Dispatch from the Bitcoin Conference: Meet the Other Maximalists

June 07, 2021

Read Time 11 MIN

VanEck assumes no liability for the content of any linked third-party site, and/or content hosted on external sites.

- Institutional Interest Accelerates

- A Preponderance of Crypto-preneurs

- Why Don’t Bitcoiners Sell? Two Reasons

- Taking Yield Back from the Banks, and Giving It to the Consumer

- ”Every Person as a Corporation”

Institutional Interest Accelerates

It is easy to get turned off by some of bitcoin's more flamboyant elements. The yolo/meme/pseudonymous ethos can alienate boomers blessed with just a normal level of fiduciary skepticism. Indeed, at last week's bitcoin 2021 conference in Miami, which attracted a reported 12,000 attendees (including yours truly) at $1,500 per ticket, there was no shortage of antics to support the bear case. That El Salvador, home of one of the world's highest crime rates, became the first country to announce it may buy bitcoin, news of which broke during the event to a full standing ovation, just adds to the occasional sense of lawlessness surrounding the asset class.

12,000 attendees waited 2+ hours on day 1 to enter the Bitcoin 2021 conference

“Dogecoin TO THE MOON” shouting protester subsequently bear hugged into submission by conference security.

It’s fitting that a YOLO BTC’er picked Lotus, who has manufactured a total of 100,000 cars in 70 years.

Maybe not the best tagline given regulators are unlikely to budge on this topic.

And yet while this seeming un-seriousness might have hindered the institutional adoption curve of digital assets in the past, that is clearly changing now. Indeed simple math dictates that it must: according to one VanEck sales rep who recently witnessed a show-of-hands-poll at a leading gathering of independent advisors, 40% of reps owned crypto in their personal accounts, but close to zero said they held for clients! Now, as the leading crypto exchanges and blockchain software leaders look to raise capital to scale, many of Wall Street’s most well-known hedge funds spent last week kicking tires in Miami, getting educated on the massive deflationary disruption hitting traditional banks and internet.

Third Point’s Dan Loeb among the many traditional hedge fund managers who made the trip to Miami last week

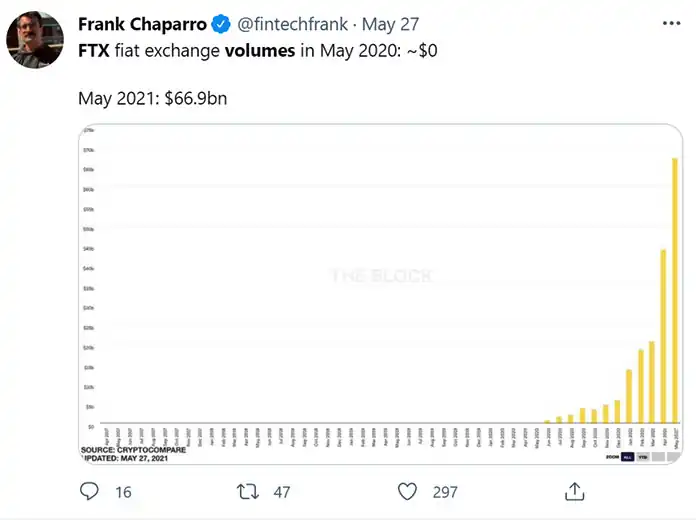

As a sign of the digital asset sector’s newfound financial clout, in just the last week, crypto exchange FTX and its founder Sam Bankman-Fried (SBF) unveiled their logo on the former American Airlines Arena in Miami after buying the naming rights for $135M, announced a $210M deal for an esports team, and separately raised $314M for their proposed lower-cost ethereum competitor, Solana. (For those concerned about over-spending, SBF said on a recent podcast he could fund the multi-year arena deal on this year’s profits alone.)

Source: Twitter

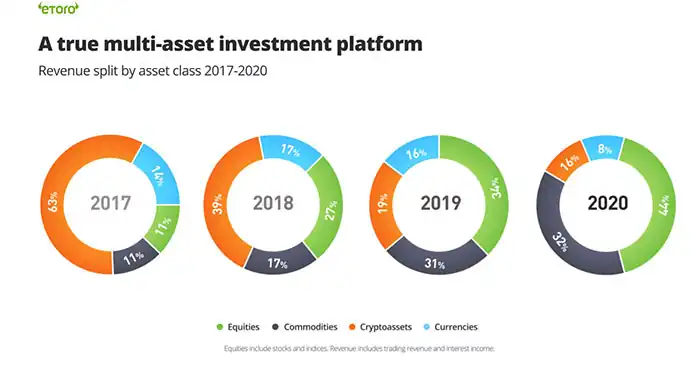

There is no reason these upstarts won’t eventually rival E-Trade, Schwab and other traditional discount equity brokers, a strategy the Israeli firm and SPAC takeover target eToro (FTCV, market value of merger: $10.4B) is already executing, with 44% of revenues from equities1 and strong cash flow fueling an aggressive marketing push in the U.S. For digital natives whose first financial purchase may be an NFT, not an ETF, why not?

