VanEck’s Ethereum Layer-2s Valuation Prediction by 2030

April 03, 2024

Read Time 10+ MIN

Please note that VanEck may have a position(s) in the digital asset(s) described below.

In this piece we:

- We conclude that Ethereum Layer- 2 landscape is crowded with few winner-take-all characteristics for now.

- Evaluate Layer-2 blockchains through a lens of developer experience, user experience, & technical capability.

- Show assumptions behind our $1 trillion market cap base case valuation for Ethereum Layer-2s by 2030.

- Layer-2 Blockchains Overview

- Layer-2s Role in Scaling Ethereum's Network

- Layer-2s Types: Optimistic Roll-Ups and Zero-Knowledge Roll-Ups

- Layer-2s Revenue Models

- Layer-2s On-Chain Cost Structures

- Layer-2s Off-Chain Cost Structures

- EIP-4844’s Answer to L2 Data Costs

- Evaluating Layer-2s Across 5 Key Areas

- Ethereum Layer-2s Valuation Prediction by 2030

Layer-2 Blockchains Overview

Ethereum's dominance in smart contracts faces a critical hurdle: scalability. While the network offers unparalleled security and decentralization, transaction fees and processing times soar when usage intensifies. To overcome this, Layer 2 solutions have emerged, and advancements like the recent fork EIP-4844 promise to unlock even greater scalability for these Ethereum offshoots. Here we analyze an array of Layer 2 solutions from the perspective of transaction pricing, developer experience, user experience, trust assumption, and ecosystem size.

Layer-2 (L2) blockchains are connected networks that operate on top of a primary blockchain, like Ethereum, to increase its capacity for processing transactions. By handling transactions off the main blockchain and then settling them back on it, L2 solutions help to scale the blockchain's capabilities without compromising its security or decentralization.

Ethereum’s current capabilities are well-known to be inadequate for hosting all of the globe’s financial transactions. To be more precise, the world’s financial system will need to process more than Ethereum’s long-term limit of around 19.2 USDC or 6.8 Uniswap trades per second. However, this is a limitation by design because Ethereum’s stewards believe that censorship resistance is best achieved by making it inexpensive for anyone to run Ethereum nodes.

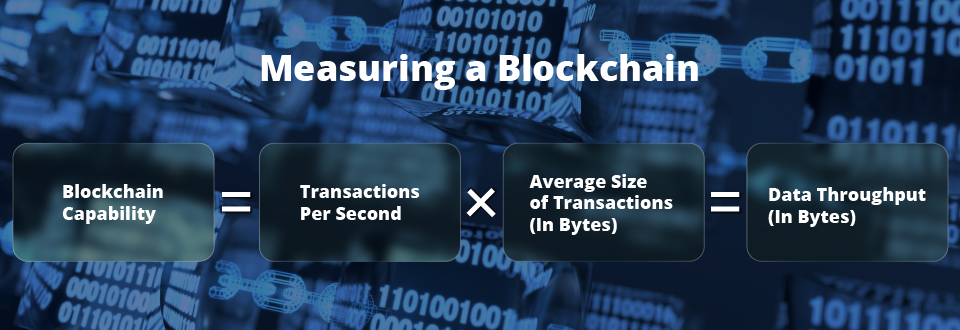

The result is that Ethereum limits its chain’s capabilities to cut down on networking requirements, data storage needs, and computer hardware demands of its nodes. This practically limits how many bytes of data Ethereum can process over a given period of time. As transactions on a blockchain are nothing more than pieces of data that the blockchain agrees are correct, the capabilities of a blockchain can be measured simply by how much useful data it can handle.

Source: VanEck Research as of 3/15/2024.

To address these constraints, Ethereum's developers initially proposed a “sharding” solution, which involved splitting the blockchain into 64 smaller, interconnected sub-blockchains called “shards.” Each of these shards would process transactions within each’s own containerized child blockchains and then submit proofs of the activity to be reconciled by Ethereum’s parent blockchain. While this approach appeared promising, and some of its components debuted on Polkadot starting in 2020, Ethereum developers eventually discarded the sharding plan called Ethereum 2.0. This is because they believed it was technically infeasible and incapable of scaling to Ethereum’s vision of becoming a blockchain for billions of users.

Instead, Ethereum's roadmap shifted towards leveraging Layer-2 (L2) blockchains. These L2 networks handle most transactions off the main Ethereum blockchain, only settling the highest-value transactions directly on it. This approach reduces the load on the main blockchain, allowing it to process more transactions efficiently. In this dynamic, Ethereum accrues value because the costs of these settlements must be paid in ETH; this strategy also reinforces the value of ETH as the true “oil” powering the entire ecosystem of connected chains.

At its core, Ethereum's primary challenge is its limited capacity to process, store, and compute data in the form of financial transactions. This bottleneck in data throughput is being addressed by offloading much of the data processing and computation to Layer-2 blockchains. As a result, Ethereum's development is now concentrated on enhancing its ability to integrate compressed transaction data from these L2 blockchains. But how exactly do these connected blockchains function, and what are their business models?

Ethereum Ecosystem Transactions vs. Ethereum Mainnet Market Share

The Ethereum Ecosystem is growing while Ethereum’s share is shrinking. Source: Artemis XYZ as of 3/22/2024. Not a recommendation to buy or sell any of the names mentioned herein. Past performance is no guarantee of future results.

Layer-2s Role in Scaling Ethereum's Network

Layer-2 (L2) blockchains enhance Ethereum's capabilities by aggregating multiple transactions into condensed bundles, known as "roll-ups.” These “bundles” of transactions are posted by L2s to Ethereum at various intervals that are spaced apart to balance transaction demand, security, and cost. As such, Ethereum is becoming a “blockchain of blockchains.”

Each L2 generally consists of its own series of smart contracts on Ethereum that keep track of L2 transaction history, facilitate data transfer between the L2 and Ethereum, run fault proof or zk verifier contract (more on this below), and function as an asset escrow between Ethereum and the L2. Very powerful computers called “sequencers” ingest and order all the transactions that occur on the L2 blockchains. This is more capable and cheaper than Ethereum because L2s run one very powerful server computer that simply intakes transactions and orders them. This dynamic allows L2s to process greater data throughput than Ethereum. By contrast, Ethereum transaction processing involves 100s of thousands of globally distributed validator nodes sending, interpreting, and agreeing upon transaction data. This takes a lot more time due to the Ethereum consensus process and involves duplicating the work of one computer on each of the 100s of thousands of Ethereum nodes. Logically, a single computer like a sequencer processing transaction is much cheaper and faster than a system of globally dispersed, less capable computers that need to collectively use gigabits of internet bandwidth to message and hundreds of thousands of CPUs to process blockchain transactions.

