Main Risk Factors of a Celestia ETN

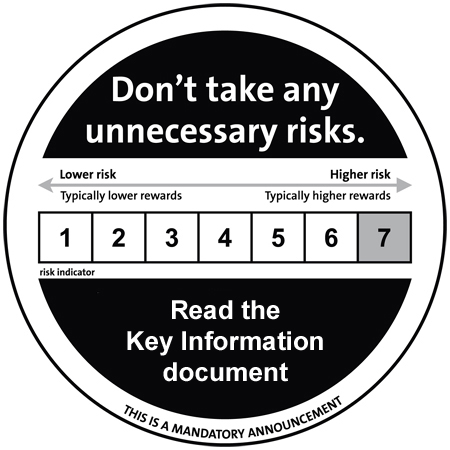

Despite all the hype, digital assets are a highly risky investment. Below are key risk factors that need to be considered before making an investment in Celestia ETN.

The trading prices of many digital assets have experienced extreme volatility in recent periods and may continue to do so. There is a risk of total loss as no guarantee can be made regarding custody due to hacking risk, counterparty risk and market risk.

The complexity of the project and its technological concepts make it challenging to assess its viability and valuation.

Celestia introduces additional technology risk due to the technology being less mature and therefore could be more prone to bugs and exploits.

Market disruptions and governmental interventions may make digital assets illegal.

Celestia introduces additional adoption risk as it is uncertain if the concept of modular blockchains will succeed.