Meanwhile Blockchain.com, already backed by Moore Capital, Lightspeed and Baillie Gifford, raised another $300M last week, pushing their valuation up 73% to $5.2B in just one month! Total crypto market cap may be down 1/3 from its April peak, but Silicon Valley and Wall Street are doubling down. The “movement” that Miami Mayor Francis Suarez admonished “haters and doubters” to not ignore in his opening keynote is entrepreneurs chasing lower costs and more freedom after decades of economic centralization. Wall Street is behind and trying to catch up.

Airlines = 2.5% of global CO2 emissions; Bitcoin = 0.1%

Source: Miami Heat Twitter

Crypto-Preneurs: Driving the Cost Curve Down

But just as a chain is only as strong as its weakest link, a movement is only as strong as its least fervent devotees. In order to understand them, I made a point to balance my meeting schedule with plenty of time to mingle with strangers. I stayed at a $120 hotel. I avoided the lavish parties. I rode the group bus to and from the event, made eye contact, and opened myself up to the kinds of conversations that might at first appear to be a waste of time. In any case, crypto conferences generally don’t provide name tags, and lots of developers are pseudonymous. You never know who you're going to meet, and I know from experience that serendipity can create as good a version of reality as a curated corporate experience anyway. In the end, I met a lot of entrepreneurs.

I met a neighbor, a Pakistani stranger who owns a building 200 yards away from my house in Queens. In the last year he bought 1,200 Chinese bitcoin mining machines and shipped them to Siberia, where the Russian firm he paid to host them is soft-pedaling the installation, costing my new friend "one million dollars in foregone revenue in the last few months." He was undeterred by that and by bitcoin's recent swoon. "Although I made my money in real estate, I am an engineer by training. I did my work on this technology," he told me.

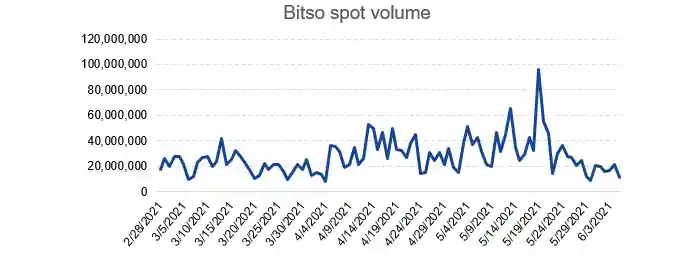

I met a Mexican-American man from Denver, also putting his real estate winnings into crypto, building a network of bitcoin ATMs to service small Mexican villages, an alternate option for payments and asset accumulation. "You might not understand how little some of these villagers in Mexico actually have," he explained. "If we can save them a few pennies on transactions, or cut down on some red tape, we can create real value." Although Mexico regulation is complex and favors large firms, my new friend pointed to Mexican exchange Bitso’s recent “unicorn” status and the purchase of bitcoin by Mexico’s third richest man as tailwinds. He reminded me that more than half of Mexicans don’t have a bank account and often pay over 4% transaction fees on remittances, which account for 4% of Mexican GDP.

Daily trading on Mexico’s largest crypto exchange Bitso

Source. Nomics.com Data as of 6/7/2021.

I met a self-described independent capitalist with a vague European accent, who regaled the bus riders with his tale of a 75-year-old hard charging "pure evil" nameless billionaire who had become so mesmerized by DeFi in recent weeks that he had dropped everything to learn how to trade it, and was calling my raconteur almost daily with specific "how to" questions about each protocol. "If bitcoin dropped 30% today, I would lose everything because of the leverage," my new European friend explained to his seatmate, glancing down at his phone. "So I need to keep my eyes on the markets."