Types of Layer-2s: Optimistic Roll-Ups (ORUs) and Zero-Knowledge Roll-Ups (ZKUs)

There are two main types of L2s connected to Ethereum: optimistic roll-ups (ORUs) and zero-knowledge roll-ups (ZKUs). Both settle their ledger balances, or "state," on Ethereum by sending a compressed version called a "Merkle Root." ORUs also post a condensed batch of transaction data to allow for verification and traceability of ledger changes over time.

Settlement in Layer-2 blockchains (L2s) can be compared to updating a baseball game's scoreboard inning by inning, with the transaction data serving as the detailed play-by-play. For optimistic roll-ups (ORUs), they operate on the principle of optimism, meaning they are presumed to be accurate unless proven otherwise. If an entity, such as a high-frequency trading firm or a mathematically adept researcher, identifies an incorrect or faulty Merkle root, they can submit a fraud attestation, known as a fault-proof, to Ethereum. Entities monitoring ORUs for fraud have a seven-day window, referred to as a "challenge period," to detect any fraudulent activity following a state update. Once this period concludes, the transactions within the ORU are deemed final. If a fault-proof successfully demonstrates fraud, the smart contract overseeing the ORU's state will revert all transactions to the state before the fraud commenced. The challenge period extends for seven days, after which each batch of transactions is irrevocably finalized.

At the time of writing, of the forty-six L2s we track through l2beat, only four chains have fraud proofs live. Two of those four are under the umbrella of Arbitrum, which boasts the highest total value locked (TVL) of any L2 at $4.31B and only allows fraud proofs from a whitelisted group of entities.

The most popular ORUs are Arbitrum, Blast, Optimism, Manta, Metis, Mantle, and Base.

Total Value Locked (TVL) vs. Annualized Revenues Optimistic Roll-Ups (ORUs)

Source: Defillama, TokenTerminal as of 3/12/2024. Not a recommendation to buy or sell any of the names mentioned herein. Past performance is no guarantee of future results.

A zero-knowledge roll-up (ZKU) operates similarly to an ORU, with one key difference. While ORUs submit both transaction data Merkle roots and state Merkle roots to Ethereum, ZKUs only send a zero-knowledge proof of the transaction data. This is because ZKUs do not operate under the assumption that the submitted state roots are correct. Instead, once the proof is submitted to Ethereum, a smart contract verifies the authenticity of the ZKU's transaction bundle.

As a result, ZKUs do not have fault proofs because proofs are generated with each state update. Unlike ORUs, ZKU transaction data is considered final once the proof is accepted on Ethereum, ensuring immediate finality and eliminating the need for a challenge period.

The most important ZKUs are currently Starkware, zkSync, zkScroll, Linea and *c zkEVM

The base economics of ZKUs and ORUs are very similar to those of L1 blockchains. Both types of roll-ups make money when users create activity on their chains and pay fees in ETH to Ethereum. Currently, all L2s price their transactions in ETH because that is the token needed to settle transaction data to Ethereum.

Layer-2s Revenue Models

Regardless of the process, it is important to understand that transaction ordering has value and that blockchains can make money by selling the rights to transaction ordering. This diagram illustrates how three different transaction sequencing models can create different revenue streams.

Source: VanEck Research as of 3/25/2024. Explanation: Assume that TX2 is a high value transaction, buying $1M of a token on an L2. In FIFO, everyone pays the sequencer the same amount. In Priority Ordering, TX2 pays the sequencer to be first. In Auctioning Specific Slots, TX3 and TX4 pay extra to be ahead of and behind TX2.

Layer-2s Transaction Sequencing: Priority, FIFO, and Auctioning

L2s charge users a fee for transaction inclusion in each block. This is composed of a base fee and a priority fee. Some L2s charge priority fees, like Optimism. Priority fees give users the ability to be first in line at the top of the block of transactions. In the last 6 months, the top 10 L2s on Ethereum made $232M in revenues from user transactions alone. This ability to “cut the line” by paying priority fees benefits users engaging in time-sensitive activities, such as arbitrage trading.

Arbitrum adopts a first-in-first-out (FIFO) sequencing approach to transactions as they arrive. In certain cases, users may prefer their transactions to follow specific others on the block. A common strategy, known as "back-running," involves positioning a transaction right after a significant trade to exploit price discrepancies across decentralized exchanges (DEXs) for arbitrage opportunities. More malicious transaction ordering techniques, such as "sandwich attacks," involve strategically placing buy orders immediately before a user's planned trade and sell orders immediately after. This manipulation drives up the price of the desired token just before the user's transaction executes, forcing them to purchase at a disadvantageous, inflated price.

On Ethereum, ordering is monetized by a software addition added to Ethereum’s validator software. This software, called Flashbots, allows for validators to auction off the right to order transactions (and insert their own) to outside entities. This auction generates "maximal extractable value" (MEV), adding to the validators' and stakers' yields. While L2s have the potential to monetize MEV by auctioning off block ordering rights, no L2 has officially done so yet. However, trading firms may already be positioning their servers close to L2 servers, akin to practices in equity and commodities exchanges.

Looking forward, many L2s plan to decentralize their sequencer set, which may involve staking tokens — possibly ETH from an Eigenlayer DA or from each roll-up’s native token. The sequencer decentralization could unlock new revenue streams from MEV. To contextualize, Ethereum's MEV take rate on DEX volume averages around 4 basis points (bps), while other blockchains like Polygon and Solana have rates of 0.4bps and 3.5bps, respectively. These rates likely understate the full scope of MEV due to the challenges in tracking and the incentives to conceal profits. By estimating MEV take rates against DEX volumes, if Arbitrum's MEV was captured at a rate of 3.0bps, it would amount to $58.9 million — a significant 57% of Arbitrum's fee-only revenue.

Arbitrum Revenues with 3bps of MEV on DEX Volumes

Source: Artemis XYZ as of 3/20/2024. Not a recommendation to buy or sell any of the names mentioned herein. Past performance is no guarantee of future results.

