VanEck’s 15 Crypto Predictions for 2024

06 December 2023

We outline our top 15 Crypto Predictions for 2024.

Please note that VanEck may have a position(s) in the digital asset(s) described below.

Step into the realm of speculation with us as we embark on a whimsical journey into the future of crypto in 2024. In the ever-evolving landscape of digital assets, where imagination is not just a luxury but a necessary locomotive for investors, predicting a path feels akin to navigating through a galaxy of possibilities. We understand the skepticism that often surrounds predictions—after all, foreseeing the twists and turns of the crypto cosmos can feel as elusive as catching stardust in your hands. Yet, here we are, ready to peer into the crystal ball with a twinkle in our eyes, saluting the challenge. Because in the world of cryptocurrencies, where coins and tokens are born from the void, imagination has always been the catalyst for innovation. So, fasten your seatbelts, stow away your doubts, and join us in this speculative expedition as we attempt these first tracks in 2024's crypto terrain…with a few potential money-making ideas along the way, we ho-ho-hope! Here are our 15 crypto predictions for 2024, :

1. The long-awaited U.S. recession will finally arrive, but so will the first spot Bitcoin ETFs!

The U.S. economy will finally succumb to recession in the first half of the year. Economic momentum has been slowing for months, and inflation has cooled along, creating an economy more vulnerable to shocks. U.S. leading indicators are now in recessionary territory after 19 months of consecutive declines, close to a record. Shares of retailers are struggling, commodities are weak, employment is softening, corporate bankruptcy filings are back to early COVID levels, and the yield curve is inverted but steepening in recent weeks- all are very late-cycle dynamics. "Soft landing" mentions in the media have spiked, as they often do before an official recession is called. Bitcoin has only experienced one official US recession, from January to April 2020, during which it fell 60% peak-to-trough before rallying sharply once the Fed provided sufficient liquidity. Gold also tends to decline in the early periods of a recession - it fell 12% in two weeks in March 2020. Still, its recent breakout confirms strong demand for hard money that is not cancellable by U.S. authorities, a characteristic shared with Bitcoin. As debt levels are more concerning at the sovereign than corporate or household levels, we expect more than $2.4B will flow into newly approved US spot Bitcoin ETFs in Q1 2024 to keep the Bitcoin price elevated. Notwithstanding the possibility of significant volatility, the Bitcoin price is unlikely to fall below $30k in Q1 2024.

We approximate the inflows into Bitcoin ETFs by examining the relative ratios of the SPDR Gold Shares (GLD) ETF and adjusting it to 2023 dollars. The GLD ETF launched on November 18, 2004, and it saw inflows of around $1B in the first few days of launch, and by the end of Q1 2005, around $2.26B was in GLD. At that date, the total physical gold supply stood at around 152k metric tons, with each ton worth around $15.6M, which implies a total market value of $2.36T. The initial dollar inflows into GLD in those first few days post-launch were around 0.04% of the total gold market. Around one quarter later, on March 31, 2005, GLD reached inflows of $2.26B, and after accounting for supply growth and gold price changes, GLD had become 0.1% of the global gold supply. If we apply these figures to the Bitcoin spot market, we arrive at inflows of $310M in the first few days of BTC spot ETF and ~$750M within a quarter.

However, that was the era of higher interest rates and a far lower money supply. In 2023, we are no longer in the “Dead Ball” era of finance but are careening through the HGH/Steroid era. As measured by the New York Federal Reserve Bank, the supply of M2 in November 2004 was 6.4T dollars compared to $20.7T in October 2023. As such, we believe it is logical to apply that ratio, 3.23x, to possible inflows, bringing us to around $1B in the first few days of a spot Bitcoin ETF and $2.4B within a quarter. Extending our logic further, a more mature state of the BTC ETF may approximate around 1.7%, the approximate amount of gold’s total supply held in gold ETFs, of the total spot market for BTC. This initial sum stands at around $12.5B. As we assume that Bitcoin is taking significant market share from Gold among the hard money crowd and expect 2024 to be a peak year of voter understanding of debt-driven money printing, we apply our 3.23x multiple based on M2 outstanding, to arrive at a medium-term estimate of $40.4B inflows over the first two years of trading.

Lastly, we note that Coinbase charges retail traders all-in transaction fees of ~2.5%. We believe spot Bitcoin ETFs will likely trade at ~10bps spreads, with zero commission at many brokerages. When was the last time a 10x cost reduction didn't catalyze MUCH higher penetration for new tech?