I also met a small businessman who structures power agreements between would-be bitcoin miners and owners of stranded energy. He approached me to introduce himself, explaining that he "was the one who did the work behind" Square's “green Bitcoin” white paper. I learned from him that Thomas Edison, the godfather of American electricity, had once proposed a scheme to use surplus commodities to back money, not dissimilar from how Bitcoin miners monetize society’s lowest value energy. Along with his friend Henry Ford, Edison hoped to expand the scheme to energy markets from agricultural commodities, in order to “cast the variable out of money. This gold money is not good enough. It’s a fiction,” he complained. Then as now, commodity producers often lack appropriate hedges for their output, a necessary though increasingly controversial input to global prosperity given rising concerns about emissions. My new entrepreneur friend’s phone is still “ringing off the hook” with inquiries from heartland energy owners. Closely-held Crusoe Energy just raised an additional $128M from the Winkelvoss brothers, Coinbase and Tesla co-founder JB Straubel, to accelerate the growth of their venture which operates 40 modular data centers mining BTC from otherwise wasted and flared natural gas throughout North Dakota, Montana, Wyoming and Colorado. Square also endorsed my new friend’s strategy again this week, announcing further investment in solar-powered bitcoin mining.

Why Don’t Bitcoiners Sell? Two Inherent Advantages

Legendary hedge fund manager Stanley Druckenmiller said in a recent speech that what attracted him to bitcoin was the fact that even in the depths of the bear market, 86% of bitcoin holders hadn't sold. And yet I know meeting the entrepreneurs above that most are not bitcoin maximalists looking for a monetary revolution. They are certainly not willing to die for the cause. They may lean conservative, and their conviction may resemble religious fervor, but it is not principally libertarian. Rather, it is based on the two fundamental network advantages of cryptocurrencies, both of which are scary to incumbents because of the scope of their disruption.

The first is openness, or "permissionlessness" as most in crypto will say. Anyone in the world with an internet connection can join the Bitcoin and other crypto networks, and in that way nobody's voice can be silenced. Twitter CEO Jack Dorsey confronted that reality head-on when a protester interrupted his keynote. "You are the king of censorship!" she shouted, to laughs, cheers and jeers alike. Dorsey’s retort: "Inspired entirely by bitcoin, we want to do the same thing for social media," he said, detailing Twitter's plans to compete with itself with a decentralized social network. You could feel the skepticism in the room, since he first announced these plans in 2019. "I know you don't believe me," he muttered, sensing the vibe. Indeed not many incumbents can incentivize their best people to work on less profitable projects – the definition of innovator’s dilemma. Personally, my money is on their open-source competitor in the "personal brand monetization" space, the equally polarizing Bitclout. But we'll come back to that another day.

