Muni Bond Risks Vary with Climate Threats and Resilience

September 23, 2022

Read Time 4 MIN

Muni bond issues cover periods of decades. Over 30 years, just like a family home financed by a mortgage, neighborhoods and municipalities can both experience meaningful changes. For the next 30 years, from 2022 to 2052, these material changes include changes in climate – shifts in weather patterns, levels of water in sea and rivers, winds, risk of fires from droughts and higher temperatures – and will test the resilience of our society, infrastructure, and capital markets.

Muni bonds can finance new buildings – like college campus expansions and new hospital centers for research and patient care. Muni bonds that address climate risks include funding for real estate projects that achieve leadership in energy and environmental design (LEED) certification (Certified, Silver, Gold, Platinum), which aim to reduce energy consumption and greenhouse gas emissions, as well as more efficient water and waste management.

Some K–12 school districts use muni bond financing to build and implement solar technology, resulting in lower energy costs and increased energy self–sufficiency. Installing solar panels in schools also has an educational component, resulting in students being better informed and aware of energy consumption and resources.

In some cases, the energy savings from school solar generation can be passed on to the whole community, helping to lower electricity bills and making room for other expenses that can enable better learning outcomes1. These factors are built into the HIP Ratings and VanEck investment process applied in the VanEck HIP Sustainable Muni ETF (SMI).

Muni bonds finance local and regional infrastructure – upgraded roads, cleaner energy, and recyclable water facilities. Muni bonds that address these sustainability challenges are increasingly popular with investors, as they can reduce future risks and shocks from factors including navigable highways in extreme weather events, unexpectedly volatile energy prices, and increasing water scarcity.

These climate challenges are present today and are increasing. Flash floods and regional fires considered 1–in–100–year events are increasing in frequency and intensity. Thus, in muni bond timeframes of multiple decades, savvy investors can choose to allocate to geographic areas that may encounter fewer risks and scrutinize areas where higher risks are expected.

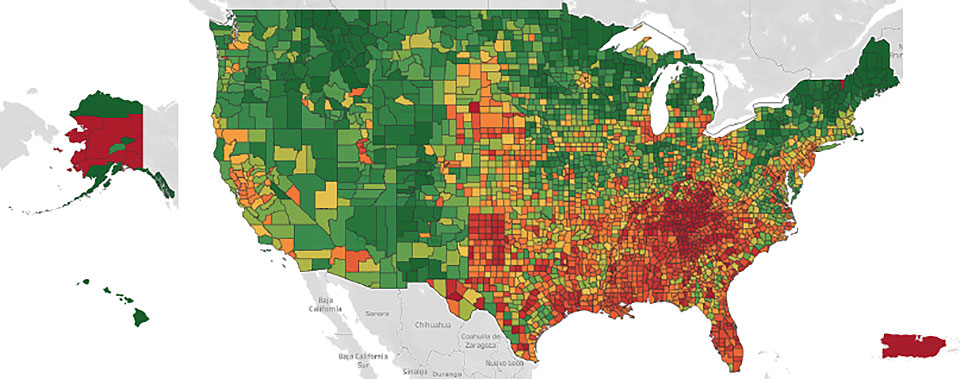

In the U.S. national map, based on HIP Investor’s Climate Threat Resilience Ratings of 3,100 counties2, the redder areas are higher climate risk and lower resilience, whereas the greener areas are lesser climate risk and enhanced resilience. Risks are rated according to HIP’s analysis of the U.S. Environmental Protection Agency (EPA) evaluations and projections of the impacts of future weather and climate events; resilience is rated based on analytics from the Sabin Center for Climate Change Law at Columbia University.

The south and southeast regions of the USA face many future risks, and local and state policies are lagging in pursuing and financing resilience.

Granular HIP Climate Threat Resilience Ratings for 3,100+ Counties Indicate Future Risks and Readiness for Climate Action

Source: HIP Investor Climate Threat Resilience Ratings; US EPA; Sabin Center for Climate Change Law at Columbia University. As of 2021.