Layer-2s On-Chain Cost Structures

Layer-2s (L2) primarily incur costs through Ethereum gas fees as they regularly post transaction data, settlements, and proofs to Ethereum. But zero-knowledge roll-ups (ZKUs) and optimistic roll-ups (ORUs) differ in their cost structures. While both update their states on the L1, ORUs have to pay onerous on-chain data costs while ZKUs must expend money proof generations and verification. Regardless, the consequence of the dependence on Ethereum is that the L2s input cost is subject to the volatility of Ethereum blockspace. For the most part, this cost difference is passed on to the user. However, the margins that L2s earn are quite volatile as a result.

Prior to EIP-4844, L2s posted both settlement data and proofs to Ethereum as single transactions in the “message field” of each transaction structure called “call data.” This was a “hack” to utilize one component of Ethereum’s standard transaction format for the purpose of holding compressed L2 data. Though this is novel, it is very expensive. For example, for the month of February, Optimism paid $5.7M, Arbitrum paid $7.2M, and Scroll paid $6.7M for posting call data to Ethereum.

Source: VanEck Research, Celestia as of 3/14/2024.

The cost components for ZKUs are inherently higher compared to ORUs because ZKUs submit both zero-knowledge proofs and call data to Ethereum. While ORUs may also involve proof costs, these are generally outsourced to third parties who challenge the state if needed, and therefore they do not heavily influence ORUs' base costs. The verification of ZKUs’ zero-knowledge proofs on Ethereum can be extremely costly. Despite Ethereum's optimization efforts, such as native op codes to streamline zk-proof verification, the expenses remain significant—for example, Scroll's ZKU incurred $1.1 million in proofing fees in just the first 13 days of March.

As a result of these high proving costs, the average profit margin for ORUs over the last six months stands at 26.7%, contrasting with 21% for ZKUs. Logically, a roll-up could send more transactions in fewer batches to decrease variable batch posting expenses. Infrequent batch posting, however, could also come as a result of less transaction throughput happening on the L2s. Regardless, L2 batch post frequency to Ethereum is a profitability lever an L2 can pull, but one that comes at the expense of user experience. In practice, L2s decide batch posting as a calculus of how many transactions they can fit into a block, Ethereum L1 gas prices, and each L2 incoming flow of transactions.

L2 Batches Per Day vs. Ethereum Settlement Costs

Source: Dune @niftytable, Etherscan as of 3/14/2024. Not a recommendation to buy or sell any of the names mentioned herein. Past performance is no guarantee of future results.

Technically, L2s can post more expansive understandings of what occurs on L2s besides the simple “scoreboard” settlements. Price competition amongst L2s to serve users the cheapest transactions cause L2s to often choose the most economical data to post. Often, this means just posting “state differences” for ZKUs, and for ORUs, it means posting highly compressed transaction data. Curiously, though ZKUs do not technically have to post full transaction data, some still do so. While Starknet and zkSync only post “state differences,” Linea, Polygon, and Scroll post full transaction data. This is done because it may be challenging for things like explorers and wallets to track blockchains without the transaction data. Another possibility is that posting full transaction data allows more transparency so that anyone can run a node to track a ZKU. ZKUs may also be open to opening up a prover to anyone in the future, and posting full transaction data to Ethereum allows ZKUs to “decentralize” their blockchains at the point of the “provers.”

A cost reduction that many L2s currently make is to improve the efficiency of their compression. For example, on February 13th, Linea deployed a new compression scheme that increased compression on the chain by a factor of 10x, moving from around 500 bytes per transaction to the mid-50s. Other L2s, both ORUs and ZKUs, had an average transaction size on Ethereum of 300 bytes for 2024. While compressing transactions may save on data costs to the L2, it reduces its potential due to the time it takes to compress transactions.

L2 On Chain Margins by Month

Source: Dune @niftytable, Artemis XYZ as of 3/13/2024. Not a recommendation to buy or sell any of the names mentioned herein. Past performance is no guarantee of future results.

EIP-4844’s Answer to L2 Data Costs: Blob Space

On March 13, 2024, Ethereum passed the Dencun upgrade, which had a handful of important changes, the most significant of which was the creation of what is called “Blob Space.” Prior to this upgrade, the main challenge for Layer-2s was the prohibitive cost associated with posting transaction data to Ethereum. Recognizing this, Ethereum’s solution was the strategic creation of a specialized data layer, colloquially known as Blob Space, designed exclusively for L2 data postings.

This newly established layer offers a targeted transaction environment tailored to receiving data from L2 networks. Blob Space's innovative aspect is its transient data handling—data blobs posted here are retained for only four weeks before deletion, significantly reducing Ethereum's data overhead. Consequently, L2s have the option to bypass the main Ethereum layer and directly post to Blob Space.

The Blob Space layer of Ethereum has its own gas prices that abide by the same rule set as Ethereum’s regular execution layer. The result is that transactions from L2s to publish data no longer have to compete with regular Ethereum transactions for blockspace. The dedicated transaction layer is also designed to price the cost of data much cheaper than posting to Ethereum as call data. At the time of writing, the Data Blobs have reduced gas usage charges to L2s by (-96%).

L2 Data Publishing Costs to Ethereum (ETH)

Source: Dune @niftytable, Artemis XYZ as of 3/19/2024. Not a recommendation to buy or sell any of the names mentioned herein. Past performance is no guarantee of future results.

Layer-2s Off-Chain Cost Structures

The first part of the off-chain cost expense for Layer-2s (L2s) are the sequencers they use for ordering transactions. This is basically just a high-end server that sits in a data center. For most L2s, the foundation or business entity behind that L2 pays for the cost of the sequencer. In the grand scheme of things, the costs of running the sequencers themselves are minor at around $1000 to $2000 in equipment and perhaps another $3000 to 5000 in manpower per month. This cost is consistent for both Optimistic Roll-Ups (ORUs) and Zero-Knowledge Roll-Ups (ZKUs).

A lesser discussed but significant cost element for ZKUs involves the operation of provers. Unlike sequencers that produce the state root, the provers are responsible for creating the zk-proof that undergoes verification on the Ethereum network. This computational process usually takes place on cloud computing platforms like AWS.

According to the decentralized zk prover project Gevulot, the costs of the proof will run between “10-20% of the cost of verification on Ethereum.” Additionally, these costs scale with the amount of transactions that are being generated by each L2s. ZKUs are faced with a balancing act between costs and user experience, with the option to reduce the frequency of proofs posted to Ethereum as a potential cost-saving measure. Through a process known as recursion, ZKU provers can consolidate several proofs into a single submission, which, while increasing off-chain computational demands, can optimize the economics by mitigating the costly proof verifications conducted on Ethereum.

At the time of writing, all ZKUs run their own provers and directly pay for the costs of proof generation. Over time, however, many intend to decentralize proof generation.

