VanEck’s Base, Bear, Bull Case: Solana Valuation by 2030

26 October 2023

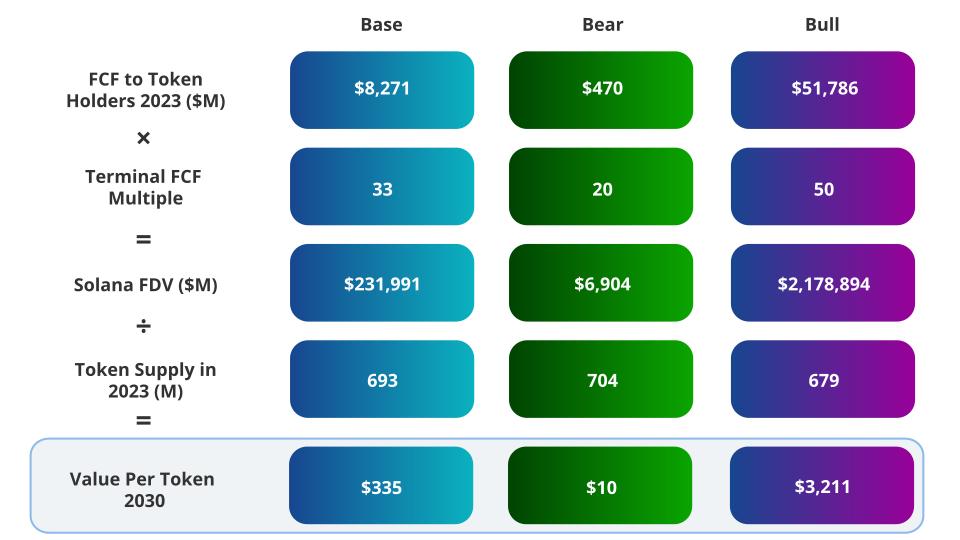

By 2030, our Solana valuation scenarios project a SOL price ranging from a bearish $9.81 to a bullish $3,211.28, anchored by varied market shares and revenue estimations across key sectors.

Please note that VanEck may have a position(s) in the digital asset(s) described below.

- In this note, we model a scenario in which Solana is the first blockchain to host an application that onboards 100M+ users.

- We assume SOL monetizes at only 20% of ETH's take rate and achieves less than half of ETH's market shares due to a fundamental difference in community philosophy.

- We see a credible path to $8B in revenues for SOL token holders by 2030.

The purpose of smart contract platforms (SCPs) is to host applications that offer their users the ability to engage in efficient, uncensorable economic activity while minimizing rent extraction on those economic activities by third parties. While many blockchains exist today, the user base of all blockchains is tiny compared to those who engage in commerce off-chain. Roughly 5.5M unique addresses are active each day on SCPs, and around 44M each month. However, it is likely these figures dramatically overstate usership because many users control multiple addresses. Even if we take them at face value, these figures compare poorly to the 2B users who interact with Facebook each day and the 431M who use PayPal every month. The reason why blockchain adoption hasn't been faster already is because blockchains are clunky to use, and there is little to do on the chain besides exchange value and speculation. For crypto to achieve widespread adoption and grow its $1.3T market cap, it needs to have a so-what for people and businesses who are not decentralization maxis or libertarian zealots. It needs a killer application. And the chain that hosts that killer application stands to benefit immensely from the activity generated by that app. In this note, we model a scenario in which Solana is the first blockchain to host a single application that onboards 100M+ users.

Monthly Active Users of SCPs

Source: Token Terminal, Dune, as of 10/25/2023. Past performance is no guarantee of future results. Not intended as a recommendation to buy or sell any securities named herein.

Solana's potential begins with its founding team's success in blending radical experimentation with applied science to monumentally improve blockchain scaling. While other chains have chosen scaling paths that cleverly circumnavigate the limitations of distributed ledgers, Solana has instead chosen to push to the limits of technological feasibility problems and work backward from there. The Ethereum ecosystem and many others have chosen a modular vision where different blockchains specialize in the core functions of a layer 1 chain. On the other hand, Solana has plowed ahead, trying to wring greater transaction throughput by optimizing every component of its own blockchain to be hyper-efficient. Consequently, Solana is vastly more capable than any of its legacy competitors regarding blockchain processing capabilities. Parallel to this, but much more importantly, Solana has translated its pioneering spirit into an ecosystem philosophy of risk-taking and techno-optimism. Solana has spawned a variety of fascinating experiments that include blockchain-optimized mobile phones, NFTs that contain applications, and consumer-focused products like decentralized mapping and automobile data collection. More so than any other ecosystem, people building projects in Solana are creating things that may provide a tangible impact on everyday life.

Solana's Approach: Usability

The probability of a blockchain network hosting the next “killer apps” hinges upon that chain's ability to make using that application fast, convenient, and accessible. The more capable the blockchain, the better the environment for a user. The key question is measuring blockchain ability and understanding how that translates into useability. A popular metric, transactions per second (TPS), is an inadequate measurement that is easily manipulated. Realistically, blockchain teams can improve this metric by many tricks, including changing the amount of data each transaction contains, forgoing the ordering of transactions, and limiting what parts of a ledger a transaction can change. In fact, the best metric to truly measure blockchain capacity is not transactions per second (TPS) but is instead data throughput.

