A Time of Tariffs Highlights the Wisdom of Diversification

12 March 2025

I am a supporter of free trade, happy to live in a globalized world where trade is more international than ever. Personally, I believe the growth of trade between nations has played a strong part in the greater prosperity enjoyed by today’s generation.

Unfortunately, though, America is moving towards a time of protectionism. Already, that has led to the gains that U.S. equities had made since the presidential election last November unwinding. Some market analysts also question whether the theme of American exceptionalism, often represented by the success of US companies, particularly in the tech sector, has been overstated.

Against this backdrop, the case for diversification in investment portfolios is getting louder. Traditional market capitalization-weighted indices have become dangerously concentrated in U.S. equities in general and the ‘magnificent 7’ tech stocks especially. Might it be prudent to opt for more diversified, equal-weighted indices instead?

Going back in Time: Historic Development of Tariffs

Fears about tariffs are well founded. There’s consensus among economists that protectionism harms economic growth and stability. For instance, a study using data from the IMF Research Department showed the negative effect of tariffs on countries’ output growth over the 50 years from 1963 to 2014. The charts below show how tariffs have fallen in the period and the negative average impact of tariffs on output in 151 countries.

Tariffs Decline Over Time (%)

Note: Tariff data is based on product-level data aggregated by country, with weights determined by each product's import share. Tariffs are averaged across income groups, with AM = advanced economies, EM = emerging economies, and LIC = low-income developing countries.

Source: “Are tariffs bad for growth?”. 2020. Data compiled by IMF Research Department with underlying sources: WITS, WDI, WTO, GATT, BTN.

The Effect of Tariffs on Output Growth (%)

Years After Tariff Increase

Note: Annual output growth after tariff hikes (percent), averaged across countries with significant tariff increases. (greater than one-third standard deviation, or a 3.6 percentage point change)

Source: “Are tariffs bad for growth?”. 2020. Data compiled by IMF Research Department with underlying sources: WITS, WDI, WTO, GATT, BTN.

Excessive Concentration

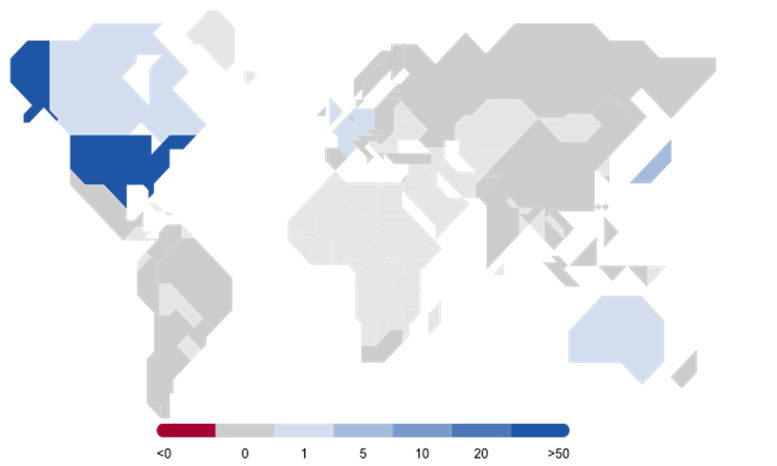

I would not say that U.S. stocks are riding for a fall. Just that the lurch towards protectionism at a time when they are highly valued is a reminder of the risks. The MSCI World Index currently has more than three quarters (75%) of its value in North America. Investors from around the world have a lot of their wealth tied up there, especially in the ‘magnificent seven’ tech stocks that have been leading the AI revolution.

For comparison, the VanEck World Equal Weight Screened UCITS ETF (TSWE), which follows the Solactive Sustainable World Equity Index has just 40% in North American equities (see chart 3). It’s also more diversified in terms of sectors and individual stocks following an equal weight strategy. Please note, there are risks associated with this investment, including equity market risk and foreign currency risk. Investors are encouraged to review the Key Information Document (KID) and the prospectus thoroughly prior to making an investment.

To my mind, the concentration of wealth in U.S. equities is one of the greatest risks facing investors today. Given these developments, investors may consider diversifying their portfolios to manage risk and reduce over exposure.

Regional Exposure in World Indices (%)

Country Revenue Exposure MSCI World Index (%)

Source: Morningstar Data as of 2025-02-28. It is not possible to invest directly in an index.

Has American Exceptionalism been Overstated?