2024 Update: Spot Bitcoin ETFs did launch in the US.

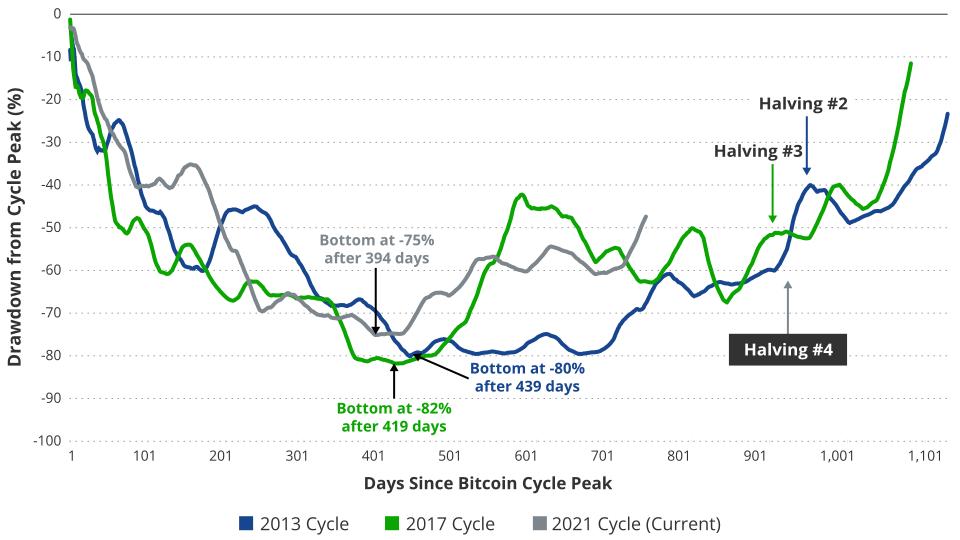

2. The 4th Bitcoin halving will occur with minimal drama.

The four-year Bitcoin halving will proceed without a major fork or missed blocks in April 2024. As the new coin issuance gets cut in half, unprofitable miners will disconnect, ceding shares to those with low-cost power. Still, the public markets will see little distress thanks to much-improved balance sheets among listed miners, who currently control a record % global hash rate (~25%). After a brief (several days to several weeks) period of consolidation post-halving, as the market digests the additional selling pressure from unprofitable miners, Bitcoin will rise above $48k, the neckline of the head-and-shoulder pattern completed in April 2022. Bitcoin miners, in aggregate, will underperform the Bitcoin price before the halving, although the low-cost miners CLSK and RIOT will outperform the field. After the halving, we expect at least one publicly traded miner to be 10x by the end of the year.

Days Since Bitcoin Cycle Peak

Source: Bloomberg, VanEck research as of 11/30/23. Past performance is not indicative of future results. Not intended as a recommendation to buy or sell any of the names mentioned herein.

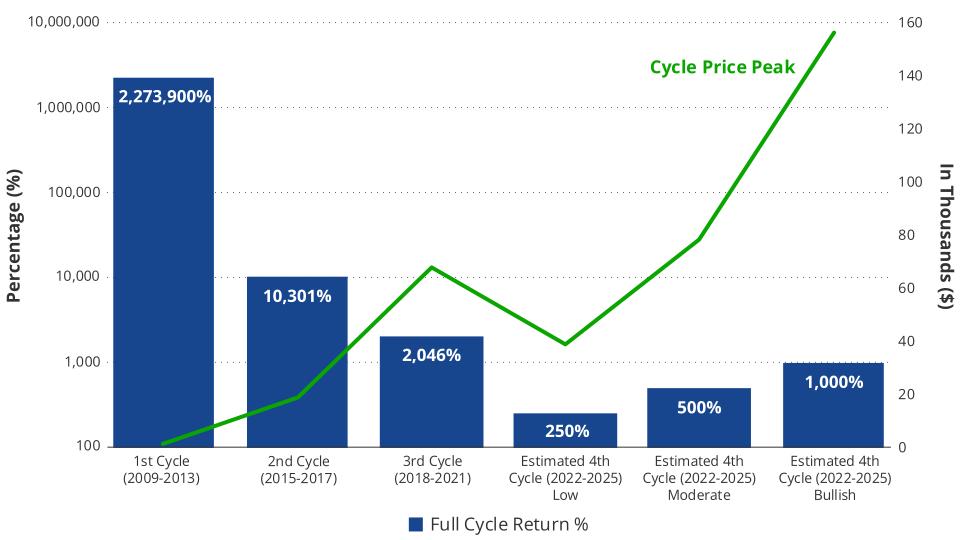

3. Bitcoin will make an all-time high in Q4.

In the second half of 2024, Bitcoin will climb a Presidential-sized wall of worry. The percentage of the global population voting in legislative and presidential elections will hit an all-time high above 45% in 2024. This high level of important elections augurs high volatility and the prospect of significant changes. More specifically, we see mounting evidence that voters and courts are rejecting the anti-growth agenda of the Green lobby. Thus, after a combative election that saw Donald Trump win 290 electoral votes and regain the Presidency, raising optimism that the SEC's hostile regulatory approach will be dismantled, we think the Bitcoin price will reach an all-time high on November 9th, exactly 3 years to the day from its last all-time high. (Recall that Bitcoin’s breakout in November 2020 also came exactly three years to the day from its November 2017 top). If Bitcoin reaches $100k by December, we make a long-shot call that Satoshi Nakamoto will be named Time Magazine's "Man of the Year."

Source: Bloomberg, VanEck research as of 11/30/23. Past performance is not indicative of future results. The information, valuation scenarios and price targets presented on Bitcoin in this blog are not intended as financial advice or any call to action, a recommendation to buy or sell Bitcoin, or as a projection of how Bitcoin will perform in the future. Actual future performance of Bitcoin is unknown, and may differ significantly from the hypothetical results depicted here. There may be risks or other factors not accounted for in the scenarios presented that may impede the performance of Bitcoin. These are solely the results of a simulation based on our research, and are for illustrative purposes only. Please conduct your own research and draw your own conclusions.