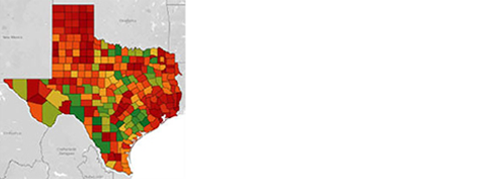

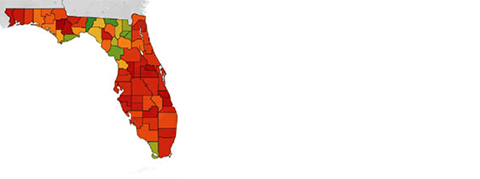

The states of Texas and Florida account for 9.40% and Florida 4.24% of the ICE US Broad Municipal Index (MUNI) yet have been generally slow – or even antagonistic – to climate action. Detailed maps of Texas and Florida show that most of the counties in those states need climate–related investments. States with lower household income and lower tax rates, like Mississippi, Alabama, and Louisiana, also face many climate risks that are not yet being addressed sufficiently.

Most Counties at Risk in Texas and Florida Green Bonds Could Target Less Risky Areas

STATE OF TEXAS

- 100 of 250 counties (or 40%) rate above the 33% hurdle rate.

- 3.9 million people in better positioned counties.

- Brownsville (southeast Texas), Laredo (southwest Texas), and Waco are less risky.

STATE OF FLORIDA

- 10 of 54 counties rate above a 50% hurdle rate.

- 300,000 people in better positioned counties.

- Gainesville, Panama City, and Inverness are less risky.

Source: HIP Investor Climate Threat Resilience Ratings; US EPA; Sabin Center for Climate Change Law at Columbia University. As of 2021.

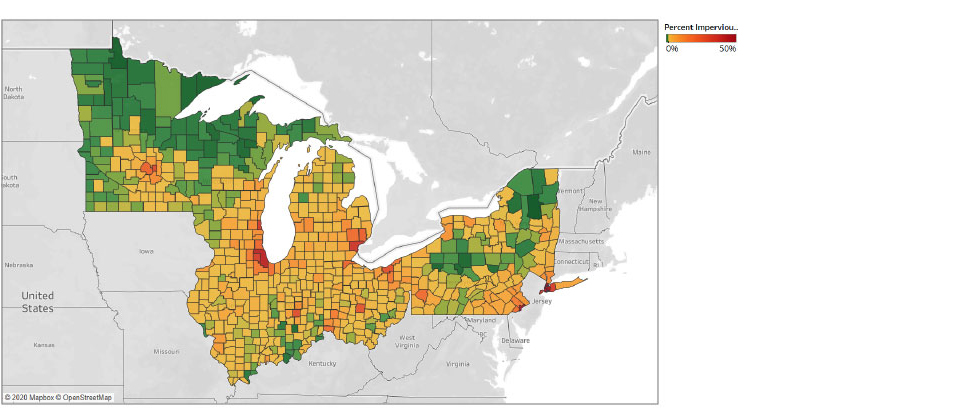

In the Midwest, additional green–stormwater infrastructure is needed, especially as many major cities and metro areas have high proportions of impervious surfaces like roads, parking lots, and highways.

In the Great Lakes Basin, Cities with the Most Impervious Surfaces Need Green Stormwater Infrastructure

- Minneapolis

- Chicago

- Detroit

- Cleveland

- Pittsburgh

- Buffalo

- Philadelphia

- New York City

Source: HIP Investor with ECT Inc. As of 2021.

The VanEck HIP Sustainable Muni ETF (SMI) incorporates HIP’s Climate Threat Resilience Ratings into the bond evaluation and selection investment process. Muni bond issuers in the bottom–third (33%) of these ratings are excluded from consideration due to the risk of principal loss or potential degradation in the probability of timely and reliable bond interest payments; insurance is not sufficient to cover these major climate risks.

Only the top two–thirds (67%) are eligible for investment in SMI, which can reduce future risk related to climate and enhance the potential for solutions that contribute to mitigating climate risk, adapting to climate change, and supporting bonds that achieve meaningful climate action – all components of stronger, resilient fixed income portfolios.

To receive more Municipal Bonds insights, sign up in our subscription center.