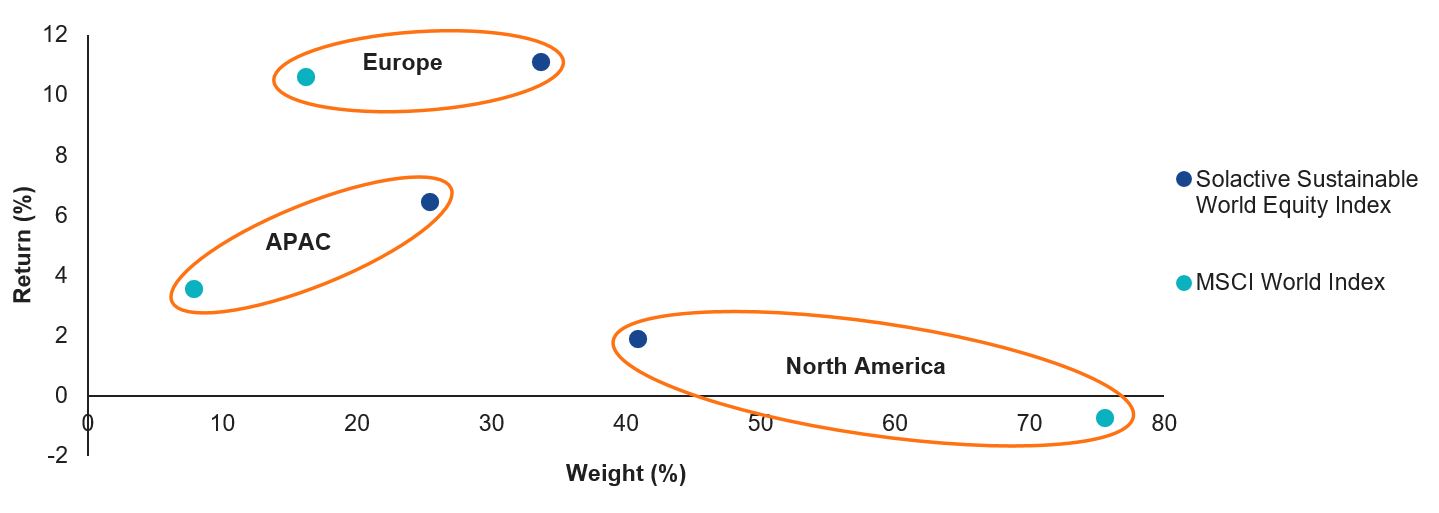

Just to reinforce the case for diversification – once described by Nobel Prize winner Harry Markowitz as the “only free lunch” in investment – the performance of equities over the past volatile months has run counter to what was expected.1 At the time of last year’s presidential election, U.S. equities were widely expected to outperform.

Yet, as the chart below shows, it’s Europe that has outperformed in the last three months. Not only has Germany’s recent election prompted expectation of a fiscal stimulus but also the European Central Bank is thought to have more scope for interest rate cuts than the US Federal Reserve.

Regional Return Comparison: Last 3 Months – Solactive Sustainable World Equity Index vs. MSCI World Index

Source: Morningstar, Data period from: 2024-11-30 to 2025-02-28, Total Return in Euro. Past performance does not indicate future performance. It is not possible to invest directly in an index.

Investors looking for a Europe-focused strategy could opt for the VanEck European Equal Weight Screened UCITS ETF (TEET), which offers a widely diversified investment in European equities. It’s important to note that this investment carries risks, including the equity market risk and foreign currency risk. Before making any investment, investors should carefully review the Key Information Document (KID) and the prospectus.

More broadly, though, the surprises of early 2025 highlight the difficulty of predicting markets – and the wisdom of being diversified in case the unexpected happens.

1 Source: The Journal of Finance . 1952.

IMPORTANT INFORMATION

This is marketing communication. Please refer to the prospectus of the UCITS and to the KID/KIID before making any final investment decisions. These documents are available in English and the KIDs/KIIDs in local languages and can be obtained free of charge at www.vaneck.com, from VanEck Asset Management B.V. (the “Management Company”) or, where applicable, from the relevant appointed facility agent for your country.

For investors in Switzerland: VanEck Switzerland AG, with registered office in Genferstrasse 21, 8002 Zurich, Switzerland, has been appointed as distributor of VanEck´s products in Switzerland by the Management Company. A copy of the latest prospectus, the Articles, the Key Information Document, the annual report and semi-annual report can be found on our website www.vaneck.com or can be obtained free of charge from the representative in Switzerland: Zeidler Regulatory Services (Switzerland) AG, Neudtadtgasse 1a, 8400 Winterthur, Switzerland. Swiss paying agent: Helvetische Bank AG, Seefeldstrasse 215, CH-8008 Zürich.

