How Much Policy Room Is Left?

October 18, 2022

Read Time 2 MIN

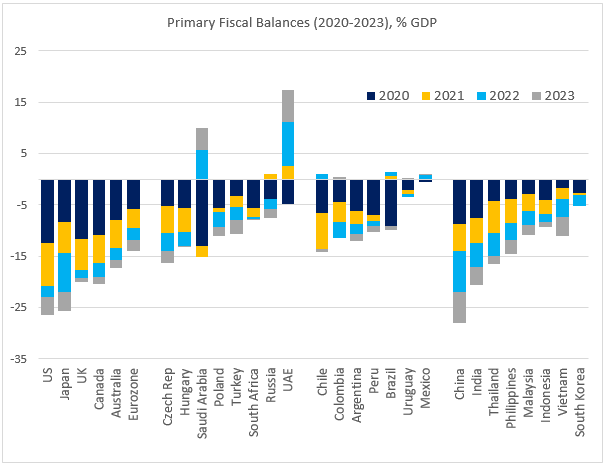

China Fiscal Stimulus

Today is a pretty “light” day data-wise, which might explain why there is so much focus on a delay in China’s activity and foreign trade numbers – presumably due to the timing of the 20th Communist Party Congress. Anyway, while leaders and officials are busy thinking about the country’s development path for the next few years, the IMF’s Fiscal Monitor raises more immediate questions about the extent of China’s fiscal stimulus during the pandemic, and how much policy room China may still have in this area going forward. China’s stimulus might have been targeted – as opposed to the “wall of liquidity” approach in major developed markets (DM) – but these small measures can still add up. The IMF projections shows that China will run the largest primary deficit (as % of GDP) among major emerging and developed markets both in 2022 and 2023 (see chart below). China is also among a handful of economies where primary deficit is set to widen in 2022 – and this widening (again, as % of GDP) is the second largest after Russia (which is financing the war in Ukraine).

China Growth Slowdown

China has so far been reluctant to use monetary policy space – the rate cuts were tiny and the 1-year medium-term lending facility rate was kept on hold last week. Further, China’s interbank rates are already quite low, so it is not clear whether additional rate cuts would make a difference. Finally, China’s falling interest rates worsen the differential with the U.S. – the 5-year differential is now very negative (-171bps) – putting additional pressure on the currency, and creating more policy challenges for the central bank. As regards domestic activity, the strongest headwinds are related to housing sector instability and the zero-COVID approach, and we hope to get more clarity on these issues once the party congress is over.

Global Rate Hikes

China is not the only economy, where market participants question the available policy space – the recent policy U-turns in the U.K. is a fascinating (and scary) example. Major central banks, however, continue to sound hawkish – recession concerns notwithstanding – supporting the market expectations of large rate hikes in the next month or two. Swap curves price in the terminal rates of about 5% in the U.S. and the U.K., and above 3% in the Eurozone. In emerging markets (EM), this week’s focus will be on Turkey – which is expected to cut the policy rate once again (to 11%, with inflation climbing to 83.5%), testing the market’s patience and authorities’ ability to rely on macroprudential measures in the run up to the elections. Stay tuned!

Chart at a Glance: Fiscal Deficits During and After Pandemic

Source: IMF Fiscal Monitor, October 2022.

Follow Us

Related Topics

PMI – Purchasing Managers’ Index: economic indicators derived from monthly surveys of private sector companies. A reading above 50 indicates expansion, and a reading below 50 indicates contraction; ISM – Institute for Supply Management PMI: ISM releases an index based on more than 400 purchasing and supply managers surveys; both in the manufacturing and non-manufacturing industries; CPI – Consumer Price Index: an index of the variation in prices paid by typical consumers for retail goods and other items; PPI – Producer Price Index: a family of indexes that measures the average change in selling prices received by domestic producers of goods and services over time; PCE inflation – Personal Consumption Expenditures Price Index: one measure of U.S. inflation, tracking the change in prices of goods and services purchased by consumers throughout the economy; MSCI – Morgan Stanley Capital International: an American provider of equity, fixed income, hedge fund stock market indexes, and equity portfolio analysis tools; VIX – CBOE Volatility Index: an index created by the Chicago Board Options Exchange (CBOE), which shows the market's expectation of 30-day volatility. It is constructed using the implied volatilities on S&P 500 index options.; GBI-EM – JP Morgan’s Government Bond Index – Emerging Markets: comprehensive emerging market debt benchmarks that track local currency bonds issued by Emerging market governments; EMBI – JP Morgan’s Emerging Market Bond Index: JP Morgan's index of dollar-denominated sovereign bonds issued by a selection of emerging market countries; EMBIG - JP Morgan’s Emerging Market Bond Index Global: tracks total returns for traded external debt instruments in emerging markets.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. This is not an offer to buy or sell, or a solicitation of any offer to buy or sell any of the securities mentioned herein. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Certain information may be provided by third-party sources and, although believed to be reliable, it has not been independently verified and its accuracy or completeness cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as the date of this communication and are subject to change. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

Investing in international markets carries risks such as currency fluctuation, regulatory risks, economic and political instability. Emerging markets involve heightened risks related to the same factors as well as increased volatility, lower trading volume, and less liquidity. Emerging markets can have greater custodial and operational risks, and less developed legal and accounting systems than developed markets.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future performance.

PMI – Purchasing Managers’ Index: economic indicators derived from monthly surveys of private sector companies. A reading above 50 indicates expansion, and a reading below 50 indicates contraction; ISM – Institute for Supply Management PMI: ISM releases an index based on more than 400 purchasing and supply managers surveys; both in the manufacturing and non-manufacturing industries; CPI – Consumer Price Index: an index of the variation in prices paid by typical consumers for retail goods and other items; PPI – Producer Price Index: a family of indexes that measures the average change in selling prices received by domestic producers of goods and services over time; PCE inflation – Personal Consumption Expenditures Price Index: one measure of U.S. inflation, tracking the change in prices of goods and services purchased by consumers throughout the economy; MSCI – Morgan Stanley Capital International: an American provider of equity, fixed income, hedge fund stock market indexes, and equity portfolio analysis tools; VIX – CBOE Volatility Index: an index created by the Chicago Board Options Exchange (CBOE), which shows the market's expectation of 30-day volatility. It is constructed using the implied volatilities on S&P 500 index options.; GBI-EM – JP Morgan’s Government Bond Index – Emerging Markets: comprehensive emerging market debt benchmarks that track local currency bonds issued by Emerging market governments; EMBI – JP Morgan’s Emerging Market Bond Index: JP Morgan's index of dollar-denominated sovereign bonds issued by a selection of emerging market countries; EMBIG - JP Morgan’s Emerging Market Bond Index Global: tracks total returns for traded external debt instruments in emerging markets.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. This is not an offer to buy or sell, or a solicitation of any offer to buy or sell any of the securities mentioned herein. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Certain information may be provided by third-party sources and, although believed to be reliable, it has not been independently verified and its accuracy or completeness cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as the date of this communication and are subject to change. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

Investing in international markets carries risks such as currency fluctuation, regulatory risks, economic and political instability. Emerging markets involve heightened risks related to the same factors as well as increased volatility, lower trading volume, and less liquidity. Emerging markets can have greater custodial and operational risks, and less developed legal and accounting systems than developed markets.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future performance.