Green Bonds in the Face of Climate Risk

February 14, 2020

Read Time 6 MIN

Though still early in the year, we are already seeing several major trends that we expect to have a significant impact on the growth of the green bond market. These include a growing understanding of how climate change may affect a bond portfolio, shifting policy and rising public awareness.

Fixed income investors are increasingly recognizing that the physical and transition risks associated with climate change may have a direct link with credit risk. The California wildfires in 2018 resulted in what has been described as the first credit event tied to climate change, when PG&E declared bankruptcy due its liabilities related to the disaster.1

In 2019, Moody’s cited climate change in two high profile ratings actions. Although weak earnings and cash generation were the main factors behind the rating agencies downgrade of Ford to junk status, challenging emissions regulations in the U.S. and Europe were also cited as potential downside risks.

When Moody’s changed Exxon’s credit rating outlook to negative due to cashflow concerns and the company’s reliance on debt, it also noted the company’s vulnerability to climate change regulation and new technologies that could impact demand for fossil fuels as a material and growing risk for the company.2 Moody’s has announced that it will begin considering material ESG risks in every rating decision it makes, across all sectors, going forward.

Along with growing awareness of how certain environmental risks can impact a company’s ability to repay its debts, companies are also facing increased litigation risks. For example, New York State sued Exxon in 2019, claiming that financial disclosures related to the impact of climate change regulation were misleading to investors.

So far, companies have generally prevailed in court in the U.S. and elsewhere, but the emerging legal issues related to climate risk and investing bear watching. We believe that these risks may increase investor demand for green bonds. Green bonds provide investors access to a group of issuers who are proactively investing in climate solutions, and therefore may provide a potential hedge against these risks. Because there is no significant yield difference, investors can view green bonds as a low cost hedge against climate risk in their portfolios.

Policy Slowly Shifting in Favor of Green Investments

Public policy also seems to have taken a decisive shift towards addressing the climate crisis, and spurring additional green finance must be an integral piece of any plan. Europe has taken the clear lead globally from a policy perspective, with what we view as an ambitious plan codified in its proposed “Green Deal,” which includes a 50% emissions reduction by 2030, carbon neutrality by 2050, infrastructure investment, emissions trading scheme and a carbon border tax.

The European Commission is also working to finalize its green taxonomy, which will define what types of business activities and investments can be considered green. The taxonomy will clearly define what projects can be financed by green bonds and the standards those projects must satisfy, as well as the ongoing reporting requirements needed.

The taxonomy goes beyond green bonds and will impact all financial products and corporates in Europe. Given the current lack of ambition in the U.S. to develop a similar or alternative standard, Europe’s green taxonomy has the potential to become the global standard of green finance.

Despite the lack of climate policy leadership from the U.S., there have been some signs of life. Two bills that would increase climate and other ESG related disclosures have passed in Democratic controlled committees in 2019, although there is currently little chance of moving forward at this point.

Most Democratic presidential candidates have laid out ambitious plans that they would seek to enact if elected, though Congressional approval would be needed for many of the specific provisions. In general, the candidates’ plans include a recommitment to the Paris Agreement, a target for the U.S. to be a net-zero greenhouse gas emitter by 2050, massive infrastructure investment, and an end to fossil fuel subsidies. Mayor Pete Buttigieg has called for the U.S. to issue green bonds to fund these plans.

Monetary policy is also gaining attention as another potential lever for policymakers, along with legislation and fiscal policy. The significant influence that central banks have over the flow of global capital has been recognized as a potential way to direct financing towards climate solutions and away from fossil fuel investments.

This could be done via their role as bank supervisors, for example by penalizing “brown” assets held on a bank’s balance sheet in recognition of risks such assets pose to the financial health of a nation’s banking system, or by setting favorable haircut levels or risk weights to green assets. Additionally, central banks could tilt asset purchases towards green assets, although any potential for distortions in market pricing must also be considered.

Notably, the Federal Reserve hosted its first climate change conference in November 2019, focusing on the macro and wealth effects of climate change. In December, Hungary’s central bank became Europe’s first central bank to promote green lending, by offering favorable treatment for energy efficient loans.

Public Awareness Will Drive Progress for Green Bonds

Most of all, public awareness of the potentially catastrophic impact of climate change is increasing rapidly. The biggest challenge to mobilizing the intellectual and financial capital needed to get the world onto a sustainable pathway has likely been the inability to fathom such long-term consequences of just a few degrees of warming.