Evaluating Layer-2s Across 5 Key Areas

In our analysis of key Layer-2s, we use five principal variables to measure potential success or failure:

- Transaction pricing – the cost to users of transacting

- Developer experience – the ease of building products and applications

- User experience – the simplicity of depositing, withdrawing, and transacting

- Trust Assumptions - liveness and safety assumptions

- Ecosystem size – how many interesting things there are to do

1. Layer-2s Transaction Pricing

The root of transaction pricing differentiation comes from a combination of data compression, data posting efficiency, L2 scale, proving costs (for ZKUs), and, most interestingly, the margin each L2 takes. L2s could also time their postings to Ethereum based upon gas prices, but in practice, we have not found empirical evidence to support this possibility. This is likely due to the general difficulties of predicting future Ethereum gas prices.

The main difference in pricing economics between ZKUs and ORUs is that ZKUs have higher fixed costs than ORUs. This is because ZKUs must pay for proof generation off Ethereum and proof verification on Ethereum. Proof generation/verification is a large, static cost that does not increase significantly as more transactions are covered by each proof. By contrast, ORUs must post full transaction data to Ethereum. Though ORUs employ different compression mechanisms to cut down on data costs, posting to Ethereum is very expensive. Because more transactions on an ORU means more data is to be committed to Ethereum, the costs of posts to Ethereum are increased. However, with the EIP-4844, the costs of posting data to Ethereum have been reduced significantly and these savings have resulted in cheaper transaction pricing for ORUs. Likewise, ORUs also have the option of placing transaction data on even cheaper data availability blockchains like Celestia, EigenDA, and Avail. Currently, Manta Pacific and Aevo post transaction data to Celestia.

In 2024, the cheapest chains by average transaction cost were Mantle ($0.17), zkSync ($0.21), and Starknet ($0.25). Each chain was able to edge out its competition on pricing using different techniques. Mantle, an ORU, is able to keep transactions cheap because it accepts lower than the average margin (19.9%), uses its own data availability (Mantle DA) for full transaction batch posting, and updates its state root updates to Ethereum, the second least frequently at every 20.7 minutes. zkSync, a ZKU, was able to price transactions inexpensively due to the high volume of transactions (94.9M), the highest of any L2, that made its proving system highly economical. Meanwhile, the ZKU chain Starknet settled to Ethereum the least often of any of the top 10 L2s, once every 57.8 minutes, while also posting only state differences in place of full transaction data. These two-cost savings resulted in the least amount of data per transaction being settled to Ethereum. Curiously, we estimate that Starknet lost -$0.09 per transaction through March 13, 2024.

Competitive Differentiation of L2s

Data for 2024. Source: Dune @niftytable, Artemis XYZ as of 3/13/2024. Not a recommendation to buy or sell any of the names mentioned herein. Past performance is no guarantee of future results.

2. Layer-2s Developer Experience

Developer experience is another important point of competitive differentiation for Layer-2s. The root understanding of making the developer experience easiest was to implement EVM compatibility. This means that smart contract code, tooling, and developer libraries could be ported over directly from Ethereum to be used on the L2. This is believed to give each L2 an advantage because of Ethereum’s large network of developers. Currently, the vast majority of L2s are EVM-compatible. However, ZKUs often have subtle differences that developers must adhere to due to the limitations of zero-knowledge proofs.

Some developers have also argued that adherence to EVM compatibility is a disadvantage because EVM places significant limitations on blockchain capabilities while boxing out developers who are more familiar with other computer languages. For example, Starknet smart contracts are written in a language called Cairo, which is more efficient for the zero-knowledge scaling of Starknet. Of course, this comes at the tradeoff where anyone deploying to Starknet must learn the complexities of Cairo. Movement Labs is another L2 developer who is allowing smart contracts to be written using the Move language which appeals to developers who know want to learn Move. And for those who are more familiar with the programming language of Solana called Rust, Eclipse is building a Layer-2 blockchain that runs in a Solana Virtual Machine. This is even expanding to other languages like Web Assembly, as Fluent has created a general-purpose L2 which supports WASM.

3. Layer-2s User Experience

User experience is another plank by which Layer-2s compete with each other. The most basic component of this is onboarding assets and removing assets from an L2. For the most part, onboarding is not significantly differentiated between L2s, with the exception that some Centralized Exchanges (CEXs) allow for native assets to be moved to each L2. For example, Kraken allows users to withdraw USDC to Arbitrum and Optimism, whereas Coinbase allows USDC to be ported to Optimism and Base.

Finality—the point at which transactions on an L2 become irreversible—marks a significant divergence in the user experience between Optimistic Roll-Ups (ORUs) and Zero-Knowledge Roll-Ups (ZKUs). For ORUs, finality occurs after the fraud challenge period ends, while for ZKUs, finality occurs once a state root and its proof have been posted to Ethereum. One consequence of finality differences is withdrawals off of an L2. For an ORU, 7 days must pass before a user can move his or her funds back to Ethereum. For a ZKU, this same process can take as little as an hour, and this depends on how frequently the ZKU posts settlements and proofs, as well as each chain’s safety system. While zkSync posts proofs every 6 minutes and state updates every hour, users must have a 24-hour wait period before assets can be bridged to Ethereum due to zkSync’s safety modules.

Current Throughput and Latency

Source: VanEck Research as of 3/19/2024. Not a recommendation to buy or sell any of the names mentioned herein. Past performance is no guarantee of future results.

When users interact with L2s, familiar tools and interfaces are paramount. The adoption of familiar wallets and blockchain explorers from Ethereum to L2s greatly enhances user comfort. This seamlessness is pivotal, as most L2s employ analogous experiences to Ethereum, ensuring a minimal learning curve for those moving across platforms. In the realm of quantifiable user experience metrics, latency and throughput stand out. Latency refers to the time it takes for a transaction to be acknowledged by the network after submission, while throughput measures the network's capacity to handle transactions per second.

The slowest block time, or Round-Trip Time (RTT)—the duration for a user's transaction to reach the sequencer and for the confirmation to be received back—typically defines an L2's latency. Arbitrum, for instance, boasts the potential for extremely low latency at 0.25 seconds, though actual latency may vary based on geographical factors and the user's proximity to the sequencer, which is speculated to be located in a Silicon Valley data center.

zkSync is noted for having the highest theoretical throughput, capable of processing up to 434 swap transactions per second. However, both latency and throughput are adjustable parameters within L2 networks.

