Fact-Check: Will Robots Replace Us?

May 16, 2024

Read Time 3 MIN

Fact-Check: Will Robots Replace Us?

The rise of artificial intelligence (AI), automation, and robotics has sparked both anticipation and apprehension regarding the future of work. With the explosion of technological advancements, the question "Will robots take my job?” is valid. Within the next five years, one in 16 workers may need to change careers due to robotics and AI (McKinsey)1. Many of these are highly skilled workers.

As alarming as predictions like these are, it's crucial to note that robots will merely displace, not completely replace. Robots' complete takeover of jobs is unrealistic, and we can look to the past to see why that is.

New Jobs Creation

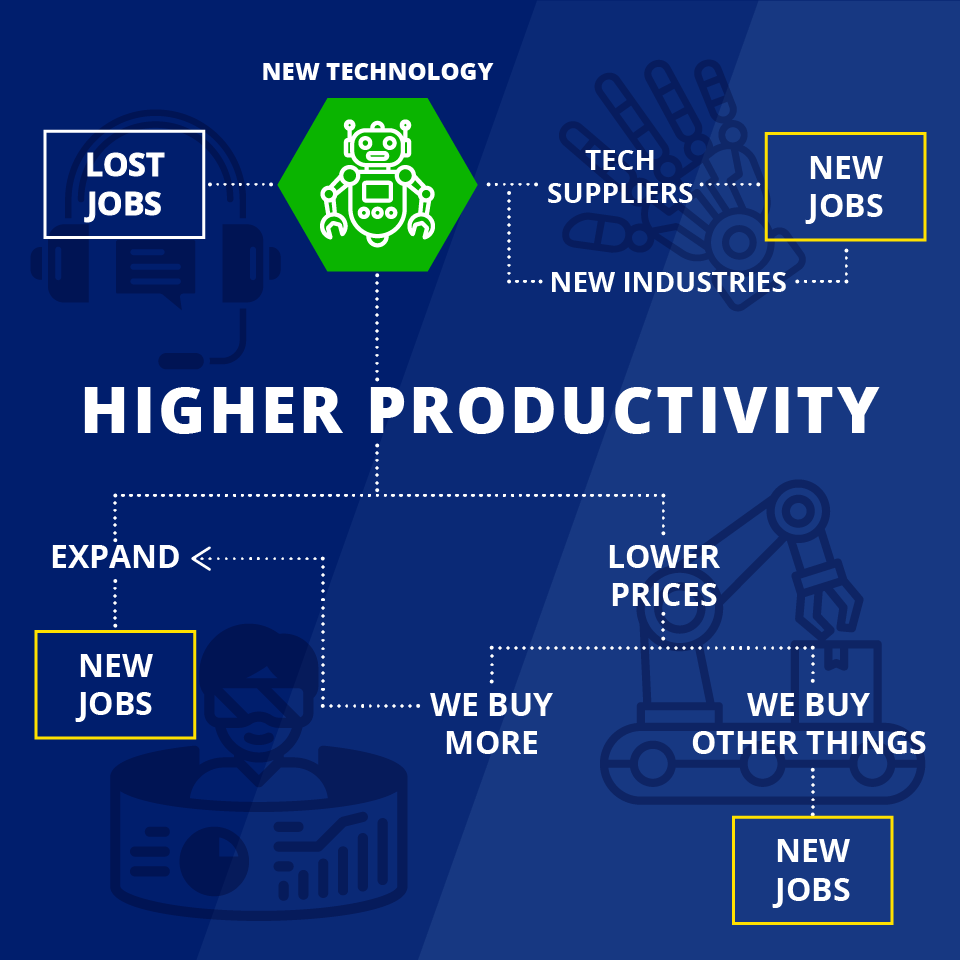

History demonstrates that technological advancements typically create more jobs than they eliminate. While robots and automation may displace specific roles, they also open avenues for the emergence of new occupations. Adapting to these changes and seizing the opportunities they present is critical.