For investors in the UK: This is a marketing communication for professional investors only. Retail clients should not rely on any of the information provided and should seek assistance from a financial intermediary for all investment guidance and advice. VanEck Securities UK Limited (FRN: 1002854) is an Appointed Representative of Sturgeon Ventures LLP (FRN: 452811), which is authorised and regulated by the Financial Conduct Authority (FCA) in the UK, to distribute VanEck´s products to FCA regulated financial intermediaries.

This information originates from VanEck (Europe) GmbH, which is authorized as an EEA investment firm under MiFID under the Markets in Financial Instruments Directive (“MiFiD). VanEck (Europe) GmbH has its registered address at Kreuznacher Str. 30, 60486 Frankfurt, Germany, and has been appointed as distributor of VanEck products in Europe by the Management Company. The Management Company is incorporated under Dutch law and registered with the Dutch Authority for the Financial Markets (AFM).

This material is only intended for general and preliminary information and shall not be construed as investment, legal or tax advice. VanEck (Europe) GmbH and its associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Information provided by third party sources is believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed.

VanEck World Equal Weight Screened UCITS ETF (the "ETF") is a sub-fund of VanEck ETFs N.V., an investment company with variable capital under the laws of the Netherlands. The ETF is registered with the AFM, passively managed and tracks an equity index. Investing in the ETF should be interpreted as acquiring shares of the ETF and not the underlying assets.

VanEck European Equal Weight Screened UCITS ETF (the "ETF") is a sub-fund of VanEck ETFs N.V., an investment company with variable capital under the laws of the Netherlands. The ETF is registered with the AFM, passively managed and tracks an equity index. Investing in the ETF should be interpreted as acquiring shares of the ETF and not the underlying assets.

The VanEck’s ETF is not sponsored, promoted, sold or supported in any other manner by Solactive AG nor does Solactive AG offer any express or implicit guarantee or assurance either with regard to the results of using the Index and/or Index trade mark or the Index Price at any time or in any other respect. The Index is calculated and published by Solactive AG. Solactive AG uses its best efforts to ensure that the Index is calculated correctly. Irrespective of its obligations towards the Issuer, Solactive AG has no obligation to point out errors in the Index to third parties including but not limited to investors and/or financial intermediaries of the financial instrument. Neither publication of the Index by Solactive AG nor the licensing of the Index or Index trade mark for the purpose of use in connection with the financial instrument constitutes a recommendation by Solactive AG to invest capital in said financial instrument nor does it in any way represent an assurance or opinion of Solactive AG with regard to any investment in VanEck’s ETF. It is not possible to invest directly in an index.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk for any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”), expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, noninfringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. It is not possible to invest directly in an index.

Investing is subject to risk, including the possible loss of principal. Investors must buy and sell units of the UCITS on the secondary market via a an intermediary (e.g. a broker) and cannot usually be sold directly back to the UCITS. Brokerage fees may incur. The buying price may exceed, or the selling price may be lower than the current net asset value. The indicative net asset value (iNAV) of the UCITS is available on Bloomberg. The Management Company may terminate the marketing of the UCITS in one or more jurisdictions. The summary of the investor rights is available in English at: complaints-procedure.pdf (vaneck.com). For any unfamiliar technical terms, please refer to ETF Glossary | VanEck.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH ©VanEck Switzerland AG © VanEck Securities UK Limited

Important Disclosure

This is a marketing communication. Please refer to the prospectus of the UCITS and to the KID before making any final investment decisions.

This information originates from VanEck (Europe) GmbH, which has been appointed as distributor of VanEck products in Europe by the Management Company VanEck Asset Management B.V., incorporated under Dutch law and registered with the Dutch Authority for the Financial Markets (AFM). VanEck (Europe) GmbH with registered address at Kreuznacher Str. 30, 60486 Frankfurt, Germany, is a financial services provider regulated by the Federal Financial Supervisory Authority in Germany (BaFin).

The information is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice VanEck (Europe) GmbH, VanEck Switzerland AG, VanEck Securities UK Limited and their associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results. Information provided by third party sources is believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Brokerage or transaction fees may apply.

All performance information is based on historical data and does not predict future returns. Investing is subject to risk, including the possible loss of principal.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH / VanEck Asset Management B.V.

Sign-up for our ETF newsletter

Related Insights

Related Insights

07 March 2025

07 February 2025

07 March 2025

12 February 2025

07 February 2025

16 January 2025

16 January 2025