The current bottlenecks for ZKUs are the speed at which their provers can handle incoming transactions, while ORUs are constrained by the efficiency of their transaction data compression and the rate at which Ethereum can absorb this data. At present, L2s voluntarily limit their throughput in alignment with Ethereum's capacity. If an L2 were to use Ethereum’s block space fully—considering Ethereum's current data cap of about 937.5kb per block plus an additional 375kb from three data blobs—this could theoretically expand to approximately 1.3 MB per block, or 110kb per second.

For a specific L2 like zkSync, which averages 62 bytes per transaction, fully exploiting Ethereum block space could potentially surge to 1764 transactions per second. In contrast, an ORU like Arbitrum, with an average of 255 bytes per transaction, could reach a processing rate of 429 transactions per second under the same conditions.

Further increases in throughput could be achieved by integrating a Data Availability blockchain such as Celestia. However, this approach raises concerns about compromising user safety, as alternative blockchains may not offer the same level of security assurances as Ethereum. The choice to expand throughput in this manner is a delicate one, requiring a balance between improved performance and the inherent safety that Ethereum's robustness provides.

4. Layer-2s Trust Assumptions

Source: VanEck Research, l2beat as of 3/19/2024. Past performance is no guarantee of future results.

There are substantial differences in the assurance of safety and liveness that L2s offer users. Safety refers to the blockchain’s properties to ensure that only an account owner can access his/her assets, while liveness refers to the safeguards in place to make sure assets can be utilized. As L2s rest upon a single sequencer who both orders a block and “proposes” it to the L1 (Ethereum) for settlement, the sequencer failure is the chief concern for L2 users. This is because each L2 currently operates a single sequencer, and if it fails, that L2 cannot process transactions. While assets cannot be stolen in the event of an outage, they also cannot be accessed by users until that outage is resolved. At the same time, if a malicious entity is able to take over a sequencer, it is possible they could mint fraudulent transactions to take the assets off an L2. The current point of weakness of all L2s is they each operate only one sequencer and that sequencer is usually centrally operated by the foundation behind the L2.

L2 builders realize the issues posed by sequencer failure or takeover, and some implement novel safety valves. These differ depending on the L2 and its safety. To complicate matters, some of these safety measures open up the possibility for other attack areas. Some of the guard rails created to protect users include allowing users, under certain conditions, to remove assets, submit transactions for the L2 blockchain by using the L1 host, or even propose L2 blocks. Mostly, these conditions occur when there is a clear failure somewhere in the L2 system.

Some L2s are developing frameworks where anyone can be a sequencer as well as allowing for multiple sequencers who each take a turn sequencing. This would be accompanied by people running the sequencers to put up an economic bond (most likely each L2 native token) to create penalties for cheaters. Companies like Espresso, Astria, and Fairblock are examples of projects that are building software for decentralized sequencers. Currently, the L2 Metis is furthest along in pioneering decentralized sequencers on its L2. Metis’s community has recently passed a governance vote that creates the framework for decentralizing its sequencer and allowing for multiple sequencers to exist.

The next point of trust assumption variation, one we discuss above, is referred to as “data availability.” While ZKUs provide proof that state updates are correct, ORUs provide evidence to allow anyone to prove that a state update is incorrect. In both cases, however, it is important to understand where the data comes from to generate proofs for either ZKUs or ORUs. Ideally, this data would be readily “available” on the L1 (Ethereum) so that anyone could verify the underlying data that generates proof. Blockchains such as Immutable X and Metis, keep full transaction data on other locations. Though ZKUs do not need to post full transaction data, chains like Linea and Polygon zkEVM do, while Starknet and zkSync simply post state differences. Additionally, L2s post the data to Ethereum, while others post it to dedicated data availability blockchains like Celestia. Posting data on other chains arguably makes an L2 less safe than Ethereum because it introduces new trust assumptions.

Another interesting dynamic for ORUs is that, as it stands, almost none of them allow for fraud-proof. This means that anyone using them is subject to censorship (transactions not going through) by the sequencer. The exception to this is Arbitrum, which allows fraud proofs. But even in Arbitrum’s case, only white-listed entities can submit fraud proofs. ZKUs, on the other hand, rely upon the prover (a different entity from the sequencer) posting proof. In the event that the ZKUs prover fails, some chains allow users to submit their own proofs (just do zero-knowledge math!) for transactions to be included on the L2.

Regardless, Layer-2s have many issues with respect to their trust assumptions. However, they currently have hundreds of thousands of daily active users, so it would seem until there is a major issue, no one will care. To simplify our views on the set of safeguards L2s have in place, we rank them from most risky to least risky and find Arbitrum to be the current, although still inadequate, gold standard.

5. Layer-2s Ecosystem Size

Bridged TVL of L2s

Source: Dune @21co as of 3/19/2024. Not a recommendation to buy or sell any of the names mentioned herein. Past performance is no guarantee of future results.

The most important competitive factor of L2s is the ecosystem that each L2 has created. Blockchain is a marketplace of services and digital commodities. The more useful things to do on a blockchain, the more value it will accrue through user transactions, demand for its native token, and network effect. Unfortunately, the metrics that measure blockchain activity do not always properly translate into the value of that blockchain’s ecosystem. Applying Goodhart’s law contends that once a metric becomes important in crypto, there is a higher chance that the metrics become manipulated. This rule becomes even more ironclad when we consider airdrop farmers (see our third paragraph from our January Monthly for an explanation) who are generating meaningless activity to receive a free airdrop of token value.

Generally, what matters are users who are willing to bring value to a blockchain to engage in meaningful activity to generate fees. In that respect, Arbitrum, Optimism, and Blast have shown they have ecosystems that matter to users as those users have bridged $16.3B, $7.85B, and $2.43B to each respectfully. For the most part, Layer-2s have generated user interest and activity through airdrops of their native tokens. Optimism, for example, has given away nearly 25% of its current floating supply to users in the form of airdrops for activity. Arbitrum has given away over $1.84B in tokens to individuals who have used Arbitrum. Blast has leveraged this concept even further to attract bridged value on the premise that there may be an airdrop of tokens from Blast itself, as well as teams who are building on Blast. Conceptually, Layer-2s compete by giving away, for free, tokens whose value grows as each L2 network grows.

Fully Diluted Value (FDV)/Revenue and Market Capitalization (MC)/Revenue

Source: Artemis XYZ as of 3/21/2024. Not a recommendation to buy or sell any of the names mentioned herein. Past performance is no guarantee of future results.