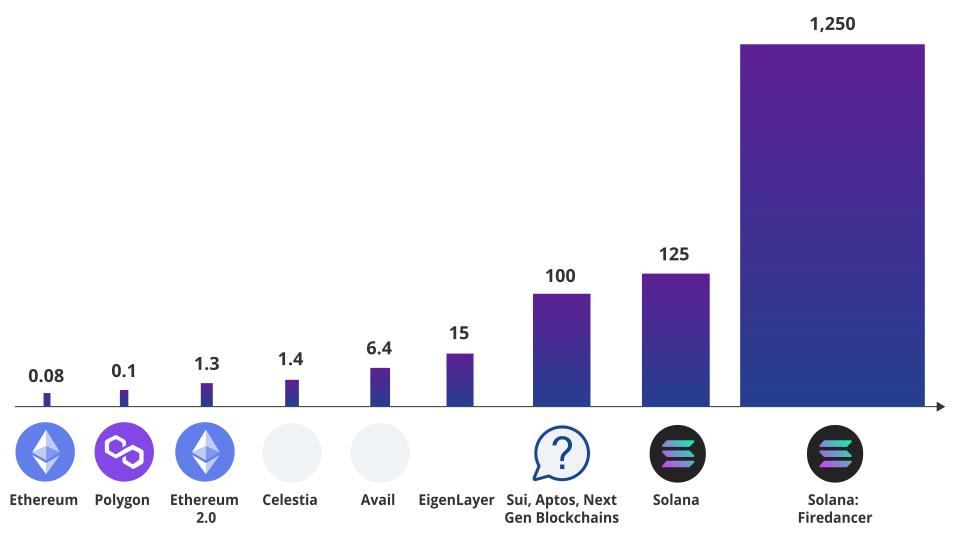

Data throughput involves a blockchain ingesting, processing, and ordering data and then agreeing on that data's impact on the blockchain's ledger. Data throughput is determined by measuring the amount of data that can be received and applied by a blockchain over a given time period. The more data a blockchain can translate into ledger updates over a time increment, the better. As it stands, Solana's data throughput exceeds that of any other blockchain in existence. In fact, Solana's data capacity exceeds that of most planned blockchains, and Solana's next significant software upgrade called the Firedancer upgrade, promises to exceed Solana's current capacity by a factor of 10. While we do not pretend to know how much data the next killer application's blockchain needs to ingest and process, we imagine that 100M+ users doing anything on-chain will push blockchain scalability to its limits.

Data Throughput Comparisons MB/S

Source: Frictionless Capital, SCP Home Pages as of 10/25/2023.

Solana translates this data throughput capability into solving problems that users care about. Solana enables quicker feedback to the user than most other chains because it offers continuous processing of transactions. For example, Ethereum works by pooling incoming transactions from users in essentially a waiting room called the mempool. Ethereum validators (block builders in the new paradigm) then pick transactions from the pool based on the price offered by each transaction and order them. Every 12 seconds, transactions are then executed, and the block containing the transactions is beamed to the rest of the Ethereum network. Consequently, Ethereum processes transactions at discrete intervals. This is a substantially slower way of processing transactions than Solana's which leads to longer wait times for the user. On Ethereum, users must wait for this entire process to unfold before they know their transaction is complete. Often, this is measured in minutes. Solana, by contrast, begins working on processing the transaction instantly, and the turnaround is approximately 2 seconds.

Apps on Solana

To make the user experience even better, Solana has also created a novel feature called Local Fee Markets. If a blockchain is a data pipeline from users to the blockchain's ledger, Solana's Local Fee Markets are essentially internal sub-pipelines that allow information to flow from different users to multiple parts of the ledger simultaneously. This solves a core problem of Ethereum and other blockchains, as overuse of one application on Ethereum's pipeline slows down all other applications. For example, if many users are trying to mint an NFT on Ethereum, the resulting congestion prevents other users from borrowing on AAVE. In the context of a killer application, users need to be able to consistently interact with the blockchain. By contrast, Solana can segment those different pipelines using Local Fee Markets to charge different prices based on demand. This allows for many applications to have access to Solana even when one application is experiencing heavy usage. This is particularly important because the functionality of a killer application could depend upon simultaneous interaction with many different applications. Additionally, being able to adjust local fee markets to price different types of transactions may be the key to Solana adjusting its price based on the use case. This may allow Solana to price transactions differently based on each's economic value. Local Fee Markets may give the killer application developers greater precision in assessing its costs.

Solana vs. Ethereum: Contrasting Philosophies

Solana was built by Qualcomm engineers who applied their expertise in enhancing mobile network capacity to build a highly performant blockchain. The foundational principle of the Solana team is to build a network that assumes consumer-grade computing power grows with Moore's Law and networking bandwidth expands alongside it. As a result, Solana is engineered to take advantage of hardware advancements more directly than competitors.

We see this as the mindset of optimism that believes in a future of abundance and progress. The core belief of the Solana team is that blockchains should make blockspace, or the amount of data that fits onto a chain in a time frame, very inexpensive. In their view, this unlocks the ability of software engineers and entrepreneurs to cheaply test new use cases for blockchain. This sharply contrasts with the view that Ethereum has evolved its business from that of selling cheap blockspace every day to that peddling expensive blockspace that secures consumer-facing blockchains. In the Ethereum paradigm, success hinges upon ETH being the principal (and only) collateral to secure all blockchains. The initial pitch for Solana was for it to become a “Decentralized Nasdaq.” Though that narrative still has potential, the launch of fascinating non-financial consumer applications such as Hivemapper, Render, and Helium has expanded the perception of Solana's capabilities.

The Solana team, to their credit, has been open-minded in use cases for Solana's ground-breaking technology. They've attempted to bring blockchain to the mobile phone through their or Solana Mobile Stack, which allows developers to create blockchain applications for cell phones. Solana's experimentation has even led them to create their own that is optimized to use blockchain. Though Solana Mobile was criticized as a distraction from Solana's core mission, It demonstrates Solana's desire to solve basic core user problems. It is this dedication to the consumer that has helped Solana ink partnerships with Shopify, Visa, and Google to explore new use cases for Solana and boost its ecosystem.