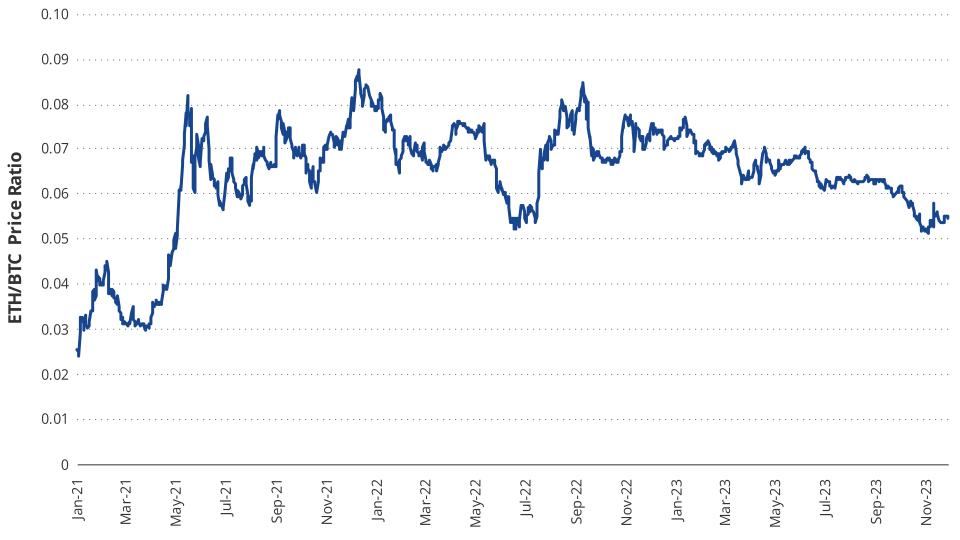

4. Ethereum won’t flip Bitcoin in 2024

Ethereum will fail to flip Bitcoin in 2024, but it will outperform every mega-cap tech stock. Bitcoin’s more apparent regulatory status and energy intensity will attract interest from quasi-state entities in Latin America, the Middle East, and Asia. Argentina will join El Salvador, the UAE, Oman, and Bhutan as the fifth country to sponsor Bitcoin mining at the state level, as Argentina’s state-owned energy giant YPF may indicate interest in mining digital assets with stranded methane and gas. Like past cycles, Bitcoin will lead the market to rally, and the value will flow into smaller tokens just after the halving. ETH won’t begin outperforming Bitcoin until post-halving and may outperform for the year, but there will be no “flippening.” Despite a strong performance in 2024, ETH will lose market share to other smart contract platforms with less uncertainty surrounding their scalability roadmap, such as Solana.

Bitcoin Mining Investments ($'m) By Country, GDP

Source: Bloomberg Intelligence as of 8/31/23. Past performance is not indicative of future results. Not intended as a recommendation to buy or sell any of the names mentioned herein.

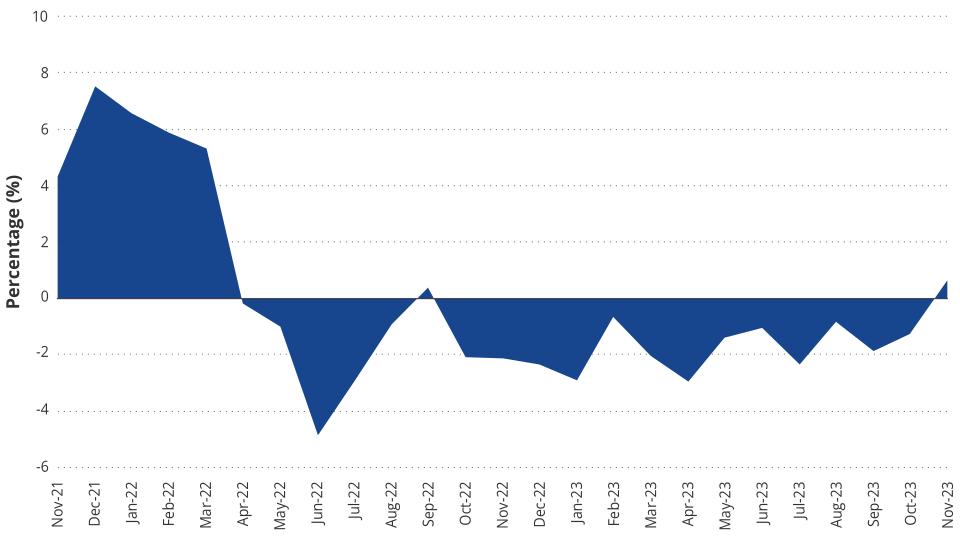

ETH: BTC Ratio

Source: Coingecko as of 11/28/2023. Past performance is not indicative of future results. Not intended as a recommendation to buy or sell any of the names mentioned herein.

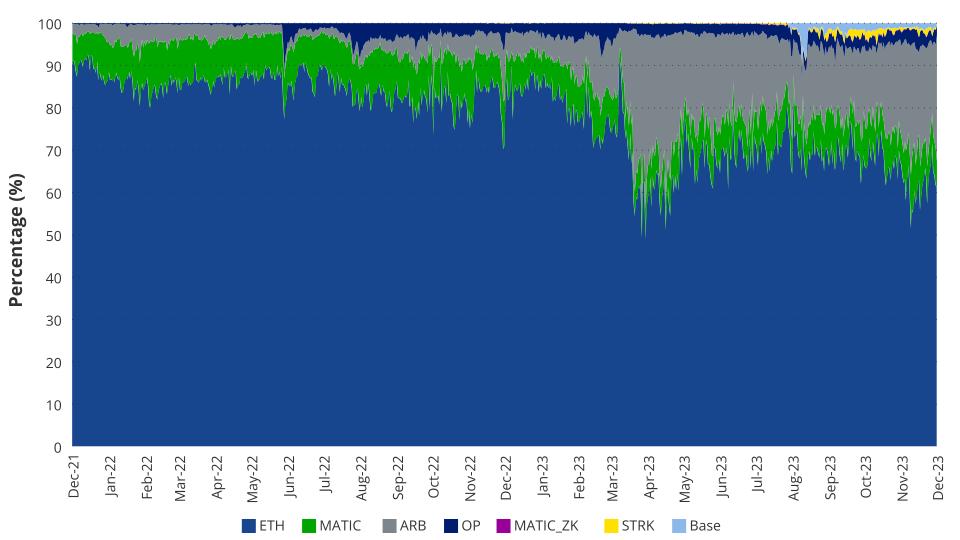

5. ETH L2s will capture the majority of EVM-compatible TVL and volume post-EIP-4844

Ethereum will implement EIP-4844 (proto-danksharding), which will reduce transaction fees and improve scalability for layer 2 chains such as Polygon, Arbitrum, Optimism, and others. Within 1 year of the upgrade, Ethereum L2s will consolidate down to 2-3 dominant players as measured by value and usage. One will achieve higher monthly DEX volume/TVL than Ethereum for the first time. Collectively, these chains may accumulate 2x the DEX volume of Ethereum (currently 0.8x) by Q4 of 2024 and 10x the number of transactions.