By measure of the trailing twelve months (TTM) revenue to fully diluted valuation (FDV) multiples, each L2’s multiple exceeds Ethereum’s by a fair margin. However, this dynamic changes if we alter the multiple to being based upon floating token supply rather than fully diluted value. This is an odd disconnect that relates to the release schedule of L2 coins – most L2 projects have only released a fraction of their supply. Realistically, we see L2s trading more on speculation of long-term value accrual rather than current revenue dynamics. We attribute this dynamic to the potential for substantially more future revenues to occur on L2s than on Ethereum.

We expect L2 revenues to exceed Ethereum’s because Ethereum cannot match the transaction throughput or user experience of L2s. We also increasingly see a state where the general-purpose roll-ups market is consolidated by a few major players. This is due to the network effect of both on chain application composability and shared value. It is also attributed to roll-up frameworks, like the OP Stack or Arbitrum Orbit, becoming dominant and the OP/ARB token accruing value from other L2 or even Layer-3s (blockchains that submit state to the L2s). It is also clear that most roll-ups will eventually move towards the zero-knowledge framework (ZKU) due to its many advantages.

Long-term, we still believe that Ethereum blockspace will be expensive, and one result may be that many L2s consolidate proofs to a unified proving layer that “recursively” combines all proofs of its layer constituents. This may be particularly true in the case of application and sector-specific roll-ups. An example of what a concept may look like is Polygon’s Aggregation. Conceptionally, something like an “Agg Layer” may also vastly improve user experience because it would be more economical to post proofs and state roots often enough to allow for bridging across L2s and Ethereum in seconds rather than hours.

Accordingly, we see cutthroat competition amongst L2s where the network effect is the only moat. As a result, we are generally bearish on the long-term value prospects for the majority of L2 tokens. The top 7 tokens for L2 collectively already have $40B of FDV, and there are many strong projects that intend to launch over the medium term. This means there is potentially $100B more in FDV in L2 tokens coming to market over the next 12-18 months. It seems a bridge too far for the crypto market to absorb even limited amounts of that supply without massive discounts. Additionally, while there are reasons to believe that some L2 tokens will become valuable, the pathways to value accrual are harder to project than they are for other crypto sectors. This is particularly the case since L2 tokens are not even the base money in their own ecosystems.

Beyond the dominance of a few roll-ups among general-purpose L2s, we forecast a future of thousands of use-case-specific roll-ups. These L2 will be segmented by sector, application, or function. Businesses will likely build roll-ups explicitly as their own revenue and/or cost centers like building an asset management Layer-2 chain. Other types of chains may be specifically geared towards hosting a whole sector, such as a roll-up that hosts a social media network, as well as applications that want to build products and services for that social media network.

Ethereum Layer-2s Valuation Prediction by 2030

We find our 2030 valuation for the L2 space by applying an FCF terminal multiple to our expectations of future cash flows. We estimate the revenues that feed these cash flows by:

- Transactions Revenues (inclusion of transactions on a blockchain)

- Estimating the revenue TAM of end markets that could utilize public blockchains

- Calculating the amount of TAM that will actually use public blockchains

- Forecasting the Ethereum ecosystem’s market share public blockchains

- Applying take rates on end market revenues that utilize Ethereum’s ecosystem for settlement and transactions

- Splitting the transaction value between Ethereum and L2s

- MEV (ordering of transactions on blockchain)

- Estimating the value of assets including currency, securities, and digital assets that will be secured by Ethereum’s ecosystem

- Project DEX volume on Ethereum’s ecosystem by applying an asset turnover estimate to our forecasts for the hosted asset value of the Ethereum ecosystem

- Multiplying DEX volumes by an MEV take rate to arrive at total MEV value

- Splitting the value between Ethereum and its L2s

| L2 Valuation - Base Case | |

| Ethereum Ecosystem Smart Contract Market Share | 60% |

| L2 Economics | |

| Estimated Revenue 2030 ($M) | $48,659 |

| Global Tax Rate on Crypto | 15% |

| Sequencer Cut | 1% |

| Value to Tokenholders in 2030 ($M) | $40,947 |

| FCF Terminal Multiple | 25 |

| L2 FDV 2030 ($M) | $1,023,681 |

| L2 Projections | |

| Transaction Value on L2 | 90% |

| Ecosystem TVL Layer 2 | 90% |

| L2 Token MEV Capture (Split to L2) | 100% |

| L2 Transaction Capture (split to L2) | 66% |

| MEV Revenue | |

| MEV LT Take Rate on DEX Volume | 0.02% |

| LT L2DEX Volume/TVL Ratio | 12 |

| MEV Value Accrual to Token | 95% |

| Crypto Terminal Market Share | Base |

| Finance, Banking, Payments | 5% |

| Metaverse, Social and Gaming | 20% |

| Infrastructure | 10% |

| Ethereum Ecosystem Value Capture of End Market Revenue | |

| Finance, Banking, Payments | 3% |

| Metaverse, Social and Gaming | 10% |

| Infrastructure | 5% |

Source: VanEck Research as of 3/21/2024. Past performance is no guarantee of future results. The information, valuation scenarios, and price targets in this blog are not intended as financial advice or any call to action, a recommendation to buy or sell, or as a projection of how Layer-2s will perform in the future. Actual future performance of Layer-2s is unknown, and may differ significantly from the hypothetical results depicted here. There may be risks or other factors not accounted for in the scenarios presented that may impede the performance. These are solely the results of a simulation based on our research, and are for illustrative purposes only. Please conduct your own research and draw your own conclusions.

Links to third party websites are provided as a convenience and the inclusion of such links does not imply any endorsement, approval, investigation, verification or monitoring by us of any content or information contained within or accessible from the linked sites. By clicking on the link to a non-VanEck webpage, you acknowledge that you are entering a third-party website subject to its own terms and conditions. VanEck disclaims responsibility for content, legality of access or suitability of the third-party websites.

To receive more Digital Assets insights, sign up in our subscription center.

Follow Us

DISCLOSURES

Coin Definitions

- Ethereum (ETH) is a decentralized, open-source blockchain with smart contract functionality. Ether is the native cryptocurrency of the platform. Amongst cryptocurrencies, Ether is second only to Bitcoin in market capitalization.

- Arbitrum (ARB) is a rollup chain designed to improve the scalability of Ethereum. It achieves this by bundling multiple transactions into a single transaction, thereby reducing the load on the Ethereum network.

- Optimism (OP) is a layer-two blockchain on top of Ethereum. Optimism benefits from the security of the Ethereum mainnet and helps scale the Ethereum ecosystem by using optimistic rollups.

