VanEck Reasserts Case for Gold Investing as Price Hits All-Time Highs

August 04, 2020

Read Time 4 MIN

Our outlook has been bullish on gold since last summer, and the case for investing in gold has not been this compelling in years. Gold prices have reached all-time highs in recent days, surpassing the previous high set in September 2011, and we believe current price trends suggest a longer, sustained rally in gold, similar to the 2001-2008 secular rally.

We think the best guidance for the current gold market is to look at prior gold bull markets.

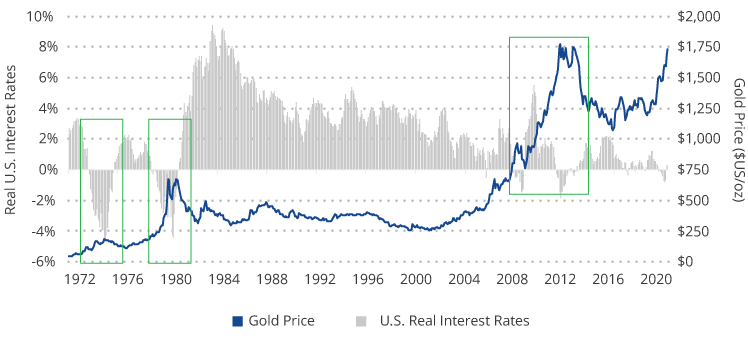

Since 1968, when gold was $35 per ounce, gold bull markets have fallen into two categories: inflationary and deflationary. We don’t see inflation spiking to 5% to 10% in the near future, like in the 1970s, so we believe this is a deflationary cycle. Deflationary conditions imply smaller negative real interest rates compared to the high inflation negative real interest rates of the 1970s—and therefore, we believe we will see a more modest price increases in gold than the 1970s.

Gold Price vs. Real Interest Rates

Source: VanEck, FactSet, Bloomberg. Data as of May 2020. Past performance is no guarantee of future results.

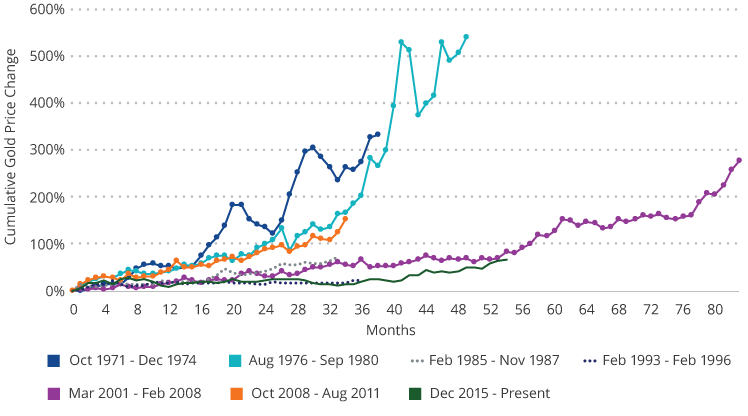

But both recent deflationary gold bull markets suggest that a price over $3,000 is reasonable in our view. If one measures the start of this bull market from the 2015 lows, then it appears similar to the long 2001-2008 bull market when gold rose over 200%, which may be over $3,000 per ounce.

Historical Gold Bull Market Rallies

Source: VanEck, Bloomberg. Data as of June 2020. Past performance is no guarantee of future results.

If one believes, as we do, that the current central bank stimulus to fight the COVID-19 virus, along with elevated levels of systemic risks, are similar to those during the global financial crisis, then $3,400 may be the target for this bull market. This target comes from taking the post-financial crisis move of 150% on top of the $1,350 gold price base in the summer of 2019.

Of course, if there is a burst of inflation, major U.S. economic weakness or uncertainty, prices may go much higher. Some technicians also believe the price target could be over $4,000. On the negative side, gold could underperform alternatives like bitcoin, which outperformed gold in 2017, or silver, which outperformed in the bull market that peaked in 2011.1

Along with the persistence of negative real rates, we believe supply and demand dynamics appear in favor of the metal moving forward. Gold continues to be a scarce commodity, and the fact that there have been no significant new gold discoveries since 2016 only adds to its supply pressure. Demand for gold, however, has continued to rise as investors have sought exposure and central banks have added to their gold reserves.

