Pharma Sector Steps up as a Portfolio Prescription

November 20, 2020

Read Time 3 MIN

Hope Springs Eternal

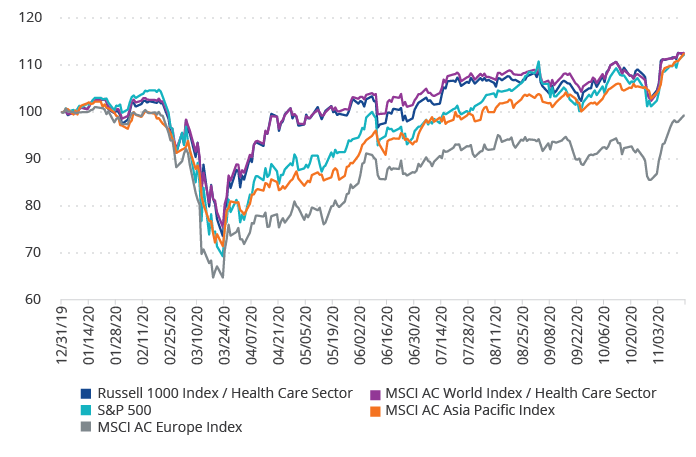

Hopes of a return to normality are increasing after a year of pandemic-induced tumult. News that COVID-19 vaccines developed by Pfizer and BioNTech, and Moderna were more than 90% effective in clinical trials lifted global stock markets, with health care stocks outpacing the gains in the U.S., Asia and Europe over the week (see Figure 1). The level of efficacy was much higher than the 70% that many had hoped for, raising expectations that vaccinations could help boost the sluggish global economy, and provide a way out of the pandemic.

Figure 1: Market performances (Total returns, rebased)

Source: Factset. As of 16 November 2020. The above chart represents past performance of various indices and not the fund. Index performance is not illustrative of the fund’s performance. You cannot invest directly in an index. Index returns assume dividends are immediately reinvested and exclude management fees and costs incurred when investing in the fund. Past performance of the indices is not a reliable indicator of guarantee of future performance of the fund.

Bright prospects

The vaccines present a big opportunity for pharmaceutical firms such as Pfizer, one of the top 10 holdings in the VanEck Vectors® Pharmaceutical ETF (PPH®). The U.S. pharmaceutical giant, which is developing the vaccine in partnership with Germany’s BioNTech, expects to produce globally up to 50 million doses this year and over one billion doses in 2021,1 subject to clinical success and regulatory authorization. Sales for the vaccine are estimated at US$3.5 billion next year before steadying at US$1.4 billion annually.

The possibility of a divided U.S. Congress may further propel the pharmaceutical sector, benefiting pharmaceutical ETFs. Although both Democrats and Republicans are supportive of drug pricing and reimbursement reform, the prospects of big changes to government health plans are lower if there is a policy gridlock.

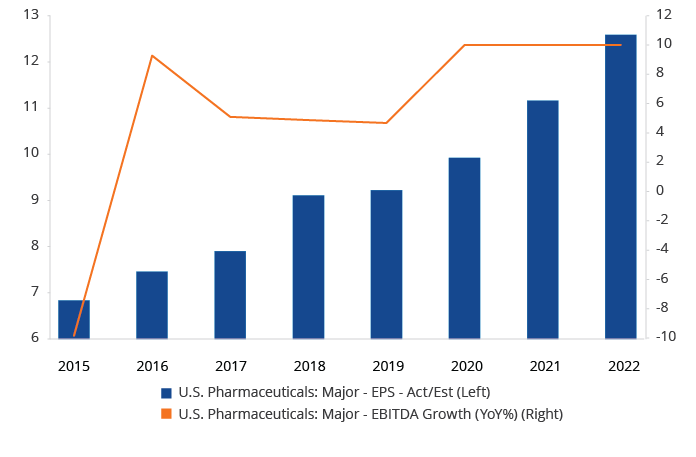

Meanwhile, third-quarter results from the pharmaceutical sector has been upbeat so far, with almost 90% of the companies reporting better-than-expected revenues and earnings. Analysts expect the momentum to continue, with industry estimates from Factset (see Figure 2) projecting earnings growth over the next couple of years.

A growing, ageing and richer global population will further boost demand for improved biotechnology and healthcare. Technological advancements such as the increased use of artificial intelligence and online doctors, and evolving care models may also ensure a long tailwind for the sector.

Figure 2: Healthcare earnings outlook

Source: Factset. Data as of 18 November 2020.

VanEck Vectors Pharmaceutical ETF (NASDAQ: PPH)

Instead of investing in individual companies, one of the easiest ways to invest in the healthcare sector is via the VanEck Vectors Pharmaceutical ETF (NASDAQ: PPH). PPH provides exposure to 25 of the largest pharmaceutical and distribution companies in the world by tracking the MVIS US Listed Pharmaceutical 25 Index. U.S. drugmakers make up slightly more than 65% of the portfolio, while the remainder of the exposure (~35%) is in other healthcare companies in Europe, Israel and Japan. In terms of charges, the fund’s expense ratio of 0.36%2 is much lower than some of the fees levied by its peers for similar funds.3

For more insights and best practices ETF capital market execution, please contact me by replying to this email.

Key points about PPH:

- An ETF to play on the potential growth of the pharmaceutical sector.

- Provides exposure to some of the world’s largest pharmaceutical companies that are well positioned to benefit from long-term growth in the industry.