- Polygon (MATIC) is the first well-structured, easy-to-use platform for Ethereum scaling and infrastructure development. Its core component is Polygon SDK, a modular, flexible framework that supports building multiple types of applications.

- Blur (BLUR) is the native governance token of Blur, a unique non-fungible token (NFT) marketplace and aggregator platform that offers advanced features such as real-time price feeds, portfolio management and multi-marketplace NFT comparisons.

- Solana (SOL) is a public blockchain platform. It is open-source and decentralized, with consensus achieved using proof of stake and proof of history. Its internal cryptocurrency is SOL.

- Polkadot (DOT) is a sharded heterogeneous multi-chain architecture which enables external networks as well as customized layer one “parachains” to communicate, creating an interconnected internet of blockchains.

- Linea is a network that scales the experience of Ethereum with out-of-the-box compatibility with the Ethereum Virtual Machine which enables the deployment of already existing applications.

- Blast (BLAST) is an EVM-equivalent Ethereum optimistic rollup with a native yield feature that aims to improve revenue and maintain value for network users.

- Manta is an EVM-equivalent Ethereum optimistic rollup with a native yield feature, offering depositors a "passive income" stream.

- Metis is an Ethereum token and operates as the internal currency for staking and payments in the Metis crypto ecosystem.

- Mantle Network is an Optimistic rollup (ORU) that scales Ethereum and aims to be EVM-compatible.

- Base is an Ethereum Layer 2, incubated by Coinbase and built on the open-source OP Stack, that allows developers to easily deploy reliable, secure applications on a scaling solution with low transaction fees.

- Scroll is a security-focused scaling solution for Ethereum, using innovations in scaling design and zero knowledge proofs to build a new layer on Ethereum.

- Starknet is an Ethereum layer-2 scaling solution that uses a zero-knowledge rollup based on StarkWare Industry's trustless “STARK” proof.

- zkSync Era is a layer 2 rollup that uses zero-knowledge proofs to scale Ethereum without compromising on security or decentralization.

- Zora is a universal media registry protocol. It's a way for creators to publish creative media, earn money on their work, and have others build and share what they create.

- Celestia is a blockchain network that introduces a modular approach to the design and functionality of blockchains.

- EigenDa is a secure and decentralized data availability layer that enables Ethereum developers to achieve high transaction speeds and low transaction costs that have never before been possible on Ethereum.

- Avail is a modular blockchain specifically designed to address the needs of next-generation, trust-minimized applications, and sovereign rollups.

- Aevo is a decentralized derivatives exchange platform that focuses on crypto options and perpetual futures trading.

- Rust is a multi-paradigm programming language that publishes and maintains independently versioned crates containing traits for many different kinds of cryptographic algorithms.

- Eclipse is a platform for the deployment of modular rollups. Providing a flexible modular architecture, Eclipse allows developers to choose the virtual machine, settlement process, consensus and data availability layer that best suits their needs.

- Kraken is a cryptocurrency exchange based in San Francisco where market participants can trade various cryptocurrencies.

Risk Considerations

This is not an offer to buy or sell, or a recommendation to buy or sell any of the securities, financial instruments or digital assets mentioned herein. The information presented does not involve the rendering of personalized investment, financial, legal, tax advice, or any call to action. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results, are for illustrative purposes only, are valid as of the date of this communication, and are subject to change without notice. Actual future performance of any assets or industries mentioned are unknown. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. VanEck does not guarantee the accuracy of third party data. The information herein represents the opinion of the author(s), but not necessarily those of VanEck or its other employees.

The information, valuation scenarios and price targets presented on any digital assets in this blog are not intended as financial advice, a recommendation to buy or sell these digital assets, or any call to action. There may be risks or other factors not accounted for in these scenarios that may impede the performance these digital assets; their actual future performance is unknown, and may differ significantly from any valuation scenarios or projections/forecasts herein. Any projections, forecasts or forward-looking statements included herein are the results of a simulation based on our research, are valid as of the date of this communication and subject to change without notice, and are for illustrative purposes only. Please conduct your own research and draw your own conclusions.

Past performance is not an indication, or guarantee, of future results. Hypothetical or model performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading, and accordingly, may have undercompensated or overcompensated for the impact, if any, of certain market factors such as market disruptions and lack of liquidity. In addition, hypothetical trading does not involve financial risk and no hypothetical trading record can completely account for the impact of financial risk in actual trading (for example, the ability to adhere to a particular trading program in spite of trading losses). Hypothetical or model performance is designed with benefit of hindsight.

Index performance is not representative of fund performance. It is not possible to invest directly in an index.

Investments in digital assets and Web3 companies are highly speculative and involve a high degree of risk. These risks include, but are not limited to: the technology is new and many of its uses may be untested; intense competition; slow adoption rates and the potential for product obsolescence; volatility and limited liquidity, including but not limited to, inability to liquidate a position; loss or destruction of key(s) to access accounts or the blockchain; reliance on digital wallets; reliance on unregulated markets and exchanges; reliance on the internet; cybersecurity risks; and the lack of regulation and the potential for new laws and regulation that may be difficult to predict. Moreover, the extent to which Web3 companies or digital assets utilize blockchain technology may vary, and it is possible that even widespread adoption of blockchain technology may not result in a material increase in the value of such companies or digital assets.

Digital asset prices are highly volatile, and the value of digital assets, and Web3 companies, can rise or fall dramatically and quickly. If their value goes down, there’s no guarantee that it will rise again. As a result, there is a significant risk of loss of your entire principal investment.

Digital assets are not generally backed or supported by any government or central bank and are not covered by FDIC or SIPC insurance. Accounts at digital asset custodians and exchanges are not protected by SPIC and are not FDIC insured. Furthermore, markets and exchanges for digital assets are not regulated with the same controls or customer protections available in traditional equity, option, futures, or foreign exchange investing.

Digital assets include, but are not limited to, cryptocurrencies, tokens, NFTs, assets stored or created using blockchain technology, and other Web3 products.

Web3 companies include but are not limited to, companies that involve the development, innovation, and/or utilization of blockchain, digital assets, or crypto technologies.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future performance.

© Van Eck Associates Corporation.

DISCLOSURES

Coin Definitions

- Ethereum (ETH) is a decentralized, open-source blockchain with smart contract functionality. Ether is the native cryptocurrency of the platform. Amongst cryptocurrencies, Ether is second only to Bitcoin in market capitalization.

