Boeing and Bank of America Headline March Review

March 23, 2020

Read Time 4 MIN

Boeing and Bank of America Headline March Review

The Morningstar® Wide Moat Focus IndexSM (the “Index”) completed its quarterly rebalance and reconstitution on Friday, March 20, 2020. The Index has a new look after assessing valuation opportunities among U.S. wide moat companies. The Index’s long-standing health care overweight was pared back while financials now take a more prominent place in the Index following that sector’s outsized participation in the recent market slide. One notable addition to the portfolio last week was Boeing Co. (BA).

Boeing Valuations Hard to Overlook

Boeing finished last week’s trading at just under $100 per share after beginning the year above $300 per share. Its decline leaves the aerospace and defense firm trading at a discount of approximately 70% to Morningstar’s fair value estimate. On March 18, 2020, Morningstar reduced its fair value estimate 5%, to $328 per share, citing lower near-term production and a longer 737 MAX grounding, which Morningstar feels could last into late 2020.

Despite the recently reduced fair value estimate, Boeing’s significant sell-off still puts the company at a discount to fair value far below any level seen since coverage was initiated by Morningstar in 2002. The unique rebalance feature of the Index will allow it to allocate to Boeing at these extreme valuations and, if the market recognizes the current mispricing, participate in its recovery. That is a big “if”, but the Index strategy is built for the long term and some allocations take longer than others to play out.

In a March 18, 2020 update, Morningstar analyst Burkett Huey noted “Ultimately, while we hesitate to recommend that investors catch a falling knife, we think Boeing’s valuation looks attractive at current levels. We remain confident in Boeing’s long-term story of supporting increasing propensity to fly in the emerging market[s] and a developed market[s] replacement cycle.” Further to the long-term story, Morningstar assigns Boeing a wide moat despite its well-documented 737 MAX troubles. Morningstar believes the barriers to entry and the costs and difficulty of switching manufacturers provide Boeing with intangible assets and switching costs that protect its competitive position for years to come.

Banking on Banks

The U.S. Federal Reserve’s (Fed’s) recent cut of the federal funds rate put pressure on financial services firms, in particular, the banking sector. Concerns over net interest income at these rate levels have caused fear for investors. However, in a March 15, 2020 research note, Morningstar analyst Eric Compton provided some perspective: “We remind investors a few bad quarters of earnings are not that important when it comes to the intrinsic value of a firm over its lifetime. When bank stock prices imply that bad times will never end, we think the odds shift in the favor of long-term investors. We believe investors should be seriously watching and considering bank stocks as this plays out.”

To that end, the Index added several financial services firms to its portfolio this quarter including American Express (AXP), US Bancorp (USB) and Bank of America (BAC). The rebalancing process also increased its allocation to Wells Fargo (WFC) and Charles Schwab (SCHW).

Bank of America, last included in the Index in March, 2009, is a compelling addition. It is the second largest money center bank in the U.S. and has undergone a decade-long transformation to streamline its business and cut expenses following its acquisitions of Merrill Lynch, Countrywide Financial and MBNA. Prior to the market impact of the coronavirus, many believed the U.S. banking system to be in strong shape. To witness a bank such as Bank of America trade at current valuations is compelling, to say the least.

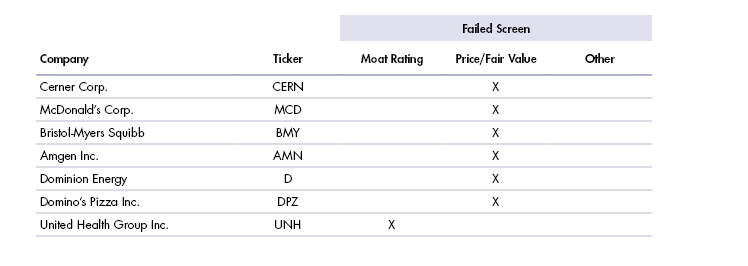

Below is a summary of the stocks added and removed in this quarter’s review. Click here for a full recap of the review.

