In-Game Spending: Revolutionizing Video Game Revenues

24 November 2020

Read Time 4 MIN

Who could have predicted that a free game would make more money than any other video game in a single year? That’s exactly what Fortnite did in 2018, when it brought in about $2.4B. It is a prominent example of how in-game spending has revolutionized the video game ecosystem.

In the traditional business model, known as “game as a product” (GAAP), a game publisher develops a game and then sells it to the consumer for a single, revenue-generating fee. After the consumer buys the game, the video game publisher has to develop another video game or add-on to generate additional revenues from that consumer.

In the mid-2000s, video game publishers began testing the “game as a service” model. In this model, the consumer may bypass the initial cost of purchasing the game, and then pay ongoing fees to continue playing the game and accessing content. There are a number of different ways the game publisher can generate revenues under this model, including game subscriptions, microtransactions and season passes. While transactions in the service model may entail smaller amounts, the publisher opens the door to an indefinite purchasing lifespan from each consumer, which can increase the total revenues generated from a single game.

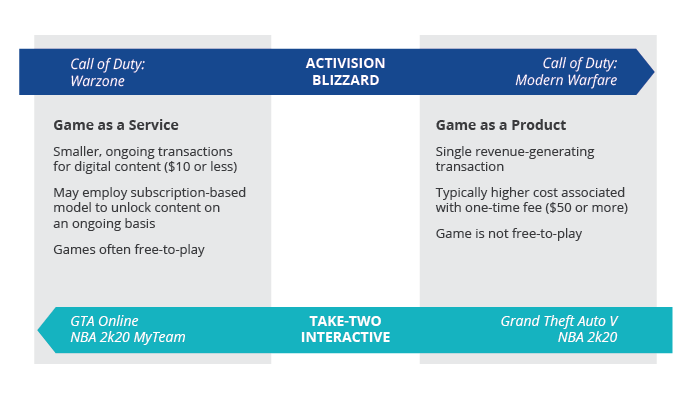

This business model serves three key purposes from the publisher’s perspective. It extends the lifecycle of games being played by consumers, increases the maximum revenue potential from a single consumer and lowers the hurdle for new potential paying customers to try the game before deciding to spend. Publishers are embracing this new model as a way to drive revenue growth. However, different publishers are tailoring their in-game spending strategy depending on their specific product lineup. Activision Blizzard and Take-Two Interactive have each adopted very different approaches to implementing this business model.

Two Different Approaches to the Game as a Service Model

Infographic has been simplified for illustrative purposes.

Activision Blizzard: From Free to Premium

Blizzard Entertainment (now a division of Activision Blizzard) was one of the pioneers of this new revenue model. It released World of Warcraft in 2004, an MMORPG (Massively Multiplayer Online Role-Playing Game) that allowed players the option to buy a monthly, ongoing subscription to access the full, unlocked game. Currently, Activision Blizzard is employing the in-game revenue model across a number of different games and platforms.

Call of Duty: Warzone is a free-to-play game that has been downloaded and played by at least 75 million people around the world since its release in Q1 2020.

- Warzone serves as a standalone revenue source through its Battle Pass subscription and digital item offerings (such as skins and weapons).

- Warzone also serves as a type of free trial for players, who may then go on to buy the full Call of Duty: Modern Warfare game, under the traditional “game as product” model.

- In Activision’s Q2 2020 earnings report, the company noted that Modern Warfare (the paid version) “added more players outside of a launch quarter to the premium Call of Duty experience than ever before, with the majority coming through upgrades from Warzone.”1

- In this example, Activision Blizzard has successfully used a free to play game (Warzone) to attract millions of new players, which in turn increased sales of their premium game (Modern Warfare) under the traditional game as a product paradigm.

Take-Two Interactive: From Product to Service

Take-Two Interactive coined the phrase “recurrent consumer spending” and defines it as revenue generated from ongoing consumer engagement, including virtual currency, add-on content and in-game purchases. These revenue streams are specifically grouped to exclude the initial game purchase.

According to Take-Two, recurrent consumer spending increased 52% and accounted for 58% of total GAAP net revenue as of the fiscal Q1 2021 quarterly earnings report.2 “The largest contributors to GAAP net revenue in fiscal first quarter 2021 were Grand Theft Auto® Online and Grand Theft Auto V; NBA® 2K20; Red Dead Redemption 2 and Red Dead Online.”3

- Recurrent consumer spending now represents the majority of net revenues for Take-Two, suggesting that the company will continue to release content and games that facilitate in-game spending.

- Grand Theft Auto V was released in 2013, but is still the top revenue source for the company. In this case, consumers initially purchased the game (game as a product) before having a chance to make further in-game purchases (game as a service).

Video Gaming and Esports: Taking Media and Entertainment to the Next Level

Activision and Take-Two have essentially adopted reverse approaches to the game as a service model. Activision’s release of a free-to-play game is helping drive consumers to purchase a traditional game, while Take-Two requires an upfront game purchase before consumers are able to spending more on in-game items.

Recurrent in-game spending is among the trends that are driving the growth of the video gaming industry and making this space, in our view, a compelling investment opportunity.

1Source: Activision Blizzard Q2 2020 Earnings Report

2Take-Two Interactive Software, Q1 2021 Earnings Report

3Ibid.

Important Disclosure

This is a marketing communication for professional investors only. Please refer to the UCITS prospectus and to the Key Investor Information Document (KIID) before making any final investment decisions.

This is a marketing communication for professional investors only. Please refer to the UCITS prospectus and to the Key Investor Information Document (KIID) before making any final investment decisions. This information originates from VanEck Securities UK Limited (FRN: 1002854), an Appointed Representative of Sturgeon Ventures LLP (FRN: 452811) which is authorised and regulated by the Financial Conduct Authority in the UK. The information is intended only to provide general and preliminary information to FCA regulated firms such as Independent Financial Advisors (IFAs) and Wealth Managers. Retail clients should not rely on any of the information provided and should seek assistance from an IFA for all investment guidance and advice. VanEck Securities UK Limited and its associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results. Information provided by third party sources is believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Brokerage or transaction fees may apply.

All performance information is based on historical data and does not predict future returns. Investing is subject to risk, including the possible loss of principal.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck Securities UK Limited

Sign-up for our ETF newsletter

Related Insights

Related Insights

07 February 2025

12 February 2025

07 February 2025

16 January 2025

16 January 2025

16 January 2025