One of them will achieve higher monthly DEX volume/TVL (total valued locked) than Ethereum for the first time. This is because cheaper transaction fees enable tighter bid/ask spreads due to the high cost of DEX transactions on Ethereum. With stricter bid/ask spreads, there exists a greater number of arbitrage opportunities, which leads to more trading. Additionally, faster block times, only 0.25 seconds on chains like Arbitrum, enable more transaction throughput and more prospects for CEX/DEX and DEX/DEX arbitrage. As a result, DEXes and L2s should attract more volume due to the trading opportunities they enable. Collectively, these chains may accumulate 2x the DEX volume of Ethereum (currently 0.8x) by Q4 of 2024 and 10x the number of transactions.

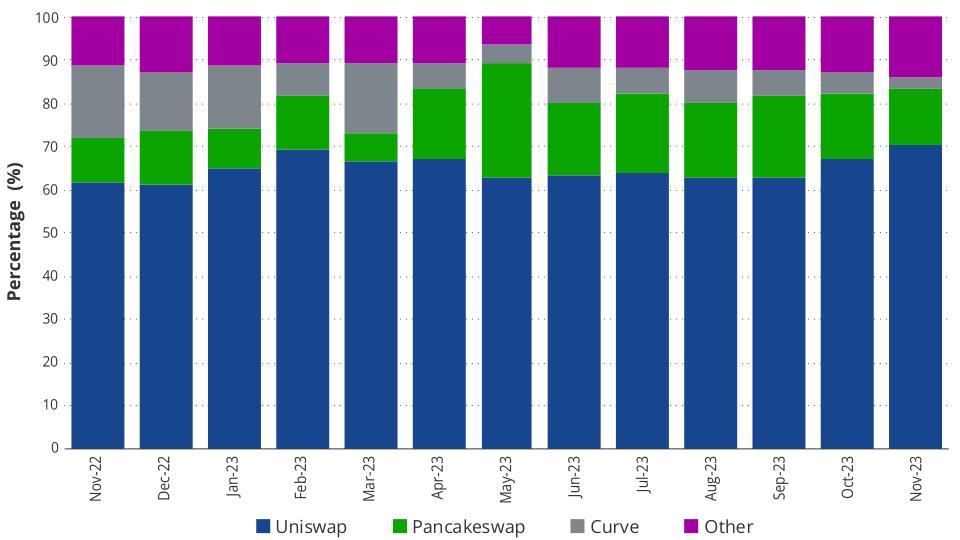

Within 1 year of the upgrade, Ethereum L2s will consolidate down to 2-3 dominant players as measured by value and usage. This is due to the fact that liquidity fragmentation will accelerate the dominance of the dominant L2s. This has already occurred in DEXes, where the exchanges Uniswap, Pancake Swap, and Curve accounted for 78% of DEX volumes in 2023. The same market consolidation on will occur across L2s, with Arbitrum and Optimism looking to be the main contenders.

Ethereum Share of DEX Volume

Source: Artemis.xyz as of 12/3/23. Past performance is not indicative of future results. Not intended as a recommendation to buy or sell any of the names mentioned herein.

6. NFT activity will rebound to an all-time high.

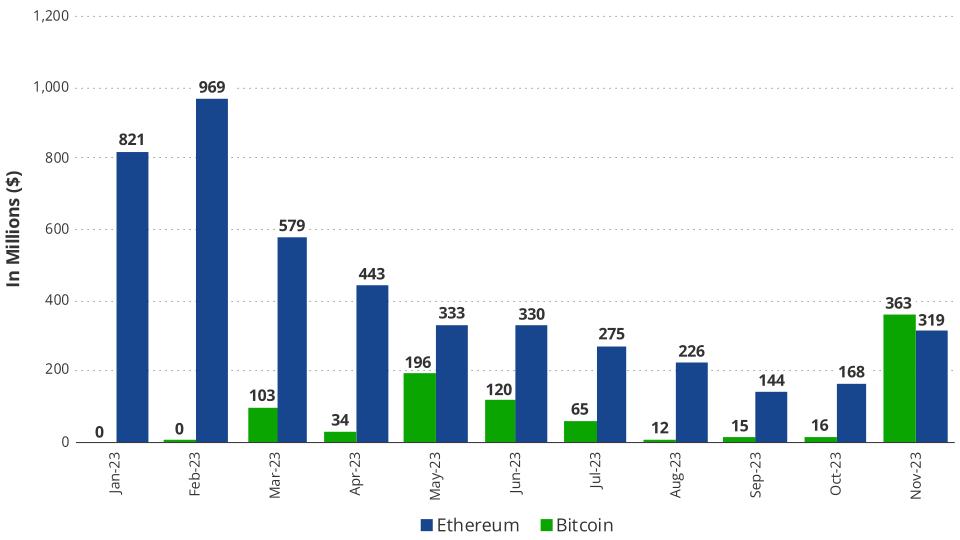

Monthly NFT volumes will approach a new all-time high as speculators return to crypto and gravitate toward top NFT collections on Ethereum, improved crypto games, and new Bitcoin-based offerings. Despite ETH's nearly 50-1 ratio vs. Bitcoin in primary NFT sales since inception, Bitcoin's Ordinals protocol and emerging layer 2 chains on Bitcoin will drive a continued rebirth in Bitcoin network fees. The ratio of ETH-to-BTC primary NFT issuance will end in 2024 closer to 3-1. Stacks (STX), a smart contract platform secured by Bitcoin, will become a top-30 coin by market cap (currently #54).

