Your Guide to Buying an NFT

February 04, 2022

Read Time 7 MIN

Please note that VanEck may have a position(s) in the digital asset(s) described below.

Before we take a journey into NFTs (non-fungible tokens), allow me to explain why I am writing this note. I currently manage a sales team on behalf of VanEck and I expect my sales professionals to be well versed in the areas where our firm has focus. VanEck was the first asset manager to file for a Bitcoin Futures ETF, and has been working diligently to gain a better understanding of the digital assets space in its entirety.

I have been involved in the digital assets space since 2016. I wasn’t early, but definitely was not late. It was a goldilocks period in many ways for me to enjoy some upside, but I was also a part of many unsuccessful project launches.

Like any good manager, I need to arm my team with a better understanding of the stories we wish to discuss with clients. For these reasons, I crafted the note below.

How Has the Crypto and NFT Space Changed Over the Past Few Years?

There is more of everything: coins, tokens, applications, and NFTs are growing. With that said, NFTs are still in early phases, as evidenced by the low-quality UI (User Interface) that hasn’t made major improvements from three years ago, in contrast with Coinbase and Robinhood, which make it incredibly easy to buy BTC. So, from a timeline perspective, we are still at a point where it takes determination and grit to get to the finish line of owning an NFT. Once the UI for NFTs becomes as easy to use as Coinbase and Robinhood, then we can make the argument that NFTs have gone mainstream.

What Is an NFT?

It is a digital representation of ownership of a thing. It is something finite, unique (and verified to be unique), and owned by its rightful owner on a blockchain.

A fellow blogger put it nicely, “NFTs have a similar appeal to trading cards... A pack of Pokémon cards wasn't too expensive back in the day. But the rare cards did jack up the prices. This is no surprise; the rarer the card, the more money a collector would pay. Today a pack of original Pokémon cards can be sold for as much as $40,000. Not a bad investment.”1

The key to NFTs is the underlying technology that makes digital ownership possible. The blockchain plays an important role, as a person with access to the blockchain could validate that you, for instance, own the NFT. Remember that due to the nature of the blockchain, all recorded buys, sells, credits, and debits remain on the ledger, forever!

For some context around the NFT space and its capacity, let us look at the marketplace’s growth potential. OpenSea is an NFT platform that controls about 98% of the NFT market. If it were to maintain its recent marketplace sales pace, it could potentially reach an annual gross merchandise value of $43.5B.2 For a comparable reference, the global art and antiques market totaled $50B in 2020. The NFT space is creeping up on the tangible art space in market size, suggesting growing popularity and investment potential. Read more about the growth of the NFT market here.

If this has sparked your interest in the NFT space, I will walk you through the steps for how to purchase NFTs below.

How to Buy an NFT

Step 1) Find the right NFT for you.

Do you want something that is similar to artwork? Do you want something that provides utility in the future? For our purposes today, we’re going to discuss a current project that at least sounds interesting, is something with possible utility, incorporates sports, and claims to bring something unique.

I am in no way endorsing this product, but merely using it for our example of how to purchase an NFT.