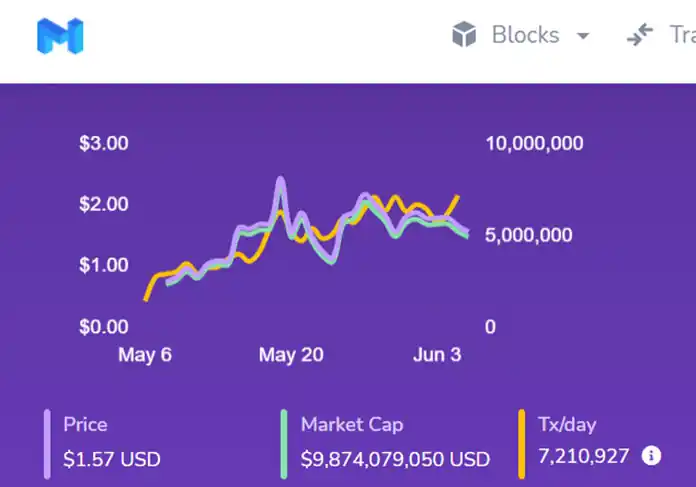

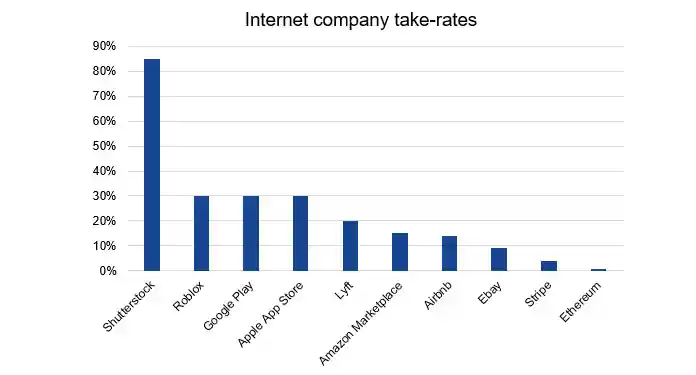

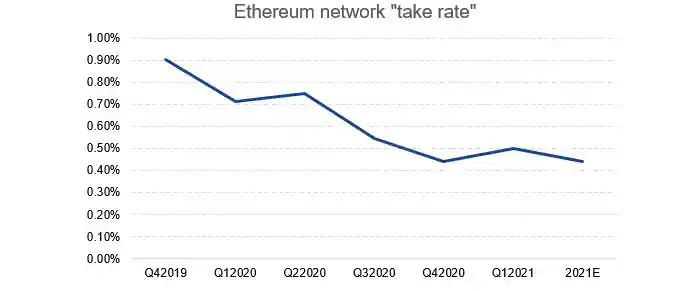

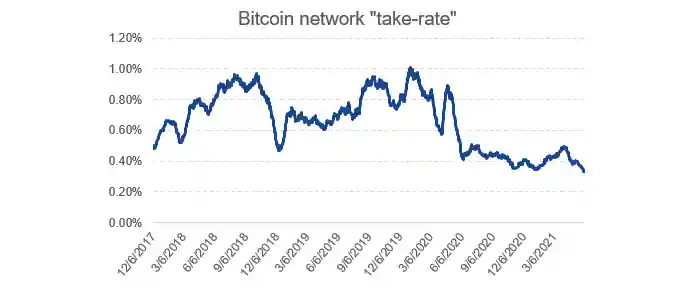

The second advantage that these entrepreneurs cite constantly is cost. Given the efficiencies already present in existing digital networks, any upstart would need to offer substantial savings to the ecosystem or it will not take share. Here the math is compelling: Web 2.0 firms charge 10-80% take-rates. Ethereum's is 50bps and falling. Bitcoin’s is even lower. Layer 2 scaling protocols Polygon and Arbitum claim to be 50 times cheaper than Ethereum. It makes sense that open-source, all-digital solutions would prompt a race to the bottom on cost, and that is exactly what is happening. And while incumbents may end up losing more value than the combined positive "market cap" created by the winners, the balance should accrue to consumer welfare. The entrepreneurs I met don’t fear the high yields available from lending digital assets on decentralized exchanges because they believe this, too.

Source: Coinmetrics, VanEck. Internet company take-rate data as of 6/4/2021. Ethereum network “take rate” data as of 5/30/2021. Bitcoin network “take rate” as of 6/5/2021.

Polygon Market Cap Vs. Transactions Per Day

Source: Polygon. Data as of 6/7/2021.

Taking Yield Back from the Banks

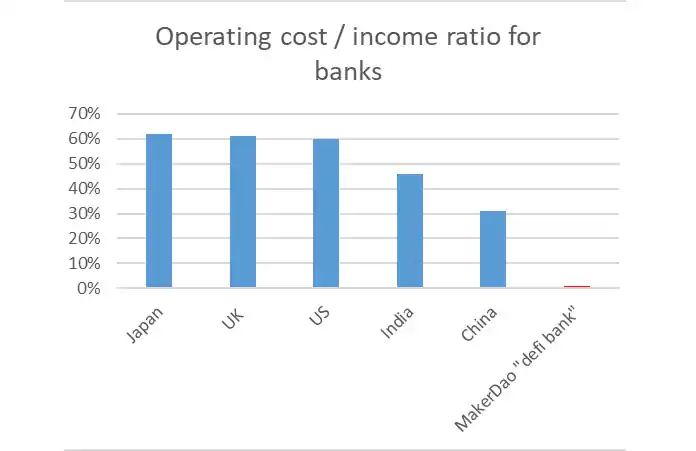

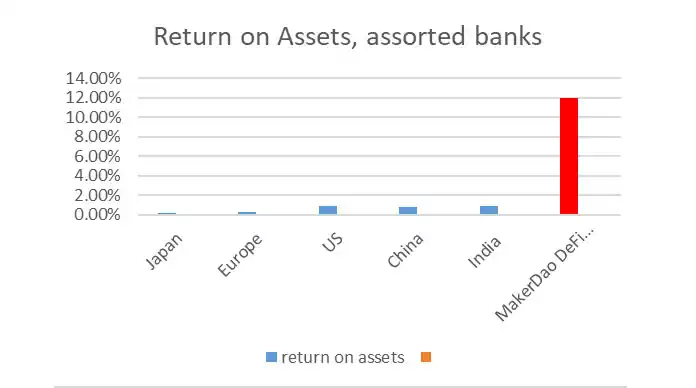

"The yield has always been there," Alex Mashinsky told us. Alex is CEO of Celsius, whose deposit-taking crypto bank currently pays 8.88% interest on stablecoins in Europe and has attracted $20B in customer deposits. "It's just that in the past it has been hoarded by the banks, and now it's available to everyone." I don’t know what Celsius profit margins are, but the largest decentralized bank Maker Dao sports a cost/income ratio of 1%. The developed market bank average is closer to 60%. The difference ends up in the wallets of all network participants.