Bitcoin & ETH NFT Volume

Source: Cryptoslam! as of 11/28/2023. Past performance is not indicative of future results. Not intended as a recommendation to buy or sell any of the names mentioned herein.

7. Binance will lose the #1 position for spot trading.

Binance will lose its throne as the #1 centralized exchange by volumes after the company's $4B settlement with US regulators. OKX, Bybit, Coinbase, and Bitget will emerge as well-funded competitors with the potential to grab the #1 spot. Crypto exchanges' pricing inclusion in regulated indices, such as those administered by VanEck subsidiary MarketVectors, will become a critical variable in determining whether certain centralized exchanges are eligible to provide liquidity for ETF-authorized participants and sponsors. With Binance now facing a 3-year DOJ colonoscopy, Coinbase's international futures market will gain share and surpass $1B/day volume, up from ~$200M/day in November 2023.

8. Stablecoin market cap will reach a new all-time high as USDC reverses share losses.

The total value of stablecoins on the chain will reach an all-time high above $200B (currently $128B) as Markets in Crypto Assets (MiCA) regulated stablecoins launch in Europe, yield-bearing stablecoins proliferate, and trading volumes continue to rebound. More controversially, USDC will flip USDT, as more institutional adoption will reveal a preference for USDC already evident on newer L2 chains. Tether’s market share losses may finally materialize after the U.S. U.S. Department of Justice (DOJ) takes enforcement against Justin Sun & Tron for Know Your Customer (KYC) infractions, terror financing, and/or market manipulation.

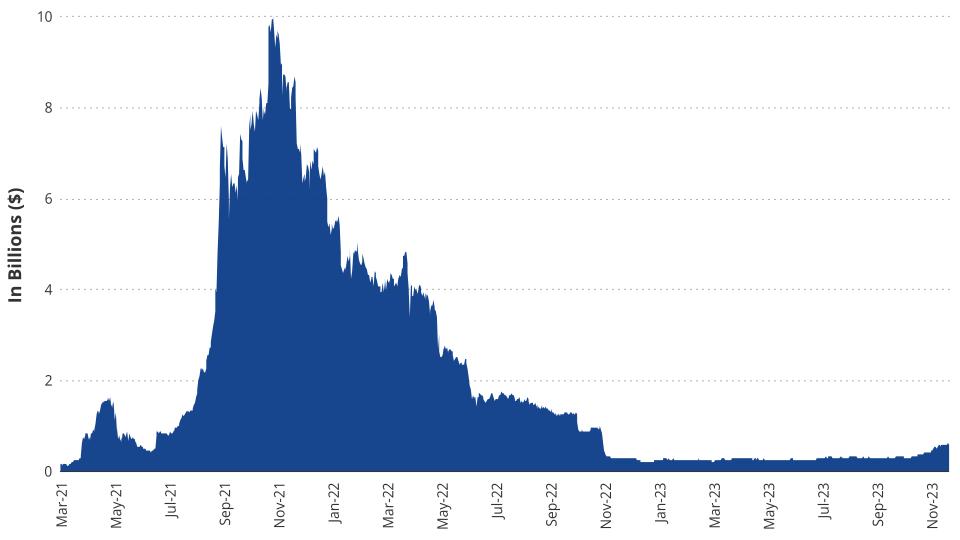

Monthly Change in Crypto USD Liquidity

Source: Coingecko as of 11/27/2023. Past performance is not indicative of future results. Not intended as a recommendation to buy or sell any of the names mentioned herein.

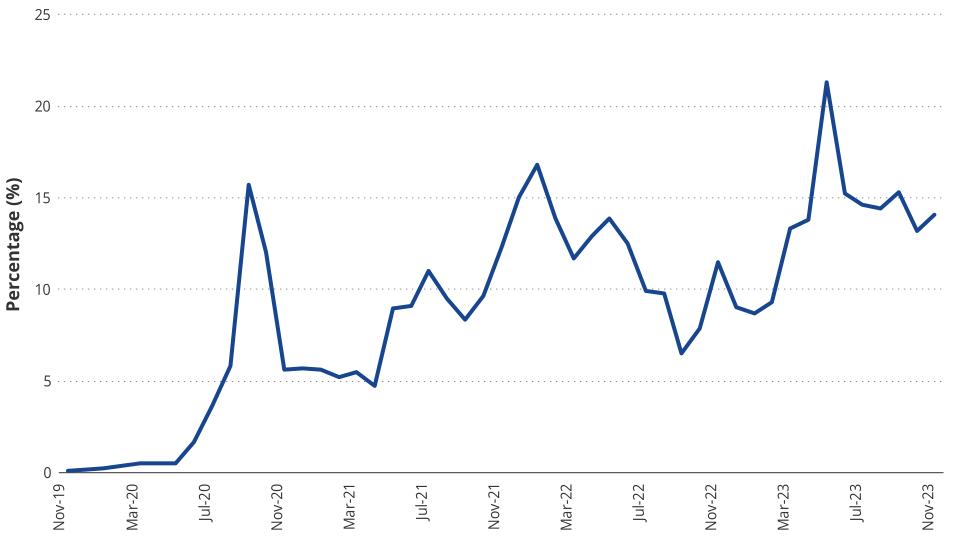

9. DEX market share of spot trading will reach new all-time highs.

DEX: CEX Spot Trade Volume

Source: The Block, The Graph, Coingecko as of 11/28/2023. Past performance is not indicative of future results. Not intended as a recommendation to buy or sell any of the names mentioned herein.