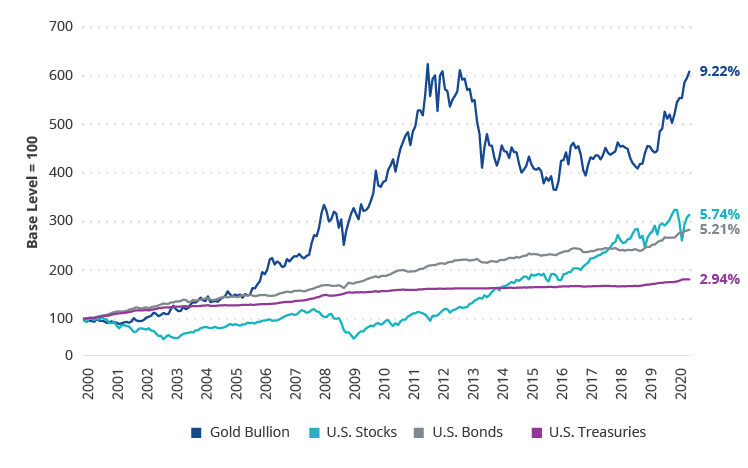

Investors have long been attracted to gold’s many potential benefits. It has historically improved portfolio diversification, acted as an inflation hedge, and proven a safe haven asset in times of market uncertainty. But some may be surprised by its impressive total return since the turn of the century, proving gold’s appreciation potential.

Gold Outperformance (1/1/2000 – 6/30/2020)

Source: Morningstar. US Stocks represented by S&P 500 Index; US Bonds represented by Bloomberg Barclays US Aggregate Bond Index; Gold Bullion represented by LBMA PM Gold Price; US Treasuries represented by the Bloomberg Barclays US 1-3 Year Treasury Bond Index. Past performance is not indicative of future results. Indices are not securities in which investments can be made. An index’s performance is not illustrative of a fund’s performance.

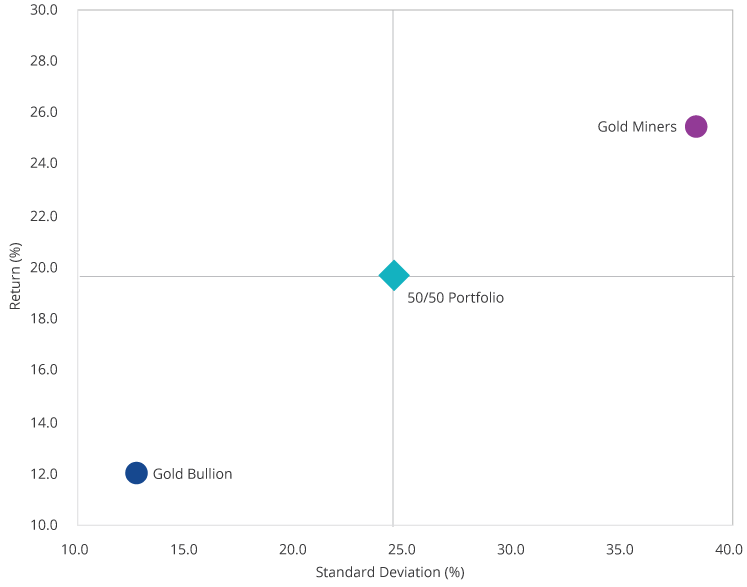

Investors can consider both a physical gold bullion investment as well as exposure to gold via companies that search for and extract gold from the ground, or gold miners. Both are affected by changes in the price of gold but offer different risk/reward profiles. Gold bullion has displayed a lower volatility profile historically and forms the basis for the price of gold. Gold miners, while a historically more volatile investment offering greater upside and downside, have reemerged from a period of management turnover and fiscal/corporate restructuring and are now better positioned to return value to shareholders in our view.

Current Gold Bull Market: Bullion and Miners Volatility (1/1/2016 – 6/30/2020)

Source: Morningstar; VanEck. Volatility is measured by standard deviation. Standard deviation is a historical measure of the variability of returns relative to the average annual return. Past performance is no guarantee of future results.

Read VanEck’s Investment Case for Gold to learn more about the current gold bull market and how to position a portfolio for it.

Follow Us

Important Disclosures

1Source: Morningstar.

Please note that Van Eck Securities Corporation (an affiliated broker-dealer of Van Eck Associates Corporation) may offer investments products that invest in the asset class(es) or industries included in this blog.

Nothing in this content should be considered a recommendation to buy or an offer to sell shares of any investment in any jurisdiction where the offer or solicitation would be unlawful under the securities laws of such jurisdiction, nor is it intended as investment, tax, financial, or legal advice. Investors should seek such professional advice for their particular situation and jurisdiction.

