Education Center

Investment Outlook

18 February 2020

ETF 101: Understanding ETFs In Simple Terms

Investment Outlook

18 February 2020

ETF 102: Why ETFs Layer Up On Liquidity

Investment Outlook

18 February 2020

ETF 103: Does Your ETF Have High Standards?

Investment Outlook

19 February 2020

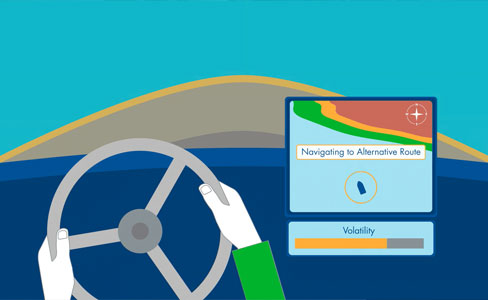

ETF 104: Trade ETFs Intelligently

Investment Outlook

19 February 2020

ETF 105: Wrap Your Fixed Income in an ETF

Investment Outlook

05 March 2021

ETF 106: Debunking Myths About Fixed Income ETFs

Thematic Investing

13 SEPTEMBER 2022

ETF 107: Passive vs. Active ETFs Explained

Investment Outlook

January 3, 2025

RSX / RSXJ Liquidation FAQ

Investment Outlook

December 24, 2024

Plan for 2025: Predictions from Our Portfolio Managers

Get your portfolio ready with detailed insights from VanEck’s investment team about the factors driving risk and returns in their respective asset classes.

Investment Outlook

December 24, 2024

Plan for 2025: Predictions from Our Portfolio Managers

Get your portfolio ready with detailed insights from VanEck’s investment team about the factors driving risk and returns in their respective asset classes.

Investment Outlook

May 12, 2021

Delegate the Work of Valuation

Valuation is a major part of an investor's decision to buy or sell an investment. Why not let a fund do this work for you?

Trends with Benefits Quickie #6: Reviewing Crypto Predictions with Matthew Sigel

VanEck’s Matthew Sigel reflects on his 2024 crypto predictions—wins, misses, and what’s next for 2025, including his bitcoin price target and the Trump administration’s impact on crypto.

Get More from VanEck

Don’t settle for the conventional. Dare to be different.

Jan van Eck, CEO

Through forward-looking, intelligently designed active and ETF solutions, VanEck offers value-added exposures to emerging industries, asset classes and markets as well as differentiated approaches to traditional strategies. We think beyond the financial markets to identify the trends—including economic, technological, political and social—that we believe will fuel investable opportunities.