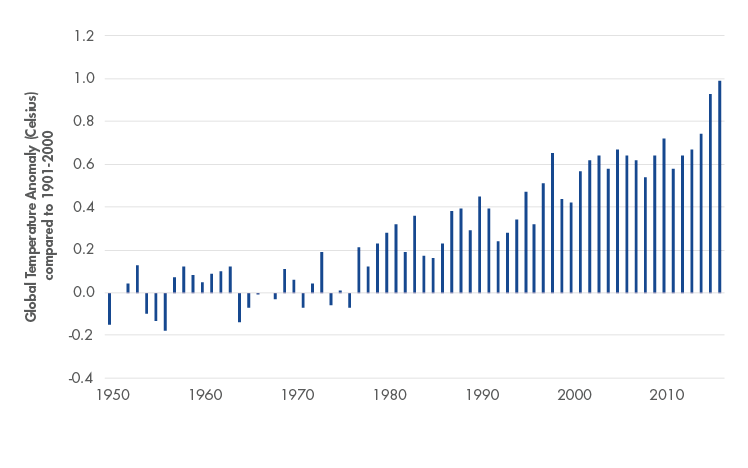

However, more frequent extreme climate events make the issue more difficult to ignore. 2019 was the second hottest year on record according to NASA and NOAA, continuing a near linear trend since the 1970s of steadily increasing temperatures.

Global Temperatures Compared to Long-Term Average

The year was characterized by wildfires in Siberia, Alaska and most recently, Australia. Floods across the Midwestern U.S. claimed 12 lives, and soaring temperatures in continental Europe over the summer killed over a thousand people, according to official figures, and perhaps many more. Greenland’s ice sheet melted the most ever in a single day since recordkeeping began, and the Bering Sea was virtually ice free at one point during the year, a phenomenon never before seen.

Climate scientists predict that on our current path, the world will experience an increase in temperature of at least 3.5 degrees Celsius – far beyond the goals of the Paris Agreement. This is an outcome that will have significant physical, human and financial impact but one that is difficult to estimate with precision.

Climate change is consistently ranked among the top threats to society, greater than ISIS or cyberattacks, according to a Pew Research Center survey. Nearly 60% of Americans view global warming as an existential threat, versus 40% just six years ago. Along with the increased demand for sustainable investments, the increased awareness of the public may increasingly drive the political rhetoric around climate change and the resulting policies to combat it.

We believe green investment initiatives will be key, and expect green bonds to be an integral piece of the financing mix. Green bonds have the ability to tap into the $100 trillion global bond market, and allow investors to build sustainable fixed income portfolios without sacrificing yield.

That is a powerful value proposition for bond investors, and with awareness increasing of the risks that climate change poses to investment portfolios, we expect demand for sustainable fixed income—and green bonds in particular—to remain strong.

Follow Us

1https://www.wsj.com/articles/pg-e-wildfires-and-the-first-climate-change-bankruptcy-11547820006

2Source: Moody’s

IMPORTANT DISCLOSURES

Please note that Van Eck Securities Corporation (an affiliated broker-dealer of Van Eck Associates Corporation) may offer investments products that invest in the asset class(es) or industries discussed herein.

This is not an offer to buy or sell, or a solicitation of any offer to buy or sell any of the securities mentioned herein. The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results, are valid as of the date of this communication and subject to change without notice. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

ESG investing is qualitative and subjective by nature, and there is no guarantee that the factors utilized by VanEck or any judgment exercised by VanEck will reflect the opinions of any particular investor. Information regarding responsible practices is obtained through voluntary or third-party reporting, which may not be accurate or complete, and VanEck is dependent on such information to evaluate a company’s commitment to, or implementation of, responsible practices. Socially responsible norms differ by region. There is no assurance that the socially responsible investing strategy and techniques employed will be successful.

ESG integration is the practice of incorporating material environmental, social and governance (ESG) information or insights alongside traditional measures into the investment decision process to improve long term financial outcomes of portfolios. Unless otherwise stated within the Fund’s investment objective, inclusion of this statement does not imply that the Fund has an ESG-aligned investment objective, but rather describes how ESG information is integrated into the overall investment process.

All investing is subject to risk, including the possible loss of the money you invest. Bonds and bond funds will decrease in value as interest rates rise. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.

Related Funds

1https://www.wsj.com/articles/pg-e-wildfires-and-the-first-climate-change-bankruptcy-11547820006

2Source: Moody’s

IMPORTANT DISCLOSURES

Please note that Van Eck Securities Corporation (an affiliated broker-dealer of Van Eck Associates Corporation) may offer investments products that invest in the asset class(es) or industries discussed herein.

This is not an offer to buy or sell, or a solicitation of any offer to buy or sell any of the securities mentioned herein. The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results, are valid as of the date of this communication and subject to change without notice. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

ESG investing is qualitative and subjective by nature, and there is no guarantee that the factors utilized by VanEck or any judgment exercised by VanEck will reflect the opinions of any particular investor. Information regarding responsible practices is obtained through voluntary or third-party reporting, which may not be accurate or complete, and VanEck is dependent on such information to evaluate a company’s commitment to, or implementation of, responsible practices. Socially responsible norms differ by region. There is no assurance that the socially responsible investing strategy and techniques employed will be successful.

ESG integration is the practice of incorporating material environmental, social and governance (ESG) information or insights alongside traditional measures into the investment decision process to improve long term financial outcomes of portfolios. Unless otherwise stated within the Fund’s investment objective, inclusion of this statement does not imply that the Fund has an ESG-aligned investment objective, but rather describes how ESG information is integrated into the overall investment process.

All investing is subject to risk, including the possible loss of the money you invest. Bonds and bond funds will decrease in value as interest rates rise. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.