Europe's Leading Role in Web3

15 July 2023

VanEck has been following the developments of the blockchain industry in Europe with great interest and optimism. Europe is not only a major player in the crypto space, but also a leader in many aspects. Something called the “MiCa effect” is set out to leave its mark permanently in the crypto industry (in a positive way). For your information, MiCA regulation (Markets in Crypto Assets Regulation for the European Union) was finalized and published in June 2023. Let me share with you some of the facts that support this claim:

Europe’s Leading Role in Crypto

- Europe is home to the highest number of Bitcoin and Ethereum nodes, which are the backbone of the decentralized networks that power these cryptocurrencies. According to Bitnodes, as of July 2023, Europe has over 2,728 Bitcoin nodes and 1,956 Ethereum nodes, accounting for 42.3% and 28.9% of the global total respectively (accounting only for publicly reachable nodes with a known geographical location).

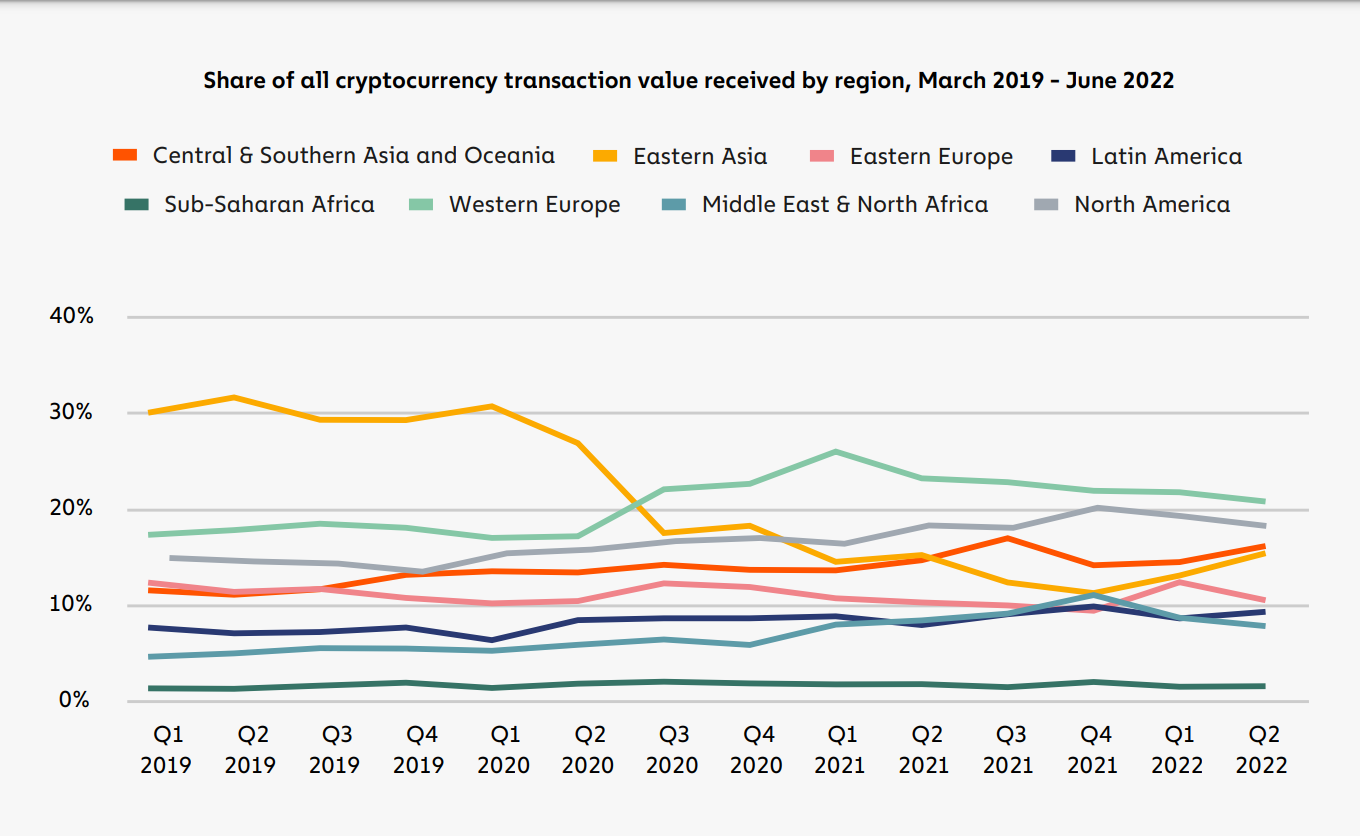

- Europe also has the largest absolute number and relative share of on-chain activity, which reflects the volume and diversity of transactions that take place on the blockchain. According to Chainalysis, in June 2022, Western Europe and Eastern Europe collectively have the largest share of on-chain transaction volume.

Source: Chainanalysis, data as of June 2022. Past performance is no indicator of future results

- Europe has the most comprehensive crypto-regulation globally, with the proposed Markets in Crypto-Assets (MiCA) regulation that aims to create a harmonized framework for crypto-assets across the European Union. MiCA will provide legal clarity and certainty for crypto-asset issuers, service providers and users, as well as enhance consumer protection and market integrity. MiCA will also foster innovation and competition by creating a level playing field for all market participants.