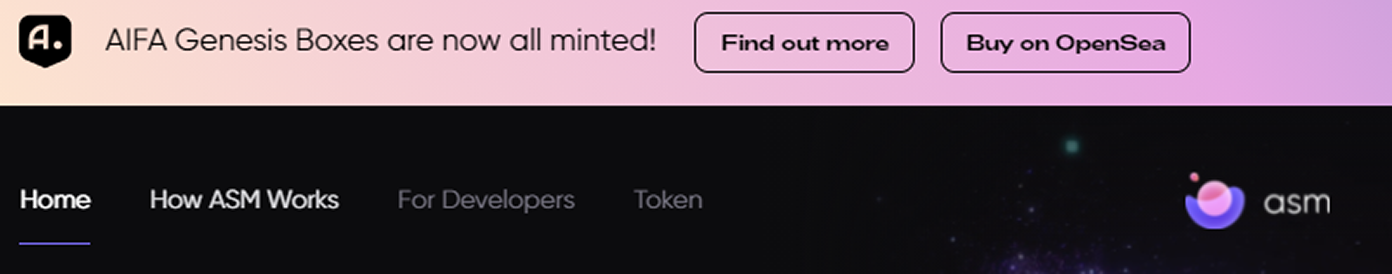

Our target NFT: The project we will pursue is ASM or “Altered State Machine” and the game that it is a part of called the Artificial Intelligence Football Association (AIFA). This project created a way for regular folks, like myself, to purchase Intelligent NFTs, or artificial intelligence on the blockchain. It is my chance to invest in a real-life (okay, virtual) Matrix.

What is it? According to the website, the choices are an Original, Rare, Mythic or Ultra box type. The difference in type is tied to its rarity and, possibly, what’s inside.

Within each box will be additional NFTs in the form of characters that can play in a future, interactive soccer game. It also includes a brain NFT that I can use to give artificial intelligence to these characters in the hopes they can outsmart and outplay my opponents. The more games I win, the more prizes I can win, too. So, let’s buy one of the Mythic Boxes!

NFT Example: AIFA Box

Source: AIFA website

Step 2) Get your wallet ready.

Investors and collectors purchase and hold NFTs within wallets. These are simply apps you can download on your android or Apple smartphone. The wallets provide a method for storage and access to cryptocurrencies and NFTs alike.

Think of the wallet similar to the banking app on your phone. You open the app and you can see the account balance. Think of that as your crypto balance. Similar to the bank app and how your money is secured elsewhere, so is your crypto. When purchasing any digital asset, you will need to have a wallet set up. I provide more details about setting up hot and cold wallets here.

The wallet will allow for the purchase of this NFT in the secondary market. If you have Coinbase and Coinbase Wallet, that will work just fine. For today’s example, I’m using Trust Wallet and will need to use Ethereum to purchase this particular NFT. If you use a wallet that currently does not contain Ethereum, as I am, then you’ll need to send enough Ethereum from your main account (e.g. Coinbase) to the correct Ethereum address in your respective wallet (e.g. Trust Wallet).

Step 3) Your wallet is ready – how do you find on NFT?

I mentioned a “secondary” market earlier; a great place to purchase NFTs in this manner is OpenSea.

OpenSea is an online crypto marketplace that looks and functions similar to eBay. You can list NFTs for sale with a “buy-it now” price, or add them to an auction.

I typed “ASM AIFA Genesis” into the search bar and was eventually led to one of their boxes.

Step 4) Make sure it’s “real”!

Just like in the real world of art, there are sometimes fakes. Before spending a sizable amount of cash or Ethereum, here are some tips to consider before making your investment.

- Access OpenSea through the project’s website. This helps to avoid stumbling upon fake listings. In my case, I went to the actual project’s website at https://www.alteredstatemachine.xyz/. You’ll notice they have a link to OpenSea that takes me directly to the right collection.

Checking an NFTs Authenticity

Source: AIFA website

- Join the project’s community chat channel. Many of these projects can be found on apps such as Discord, Slack, and GitHub. Each channel’s community is heavily invested in the project’s success, so usually developers and others will be happy to look at the NFT for you in advance of purchasing it to make sure it’s the real deal!

- Be early. If you can be part of the project’s “Whitelist” (typically early contributors to the project), the safer your experience will be.

Step 5) Purchase the NFT.

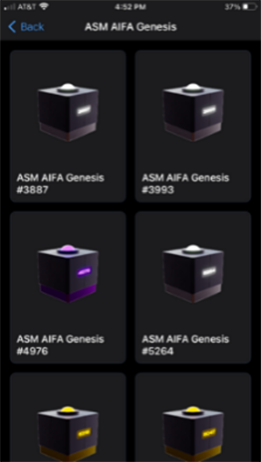

NFTs in a Wallet

Source: AIFA website

Remember, buy the NFT that interests you! The purchase process will require you to sign into your wallet, connect your wallet to OpenSea, confirm your purchases, and wait for the transaction(s) to execute. When the transaction is complete, your wallet’s “Collectible” section will display your items.