The creation of new jobs often correlates with heightened productivity. Businesses adopting new technologies work more efficiently, increasing worker output. This productivity surge can drive company expansion, resulting in more job opportunities. Additionally, increased efficiency may lower prices, stimulating consumer spending and further job creation across various sectors.

The integration of robotics in manufacturing has spawned roles in robotics manufacturing, software development, and system integration. Similarly, fields such as artificial intelligence, data science, and cybersecurity have experienced significant growth. However, this labor abundance contributes to another challenge humans will face soon.

Global Labor Force Shortage

The looming global labor force shortage must be discussed more, as declining birth rates and aging populations in countries like China, South Korea, and Japan exacerbate it. Even the United States is experiencing this as fertility rates dropped 3% this past year (CDC). The fertility rate has been well below replacement for decades. Amongst developed nations, the split between adults who are working age and those who are retired will be nearly 50/50. That is, too many people depend on the working class at our current levels of efficiency. With these demographic changes, innovative solutions are imperative to maintain economic productivity.

Percentage of Working Age vs. Retirement Age

Source: United Nations. As of July 2022. Annual old-age dep. ratio [65+ / 20-64] (%). *Assuming constant fertility and mortality. They are not intended as a forecast or prediction of future results.

In this context, robots and automation technologies can be valuable allies rather than adversaries. By augmenting human labor with robotic assistance, industries can mitigate manpower shortages and enhance efficiency. For instance, in Japan, where the aging population poses a significant challenge, robots are deployed in healthcare settings to alleviate strain on the healthcare system.

Complementary Nature of Humans and Robots

With their capacity for tackling precise and repetitive tasks, robots still lean on human insight for activities that require flexibility, inventive thought, and nuanced decision-making. This mutual dependency bolsters the argument for collaboration, not competition, as we move towards the future of work.

Collaborating robots, or "cobots," are interweaving into this dynamic, revolutionizing the manufacturing landscape with safe, cost-efficient automation solutions. These innovative cobots operate in tandem with human workers, broadening the scope of automation through user-friendly interfaces that boost productivity and workplace safety.

This surge in automation sweeps away monotonous tasks from the human workload, granting workers the freedom to contribute higher cognitive skills that demand emotional intelligence, critical thinking, and interpersonal abilities traits genuinely human and beyond the reach of mechanical substitution.

Investing in the Future

The rise of robotics and automation presents not a harbinger of joblessness but an opportunity for economic sustainability. Far from rendering human labor obsolete, these technological advances ensure the continuation of work in the face of global labor shortages and the retirement of older generations. By pairing robotic efficiency with human creativity and problem-solving, we can forge a collaborative future that elevates productivity and fosters job creation in AI, data science, and robotics sectors.

Investors can participate in the growth of industries poised to shape the future of work through instruments like the VanEck Robotics ETF, capturing the growth of forward-looking industries while remaining cognizant of the broader trends shaping our evolving economy. The future is not to be feared—it is to be shaped with optimism, where humans utilize machines to progress toward a prosperous tomorrow.

To receive more Thematic Investing insights, sign up in our subscription center.

Follow Us

Important Disclosures

This is not an offer to buy or sell, or a recommendation to buy or sell any of the securities, financial instruments or digital assets mentioned herein. The information presented does not involve the rendering of personalized investment, financial, legal, tax advice, or any call to action. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results, are for illustrative purposes only, are valid as of the date of this communication, and are subject to change without notice. Actual future performance of any assets or industries mentioned are unknown. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. VanEck does not guarantee the accuracy of third party data. The information herein represents the opinion of the author(s), but not necessarily those of VanEck or its other employees.

An investment in the Fund may be subject to risks which include, among others, risks related to investing in robotics companies, information technology sector, industrials sector, equity securities, medium-capitalization companies, special risk considerations of investing in Japanese issuers, foreign securities, semiconductor industry, depositary receipts, market, operational, index tracking, authorized participant concentration, no guarantee of active trading market, trading issues, passive management, fund shares trading, premium/discount risk and liquidity of fund shares, non-diversified and index-related concentration risk, all of which may adversely affect the Fund. Medium-capitalization companies may be subject to elevated risks.