Decentralized Exchange (DEX) market share of spot crypto trading will rise to an all-time high as high-throughput chains like Solana improve the on-chain trading experience for users. Meanwhile, much-improved wallets - incorporating "account abstraction," a critical feature in enabling automated payments -- will push more users on-chain and into self-custody solutions. As BTC and ETH dominance likely declines after the Bitcoin halving, the long tail of assets may grow faster, skewing trading activity towards decentralized exchanges that list coins earlier in their lifecycle.

10. Remittances and smart contract platforms will power a new Bitcoin yield opportunity

Remittances will emerge as a killer blockchain use case as easier off-ramping and spending of stablecoins make recipient payouts cheap and useful in emerging markets. Given the use of the Bitcoin and layer 2 Lightning (LN) network in some remittance corridors, "Bitcoin Staking" will become a narrative in 2024. With transaction costs rising on the Bitcoin blockchain, BTC maximalists will start spreading the news that you can stake on the BTC network and earn a yield. Staking to Lightning Nodes happens today but is risky and has low return as your BTC is used for payment settlements on the Lightning network. With the proliferation protocols that abstract the technical nuances of managing a Lightning node, such as Amboss, along with federated self-custody solutions like Fedi, users will be able to participate in the remittance market from cold wallets and earn some yield. In addition, Bitcoin holders will be given a new business opportunity in 2024 as a provider of security to Proof of Stake blockchains. Utilizing projects like Cosmos-based Babylon, which will enable BTC holders to earn yield by offering non-custodial staking of PoS chains, Bitcoin holders will be able to earn yield on their Bitcoin and potentially participate in an array of other productive use cases for their BTC.

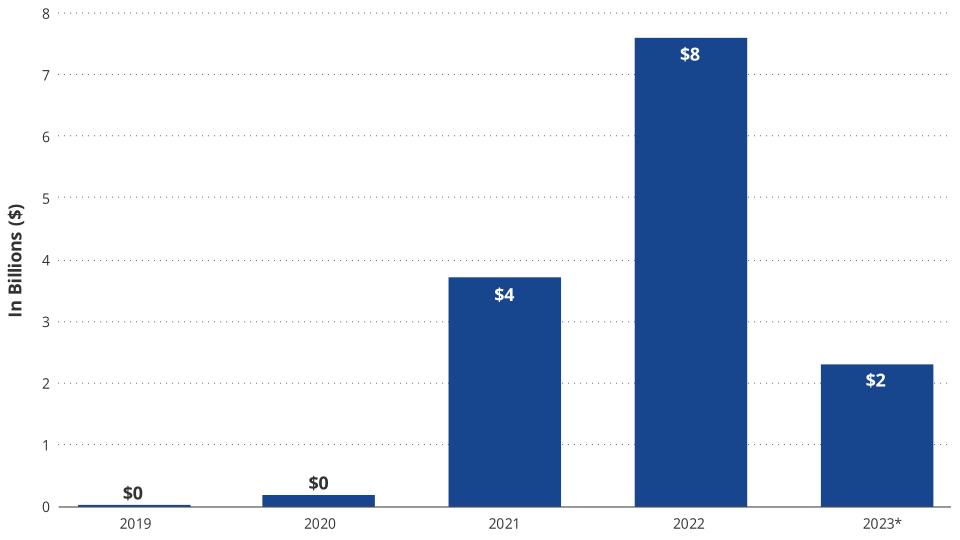

11. A breakout blockchain game will finally arrive.

Web3 Gaming Investment

Source: DappRadar as of 10/12/2023. Past performance is not indicative of future results. Not intended as a recommendation to buy or sell any of the names mentioned herein.

Blockchain gaming will see at least one title surpass 1 million+ daily active users, demonstrating the long-awaited potential. Among candidates to achieve this milestone, IMX is most likely to become a top 25 coin by market cap (currently #42) with the release of Illuvium, Guild of Guardians, and other high-budget games in 2024 and a well-designed token that aligns interests better than most. According to a recent report from DappRadar, the WAX blockchain currently leads the gaming sector with 406k daily unique active wallets, of which ~100k are playing Alien Worlds, a metaverse with multiple simple games that reward players with the Trillium token. However, many of these players are likely bots farming the tokens due to the simplicity of the games. On the other hand, Immutable has multiple AAA games building on their platform that implement token models that cannot be simply farmed and are truly fun games to play. These titles, which have been building for years and received $100m+ in funding, are being released in 2024. They could attract players at the scale of traditional AAA games like Starfield, which was released earlier this year and reached 10 million players within its first two weeks.

Additionally, Immutable has been working to resolve many of the technical pain points that have inhibited the success of Web3 gaming so far, such as wallet management. Immutable’s “Passport” allows users to log in to games and manage their blockchain-based game items through a familiar single sign-on process while abstracting away blockchain interaction. The increased simplicity that Immutable provides gamers combined with large distribution partners such as the Epic Games Store and GameStop could finally allow a blockchain-based game to become a mainstream hit.

12. Solana will continue to outperform ETH as DeFi TVL returns.

Solana Total Value Locked

Source: DefiLlama as of 11/28/2023. Past performance is not indicative of future results. Not intended as a recommendation to buy or sell any of the names mentioned herein.

Solana will become a top 3 blockchain by market cap, Total Value Locked (TVL), and active users. Fueled by this rise, Solana will join the spot ETF wars thanks to a flurry of asset managers submitting filings. Related to Solana's continued market share gains, we see a legitimate possibility that Solana-based price oracle Pyth flips Chainlink in Total Value Secured (“TVS”). For reference, Chainlink today stands at ~$15bn TVS vs. Pyth’s <$2bn, with that dominance driven primarily by blue-chip DeFi protocols on Ethereum mainnet. As TVL continues to grow across high-throughput chains (like Solana) and Chainlink struggles to find institutional adoption of its LINK token, we expect Pyth to gain meaningful market share on the back of several genuine innovations, including its "pull" architecture and confidence interval system.