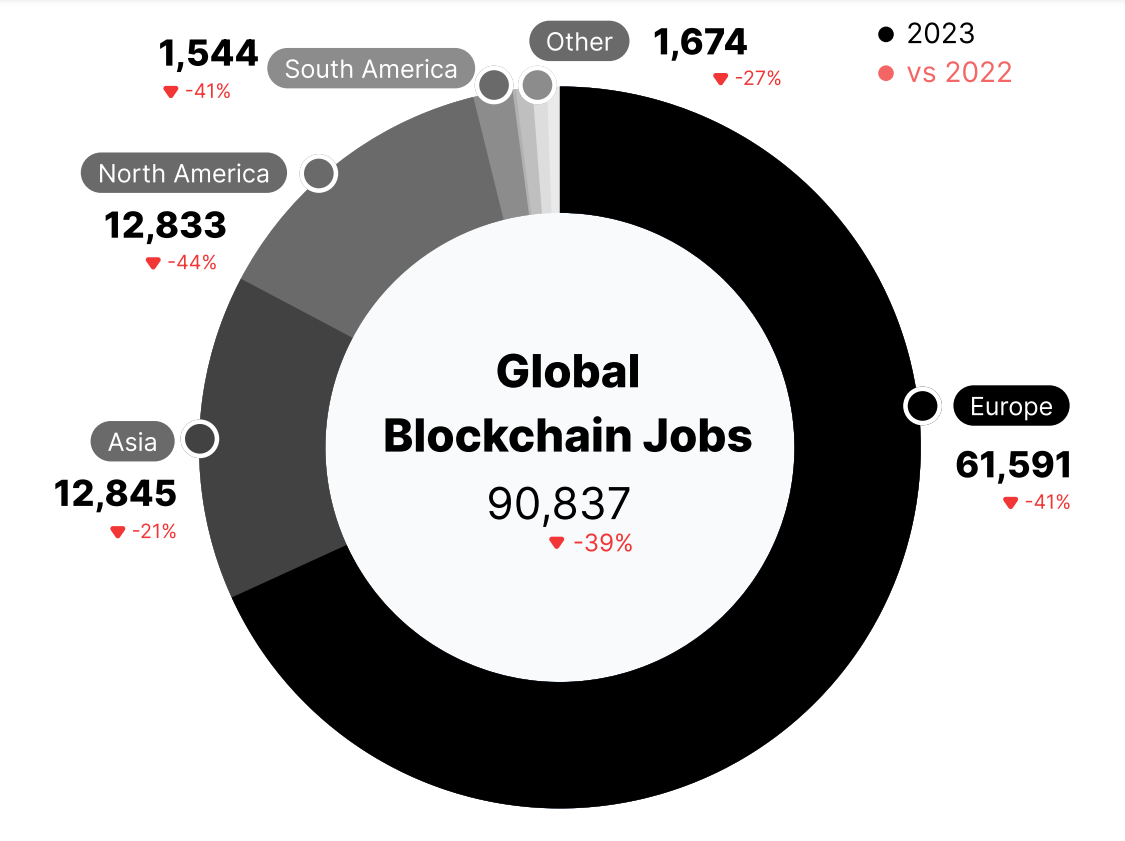

- Europe hosts two-thirds of global industry jobs, according to a report by Coincub. The report estimates that there are over 61,000 people employed in the crypto industry in Europe, compared to 12,845 in Asia and 12,833 in North America. While overall this is a decrease of -39% relative to 2022, we expect this to recover by the end of 2023 and the beginning of 2024 as regulation effects come into play. The report also ranks US, Germany and France as the top three countries in terms of crypto employment. According to a report of TrueUp, most open positions in June 2023 are from Binance, OKX and Token Metrics. Much like the decentralized nature of cryptocurrencies, over 25% are fully remote. As most jobs in crypto are engineering jobs, it also means that Europe likely is home to the largest number of blockchain developers.

Source: Coincub, data as of July 2023. Past performance is no indicator of future results