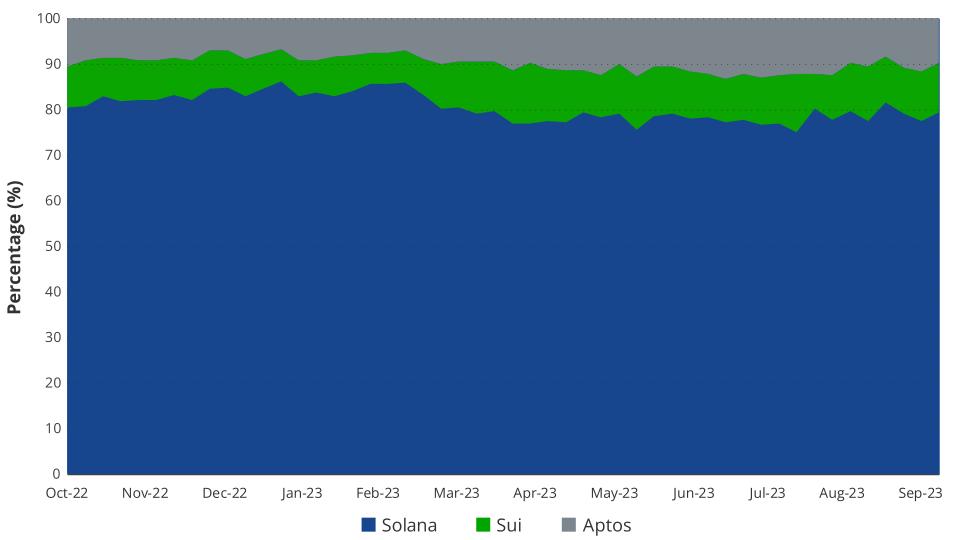

Solana Developer Market Share – SCP Monolithic Chains

Solana Developer Share. Source: Artemis XYZ as of 10/25/2023. Past performance is no guarantee of future results. Not intended as a recommendation to buy or sell any securities named herein.

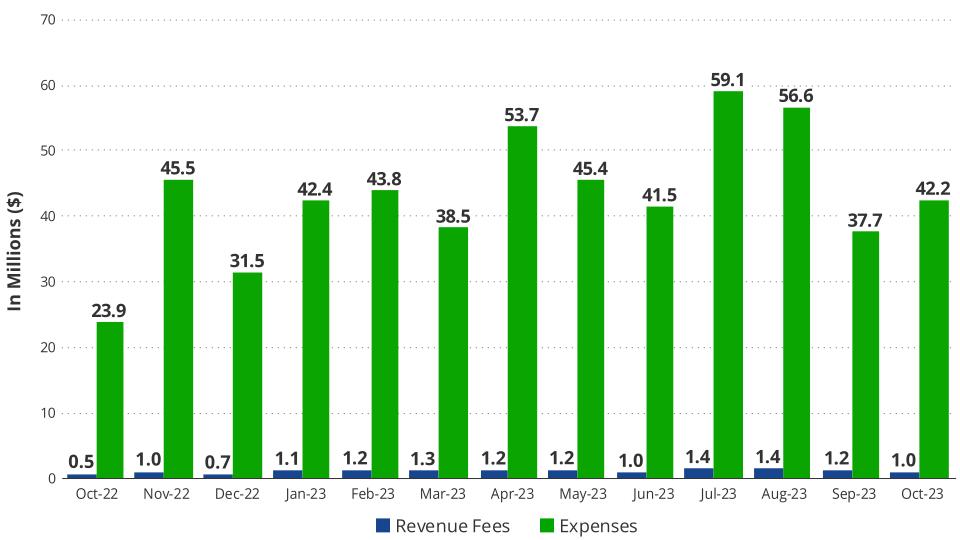

Solana's Cost vs. Revenue Challenge

Solana's focus on cheap blockspace, experimentation, and vanguard technology has not been without drawbacks. While providing cheap blockspace encourages ecosystem growth by giving projects and users a nearly costless (to them) sandbox, it is important to remember that supplying that blockspace still has costs. Though Solana has generated $1.26M in revenue fees over the previous 30 days, Solana's cost of securing its blockchain by paying validators using SOL inflation was $52.78M over the same time period. While Solana is not a business that is in danger of collapsing due to this lack of “profitability” in the near term, long-term the cost of security must be met by organic SOL demand to use the Solana blockchain. This is because Solana validators sell some portion of their token inflation to cover their overhead costs, which include hardware, labor, and connectivity costs (we omit voting costs in this calculation).

Solana Revenue Fees vs. Expenses

Source: Token Terminal as of 10/25/2023. Past performance is no guarantee of future results. Not intended as a recommendation to buy or sell any securities named herein.

We estimate that the total non-blockchain costs for running all of Solana’s 1,977 validator nodes is ~$11.8M per year even before labor is included. As a result, we ballpark this figure as the minimum estimate of Solana’s yearly SOL token sell pressure. On the revenue side, half of the revenue fees, $7.56M, are burned and this represents buy pressure of the SOL token (the other half of tokens are remitted to validators and stakers and are offset by potential selling). Applying this simplified summary of buy pressure and sell pressure, we calculate a net imbalance of -$4.24M which represents buy pressure that has to offset collective validator sell pressure. In practice, these token sales by Solana validators has been offset with capital from speculators. Thus, until fee revenue of Solana improves, Solana is an ecosystem whose ability to function in its current state depends upon the consistent introduction of new speculative capital.