Do the Research on NFTs

If you want to better understand NFTs, make sure you take your time in developing knowledge of and familiarity with NFTs. Similar to tangible items, digital ownership of an NFT means you are the owner of the product until you decide to sell. Do the research to make sure you understand how to set up a wallet, how to locate and identify authentic NFTs, the full scope of the projects and risks, and how to make a secure purchase. Do not be afraid to seek out resources and help from those more knowledgeable in the space.

For further learning, we have created a helpful Crypto Guide to aid in navigating our crypto and digital assets resources.

Access our crypto and digital assets education and research for more insights to the digital assets space.

Subscribe for updates and register for upcoming webinars and replays of our crypto discussions.

DISCLOSURES

Please note the author has invested in the Artificial Intelligence Football Association (AIFA) boxes through the, Altered State Machine site mentioned in this blog.

1 Source: https://vocal.media/01/what-the-heck-is-an-nft.

2 Source: The Block Research 9/1/2021; DappRadar https://dappradar.com/ethereum/marketplaces/opensea; World Bank https://data.worldbank.org/indicator/NY.GDP.MKTP.CD?most_recent_value_desc=true.

VanEck owns no rights to the NFTs. Images of NFTs were taken directly from respective websites.

Please note that VanEck may offer investments products that invest in the asset class(es) or industries included herein.

This is not an offer to buy or sell, or a recommendation to buy or sell any of the cryptocurrencies mentioned herein. The information herein represents the opinion of the author(s), but not necessarily those of VanEck, and these opinions may change at any time. Non-VanEck proprietary information contained herein has been obtained from sources believed to be reliable, but not guaranteed. Not intended to be a forecast of future events, a guarantee of future results or investment advice. Historical performance is not indicative of future results. Current data may differ from data quoted. Any graphs shown herein are for illustrative purposes only.

Cryptocurrency is a digital representation of value that functions as a medium of exchange, a unit of account, or a store of value, but it does not have legal tender status. Cryptocurrencies are sometimes exchanged for U.S. dollars or other currencies around the world, but they are not generally backed or supported by any government or central bank. Their value is completely derived by market forces of supply and demand, and they are more volatile than traditional currencies. The value of cryptocurrency may be derived from the continued willingness of market participants to exchange fiat currency for cryptocurrency, which may result in the potential for permanent and total loss of value of a particular cryptocurrency should the market for that cryptocurrency disappear. Cryptocurrencies are not covered by either FDIC or SIPC insurance. Legislative and regulatory changes or actions at the state, federal, or international level may adversely affect the use, transfer, exchange, and value of cryptocurrency.

Investing in cryptocurrencies comes with a number of risks, including volatile market price swings or flash crashes, market manipulation, and cybersecurity risks. In addition, cryptocurrency markets and exchanges are not regulated with the same controls or customer protections available in equity, option, futures, or foreign exchange investing. There is no assurance that a person who accepts a cryptocurrency as payment today will continue to do so in the future.

Investors should conduct extensive research into the legitimacy of each individual cryptocurrency, including its platform, before investing. The features, functions, characteristics, operation, use and other properties of the specific cryptocurrency may be complex, technical, or difficult to understand or evaluate. The cryptocurrency may be vulnerable to attacks on the security, integrity or operation, including attacks using computing power sufficient to overwhelm the normal operation of the cryptocurrency’s blockchain or other underlying technology. Some cryptocurrency transactions will be deemed to be made when recorded on a public ledger, which is not necessarily the date or time that a transaction may have been initiated.

- Investors must have the financial ability, sophistication and willingness to bear the risks of an investment and a potential total loss of their entire investment in cryptocurrency.

- An investment in cryptocurrency is not suitable or desirable for all investors.

- Cryptocurrency has limited operating history or performance.

- Fees and expenses associated with a cryptocurrency investment may be substantial.