13. DePin networks see meaningful adoption.

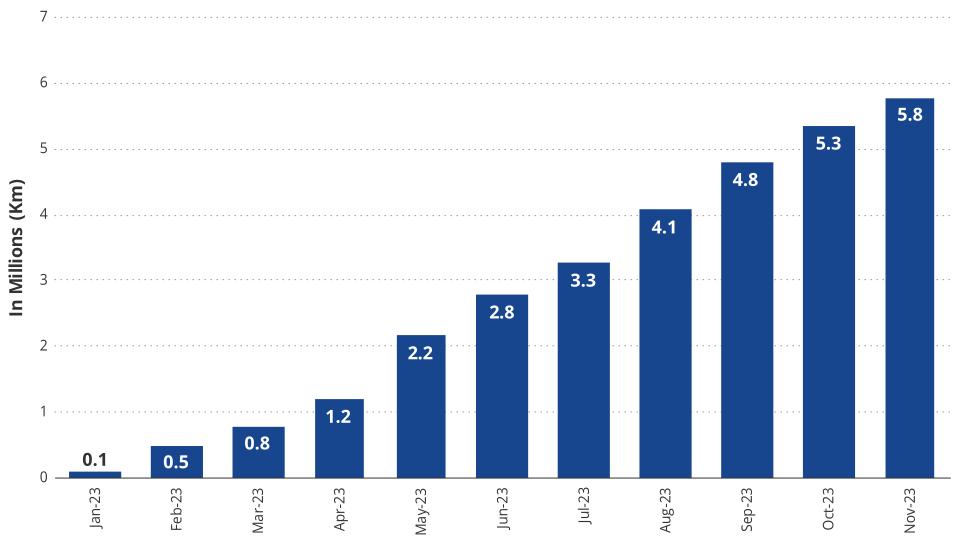

Hivemapper Unique Km Mapped

Source: Hivemapper, as of 12/1/2023. Past performance is not indicative of future results. Not intended as a recommendation to buy or sell any of the names mentioned herein.

Multiple decentralized physical infrastructure (DePin) networks will see meaningful adoption that captures the public's attention.

Hivemapper, the decentralized mapping protocol aiming to bootstrap a community-owned competitor to Google Streetview, will map its 10 millionth unique KM, surpassing 15% of global roads capacity. Hivemapper uses its native token, $HONEY, to incentivize thousands of drivers worldwide to mount dashboards to their cars and contribute to its growing database. This global network of permissionless contributors may give Hivemapper a meaningful speed and cost-of-capital advantage relative to the incumbent Google. Google Maps is projected to make more than $11bn in revenue in 2023, representing a meaningful opportunity for Hivemapper if the experiment is successful.

Helium, the decentralized network of wireless hotspots, will reach 100k paying subscribers for its nationwide US 5G plan, up from 5k currently. Hotspots can be set up by anyone, and hotspot operators are paid through crypto rails in Helium’s native tokens. This powerful system of incentives gives Helium some key advantages relative to incumbent wireless infrastructure:

- It is capital-light (from Helium’s perspective).

- It turns hotspot providers into advocates & supporters (given their ongoing stake in the network).

- It gives Helium the ability to respond to real-time data & improve the network by adjusting its incentives (i.e., boosting rewards in areas with poor coverage).

Wireless infrastructure is a $200B, relatively mature market. We see significant scope for disintermediating legacy providers (Towers) as end-users tend towards low-cost solutions with a differentiated brand (“user-owned”). Helium claims they can deliver data at less than 50% of the cost of legacy networks. As crypto adoption becomes more mainstream, and if that claim is true, they will likely join a significant share.

14. New accounting treatment will rejuvenate the case for corporate crypto holdings.

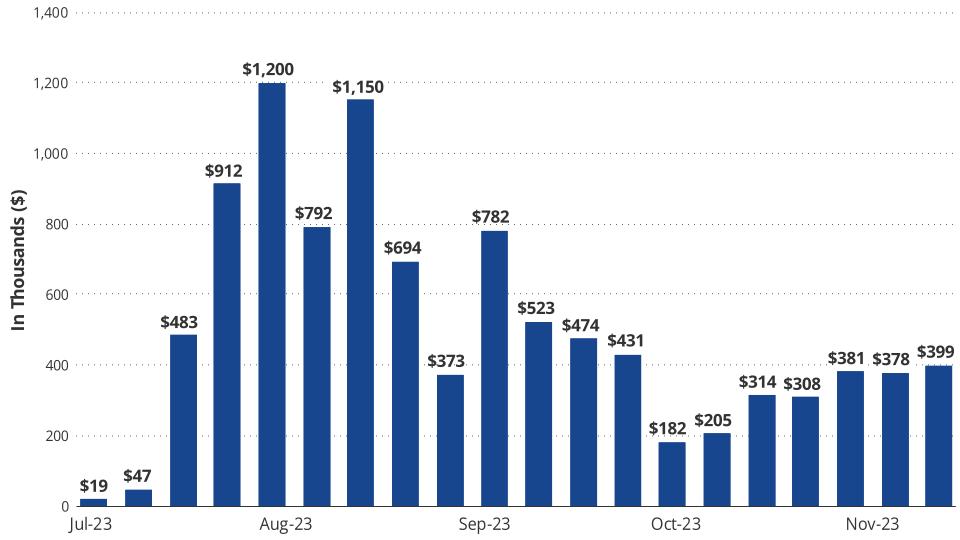

Base Weekly Fees

Source: DefiLlama as of 11/28/2023. Past performance is not indicative of future results. Not intended as a recommendation to buy or sell any of the names mentioned herein.