Long-term pricing of Solana's blockspace and how much it costs to utilize Solana is another thorny issue. The chief problem of a monolithic chain like Solana is that it is difficult to extract value from users and remit that back to token holders. This paradigm exists because Solana prices its transactions based on the required compute, total demand for compute, and congestion of the area where that compute is applied. While resource pricing is economically logical from the standpoint of pricing the Solana network's ability to allocate its network resources, it is illogical from the standpoint of pricing various user actions effectively.

For example, sending a trade order to the Chicago Mercantile Exchange (CME) is essentially free. However, the CME and other similar exchanges charge that trader a fee when that trade executes and may even change the amount charged based upon whether that trade executes after it “actively takes” another order or another order “takes it.” Likewise, with something like Twitter, while it costs nothing to make a post if a user chooses to promote that post or target other users with that post, it will cost a lot. In a vacuum, this pricing, while suboptimal from a value extraction standpoint, is irrelevant. However, in the context of there being tens of thousands of blockchains, each tailored to a specific use case, each of these blockchains may be able to capture value more effectively for token holders. This may threaten the economic sustainability of Solana if weakening SOL prices cause Solana's security budget to fall below its needs. Likewise, from a resource's perspective, a blockchain will want to make sure to allocate its finite resources to economically beneficial activities. If resources are priced inadequately, a blockchain could become saturated with economically detrimental activities regardless of if those activities are segmented by Solana's Local Fee Markets. This has already and resulted in more disruption of more legitimate use cases. Likewise, while Solana is performing hundreds of transactions per second, many of these are low- spamming the network. Through Local Fees Markets may mitigate the issue, it is yet to be seen if this improvement will be sufficiently adaptable if Solana's usage meaningfully accelerates.

We give Solana and its team immense credit for their vision and desire to experiment, but its architecture has led to undesirable outcomes that have affected Solana's technical stability. While Solana has had 100% uptime since March 2023 after a series of important network upgrades, previous to that, it has experienced unpredictable downtimes that completely halted network function. Between January 2022 and February 2023, Solana had occasions in 7 out of those 13 months with outages. The most recent of these outages, on February 25, 2023, lasted nearly 19 hours. The core issue of this outage and others in the past stems from the fact that Solana is running an experimental system. There is no formal verification of the Solana consensus mechanism, nor is there the ability to predict future failures in Solana's design because of the colossal data volumes that the system processes. Though Solana has implemented numerous improvements to mitigate past issues, Solana's design may make it impossible to understand future complications until they happen. As a result, the Solana team still considers the chain to be in “Beta” because future network failures could result from unforeseen causes. And because of the complexity of Solana and the amount of data it processes, resolving these issues might take substantial periods of time to fix.

Clearly, this dynamic is unacceptable to serious financial and non-financial businesses that may want to deploy to Solana. The unpredictability of uptime is partly responsible for Solana's low TVL (total valued locked) in decentralized finance relative to its peers. While the Solana team has implemented what they believe are important fixes, network fragility will remain an issue for the foreseeable future, and the roll-out of the new design Firedancer may even increase the potential for irreconcilable problems.

SCL Weekly Active Developer Market Share

Source: Artemis XYZ as of 10/25/2023. Past performance is no guarantee of future results. Not intended as a recommendation to buy or sell any securities named herein.

Finally, we take some issue with Solana's ability to attract developers to its ecosystem. Because of the complexities of Solana's virtual machine (SVM) and Solana's complex design, creating applications on Solana is a challenging task. In fact, building is difficult for developers, that the founder of Solana Anatoly has likened it to “.” This is partly due to the need for Solana developers to be familiar with Rust, a language with active developers, compared to Ethereum which can draw from the JavaScript developers. Though Solana has made great strides in creating the tooling to make development simpler, its high bar for programming proficiency has resulted in Solana accounting for roughly 6-7% of weekly active crypto developers over the last 18 months. While this consistent share is remarkable given that Solana lost one of its biggest backers in FTX/Alameda in November 2022, it needs to increase its total developer count as well as its market share of developers to increase the probability of hosting the tomorrow's blockbuster application. Though it may be likely that the average Solana developer is better than the average Polkadot (DOT) developer, building a widely adopted consumer application may be analogous to the Infinite Monkey Theorem (IFM). In the IFM, the greater the number of monkeys one employs randomly hitting keys on a typewriter, the shorter the time (measured in eons) frame it takes for them to randomly write out the complete works of William Shakespeare. In the context of building an application that brings the next 100M users to the blockchain, the more developers working on the problem, the higher the likelihood of one of them randomly banging out the next Instagram.

Solana Valuation Scenarios Overview by 2030

Source: VanEck Research as of Oct 25th 2023. Past performance is no guarantee of future results. The information, valuation scenarios and price targets presented on Solana in this blog are not intended as financial advice or any call to action, a recommendation to buy or sell Solana, or as a projection of how Solana will perform in the future. Actual future performance of Solana is unknown, and may differ significantly from the hypothetical results depicted here. There may be risks or other factors not accounted for in the scenarios presented that may impede the performance of Solana. These are solely the results of a simulation based on our research, and are for illustrative purposes only. Please conduct your own research and draw your own conclusions.