Follow Us

Important Disclosures:

1 Source: https://generation180.org/wp-content/uploads/2022/09/BrighterFuture2022.pdf

2 Source: https://hipinvestor.com/climate-threat-resilience-ratings/

This is not an offer to buy or sell, or a recommendation to buy or sell any of the securities/financial instruments mentioned herein. The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results, are valid as of the date of this communication and subject to change without notice. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. VanEck does not guarantee the accuracy of third party data. The information herein represents the opinion of the author(s), but not necessarily those of VanEck or its employees.

Sustainable Investing Considerations: Sustainable investing strategies aim to consider and in some instances integrate the analysis of environmental, social and governance (ESG) factors into the investment process and portfolio. Strategies across geographies and styles approach ESG analysis and incorporate the findings in a variety of ways. Incorporating ESG factors or Sustainable Investing considerations may inhibit the portfolio manager’s ability to participate in certain investment opportunities that otherwise would be consistent with its investment objective and other principal investment strategies.

ESG investing is qualitative and subjective by nature, and there is no guarantee that the factors utilized by VanEck or any judgment exercised by VanEck will reflect the opinions of any particular investor. Information regarding responsible practices is obtained through voluntary or third–party reporting, which may not be accurate or complete, and VanEck is dependent on such information to evaluate a company’s commitment to, or implementation of, responsible practices. Socially responsible norms differ by region. There is no assurance that the socially responsible investing strategy and techniques employed will be successful. An investment strategy may hold securities of issuers that are not aligned with ESG principles.

ESG integration is the practice of incorporating material environmental, social and governance (ESG) information or insights alongside traditional measures into the investment decision process to improve long term financial outcomes of portfolios. Unless otherwise stated within an active investment strategy’s investment objective, inclusion of this statement does not imply that an active investment strategy has an ESG–aligned investment objective, but rather describes how ESG information may be integrated into the overall investment process.

The Fund's strategy of investing in municipal debt securities of issuers promoting sustainable development may limit the types and number of investments available to the Fund or cause the Fund to invest in securities that underperform the market as a whole. As a result, the Fund may underperform funds that do not have a sustainable investing strategy or funds with sustainable investing strategies that do not employ HIP Ratings. In addition, the Fund relies on the Data Provider for the identification of issuers that promote sustainable development based on their HIP Ratings; however, there can be no guarantee that the Data Provider's methodology will align with the Fund's investment strategy or desirable issuers can be correctly identified. Moreover, the United Nations Sustainable Development Goals (“SDGs”) 9, 11 and 12 may be modified or abandoned in the future and there can be no guarantee that the Fund will be able to continue to use HIP Ratings or find an appropriate substitute ratings system.

An investment in the Fund may be subject to risks which include, among others, risks related sustainable impact investing strategy, municipal securities, credit, interest rate, call, data, California, New York, education bond , health care bond, housing bond, transportation bond, management, operational, authorized participant concentration, absence of prior active market, trading issues, market, fund shares trading, premium/discount and liquidity of fund Shares, non–diversified, state concentration risks all of which may adversely affect the Fund. Municipal bonds may be less liquid than taxable bonds. There is no guarantee that the Fund's income will be exempt from federal, state or local income taxes, and changes in those tax rates or in alternative minimum tax rates or in the tax treatment of municipal bonds may make them less attractive as investments and cause them to lose value. Capital gains, if any, are subject to capital gains tax. The Fund's assets may be concentrated in a particular sector and may be subject to more risk than investments in a diverse group of sectors.

ICE US Broad Municipal Index tracks the performance of US dollar denominated investment grade tax–exempt debt publicly issued by US states and territories, and their political subdivisions, in the US domestic market. Qualifying securities must have at least one day remaining term to final maturity, at least 18 months to final maturity at the time of issuance, a fixed coupon schedule and an investment grade rating (based on an average of Moody’s, S&P and Fitch). Index constituents are market capitalization weighted.

© 2006–2022 HIP Investor Inc. All Rights Reserved. The information contained herein: (1) is proprietary to HIP Investor and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither HIP Investor nor its content providers are responsible for any damages or losses arising from any unauthorized use of this information. Past performance is no guarantee of future results. All investing entails risks.

