China Growth Back on Track

09 April 2021

China has been a major contributor to global growth, and its economic activity tends to have significant repercussions for the global economy. To understand where the Chinese economy is in its growth cycle, we highlight several key charts below, which may also provide context for the impact of the coronavirus. China remains an important economic bellwether for countries that have started to reopen following the COVID-19 epidemic.

China’s latest activity gauges should lay to rest any remaining doubts about the post-pandemic recovery. The March numbers looked really good. Yes, this was in part due to the Lunar New Year seasonality, but the slump associated with the virus’s winter resurgence appears to be over. The end of the lockdowns gave an extra boost to the manufacturing purchasing managers index (PMI)1—it bounced more than expected to 51.9—and especially to the services PMI, which soared to 56.3. The latter was a welcome sign that the recovery is becoming more balanced.

Chinese Economy Health Check: PMIs

Source: Bloomberg. Data as of 31/3/2021. Past performance is no guarantee of future results. Chart is for illustrative purposes only.

Details also looked reassuring, including new orders, employment and new export orders. The small companies’ PMI was back in expansion zone, albeit authorities are not taking anything for granted here, expanding certain kinds of tax relief for small and medium-sized enterprises (SMEs) until the end of the year. This is a smart move in our view, given that the funding costs for private enterprises are still painfully high, despite some improvement in the past months.

Understanding the Credit Cycle

Source: UBS. Data as of 23/3/2021. Past performance is no guarantee of future results. Chart is for illustrative purposes only. Spreads are measured relative to average yield of 1, 3, 5, and 10 year bonds issued by the China Development Bank.

The general industry consensus now expects the Chinese economy to grow 8.5% this year in real terms.2 This is much more optimistic than the official target of over 6%.3 What to make of this discrepancy?

The most obvious conclusion is that authorities will continue to withdraw the policy stimulus. The continuation of the SME tax relief, however, suggest that the withdrawal will be just as targeted as the stimulus itself, without too many sharp turns.

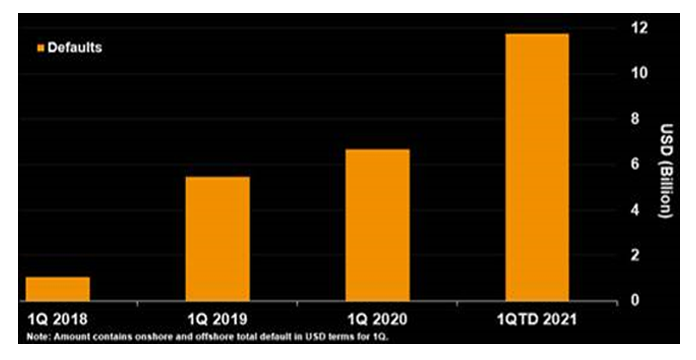

Stronger than expected growth can further embolden authorities to tighten regulations in some areas (such as environmental and green issues and overheating sectors like real estate) and decrease moral hazard by allowing more corporate defaults, including by state-owned enterprises. China’s Q1 corporate default statistics is quite telling in this regard, as defaults continued to increase despite economic headwinds from COVID’s winter resurgence. We realize that corporate defaults might be associated with higher credit risks, but they can also be a sign of a more mature system that does not want to coddle individual economic agents forever.

China Corporate Defaults Continued to Increase in Q1

Source: Bloomberg LP

1Purchasing managers index (PMI) is an economic indicator derived from monthly surveys of private sector companies. A reading above 50 indicates expansion, and a reading below 50 indicates contraction. We believe PMIs are a better indicator of the health of the Chinese economy than the gross domestic product (GDP) number, which is politicized and is a composite in any case. The manufacturing and non-manufacturing, or service, PMIs have been separated in order to understand the different sectors of the economy. These days, we believe the manufacturing PMI is the number to watch for cyclicality.

2Source: Bloomberg

3Source: https://www.wsj.com/articles/china-sets-2021-gdp-growth-target-at-over-6-11614907661

Important Disclosure

This is a marketing communication. Please refer to the prospectus of the UCITS and to the KID before making any final investment decisions.

This information originates from VanEck (Europe) GmbH, which has been appointed as distributor of VanEck products in Europe by the Management Company VanEck Asset Management B.V., incorporated under Dutch law and registered with the Dutch Authority for the Financial Markets (AFM). VanEck (Europe) GmbH with registered address at Kreuznacher Str. 30, 60486 Frankfurt, Germany, is a financial services provider regulated by the Federal Financial Supervisory Authority in Germany (BaFin).

The information is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice VanEck (Europe) GmbH, VanEck Switzerland AG, VanEck Securities UK Limited and their associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results. Information provided by third party sources is believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Brokerage or transaction fees may apply.

All performance information is based on historical data and does not predict future returns. Investing is subject to risk, including the possible loss of principal.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH / VanEck Asset Management B.V.

Sign-up for our ETF newsletter

Related Insights

Related Insights

13 December 2024

06 August 2024

01 May 2024

12 February 2024