We apply VanEck's standardized valuation framework to Solana to achieve a token valuation of $335 in our 2030 Base. The estimate is based upon projecting a terminal valuation multiple on Solana's SOL tokens derived from a predicted real rate of return. This real rate of return is calculated from estimated cash flow remittance to SOL token holders. This multiple is then applied to the terminal year's FCF (free cash flow) to the token and divided by the expected number of tokens in the terminal year.

| Solana Revenue Breakdown | ||||

| Today | Base 2030 | Bear 2030 | Bull 2030 | |

| Solana Total Revenue | $28 | $8,869 | $454 | $54,283 |

| Transactions | $12 | $2,882 | $19 | $29,312 |

| Finance, Banking, Payments | $9 | $984 | $8 | $13,117 |

| Metaverse, Social and Gaming | $3 | $1,339 | $11 | $11,220 |

| Infrastructure | $0 | $560 | $0 | $4,975 |

| MEV - Block Builder Revenue | $16 | $5,987 | $435 | $24,971 |

Source: VanEck Research as of Oct 25th 2023. Past performance is no guarantee of future results. The information, valuation scenarios and price targets presented on Solana in this blog are not intended as financial advice or any call to action, a recommendation to buy or sell Solana, or as a projection of how Solana will perform in the future. Actual future performance of Solana is unknown, and may differ significantly from the hypothetical results depicted here. There may be risks or other factors not accounted for in the scenarios presented that may impede the performance of Solana. These are solely the results of a simulation based on our research, and are for illustrative purposes only. Please conduct your own research and draw your own conclusions.

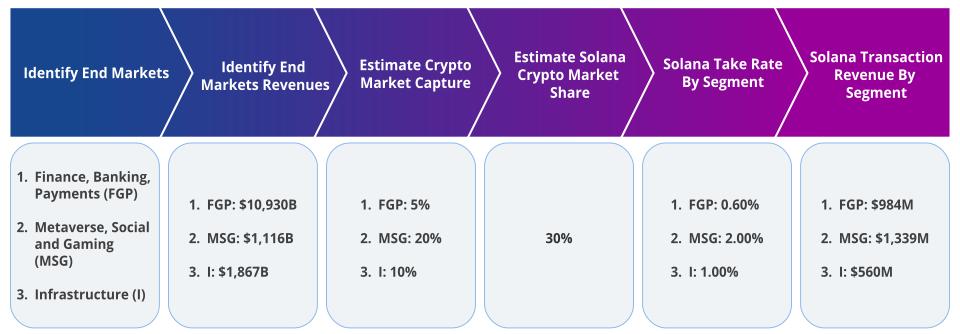

More specifically, on revenues and cashflows, our framework begins by examining the different revenue items for Solana. First is a take rate on end market activity. We begin this exercise by identifying end markets that will utilize public blockchains, such as Ethereum and Solana. The three main categories for this are Finance, Banking and Payments (FBP), Metaverse and Gaming (MG), and Infrastructure (I). Depending upon the scenario, we then assume a certain portion of businesses and their revenues will be derived from blockchain activities or employ blockchain in some capacity to find customers, create new products, reduce costs, or simplify back-end business functions. Since public blockchains are analogous to Web 2.0 platforms like Amazon, the Apple App Store, and Uber, we then suppose that public blockchains will have an effective take rate of the GMV of their end markets' revenues. In our Base Case, we find a take rate that is 1/5th of the Ethereum equivalent take rate on blockchain activity. Thus, the total revenue to Solana from end-market transactions is $2.88B. Additionally, we also factor in MEV as a revenue item that is effectively waterfalled from trader entities to validators to token holders. We calculate MEV by estimating the total number of assets locked in Solana DeFi and multiply it by an annual take rate. Our Base Case finds revenue from MEV in 2030 to be $5.99B. Once we have the raw revenue figures, we deduct an assumed tax rate as well as an approximation of the validators' cost to the ecosystem.

Base Case 2030 Transaction Revenue Estimate Assumptions

Source: VanEck Research as of Oct 2023. Past performance is no guarantee of future results. The information, valuation scenarios and price targets presented on Solana in this blog are not intended as financial advice or any call to action, a recommendation to buy or sell Solana, or as a projection of how Solana will perform in the future. Actual future performance of Solana is unknown, and may differ significantly from the hypothetical results depicted here. There may be risks or other factors not accounted for in the scenarios presented that may impede the performance of Solana. These are solely the results of a simulation based on our research, and are for illustrative purposes only. Please conduct your own research and draw your own conclusions.