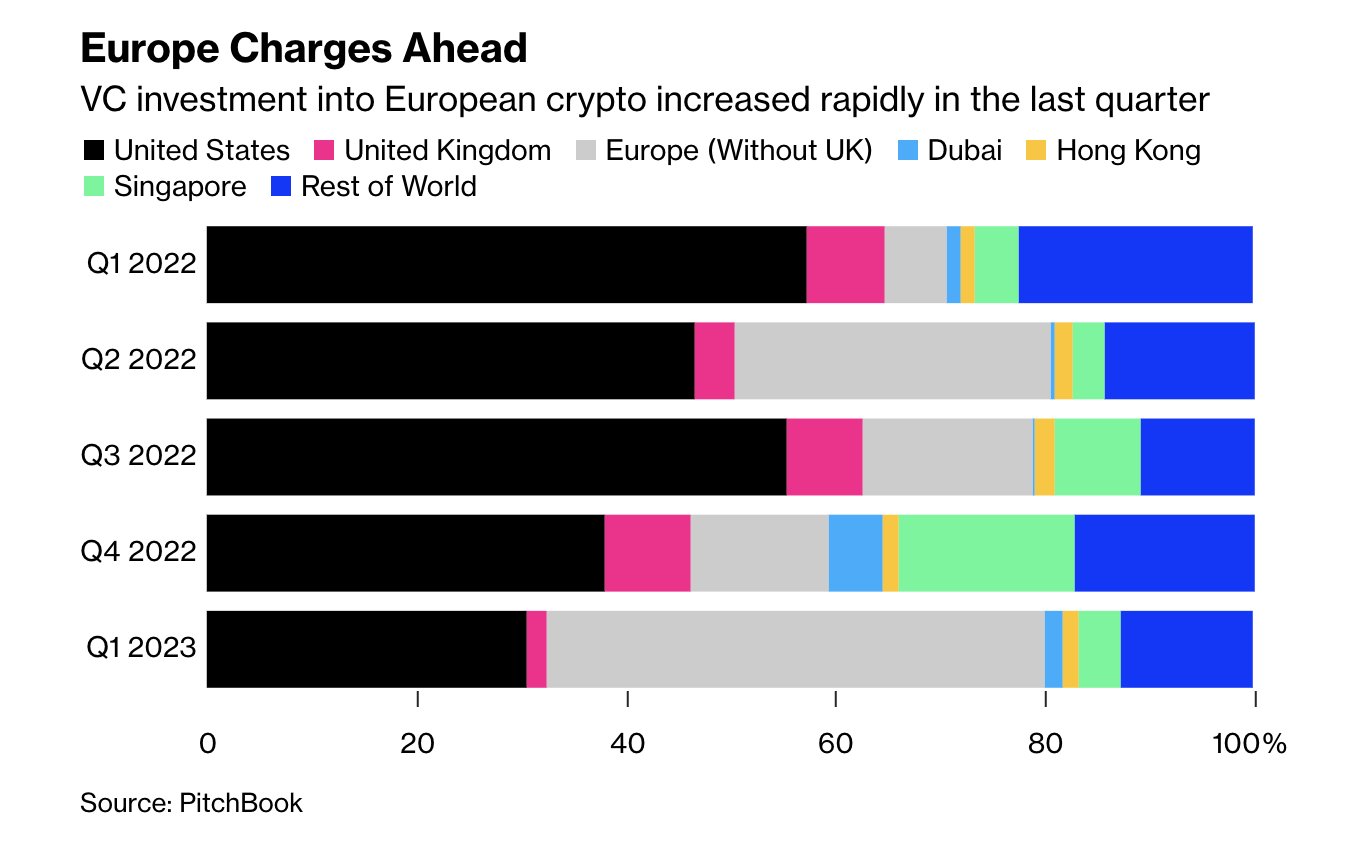

- Europe attracts 50% of venture-funded crypto projects globally, according to a study by Pitchbook. This figure is up approximately 7 times compares to Q1 2022. Other countries and regions have seen a significant decrease in crypto startup funding. This may be a leading indicator of a massive growth opportunity in Europe and for crypto in general.

Source: PitchBook, data as of April 2023. Past performance is no indicator of future results.

- Europe offers favourable tax regimes for crypto investors and entrepreneurs, according to a report by PwC. The report analyzes the tax treatment of crypto-assets in 29 jurisdictions around the world and ranks Malta, Portugal and Switzerland as the most attractive countries for crypto taxation in Europe. The report also notes that many European countries have issued clear and favourable tax guidance for crypto-assets, or have adopted a low or zero tax rate for certain types of crypto transactions. The reader should not perceive this as tax advice, please ask your tax advisor what taxation applies to your situation.

What is MiCAR?

MiCAR was published on the 9th of June, 2023. The first draft was created in 2018 following up after the bull run of Bitcoin in 2017. The main goal is to protect crypto users against unregulated virtual assets, fight money laundering and terrorist funding and protect the sovereignty of the Euro. It will make it significantly easier to operate in the EU and provide licensed services under MiCA’s harmonized European regulation. The regulation will apply in all EU member states as of 30 June 2024 for Asset Referencing Tokens (ARTs) and E-Money Tokens (EMTs) and 30th of December 2024 for Crypto Asset Service Providers (CASPs)

Important Information