Please note that the information herein represents the opinion of the author, but not necessarily those of VanEck, and this opinion may change at any time and from time to time. Non-VanEck proprietary information contained herein has been obtained from sources believed to be reliable, but not guaranteed. Not intended to be a forecast of future events, a guarantee of future results or investment advice. Historical performance is not indicative of future results. Current data may differ from data quoted. Any graphs shown herein are for illustrative purposes only. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

Gold Bullion or LBMA Gold Price is the London Bullion Market Association measure of gold price quoted in U.S dollars. S&P 500®Index (S&P 500) consists of 500 widely held common stocks, covering four broad sectors (industrials, utilities, financial and transportation). Bloomberg Barclays US Treasury Index measures U.S. dollar-denominated, fixed-rate, nominal debt issued by the U.S. Treasury. Bloomberg Barclays US 1-3 Year Treasury Bond Index measures public obligations of the U.S. Treasury with a maturity between 1 and up to (but not including) 3 years.

Any indices listed are unmanaged indices and include the reinvestment of all dividends, but do not reflect the payment of transaction costs, advisory fees or expenses that are associated with an investment in a Fund. Certain indices may take into account withholding taxes. An index’s performance is not illustrative of a Fund’s performance. Indices are not securities in which investments can be made.

The S&P 500®Index is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Van Eck Associates Corporation. Copyright © 2020 S&P Dow Jones Indices LLC, a division of S&P Global, Inc., and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC. For more information on any of S&P Dow Jones Indices LLC’s indices please visit www.spdji.com. S&P®is a registered trademark of S&P Global and Dow Jones®is a registered trademark of Dow Jones Trademark Holdings LLC. Neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors make any representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector that it purports to represent and neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors shall have any liability for any errors, omissions, or interruptions of any index or the data included therein.

Bloomberg Barclays Indices does not sponsor, endorse, or promote any Fund and bears no liability with respect to a Fund or security.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.

©2020 VanEck

Related Funds

Important Disclosures

1Source: Morningstar.

Please note that Van Eck Securities Corporation (an affiliated broker-dealer of Van Eck Associates Corporation) may offer investments products that invest in the asset class(es) or industries included in this blog.

Nothing in this content should be considered a recommendation to buy or an offer to sell shares of any investment in any jurisdiction where the offer or solicitation would be unlawful under the securities laws of such jurisdiction, nor is it intended as investment, tax, financial, or legal advice. Investors should seek such professional advice for their particular situation and jurisdiction.

Please note that the information herein represents the opinion of the author, but not necessarily those of VanEck, and this opinion may change at any time and from time to time. Non-VanEck proprietary information contained herein has been obtained from sources believed to be reliable, but not guaranteed. Not intended to be a forecast of future events, a guarantee of future results or investment advice. Historical performance is not indicative of future results. Current data may differ from data quoted. Any graphs shown herein are for illustrative purposes only. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

Gold Bullion or LBMA Gold Price is the London Bullion Market Association measure of gold price quoted in U.S dollars. S&P 500®Index (S&P 500) consists of 500 widely held common stocks, covering four broad sectors (industrials, utilities, financial and transportation). Bloomberg Barclays US Treasury Index measures U.S. dollar-denominated, fixed-rate, nominal debt issued by the U.S. Treasury. Bloomberg Barclays US 1-3 Year Treasury Bond Index measures public obligations of the U.S. Treasury with a maturity between 1 and up to (but not including) 3 years.

Any indices listed are unmanaged indices and include the reinvestment of all dividends, but do not reflect the payment of transaction costs, advisory fees or expenses that are associated with an investment in a Fund. Certain indices may take into account withholding taxes. An index’s performance is not illustrative of a Fund’s performance. Indices are not securities in which investments can be made.

The S&P 500®Index is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Van Eck Associates Corporation. Copyright © 2020 S&P Dow Jones Indices LLC, a division of S&P Global, Inc., and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC. For more information on any of S&P Dow Jones Indices LLC’s indices please visit www.spdji.com. S&P®is a registered trademark of S&P Global and Dow Jones®is a registered trademark of Dow Jones Trademark Holdings LLC. Neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors make any representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector that it purports to represent and neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors shall have any liability for any errors, omissions, or interruptions of any index or the data included therein.

Bloomberg Barclays Indices does not sponsor, endorse, or promote any Fund and bears no liability with respect to a Fund or security.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.

©2020 VanEck