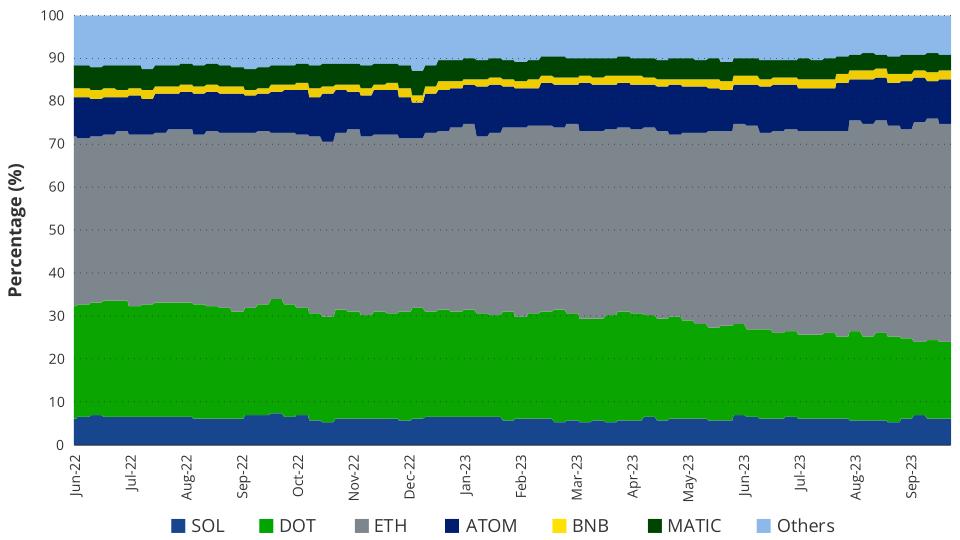

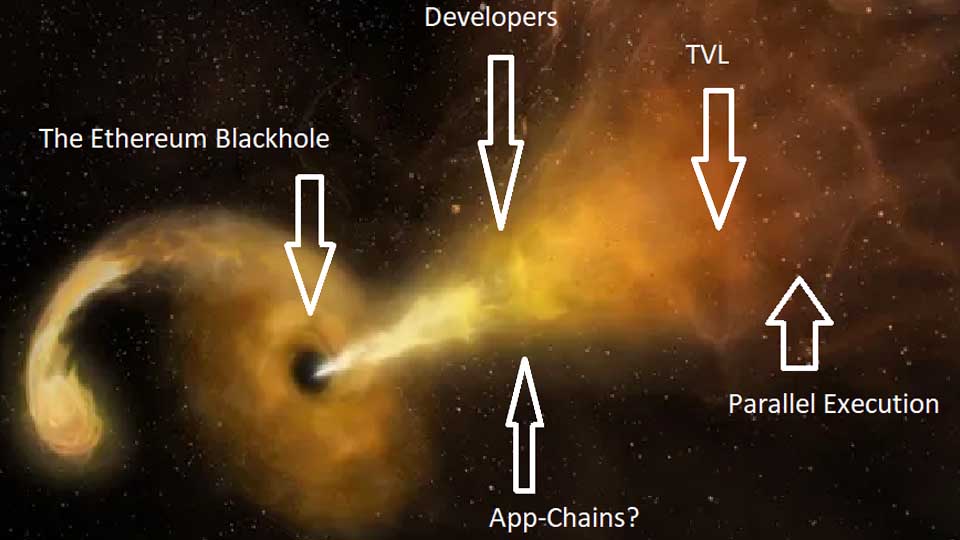

Despite its potential, we believe Solana's likelihood of hosting the majority of the world's crypto transactions by 2030 is lower than Ethereum's. While Solana's network and execution engine enables higher throughput and unlock greater potential, it lacks adoption momentum by the majority of crypto users and developers. Solana currently retains a substantially lower share of crypto TVL $408M out of $46B, and a similarly small percentage of daily active users, with 184K out of 5.5M. We also believe that new developers entering the space during widespread public blockchains may not be wedded to existing ecosystems nor be decentralization maximalists. As a result, future inbound new developers may become enamored with the next generation of blockchains that offer novel developer frameworks, features, and capabilities, as has been the case in prior crypto cycles As a result, in our base case, we see Solana adoption nearing 30% - a substantial jump from today's figures, but far lower than Ethereum's base case of 70%. This comparison is apt due to the blackhole-like effect of the Ethereum ecosystem growth by swallowing and absorbing ideas while increasing its share of blockchain developers. For context, our $11.8k price target for Ethereum was based on the ETH network achieving a 70% market share of value transmitted across open-source blockchains. Were Solana to avoid Ethereum's event horizon and achieve Ethereum-like dominance, our bull case reveals $51.8B in revenues and a $3,211 price target in 2030.

Source: Space.com as of Oct 2023.

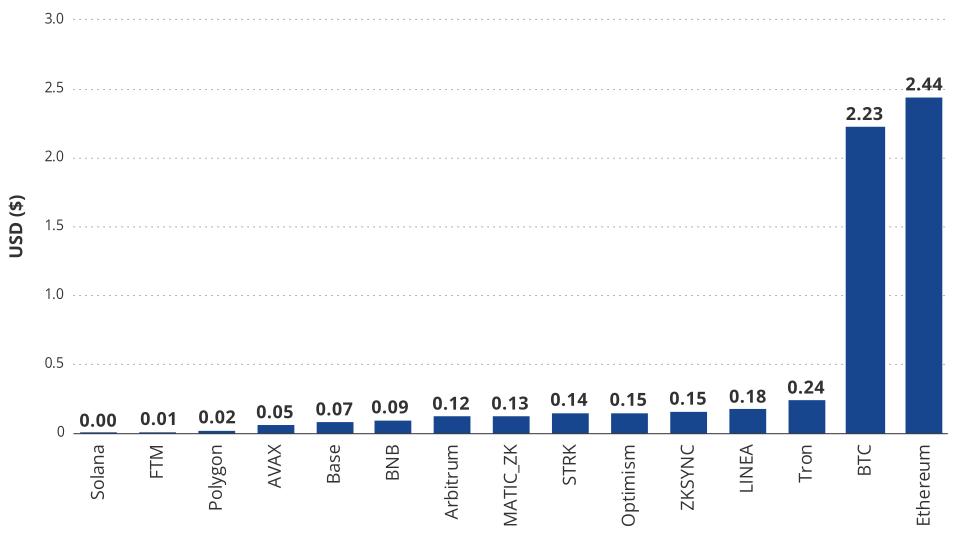

In terms of value capture of end-market revenues that employ blockchain, we believe Solana has less potential for value capture than Ethereum. In our base case, we believe that Solana's value capture of GMV will be 20% of that of Ethereum's. We make this assertion based upon the simplicity of Solana's value capture stack and the philosophical assertions of the founder Anatoly Yakovenko that favor abundance over scarcity. The result of abundance over scarcity means that blockspace will remain inexpensive, and the result will be extremely cheap transactions. Putting this into mathematical terms, this ballparks Solana's “take rate” on GMV at 0.60% of FBP, 2.00% of MSG, and 1.00% of I.

Average Fee Per Transaction Last 30 Days

Source: Artemis XYZ as of October 25th, 2023. Past performance is no guarantee of future results. Not intended as a recommendation to buy or sell any securities named herein.