We publish this newsletter to inform and educate about recent market developments and technological updates, not to give any recommendation for certain products or projects. The selection of articles should therefore not be understood as financial advice or recommendation for any specific product and/or digital asset. We may occasionally include analysis of past market, network performance expectations and/or on-chain performance. Historical performance is not indicative for future returns.

Important Disclosure

This is a marketing communication for professional investors only. Please refer to the UCITS prospectus and to the Key Investor Information Document (KIID) before making any final investment decisions.

This is a marketing communication for professional investors only. Please refer to the UCITS prospectus and to the Key Investor Information Document (KIID) before making any final investment decisions. This information originates from VanEck Securities UK Limited (FRN: 1002854), an Appointed Representative of Sturgeon Ventures LLP (FRN: 452811) which is authorised and regulated by the Financial Conduct Authority in the UK. The information is intended only to provide general and preliminary information to FCA regulated firms such as Independent Financial Advisors (IFAs) and Wealth Managers. Retail clients should not rely on any of the information provided and should seek assistance from an IFA for all investment guidance and advice. VanEck Securities UK Limited and its associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results. Information provided by third party sources is believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Brokerage or transaction fees may apply.

All performance information is based on historical data and does not predict future returns. Investing is subject to risk, including the possible loss of principal.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck Securities UK Limited

Sign-up for our ETF newsletter

Related Insights

Related Insights

11 October 2024

16 January 2025

27 November 2024

11 October 2024

11 October 2024