Coinbase will become the first publicly traded company to break out and report Layer 2 blockchain revenues in its quarterly filings as its Base Protocol crosses $100M+ in annualized revenues and becomes a meaningful contributor to the business. The additional disclosure may be catalyzed by corporate adoption of new FASB guidelines that allow corporates to book mark-to-market gains on crypto, which will favorably impact corporate preference for holding Bitcoin and other crypto as treasury assets. Due to these accounting changes, which take effect in 2025 but can be adopted by corporates earlier, a major, non-crypto financial entity (bank, exchange) may announce the creation of a quasi-public blockchain like an L2, with the possible bridging capability to public blockchains by authorized participants.

15. DeFi Reconciles with Know Your Customer (KYC)

KYC-enabled and walled garden apps like those using Ethereum Attestation Service or Uniswap Hooks will gain significant traction, approaching or even flipping non-KYC applications in user base and fees. Uniswap will lead other protocols in enabling this functionality, which will drive institutional liquidity and volume to the protocol. The additional volume from KYC-gated hooks will significantly bolster protocol fees by allowing new entrants to participate in DeFi without the fear of interacting with OFAC-sanctioned entities. The addition of hooks will help Uniswap reinforce its moat and competitiveness, which should drive token appreciation, especially once the DAO finally votes in favor of turning on the Uniswap Protocol fee switch to allow value to accrue to the token. If so, we expect such fees to be no higher than 10bps.

Decentralized Exchange Market Share

Source: DefiLlama as of 11/28/23. Past performance is not indicative of future results. Not intended as a recommendation to buy or sell any of the names mentioned herein.

Links to third party websites are provided as a convenience and the inclusion of such links does not imply any endorsement, approval, investigation, verification or monitoring by us of any content or information contained within or accessible from the linked sites. By clicking on the link to a non-VanEck webpage, you acknowledge that you are entering a third-party website subject to its own terms and conditions. VanEck disclaims responsibility for content, legality of access or suitability of the third-party websites.

To receive more Digital Assets insights, subscribe for our Crypto Newsletter

Important Information

This is not financial research but the opinion of the author of the article. We publish this information to inform and educate about recent market developments and technological updates, not to give any recommendation for certain products or projects. The selection of articles should therefore not be understood as financial advice or recommendation for any specific product and/or digital asset. We may occasionally include analysis of past market, network performance expectations and/or on-chain performance. Historical performance is not indicative for future returns.

For informational and advertising purposes only.

This information originates from VanEck (Europe) GmbH, Kreuznacher Straße 30, 60486 Frankfurt am Main. It is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice. VanEck (Europe) GmbH and its associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. Views and opinions expressed are current as of the date of this information and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. VanEck makes no representation or warranty, express or implied regarding the advisability of investing in securities or digital assets generally or in the product mentioned in this information (the “Product”) or the ability of the underlying Index to track the performance of the relevant digital assets market.

The underlying Index is the exclusive property of MarketVector Indexes GmbH, which has contracted with CryptoCompare Data Limited to maintain and calculate the Index. CryptoCompare Data Limited uses its best efforts to ensure that the Index is calculated correctly. Irrespective of its obligations towards the MarketVector Indexes GmbH, CryptoCompare Data Limited has no obligation to point out errors in the Index to third parties.

Investing is subject to risk, including the possible loss of principal up to the entire invested amount and the extreme volatility that ETNs experience. You must read the prospectus and KID before investing, in order to fully understand the potential risks and rewards associated with the decision to invest in the Product. The approved Prospectus is available at www.vaneck.com . Please note that the approval of the prospectus should not be understood as an endorsement of the Products offered or admitted to trading on a regulated market.

Performance quoted represents past performance, which is no guarantee of future results and which may be lower or higher than current performance.

Current performance may be lower or higher than average annual returns shown. Performance shows 12 month performance to the most recent Quarter end for each of the last 5yrs where available. E.g. '1st year' shows the most recent of these 12-month periods and '2nd year' shows the previous 12 month period and so on. Performance data is displayed in Base Currency terms, with net income reinvested, net of fees. Brokerage or transaction fees will apply. Investment return and the principal value of an investment will fluctuate. Notes may be worth more or less than their original cost when redeemed.

Index returns are not ETN returns and do not reflect any management fees or brokerage expenses. An index’s performance is not illustrative of the ETN’s performance. Investors cannot invest directly in the Index. Indices are not securities in which investments can be made.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH

Important Disclosure

This is a marketing communication for professional investors only. Please refer to the UCITS prospectus and to the Key Investor Information Document (KIID) before making any final investment decisions.

This is a marketing communication for professional investors only. Please refer to the UCITS prospectus and to the Key Investor Information Document (KIID) before making any final investment decisions. This information originates from VanEck Securities UK Limited (FRN: 1002854), an Appointed Representative of Sturgeon Ventures LLP (FRN: 452811) which is authorised and regulated by the Financial Conduct Authority in the UK. The information is intended only to provide general and preliminary information to FCA regulated firms such as Independent Financial Advisors (IFAs) and Wealth Managers. Retail clients should not rely on any of the information provided and should seek assistance from an IFA for all investment guidance and advice. VanEck Securities UK Limited and its associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results. Information provided by third party sources is believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Brokerage or transaction fees may apply.

All performance information is based on historical data and does not predict future returns. Investing is subject to risk, including the possible loss of principal.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck Securities UK Limited

Sign-up for our ETF newsletter

Related Insights

Related Insights

11 October 2024

16 January 2025

27 November 2024

11 October 2024

11 October 2024