The key question is, “given its low transaction pricing, how will Solana make money over the long term?” Currently, transaction prices are so minuscule that it will take an immense amount of activity to bring up Solana's revenue figures. In our base model, we assume roughly 600B in yearly transactions by 2030, and we deduce that transaction figure from an expectation of 534M monthly active users given Solana's market share of end markets and an assumption of the number of transactions each user will perform. While MEV will be the most important value capture mechanism of Solana, accounting for 67.5% of all revenues in our base case, we believe there is a possibility that Solana can pull other levers to make its token more valuable even if usage does not appreciate to our base case estimates.

As we noted earlier, blockchains must price activity in such a way as to be cheap enough to encourage widespread usage while still ensuring that its validators get paid enough to validate the network. Blockchains like Solana bootstrap this security budget, the money paid to validators, by building in inflation that dilutes existing token holders to compensate validators. Paying a security budget solely out of Inflation is not sustainable indefinitely if there is no economic activity or if economic activity on the chain is priced too cheaply.

Long run, even if Solana is not able to attract 600B transactions per annum, they have ample levers to pull that could increase the token's value. The first of which is simply to raise transaction prices. While Solana will almost certainly see less transaction throughput if they raise prices, if there are economically valuable activities, it stands to reason that Solana should be able to effectively capture some of that value. Furthermore, Solana could also decrease the effective supply of its token by increasing the amount it charges programs (applications), crypto wallets, NFTs, and tokens to store data on the chain. On Solana, all entities that deploy code to Solana or operate a wallet must pay fees in SOL based on the size of their storage. Anyone using Solana also has the option to forgo this fee by keeping enough SOL in their account to pay for 2 years of rent. With storage fees at 0.00000348 SOL per byte and wallet data size of 372 bytes, each active wallet holder must maintain 0.0026 SOL. Similarly, applications and token smart contracts have to maintain these storage fees as well. A program like Serum which has around 340KB will need to keep a balance of 2.4 SOL to avoid paying rent. If Solana chooses to do so, it could dramatically increase these balances and effectively reduce the supply of floating SOL.

Of course, these rent and transaction cost changes would violate the current principles of the Solana founding team, which controls the protocol. At the same time, there is no governance on Solana to mediate these decisions but recently some validators have brought up to introduce token-voting governance on Solana. By the year 2030, we believe that Solana will already be practicing governance using token-voting and we believe this will enhance the economics of the SOL token if the Solana blockchain has a vibrant ecosystem of activity.

Solana's Potential: Risks and Rewards

Solana is an endlessly fascinating project that is committed to improving the user experience by pushing the edge of what is possible on a blockchain. As a result, it offers the cradle with the right features that have the best opportunity of growing the next killer application. Additionally, the Solana team are titans of the space whose non-consensus thinking has birthed in the most capable blockchain in existence. As they continue to innovate, their philosophy of experimentation and optimism has infused a small yet creative ecosystem of consumer-focused applications. Most importantly, Solana's community has a strong identity that allowed it to remain resilient despite immense setbacks that would have destroyed many other blockchain ecosystems.

That said, Solana is surfing in currents that are far different from the consensus view of established names in the space, like Ethereum. Rather than specializing in modular blockchain components as Ethereum and its supplicants are building, they are cutting a course to develop an integrated blockchain that combines these components into an integrated data throughput machine. This is a monumental task, and the Solana team is starting from a position of relative weakness – they have fewer developers, TVL, VC funds and foundation capital to build their vision than EVM-compatible chains. Likewise, they still face tremendous questions over the long-term stability of their blockchain's technical approach. Still, even using terminal market share and take-rate assumptions well below that which we use for Ethereum, our model produces more upside in our base case for the SOL token. Thus, we believe a meaningful weight for SOL in investor portfolios is justified.

Disclosure: The VanEck team owns SOL tokens and stakes in other Solana-based applications such as Hive mapper, Helium, and Render.

| Solana Valuation Scenarios | |||

| Base | Bear | Bull | |

| SOL Price Estimate | |||

| Solana Terminal Smart Contract Market Share | 30.00% | 5.00% | 80.00% |

| Estimated Revenue 2030 (M) | $8,271 | $410 | $51,786 |

| Global Tax Rate on Crypto | 15.00% | 15.00% | 15.00% |

| Validator Cut | 1.00% | 1.00% | 1.00% |

| FCF to Tokenholders in 2030 (M) | $6,960 | $345 | $43,578 |

| FCF Terminal Multiple | 33 | 20 | 50 |

| SOL FDV (M) | $231,991 | $6,904 | $2,178,894 |

| SOL Supply in 2030 (M) | 693.12 | 703.88 | 678.51 |

| SOL Price 2030 | $334.70 | $9.81 | $3,211.28 |

| Crypto Terminal Market Share | |||

| Finance, Banking, Payments | 5.00% | 1.00% | 15.00% |

| Metaverse, Social and Gaming | 20.00% | 5.00% | 50.00% |

| Infrastructure | 10.00% | 1.00% | 20.00% |

| Solana Market Share of Crypto | 30.00% | 5.00% | 80.00% |

| Solana Value Capture of End Market Revenue | |||

| Finance, Banking, Payments | 0.60% | 0.15% | 1.00% |

| Metaverse, Social and Gaming | 2.00% | 0.50% | 3.33% |

| Infrastructure | 1.00% | 0.25% | 1.67% |

| MEV Revenue | |||

| MEV LT Take Rate | 0.10% | 0.10% | 0.10% |

| MEV Value Accrual to Token | 90.00% | 90.00% | 90.00% |

Source: VanEck Research as of Oct 2023. Past performance is no guarantee of future results. The information, valuation scenarios and price targets presented on Solana in this blog are not intended as financial advice or any call to action, a recommendation to buy or sell Solana, or as a projection of how Solana will perform in the future. Actual future performance of Solana is unknown, and may differ significantly from the hypothetical results depicted here. There may be risks or other factors not accounted for in the scenarios presented that may impede the performance of Solana. These are solely the results of a simulation based on our research, and are for illustrative purposes only. Please conduct your own research and draw your own conclusions.