- Arbitrum (ARB) is a rollup chain designed to improve the scalability of Ethereum. It achieves this by bundling multiple transactions into a single transaction, thereby reducing the load on the Ethereum network.

- Optimism (OP) is a layer-two blockchain on top of Ethereum. Optimism benefits from the security of the Ethereum mainnet and helps scale the Ethereum ecosystem by using optimistic rollups.

- Polygon (MATIC) is the first well-structured, easy-to-use platform for Ethereum scaling and infrastructure development. Its core component is Polygon SDK, a modular, flexible framework that supports building multiple types of applications.

- Blur (BLUR) is the native governance token of Blur, a unique non-fungible token (NFT) marketplace and aggregator platform that offers advanced features such as real-time price feeds, portfolio management and multi-marketplace NFT comparisons.

- Solana (SOL) is a public blockchain platform. It is open-source and decentralized, with consensus achieved using proof of stake and proof of history. Its internal cryptocurrency is SOL.

- Polkadot (DOT) is a sharded heterogeneous multi-chain architecture which enables external networks as well as customized layer one “parachains” to communicate, creating an interconnected internet of blockchains.

- Linea is a network that scales the experience of Ethereum with out-of-the-box compatibility with the Ethereum Virtual Machine which enables the deployment of already existing applications.

- Blast (BLAST) is an EVM-equivalent Ethereum optimistic rollup with a native yield feature that aims to improve revenue and maintain value for network users.

- Manta is an EVM-equivalent Ethereum optimistic rollup with a native yield feature, offering depositors a "passive income" stream.

- Metis is an Ethereum token and operates as the internal currency for staking and payments in the Metis crypto ecosystem.

- Mantle Network is an Optimistic rollup (ORU) that scales Ethereum and aims to be EVM-compatible.

- Base is an Ethereum Layer 2, incubated by Coinbase and built on the open-source OP Stack, that allows developers to easily deploy reliable, secure applications on a scaling solution with low transaction fees.

- Scroll is a security-focused scaling solution for Ethereum, using innovations in scaling design and zero knowledge proofs to build a new layer on Ethereum.

- Starknet is an Ethereum layer-2 scaling solution that uses a zero-knowledge rollup based on StarkWare Industry's trustless “STARK” proof.

- zkSync Era is a layer 2 rollup that uses zero-knowledge proofs to scale Ethereum without compromising on security or decentralization.

- Zora is a universal media registry protocol. It's a way for creators to publish creative media, earn money on their work, and have others build and share what they create.

- Celestia is a blockchain network that introduces a modular approach to the design and functionality of blockchains.

- EigenDa is a secure and decentralized data availability layer that enables Ethereum developers to achieve high transaction speeds and low transaction costs that have never before been possible on Ethereum.

- Avail is a modular blockchain specifically designed to address the needs of next-generation, trust-minimized applications, and sovereign rollups.

- Aevo is a decentralized derivatives exchange platform that focuses on crypto options and perpetual futures trading.

- Rust is a multi-paradigm programming language that publishes and maintains independently versioned crates containing traits for many different kinds of cryptographic algorithms.

- Eclipse is a platform for the deployment of modular rollups. Providing a flexible modular architecture, Eclipse allows developers to choose the virtual machine, settlement process, consensus and data availability layer that best suits their needs.

- Kraken is a cryptocurrency exchange based in San Francisco where market participants can trade various cryptocurrencies.

Risk Considerations

This is not an offer to buy or sell, or a recommendation to buy or sell any of the securities, financial instruments or digital assets mentioned herein. The information presented does not involve the rendering of personalized investment, financial, legal, tax advice, or any call to action. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results, are for illustrative purposes only, are valid as of the date of this communication, and are subject to change without notice. Actual future performance of any assets or industries mentioned are unknown. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. VanEck does not guarantee the accuracy of third party data. The information herein represents the opinion of the author(s), but not necessarily those of VanEck or its other employees.

The information, valuation scenarios and price targets presented on any digital assets in this blog are not intended as financial advice, a recommendation to buy or sell these digital assets, or any call to action. There may be risks or other factors not accounted for in these scenarios that may impede the performance these digital assets; their actual future performance is unknown, and may differ significantly from any valuation scenarios or projections/forecasts herein. Any projections, forecasts or forward-looking statements included herein are the results of a simulation based on our research, are valid as of the date of this communication and subject to change without notice, and are for illustrative purposes only. Please conduct your own research and draw your own conclusions.

Past performance is not an indication, or guarantee, of future results. Hypothetical or model performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading, and accordingly, may have undercompensated or overcompensated for the impact, if any, of certain market factors such as market disruptions and lack of liquidity. In addition, hypothetical trading does not involve financial risk and no hypothetical trading record can completely account for the impact of financial risk in actual trading (for example, the ability to adhere to a particular trading program in spite of trading losses). Hypothetical or model performance is designed with benefit of hindsight.

Index performance is not representative of fund performance. It is not possible to invest directly in an index.

Investments in digital assets and Web3 companies are highly speculative and involve a high degree of risk. These risks include, but are not limited to: the technology is new and many of its uses may be untested; intense competition; slow adoption rates and the potential for product obsolescence; volatility and limited liquidity, including but not limited to, inability to liquidate a position; loss or destruction of key(s) to access accounts or the blockchain; reliance on digital wallets; reliance on unregulated markets and exchanges; reliance on the internet; cybersecurity risks; and the lack of regulation and the potential for new laws and regulation that may be difficult to predict. Moreover, the extent to which Web3 companies or digital assets utilize blockchain technology may vary, and it is possible that even widespread adoption of blockchain technology may not result in a material increase in the value of such companies or digital assets.

Digital asset prices are highly volatile, and the value of digital assets, and Web3 companies, can rise or fall dramatically and quickly. If their value goes down, there’s no guarantee that it will rise again. As a result, there is a significant risk of loss of your entire principal investment.

Digital assets are not generally backed or supported by any government or central bank and are not covered by FDIC or SIPC insurance. Accounts at digital asset custodians and exchanges are not protected by SPIC and are not FDIC insured. Furthermore, markets and exchanges for digital assets are not regulated with the same controls or customer protections available in traditional equity, option, futures, or foreign exchange investing.

Digital assets include, but are not limited to, cryptocurrencies, tokens, NFTs, assets stored or created using blockchain technology, and other Web3 products.

Web3 companies include but are not limited to, companies that involve the development, innovation, and/or utilization of blockchain, digital assets, or crypto technologies.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future performance.

© Van Eck Associates Corporation.