports betting represents the biggest growth opportunity for the U.S. gambling industry in the coming years. He estimates that sports betting revenue will reach $7 billion by 2025, up from less than $1 billion in 2019. The total size of the sports betting market is estimated at $15 billion,3 assuming broad legalization occurs at the state level. So far, 20 states allow some form of sports betting with many more working on bills.

Drawing the Betting Lines: States that Have Allowed Legal Sports Wagering

Source: Morgan Stanley, The Action Network

From Backroom Bookies to Digital

Currently, the industry is focused on mobile platforms, as many bettors seem to prefer to wage on their smart device rather than in person. A number of gambling companies have made the move to New Jersey because of the state’s law allowing online gambling. Last year alone, $4.5 billion was wagered in sports betting in NJ, generating $300 million in revenues.4

Betting on Gaming

Just last week, Penn National Gaming agreed to buy a 36% stake in Barstool Sports for $136 million. Penn National will provide the infrastructure, and Barstool will bring its 66 million unique monthly visitors, with the vast majority ages 18-34. With the deal, Penn National will rebrand its retail approach as the “Barstool Sportsbook” with the idea of opening 20 retail locations by the end of 2020.5

Between the legalization of sports betting and improving technology, sports wagering is becoming more easily accessible to more bettors. We believe this will help drive growth in the U.S. gaming industry and create interesting investment opportunities.

DISCLOSURES

1Source: American Gaming Association, “A Record 26 Million Americans Will Wager on Super Bowl LIV.”

2Source: American Gaming Association, “97% of Expected $10 Billion Wagered on March Madness to be bet Illegally.”

3Source: Barron’s, “Sports Gambling Will Be a Huge Opportunity. Bet on These Stocks.”

4Source: Action Network, “New Jersey 2019 Sports Betting Handle, Revenue, Taxes & More.”

5Source: Legal Sports Report, “Where The First Barstool Sportsbook In The United States Will Be Located.”

This is not an offer to buy or sell, or a solicitation of any offer to buy or sell any of the securities mentioned herein. The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results, are valid as of the date of this communication and subject to change without notice. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

An investment in the VanEck Vectors®Gaming ETF (BJK®) may be subject to risks which include, among others, investing in the gaming industry, equity securities, consumer discretionary sector, foreign securities, emerging market issuers, foreign currency, special risk considerations of investing in Asian and Chinese issuers, depositary receipts, small- and medium-capitalization companies, cash transactions, market, operational, index tracking, authorized participant concentration, no guarantee of active trading market, trading issues, passive management, fund shares trading, premium/discount risk and liquidity of fund shares, non-diversified, and concentration risks, all of which may adversely affect the Fund. Foreign investments are subject to risks, which include changes in economic and political conditions, foreign currency fluctuations, changes in foreign regulations, and changes in currency exchange rates which may negatively impact the Fund's returns. Small- and medium-capitalization companies may be subject to elevated risks.

Fund shares are not individually redeemable and will be issued and redeemed at their net asset value (NAV) only through certain authorized broker-dealers in large, specified blocks of shares called “creation units” and otherwise can be bought and sold only through exchange trading. Shares may trade at a premium or discount to their NAV in the secondary market. You will incur brokerage expenses when trading Fund shares in the secondary market. Past performance is no guarantee of future results.

Investing involves substantial risk and high volatility, including possible loss of principal. An investor should consider a Fund's investment objective, risks, charges and expenses carefully before investing. To obtain a prospectus and summary prospectus for VanEck Funds and VanEck Vectors ETFs, which contain this and other information, call 800.826.2333 or visit vaneck.com. Please read the prospectus and summary prospectus for VanEck Funds and VanEck Vectors ETFs carefully before investing.

Related Funds

DISCLOSURES

1Source: American Gaming Association, “A Record 26 Million Americans Will Wager on Super Bowl LIV.”

2Source: American Gaming Association, “97% of Expected $10 Billion Wagered on March Madness to be bet Illegally.”

3Source: Barron’s, “Sports Gambling Will Be a Huge Opportunity. Bet on These Stocks.”

4Source: Action Network, “New Jersey 2019 Sports Betting Handle, Revenue, Taxes & More.”

5Source: Legal Sports Report, “Where The First Barstool Sportsbook In The United States Will Be Located.”

This is not an offer to buy or sell, or a solicitation of any offer to buy or sell any of the securities mentioned herein. The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results, are valid as of the date of this communication and subject to change without notice. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

An investment in the VanEck Vectors®Gaming ETF (BJK®) may be subject to risks which include, among others, investing in the gaming industry, equity securities, consumer discretionary sector, foreign securities, emerging market issuers, foreign currency, special risk considerations of investing in Asian and Chinese issuers, depositary receipts, small- and medium-capitalization companies, cash transactions, market, operational, index tracking, authorized participant concentration, no guarantee of active trading market, trading issues, passive management, fund shares trading, premium/discount risk and liquidity of fund shares, non-diversified, and concentration risks, all of which may adversely affect the Fund. Foreign investments are subject to risks, which include changes in economic and political conditions, foreign currency fluctuations, changes in foreign regulations, and changes in currency exchange rates which may negatively impact the Fund's returns. Small- and medium-capitalization companies may be subject to elevated risks.

Fund shares are not individually redeemable and will be issued and redeemed at their net asset value (NAV) only through certain authorized broker-dealers in large, specified blocks of shares called “creation units” and otherwise can be bought and sold only through exchange trading. Shares may trade at a premium or discount to their NAV in the secondary market. You will incur brokerage expenses when trading Fund shares in the secondary market. Past performance is no guarantee of future results.

Investing involves substantial risk and high volatility, including possible loss of principal. An investor should consider a Fund's investment objective, risks, charges and expenses carefully before investing. To obtain a prospectus and summary prospectus for VanEck Funds and VanEck Vectors ETFs, which contain this and other information, call 800.826.2333 or visit vaneck.com. Please read the prospectus and summary prospectus for VanEck Funds and VanEck Vectors ETFs carefully before investing.