A fund's price/book (P/B) ratio can serve as an evaluation tool for investors to assess the valuation of stocks and exchange-traded funds (ETFs) within the current market environment. By comparing the market price of the fund's holdings to their book values, investors can gain insights into whether the underlying assets are overvalued, valued, or undervalued.

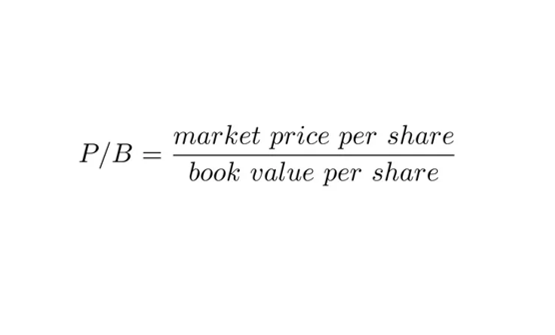

The P/B ratio provides a quick snapshot of a company's valuation by comparing its current stock price to its book value per share. This ratio helps investors determine whether a stock is priced relative to the value of the company's assets, as recorded on the balance sheet.

Price to Book Ratio - Interpretation

To better understand the significance of the P/B ratio, we can use this table:

| P/B Ratio: | Significance: |

| P/B =1 | It indicates that the market value of the company's shares is exactly equal to its book value, suggesting that investors believe the company's current assets and liabilities are fairly valued |

| P/B Ratio < 1 (Low) | May indicate an undervalued stock or potential financial troubles, suggesting that the market price is less than the company's book value. |

| P/B Ratio > 1 (High) | Often implies that the stock is overvalued or that the company is expected to generate high returns in the future, with the market price exceeding the book value. |

However, this is not a universal rule, and there are several limitations to applying this metric alone like:

- Intangible Assets: The P/B ratio might not fully reflect a company's intangible assets, like patents, trademarks, or brand value, which can be substantial in certain sectors.

- Industry Variations: The significance of the P/B ratio can vary widely depending on the industry, with capital-intensive sectors typically showing different P/B norms compared to tech or service-based industries.

While the P/B ratio is a useful metric for assessing company valuation, it should not be used alone. Investors should combine it with other financial metrics and qualitative factors for a well-rounded analysis.