Source: Bloomberg, MakerDao, VanEck. Data as of 12/31/2020

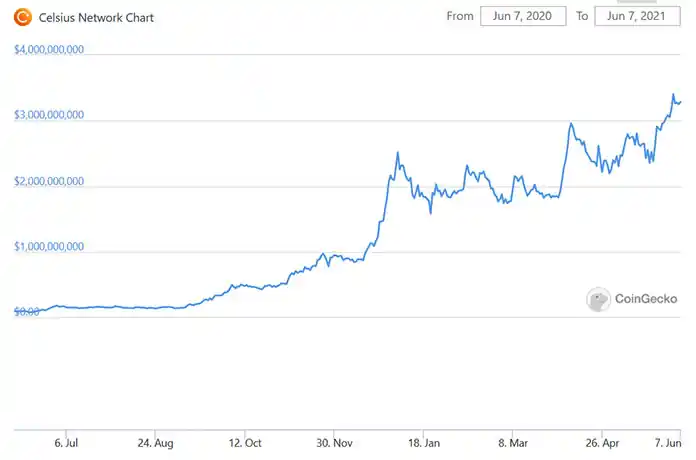

Celsius’ native token, which depositors can choose to accept in lieu of stablecoins to boost the interest rate, is just pennies from its all-time high, up 40% this year after 2020’s 50x increase. NBA all-star Spencer Dinwoodie just signed an endorsement deal with Celsius that will focus on cryptocurrency education. In the press release, he gave thanks for “a business model which prioritizes giving back to the community it serves.” What do they give back exactly? The answer is two-fold: “more money” (cost advantage), and “more autonomy” (no permission needed).

Celsius has attracted $20b in customer deposits from 800,000 customers. The company has a loan-to-deposit ratio of 27%.

Source: Coingecko. Data as of 6/7/2021.

Every Person as Corporation

“For me, everything changed when I started thinking of myself as a corporation,” said NFL tight end Sean Culkin during a session called “pay me in bitcoin,” which included athletes, artists and musicians who have embraced bitcoin and other digital assets. He was referring to the ability to transact with no intermediary, at increasingly low costs, directly with his fans. To the extent that the Bitcoin 2021 conference attracted maximalists, their collective allegiance was to individual economic empowerment and entrepreneurship, not monetary revolution. That’s a powerful one-two punch for risk-seeking capital. I expect it will continue to resonate.

“For me, everything changed when I started thinking about myself as a corporation.” – NFL tight end Sean Culkin

DISCLOSURES

1 Source: Techcrunch, eToro Investor Presentation

VanEck assumes no liability for the content of any linked third-party site, and/or content hosted on external sites.

Cryptocurrency is a digital representation of value that functions as a medium of exchange, a unit of account, or a store of value, but it does not have legal tender status. Cryptocurrencies are sometimes exchanged for U.S. dollars or other currencies around the world, but they are not generally backed or supported by any government or central bank. Their value is completely derived by market forces of supply and demand, and they are more volatile than traditional currencies. The value of cryptocurrency may be derived from the continued willingness of market participants to exchange fiat currency for cryptocurrency, which may result in the potential for permanent and total loss of value of a particular cryptocurrency should the market for that cryptocurrency disappear. Cryptocurrencies are not covered by either FDIC or SIPC insurance. Legislative and regulatory changes or actions at the state, federal, or international level may adversely affect the use, transfer, exchange, and value of cryptocurrency.

Investing in cryptocurrencies comes with a number of risks, including volatile market price swings or flash crashes, market manipulation, and cybersecurity risks. In addition, cryptocurrency markets and exchanges are not regulated with the same controls or customer protections available in equity, option, futures, or foreign exchange investing. There is no assurance that a person who accepts a cryptocurrency as payment today will continue to do so in the future.

Investors should conduct extensive research into the legitimacy of each individual cryptocurrency, including its platform, before investing. The features, functions, characteristics, operation, use and other properties of the specific cryptocurrency may be complex, technical, or difficult to understand or evaluate. The cryptocurrency may be vulnerable to attacks on the security, integrity or operation, including attacks using computing power sufficient to overwhelm the normal operation of the cryptocurrency’s blockchain or other underlying technology. Some cryptocurrency transactions will be deemed to be made when recorded on a public ledger, which is not necessarily the date or time that a transaction may have been initiated.