There may be risks posed by the lack of regulation for cryptocurrencies and any future regulatory developments could affect the viability and expansion of the use of cryptocurrencies. Investors should conduct extensive research before investing in cryptocurrencies.

Information provided by Van Eck is not intended to be, nor should it be construed as financial, tax or legal advice. It is not a recommendation to buy or sell an interest in cryptocurrencies.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.

Van Eck Associates Corporation

Related Insights

April 08, 2022

Related Funds

DISCLOSURES

Please note the author has invested in the Artificial Intelligence Football Association (AIFA) boxes through the, Altered State Machine site mentioned in this blog.

1 Source: https://vocal.media/01/what-the-heck-is-an-nft.

2 Source: The Block Research 9/1/2021; DappRadar https://dappradar.com/ethereum/marketplaces/opensea; World Bank https://data.worldbank.org/indicator/NY.GDP.MKTP.CD?most_recent_value_desc=true.

VanEck owns no rights to the NFTs. Images of NFTs were taken directly from respective websites.

Please note that VanEck may offer investments products that invest in the asset class(es) or industries included herein.

This is not an offer to buy or sell, or a recommendation to buy or sell any of the cryptocurrencies mentioned herein. The information herein represents the opinion of the author(s), but not necessarily those of VanEck, and these opinions may change at any time. Non-VanEck proprietary information contained herein has been obtained from sources believed to be reliable, but not guaranteed. Not intended to be a forecast of future events, a guarantee of future results or investment advice. Historical performance is not indicative of future results. Current data may differ from data quoted. Any graphs shown herein are for illustrative purposes only.

Cryptocurrency is a digital representation of value that functions as a medium of exchange, a unit of account, or a store of value, but it does not have legal tender status. Cryptocurrencies are sometimes exchanged for U.S. dollars or other currencies around the world, but they are not generally backed or supported by any government or central bank. Their value is completely derived by market forces of supply and demand, and they are more volatile than traditional currencies. The value of cryptocurrency may be derived from the continued willingness of market participants to exchange fiat currency for cryptocurrency, which may result in the potential for permanent and total loss of value of a particular cryptocurrency should the market for that cryptocurrency disappear. Cryptocurrencies are not covered by either FDIC or SIPC insurance. Legislative and regulatory changes or actions at the state, federal, or international level may adversely affect the use, transfer, exchange, and value of cryptocurrency.

Investing in cryptocurrencies comes with a number of risks, including volatile market price swings or flash crashes, market manipulation, and cybersecurity risks. In addition, cryptocurrency markets and exchanges are not regulated with the same controls or customer protections available in equity, option, futures, or foreign exchange investing. There is no assurance that a person who accepts a cryptocurrency as payment today will continue to do so in the future.

Investors should conduct extensive research into the legitimacy of each individual cryptocurrency, including its platform, before investing. The features, functions, characteristics, operation, use and other properties of the specific cryptocurrency may be complex, technical, or difficult to understand or evaluate. The cryptocurrency may be vulnerable to attacks on the security, integrity or operation, including attacks using computing power sufficient to overwhelm the normal operation of the cryptocurrency’s blockchain or other underlying technology. Some cryptocurrency transactions will be deemed to be made when recorded on a public ledger, which is not necessarily the date or time that a transaction may have been initiated.

- Investors must have the financial ability, sophistication and willingness to bear the risks of an investment and a potential total loss of their entire investment in cryptocurrency.

- An investment in cryptocurrency is not suitable or desirable for all investors.

- Cryptocurrency has limited operating history or performance.

- Fees and expenses associated with a cryptocurrency investment may be substantial.

There may be risks posed by the lack of regulation for cryptocurrencies and any future regulatory developments could affect the viability and expansion of the use of cryptocurrencies. Investors should conduct extensive research before investing in cryptocurrencies.

Information provided by Van Eck is not intended to be, nor should it be construed as financial, tax or legal advice. It is not a recommendation to buy or sell an interest in cryptocurrencies.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.

Van Eck Associates Corporation

Related Insights

April 08, 2022