Will Strong Global Growth Lead to Disappointment?

November 18, 2020

Read Time 3 MIN

Our quarterly investment outlooks comprise our general observations on the market. Each quarter, we post a video with a short synopsis of one or two themes. Our investment committee also produces a chart pack, which can be downloaded here.

Overview

Despite a pandemic that has led large parts of the world to lockdown, global growth has been strong, which we previously noted in last quarter's investment outlook. We have seen this trend persist as we look at key indicators like global Purchasing Managers Indices (PMIs)—we are keeping a close eye on China’s PMIs and pace of recovery—and the price of copper, which is near four-year highs. Unemployment is also decreasing in the U.S., which is a very positive sign. The strong growth is not that surprising given the significant stimulus from fiscal spending and central banks lowering rates. In the later months of the summer, economies also started reopening from their lockdowns.

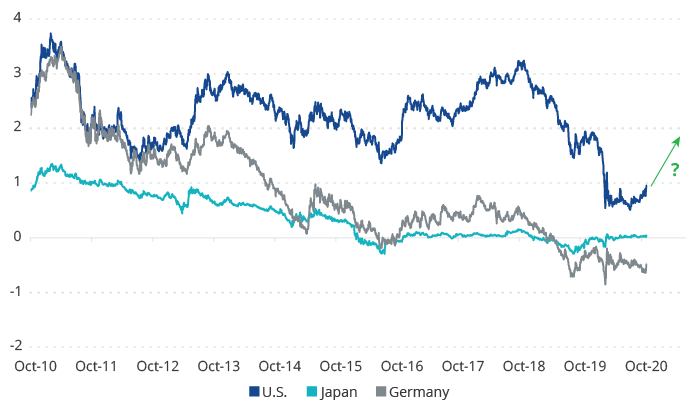

Will Global Growth Put Upward Pressure on Interest Rates?

Looking into 2021, my saying now is: “Prepare to be disappointed.” Not all forces are working in favor for financial markets. If global growth continues to be strong, it may push up 10-year interest rates. The increase may not be dramatic, but even a move up to 1.5-2% would not be great for stock and bond markets. It might not be too negative, but it won’t be positive. Put another way, there is a saying that “Not all that’s good for Wall Street is good for Main Street.” Well, the reverse can be true as well.

Continued Global Growth May Push Interest Rates Up

Source: Bloomberg. Data as of November 10, 2020. Past performance is not a guarantee of future results.

Source: Bloomberg. Data as of November 10, 2020. Past performance is not a guarantee of future results.

I think we have two scenarios to consider. First, this may be a goldilocks economy1, where we have lower-for-longer interest rates and financial assets continue to do fine. Second, if economic growth continues to strengthen heading into 2021 and puts upwards pressure on interest rates, then as I said, prepare to be disappointed.

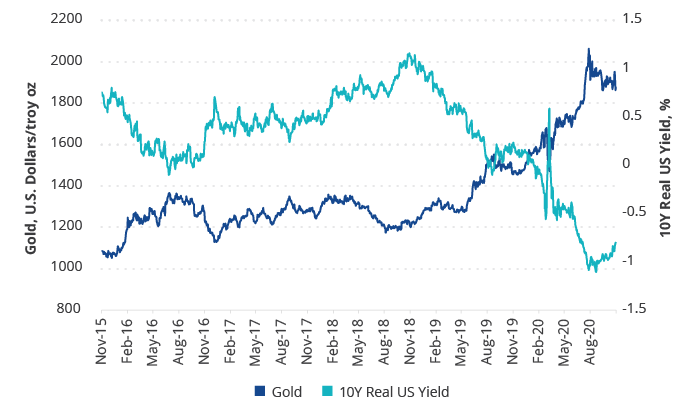

If nominal rates rise, we also have to look at what happens to real interest rates and what that means for gold. Nominal interest rates have come down, but because inflation is higher, real rates are negative. Negative real rates are a dream scenario for gold.

If Nominal Rates Rise, Will Real Rates Rise, Hurting Gold?

Source: Bloomberg. Data as of September 30, 2020. Past performance is not a guarantee of future results. Chart is for illustrative purposes only.

Source: Bloomberg. Data as of September 30, 2020. Past performance is not a guarantee of future results. Chart is for illustrative purposes only.

What we need to watch for is if interest rates rise and inflation does not go up with it, that scenario will not be great for gold. A weaker dollar may help push inflation up and our overall bullish outlook on gold remains, but we do have this warning flag to raise. Additionally, there is a potential risk that long-term rates go up—but not until 2022 or 2023.

Still Believing in a Balanced Stock Market Portfolio

We pointed out this summer that growth stocks may be overheated. Since then, we have seen the stock market reorganize itself. Smaller cap stocks have been performing better, and value is having a bit of a day in the sun. Especially now, we believe investors should be seeking an equity exposure that’s not overly growth-oriented.

Higher interest rates could also benefit out-of-favor sectors like the financial sector. If global growth continues, then that may place upward pressure on oil prices as well and help lift the beleaguered energy sector. Both of these sectors may face some long-term challenges, but overall, equities should be fine. However, we recommend a more balanced allocation.

How Investors Can Interpret the Election Results

Ahead of the election, our investment professionals shared their insights on the impact of the election on their respective asset classes and what investors can expect in the aftermath. Regardless of the results, we knew the Federal Reserve was going to try to keep rates lower for longer, and that is unlikely to change.

On fiscal policy, the Senate hawks that are worried about over-spending are likely to keep fiscal spending reigned in. That was one of the reasons a spending deal wasn’t reached before the election. If this is the case, then again, prepare to be disappointed. Some of the tailwinds for the stock market that were in place at the end of 2020 do not appear to be in place for 2021.

Follow Us

DISCLOSURES

1 A goldilocks economy is an economy that is not so hot that it causes inflation and not so cold that it causes a recession.

Please note that VanEck may offer investments products that invest in the asset class(es) or industries included herein.

This is not an offer to buy or sell, or a solicitation of any offer to buy or sell any of the securities/financial instruments mentioned herein. The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results, are valid as of the date of this communication and subject to change without notice. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.

DISCLOSURES

1 A goldilocks economy is an economy that is not so hot that it causes inflation and not so cold that it causes a recession.

Please note that VanEck may offer investments products that invest in the asset class(es) or industries included herein.

This is not an offer to buy or sell, or a solicitation of any offer to buy or sell any of the securities/financial instruments mentioned herein. The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results, are valid as of the date of this communication and subject to change without notice. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.