Main Risk Factors of a Dividend ETF

Because all or a portion of the Fund are being invested in securities denominated in foreign currencies, the Fund’s exposure to foreign currencies and changes in the value of foreign currencies versus the base currency may result in reduced returns for the Fund, and the value of certain foreign currencies may be subject to a high degree of fluctuation.

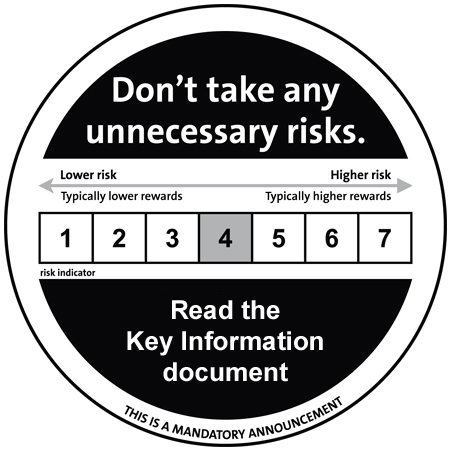

The prices of the securities in the Fund are subject to the risks associated with investing in the securities market, including general economic conditions and sudden and unpredictable drops in value. An investment in the Fund may lose money.