- Investors must have the financial ability, sophistication and willingness to bear the risks of an investment and a potential total loss of their entire investment in cryptocurrency.

- An investment in cryptocurrency is not suitable or desirable for all investors.

- Cryptocurrency has limited operating history or performance.

- Fees and expenses associated with a cryptocurrency investment may be substantial.

There may be risks posed by the lack of regulation for cryptocurrencies and any future regulatory developments could affect the viability and expansion of the use of cryptocurrencies. Investors should conduct extensive research before investing in cryptocurrencies.

Information provided by Van Eck is not intended to be, nor should it be construed as financial, tax or legal advice. It is not a recommendation to buy or sell an interest in cryptocurrencies.

The information herein represents the opinion of the author(s), but not necessarily those of VanEck, and these opinions may change at any time and from time to time. Non-VanEck proprietary information contained herein has been obtained from sources believed to be reliable, but not guaranteed. Not intended to be a forecast of future events, a guarantee of future results or investment advice. Historical performance is not indicative of future results. Current data may differ from data quoted. Any graphs shown herein are for illustrative purposes only. Not a recommendation to buy or to sell any of the cryptocurrencies mentioned herein.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.

Related Funds

DISCLOSURES

1 Source: Techcrunch, eToro Investor Presentation

VanEck assumes no liability for the content of any linked third-party site, and/or content hosted on external sites.

Cryptocurrency is a digital representation of value that functions as a medium of exchange, a unit of account, or a store of value, but it does not have legal tender status. Cryptocurrencies are sometimes exchanged for U.S. dollars or other currencies around the world, but they are not generally backed or supported by any government or central bank. Their value is completely derived by market forces of supply and demand, and they are more volatile than traditional currencies. The value of cryptocurrency may be derived from the continued willingness of market participants to exchange fiat currency for cryptocurrency, which may result in the potential for permanent and total loss of value of a particular cryptocurrency should the market for that cryptocurrency disappear. Cryptocurrencies are not covered by either FDIC or SIPC insurance. Legislative and regulatory changes or actions at the state, federal, or international level may adversely affect the use, transfer, exchange, and value of cryptocurrency.

Investing in cryptocurrencies comes with a number of risks, including volatile market price swings or flash crashes, market manipulation, and cybersecurity risks. In addition, cryptocurrency markets and exchanges are not regulated with the same controls or customer protections available in equity, option, futures, or foreign exchange investing. There is no assurance that a person who accepts a cryptocurrency as payment today will continue to do so in the future.

Investors should conduct extensive research into the legitimacy of each individual cryptocurrency, including its platform, before investing. The features, functions, characteristics, operation, use and other properties of the specific cryptocurrency may be complex, technical, or difficult to understand or evaluate. The cryptocurrency may be vulnerable to attacks on the security, integrity or operation, including attacks using computing power sufficient to overwhelm the normal operation of the cryptocurrency’s blockchain or other underlying technology. Some cryptocurrency transactions will be deemed to be made when recorded on a public ledger, which is not necessarily the date or time that a transaction may have been initiated.

- Investors must have the financial ability, sophistication and willingness to bear the risks of an investment and a potential total loss of their entire investment in cryptocurrency.

- An investment in cryptocurrency is not suitable or desirable for all investors.

- Cryptocurrency has limited operating history or performance.

- Fees and expenses associated with a cryptocurrency investment may be substantial.

There may be risks posed by the lack of regulation for cryptocurrencies and any future regulatory developments could affect the viability and expansion of the use of cryptocurrencies. Investors should conduct extensive research before investing in cryptocurrencies.

Information provided by Van Eck is not intended to be, nor should it be construed as financial, tax or legal advice. It is not a recommendation to buy or sell an interest in cryptocurrencies.

The information herein represents the opinion of the author(s), but not necessarily those of VanEck, and these opinions may change at any time and from time to time. Non-VanEck proprietary information contained herein has been obtained from sources believed to be reliable, but not guaranteed. Not intended to be a forecast of future events, a guarantee of future results or investment advice. Historical performance is not indicative of future results. Current data may differ from data quoted. Any graphs shown herein are for illustrative purposes only. Not a recommendation to buy or to sell any of the cryptocurrencies mentioned herein.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.