- Obtaining access to these leading companies doesn’t come at a high cost. PPH’s expense ratio is among the lowest compared to the charges levied by its peers for similar funds.4

DISCLOSURES

1 Source: Pfizer, as of 11 November 2020.

2 Expenses for PPH are capped contractually at 0.35% until February 1, 2021. Cap excludes acquired fund fees and expenses, interest expense, trading expenses, taxes and extraordinary expenses.

3 Source: Morningstar.

4 Source: Morningstar.

This material is for informational purposes only. The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results, are valid as of the date of this communication and are subject to change without notice. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

This is not an offer to buy or sell, or a solicitation of any offer to buy or sell any of the companies mentioned herein. Fund holdings will vary. For a complete list of holdings in the ETF, please click here: https://www.vaneck.com/etf/equity/pph/holdings/.

Earnings per share (EPS) is the monetary value of earnings per outstanding share of common stock for a company. Earnings before interest, taxes, depreciation, and amortization (EBITDA) is an accounting measure calculated using a company's earnings, before interest expenses, taxes, depreciation, and amortization are subtracted, as a proxy for a company's current operating profitability.

An investment in VanEck Vectors Pharmaceutical ETF (PPH) may be subject to risks which include, among others, investing in the pharmaceutical industry, equity securities, health care sector, depositary receipts, special risk considerations of investing in European issuers, foreign securities, foreign currency, small- and medium-capitalization companies, issuer-specific changes, market, operational, index tracking, authorized participant concentration, no guarantee of active trading market, trading issues, passive management, fund shares trading, premium/discount risk and liquidity of fund shares, non-diversified, and concentration risks, all of which may adversely affect the Fund. Foreign investments are subject to risks, which include changes in economic and political conditions, foreign currency fluctuations, changes in foreign regulations, and changes in currency exchange rates which may negatively impact the Fund's returns. Small- and medium-capitalization companies may be subject to elevated risks.

MVIS US Listed Pharmaceutical 25 Index is the exclusive property of MarketVector Indexes GmbH (a wholly owned subsidiary of the Adviser), which has contracted with Solactive AG to maintain and calculate the Index. Solactive AG uses its best efforts to ensure that the Index is calculated correctly. Irrespective of its obligations toward MarketVector Indexes GmbH, Solactive AG has no obligation to point out errors in the Index to third parties. The VanEck Vectors Pharmaceutical ETF is not sponsored, endorsed, sold or promoted by MarketVector Indexes GmbH and MarketVector Indexes GmbH makes no representation regarding the advisability of investing in the Fund.

Investing involves substantial risk and high volatility, including possible loss of principal. An investor should consider the investment objective, risks, charges and expenses of a Fund carefully before investing. To obtain a prospectus and summary prospectus, which contain this and other information, call 800.826.2333 or visit vaneck.com. Please read the prospectus and summary prospectus carefully before investing.

Related Funds

DISCLOSURES

1 Source: Pfizer, as of 11 November 2020.

2 Expenses for PPH are capped contractually at 0.35% until February 1, 2021. Cap excludes acquired fund fees and expenses, interest expense, trading expenses, taxes and extraordinary expenses.

3 Source: Morningstar.

4 Source: Morningstar.

This material is for informational purposes only. The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results, are valid as of the date of this communication and are subject to change without notice. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

This is not an offer to buy or sell, or a solicitation of any offer to buy or sell any of the companies mentioned herein. Fund holdings will vary. For a complete list of holdings in the ETF, please click here: https://www.vaneck.com/etf/equity/pph/holdings/.

Earnings per share (EPS) is the monetary value of earnings per outstanding share of common stock for a company. Earnings before interest, taxes, depreciation, and amortization (EBITDA) is an accounting measure calculated using a company's earnings, before interest expenses, taxes, depreciation, and amortization are subtracted, as a proxy for a company's current operating profitability.

An investment in VanEck Vectors Pharmaceutical ETF (PPH) may be subject to risks which include, among others, investing in the pharmaceutical industry, equity securities, health care sector, depositary receipts, special risk considerations of investing in European issuers, foreign securities, foreign currency, small- and medium-capitalization companies, issuer-specific changes, market, operational, index tracking, authorized participant concentration, no guarantee of active trading market, trading issues, passive management, fund shares trading, premium/discount risk and liquidity of fund shares, non-diversified, and concentration risks, all of which may adversely affect the Fund. Foreign investments are subject to risks, which include changes in economic and political conditions, foreign currency fluctuations, changes in foreign regulations, and changes in currency exchange rates which may negatively impact the Fund's returns. Small- and medium-capitalization companies may be subject to elevated risks.

MVIS US Listed Pharmaceutical 25 Index is the exclusive property of MarketVector Indexes GmbH (a wholly owned subsidiary of the Adviser), which has contracted with Solactive AG to maintain and calculate the Index. Solactive AG uses its best efforts to ensure that the Index is calculated correctly. Irrespective of its obligations toward MarketVector Indexes GmbH, Solactive AG has no obligation to point out errors in the Index to third parties. The VanEck Vectors Pharmaceutical ETF is not sponsored, endorsed, sold or promoted by MarketVector Indexes GmbH and MarketVector Indexes GmbH makes no representation regarding the advisability of investing in the Fund.

Investing involves substantial risk and high volatility, including possible loss of principal. An investor should consider the investment objective, risks, charges and expenses of a Fund carefully before investing. To obtain a prospectus and summary prospectus, which contain this and other information, call 800.826.2333 or visit vaneck.com. Please read the prospectus and summary prospectus carefully before investing.