HIP Investor, Inc. (“HIP”) is a provider to Van Eck Associates Corporation (“Van Eck”) of proprietary research products and services, including ESG ratings, Sustainable Development Goal ratings, Opportunity Zone mapping, Climate–Threat and Resilience ratings, and Human Impact + Profit ratings (collectively, the “HIP Ratings”). HIP is the exclusive provider to Van Eck of HIP ratings and similar data used in connection with any sustainable municipal–bond ETF provided by Van Eck, including the VanEck HIP Sustainable Muni ETF. HIP Investor, Inc. (“HIP”) receives certain fees related to the assets under management (AUM) of the VanEck HIP Sustainable Muni ETF, which creates a conflict of interest with actual and prospective clients of HIP, and biases the objectivity of HIP when discussing, evaluating, and recommending the VanEck HIP Sustainable Muni ETF to actual or prospective clients of HIP. The determination to purchase or utilize the VanEck HIP Sustainable Muni ETF is an important decision and should not be based solely upon HIP’s recommendation, guidance, or services. HIP is an independent contractor of Van Eck Associates Corporation, however HIP does not control or supervise the services or products of Van Eck Associates Corporation, and reference to the VanEck HIP Sustainable Muni ETF does not mean that HIP has performed any level of due diligence on the services or products of Van Eck Associates Corporation. Users of HIP’s website, as well as actual and prospective clients of HIP, are urged to perform their own due diligence on, or consult with a separate registered investment adviser with respect to, the VanEck HIP Sustainable Muni ETF. There is no obligation to purchase or utilize the VanEck HIP Sustainable Muni ETF.

An investor should consider the investment objective, risks, charges and expenses of the Funds carefully before investing. To obtain a prospectus and summary prospectus, which contain this and other information, call 800.826.2333 or visit vaneck.com. Please read the prospectus and summary prospectus carefully before investing.

© Van Eck Securities Corporation, Distributor, a wholly owned subsidiary of Van Eck Associates Corporation.

Related Funds

Important Disclosures:

1 Source: https://generation180.org/wp-content/uploads/2022/09/BrighterFuture2022.pdf

2 Source: https://hipinvestor.com/climate-threat-resilience-ratings/

This is not an offer to buy or sell, or a recommendation to buy or sell any of the securities/financial instruments mentioned herein. The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results, are valid as of the date of this communication and subject to change without notice. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. VanEck does not guarantee the accuracy of third party data. The information herein represents the opinion of the author(s), but not necessarily those of VanEck or its employees.

Sustainable Investing Considerations: Sustainable investing strategies aim to consider and in some instances integrate the analysis of environmental, social and governance (ESG) factors into the investment process and portfolio. Strategies across geographies and styles approach ESG analysis and incorporate the findings in a variety of ways. Incorporating ESG factors or Sustainable Investing considerations may inhibit the portfolio manager’s ability to participate in certain investment opportunities that otherwise would be consistent with its investment objective and other principal investment strategies.

ESG investing is qualitative and subjective by nature, and there is no guarantee that the factors utilized by VanEck or any judgment exercised by VanEck will reflect the opinions of any particular investor. Information regarding responsible practices is obtained through voluntary or third–party reporting, which may not be accurate or complete, and VanEck is dependent on such information to evaluate a company’s commitment to, or implementation of, responsible practices. Socially responsible norms differ by region. There is no assurance that the socially responsible investing strategy and techniques employed will be successful. An investment strategy may hold securities of issuers that are not aligned with ESG principles.

ESG integration is the practice of incorporating material environmental, social and governance (ESG) information or insights alongside traditional measures into the investment decision process to improve long term financial outcomes of portfolios. Unless otherwise stated within an active investment strategy’s investment objective, inclusion of this statement does not imply that an active investment strategy has an ESG–aligned investment objective, but rather describes how ESG information may be integrated into the overall investment process.