March 2020 Morningstar® Wide Moat Focus IndexSM Review

Index Additions & Increased Allocations

Index Deletions & Decreased Allocations

Source: Morningstar. Price/fair value data as of March 10, 2020. Past performance is no guarantee of future results. For illustrative purposes only.

VanEck Vectors Morningstar Wide ETF (MOAT) seeks to replicate as closely as possible, before fees and expenses the price and yield performance of the Morningstar Wide Moat Focus Index.

Important Disclosures

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results, are valid as of the date of this communication and subject to change without notice. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

This commentary is not intended as a recommendation to buy or to sell any of the sectors or securities mentioned herein. Holdings will vary for the MOAT ETF and its corresponding Index. For a complete list of holdings in the ETF, please click here: https://www.vaneck.com/etf/equity/moat/holdings/

An investor cannot invest directly in an index. Returns reflect past performance and do not guarantee future results. Results reflect the reinvestment of dividends and capital gains, if any. Certain indices may take into account withholding taxes. Index returns do not represent Fund returns. The Index does not charge management fees or brokerage expenses, nor does the Index lend securities, and no revenues from securities lending were added to the performance shown.

Fair value estimate: the Morningstar analyst's estimate of what a stock is worth.

Price/Fair Value: ratio of a stock's trading price to its fair value estimate.

The Morningstar® Wide Moat Focus IndexSM was created and is maintained by Morningstar, Inc. Morningstar, Inc. does not sponsor, endorse, issue, sell, or promote the VanEck Vectors Morningstar Wide Moat ETF and bears no liability with respect to that ETF or any security. Morningstar® is a registered trademark of Morningstar, Inc. Morningstar®Wide Moat Focus IndexSM is a service mark of Morningstar, Inc

The Morningstar® Wide Moat Focus IndexSM consists of U.S. companies identified as having sustainable, competitive advantages and whose stocks are attractively priced, according to Morningstar.

Effective June 20, 2016, Morningstar implemented several changes to the Morningstar Wide Moat Focus Index construction rules. Among other changes, the index increased its constituent count from 20 stocks to at least 40 stocks and modified its rebalance and reconstitution methodology. These changes may result in more diversified exposure, lower turnover and longer holding periods for index constituents than under the rules in effect prior to this date.

The S&P 500® Index is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Van Eck Associates Corporation. Copyright ©2020 S&P Dow Jones Indices LLC, a division of S&P Global, Inc., and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC. For more information on any of S&P Dow Jones Indices LLC’s indices please visit www.spdji.com. S&P® is a registered trademark of S&P Global and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC. Neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors make any representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector that it purports to represent and neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors shall have any liability for any errors, omissions, or interruptions of any index or the data included therein.

An investment in the VanEck Vectors Morningstar Wide Moat ETF (MOAT®) may be subject to risks which include, among others, investing in equity securities, consumer discretionary, financials, health care, industrials and information technology sectors, medium-capitalization companies, market, operational, index tracking, authorized participant concentration, no guarantee of active trading market, trading issues, passive management, fund shares trading, premium/discount risk and liquidity of fund shares, non-diversified, and concentration risks, which may make these investments volatile in price or difficult to trade. Medium-capitalization companies may be subject to elevated risks.

Fund shares are not individually redeemable and will be issued and redeemed at their net asset value (NAV) only through certain authorized broker-dealers in large, specified blocks of shares called "creation units" and otherwise can be bought and sold only through exchange trading. Shares may trade at a premium or discount to their NAV in the secondary market. You will incur brokerage expenses when trading Fund shares in the secondary market. Past performance is no guarantee of future results.

Investing involves substantial risk and high volatility, including possible loss of principal. An investor should consider a Fund's investment objective, risks, charges and expenses carefully before investing. To obtain a prospectus and summary prospectus for VanEck Funds and VanEck Vectors ETFs, which contain this and other information, call 800.826.2333 or visit vaneck.com. Please read the prospectus and summary prospectus for VanEck Funds and VanEck Vectors ETFs carefully before investing.