| Top Five Gas-Guzzling dApps on Solana | ||

| Name | Category | % of Gas (90d) |

| Pyth Price Oracle | Infrastructure | 21.5 |

| Magic Eden | NFT Exchange | 5.2 |

| Chainlink Data Storage | Infrastructure | 3.6 |

| Mango Markets | DeFi | 2.5 |

| Zeta | DeFi | 2.1 |

| Five Promising dApps on Solana | |||

| Name | Category | Usage | YTD Change |

| Backpack xNFTs | Wallet | 55,000+ Users | 3.02 |

| Render | Decentralized Compute | 117,900* | 7.67 |

| Hivemapper | DePIN | 23,756 Mappers | 4.88 |

| Helium | DePIN | 907** | 0.85 |

| Star Atlas | Gaming | 1.9M Daily Txns | 10.89 |

* Number of scenes rendered monthly.

** Average daily Data Credits burned ($).

Source: chrome-stats.com, Dune, Flipside Crypto, Hivemapper, VanEck as of October 25th, 2023.

Thank you to all who contributed perspective to this article including Eugene Chen from Ellipsis Labs, Edgar Xi from Jito Labs, Matt Sorg from Solana, and 0xkrane.

Links to third party websites are provided as a convenience and the inclusion of such links does not imply any endorsement, approval, investigation, verification or monitoring by us of any content or information contained within or accessible from the linked sites. By clicking on the link to a non-VanEck webpage, you acknowledge that you are entering a third-party website subject to its own terms and conditions. VanEck disclaims responsibility for content, legality of access or suitability of the third-party websites.

To receive more Digital Assets insights, subscribe for our Crypto Newsletter

Important Information

This is not financial research but the opinion of the author of the article. We publish this information to inform and educate about recent market developments and technological updates, not to give any recommendation for certain products or projects. The selection of articles should therefore not be understood as financial advice or recommendation for any specific product and/or digital asset. We may occasionally include analysis of past market, network performance expectations and/or on-chain performance. Historical performance is not indicative for future returns.

For informational and advertising purposes only.

This information originates from VanEck (Europe) GmbH, Kreuznacher Straße 30, 60486 Frankfurt am Main. It is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice. VanEck (Europe) GmbH and its associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. Views and opinions expressed are current as of the date of this information and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. VanEck makes no representation or warranty, express or implied regarding the advisability of investing in securities or digital assets generally or in the product mentioned in this information (the “Product”) or the ability of the underlying Index to track the performance of the relevant digital assets market.

The underlying Index is the exclusive property of MarketVector Indexes GmbH, which has contracted with CryptoCompare Data Limited to maintain and calculate the Index. CryptoCompare Data Limited uses its best efforts to ensure that the Index is calculated correctly. Irrespective of its obligations towards the MarketVector Indexes GmbH, CryptoCompare Data Limited has no obligation to point out errors in the Index to third parties.

Investing is subject to risk, including the possible loss of principal up to the entire invested amount and the extreme volatility that ETNs experience. You must read the prospectus and KID before investing, in order to fully understand the potential risks and rewards associated with the decision to invest in the Product. The approved Prospectus is available at www.vaneck.com . Please note that the approval of the prospectus should not be understood as an endorsement of the Products offered or admitted to trading on a regulated market.

Performance quoted represents past performance, which is no guarantee of future results and which may be lower or higher than current performance.

Current performance may be lower or higher than average annual returns shown. Performance shows 12 month performance to the most recent Quarter end for each of the last 5yrs where available. E.g. '1st year' shows the most recent of these 12-month periods and '2nd year' shows the previous 12 month period and so on. Performance data is displayed in Base Currency terms, with net income reinvested, net of fees. Brokerage or transaction fees will apply. Investment return and the principal value of an investment will fluctuate. Notes may be worth more or less than their original cost when redeemed.

Index returns are not ETN returns and do not reflect any management fees or brokerage expenses. An index’s performance is not illustrative of the ETN’s performance. Investors cannot invest directly in the Index. Indices are not securities in which investments can be made.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH

Important Disclosure

This is a marketing communication for professional investors only. Please refer to the UCITS prospectus and to the Key Investor Information Document (KIID) before making any final investment decisions.

This is a marketing communication for professional investors only. Please refer to the UCITS prospectus and to the Key Investor Information Document (KIID) before making any final investment decisions. This information originates from VanEck Securities UK Limited (FRN: 1002854), an Appointed Representative of Sturgeon Ventures LLP (FRN: 452811) which is authorised and regulated by the Financial Conduct Authority in the UK. The information is intended only to provide general and preliminary information to FCA regulated firms such as Independent Financial Advisors (IFAs) and Wealth Managers. Retail clients should not rely on any of the information provided and should seek assistance from an IFA for all investment guidance and advice. VanEck Securities UK Limited and its associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results. Information provided by third party sources is believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Brokerage or transaction fees may apply.

All performance information is based on historical data and does not predict future returns. Investing is subject to risk, including the possible loss of principal.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck Securities UK Limited

Sign-up for our ETF newsletter

Related Insights

Related Insights

11 October 2024

17 January 2025

27 November 2024

11 October 2024

11 October 2024