BlueStar® Robotics Index is the exclusive property of MarketVector Indexes GmbH (a wholly owned subsidiary of Van Eck Securities Corporation), which has contracted with Solactive AG to maintain and calculate the Index. Solactive AG uses its best efforts to ensure that the Index is calculated correctly. Irrespective of its obligations towards MarketVector Indexes GmbH, Solactive AG has no obligation to point out errors in the Index to third parties. The VanEck Robotics ETF is not sponsored, endorsed, sold or promoted by MarketVector Indexes GmbH and MarketVector Indexes GmbH makes no representation regarding the advisability of investing in the Fund.

An investor cannot invest directly in an index. Returns reflect past performance and do not guarantee future results. Results reflect the reinvestment of dividends and capital gains, if any. Certain indices may take into account withholding taxes. Index returns do not represent Fund returns. The Index does not charge management fees or brokerage expenses, nor does the Index lend securities, and no revenues from securities lending were added to the performanceshown.

Investing involves substantial risk and high volatility, including possible loss of principal. An investor should consider the investment objective, risks, charges and expenses of a Fund carefully before investing. To obtain a prospectus and summary prospectus, which contain this and other information, call 800.826.2333 or visit vaneck.com. Please read the prospectus and summary prospectus carefully before investing.

© Van Eck Securities Corporation, Distributor, a wholly owned subsidiary of Van Eck Associates Corporation.

Related Funds

Important Disclosures

This is not an offer to buy or sell, or a recommendation to buy or sell any of the securities, financial instruments or digital assets mentioned herein. The information presented does not involve the rendering of personalized investment, financial, legal, tax advice, or any call to action. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results, are for illustrative purposes only, are valid as of the date of this communication, and are subject to change without notice. Actual future performance of any assets or industries mentioned are unknown. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. VanEck does not guarantee the accuracy of third party data. The information herein represents the opinion of the author(s), but not necessarily those of VanEck or its other employees.

An investment in the Fund may be subject to risks which include, among others, risks related to investing in robotics companies, information technology sector, industrials sector, equity securities, medium-capitalization companies, special risk considerations of investing in Japanese issuers, foreign securities, semiconductor industry, depositary receipts, market, operational, index tracking, authorized participant concentration, no guarantee of active trading market, trading issues, passive management, fund shares trading, premium/discount risk and liquidity of fund shares, non-diversified and index-related concentration risk, all of which may adversely affect the Fund. Medium-capitalization companies may be subject to elevated risks.

BlueStar® Robotics Index is the exclusive property of MarketVector Indexes GmbH (a wholly owned subsidiary of Van Eck Securities Corporation), which has contracted with Solactive AG to maintain and calculate the Index. Solactive AG uses its best efforts to ensure that the Index is calculated correctly. Irrespective of its obligations towards MarketVector Indexes GmbH, Solactive AG has no obligation to point out errors in the Index to third parties. The VanEck Robotics ETF is not sponsored, endorsed, sold or promoted by MarketVector Indexes GmbH and MarketVector Indexes GmbH makes no representation regarding the advisability of investing in the Fund.

An investor cannot invest directly in an index. Returns reflect past performance and do not guarantee future results. Results reflect the reinvestment of dividends and capital gains, if any. Certain indices may take into account withholding taxes. Index returns do not represent Fund returns. The Index does not charge management fees or brokerage expenses, nor does the Index lend securities, and no revenues from securities lending were added to the performanceshown.

Investing involves substantial risk and high volatility, including possible loss of principal. An investor should consider the investment objective, risks, charges and expenses of a Fund carefully before investing. To obtain a prospectus and summary prospectus, which contain this and other information, call 800.826.2333 or visit vaneck.com. Please read the prospectus and summary prospectus carefully before investing.

© Van Eck Securities Corporation, Distributor, a wholly owned subsidiary of Van Eck Associates Corporation.