The Fund's strategy of investing in municipal debt securities of issuers promoting sustainable development may limit the types and number of investments available to the Fund or cause the Fund to invest in securities that underperform the market as a whole. As a result, the Fund may underperform funds that do not have a sustainable investing strategy or funds with sustainable investing strategies that do not employ HIP Ratings. In addition, the Fund relies on the Data Provider for the identification of issuers that promote sustainable development based on their HIP Ratings; however, there can be no guarantee that the Data Provider's methodology will align with the Fund's investment strategy or desirable issuers can be correctly identified. Moreover, the United Nations Sustainable Development Goals (“SDGs”) 9, 11 and 12 may be modified or abandoned in the future and there can be no guarantee that the Fund will be able to continue to use HIP Ratings or find an appropriate substitute ratings system.

An investment in the Fund may be subject to risks which include, among others, risks related sustainable impact investing strategy, municipal securities, credit, interest rate, call, data, California, New York, education bond , health care bond, housing bond, transportation bond, management, operational, authorized participant concentration, absence of prior active market, trading issues, market, fund shares trading, premium/discount and liquidity of fund Shares, non–diversified, state concentration risks all of which may adversely affect the Fund. Municipal bonds may be less liquid than taxable bonds. There is no guarantee that the Fund's income will be exempt from federal, state or local income taxes, and changes in those tax rates or in alternative minimum tax rates or in the tax treatment of municipal bonds may make them less attractive as investments and cause them to lose value. Capital gains, if any, are subject to capital gains tax. The Fund's assets may be concentrated in a particular sector and may be subject to more risk than investments in a diverse group of sectors.

ICE US Broad Municipal Index tracks the performance of US dollar denominated investment grade tax–exempt debt publicly issued by US states and territories, and their political subdivisions, in the US domestic market. Qualifying securities must have at least one day remaining term to final maturity, at least 18 months to final maturity at the time of issuance, a fixed coupon schedule and an investment grade rating (based on an average of Moody’s, S&P and Fitch). Index constituents are market capitalization weighted.

© 2006–2022 HIP Investor Inc. All Rights Reserved. The information contained herein: (1) is proprietary to HIP Investor and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither HIP Investor nor its content providers are responsible for any damages or losses arising from any unauthorized use of this information. Past performance is no guarantee of future results. All investing entails risks.

HIP Investor, Inc. (“HIP”) is a provider to Van Eck Associates Corporation (“Van Eck”) of proprietary research products and services, including ESG ratings, Sustainable Development Goal ratings, Opportunity Zone mapping, Climate–Threat and Resilience ratings, and Human Impact + Profit ratings (collectively, the “HIP Ratings”). HIP is the exclusive provider to Van Eck of HIP ratings and similar data used in connection with any sustainable municipal–bond ETF provided by Van Eck, including the VanEck HIP Sustainable Muni ETF. HIP Investor, Inc. (“HIP”) receives certain fees related to the assets under management (AUM) of the VanEck HIP Sustainable Muni ETF, which creates a conflict of interest with actual and prospective clients of HIP, and biases the objectivity of HIP when discussing, evaluating, and recommending the VanEck HIP Sustainable Muni ETF to actual or prospective clients of HIP. The determination to purchase or utilize the VanEck HIP Sustainable Muni ETF is an important decision and should not be based solely upon HIP’s recommendation, guidance, or services. HIP is an independent contractor of Van Eck Associates Corporation, however HIP does not control or supervise the services or products of Van Eck Associates Corporation, and reference to the VanEck HIP Sustainable Muni ETF does not mean that HIP has performed any level of due diligence on the services or products of Van Eck Associates Corporation. Users of HIP’s website, as well as actual and prospective clients of HIP, are urged to perform their own due diligence on, or consult with a separate registered investment adviser with respect to, the VanEck HIP Sustainable Muni ETF. There is no obligation to purchase or utilize the VanEck HIP Sustainable Muni ETF.

An investor should consider the investment objective, risks, charges and expenses of the Funds carefully before investing. To obtain a prospectus and summary prospectus, which contain this and other information, call 800.826.2333 or visit vaneck.com. Please read the prospectus and summary prospectus carefully before investing.

© Van Eck Securities Corporation, Distributor, a wholly owned subsidiary of Van Eck Associates Corporation.