VanEck Crypto Monthly Recap for December 2023

14 January 2024

In 2023, Bitcoin had its best year since 2020 with a 154% increase.

In December, Bitcoin outperformed the S&P 500 for the fourth straight month (+9% vs. +4%) to end 2023 +154%, its best year since 2020 when BTC rose 305%. While Bitcoin ETN inflows slowed to $300M for the month, a significant deceleration from November’s $1B+, investors recycled previous BTC gains into more speculative alt-coins, especially Layer 1 smart contract platforms as represented by the MVIS Smart Contract Leaders Index, which rose 44% in December for its best month since mid-2021.

Simultaneously, the US dollar experienced another 2% decline for December following November’s 3% fall, after the Jerome Powell-led FOMC signaled US rate cuts as soon as Q1 and the BRICS group expanded to include Saudi Arabia, the UAE, Iran, Egypt and Ethiopia. The market also took cues from significant crypto policy support outside the US, where Bitcoin adoption is more apparent. For example, the Nigerian Central Bank made a major policy change in December by reversing the ban prohibiting banks from servicing virtual asset service providers. An influential 90-year-old Saudi cleric acknowledged Bitcoin as permissible (not haram) in a new fatwah. Argentina’s libertarian President Javier Milei’s new foreign minister said that contracts settled in Bitcoin would be legal under certain conditions. With 50% of the world population voting in national presidential or legislative elections in 2024, we see the prospect for more significant, pro-crypto policies to emerge.

Continuing the notable shift that began in November, small-cap tokens (+27%) dramatically outperformed large-caps (+12%) as crypto natives drove meme coins and less liquid tokens in the Solana ecosystem, particularly to outsized gains. However, as of January 2nd, funding rates are now quite elevated across many digital assets, driving an emerging “sell the news” narrative around the Bitcoin ETFs, which we are reluctant to embrace.

| December | 2023 | |

| Coinbase | 39% | 391% |

| Bitcoin | 11% | 154% |

| MarketVectorTM Smart Contract Leaders Index | 44% | 149% |

| MarketVectorTM Infrastructure Application Leaders Index | 25% | 136% |

| MarketVectorTM Decentralized Finance Leaders Index | 11% | 94% |

| Ethereum | 13% | 92% |

| Nasdaq Index | 6% | 44% |

| MarketVectorTM Centralized Exchanges Index | 32% | 30% |

| S&P 500 Index | 4% | 24% |

| MarketVectorTM Media & Entertainment Leaders Index | 27% | -41% |

Source: Bloomberg, as of 12/31/2023. Past performance is no guarantee of future results. Not intended as a recommendation to buy or sell any securities named herein.

Smart Contract Platforms

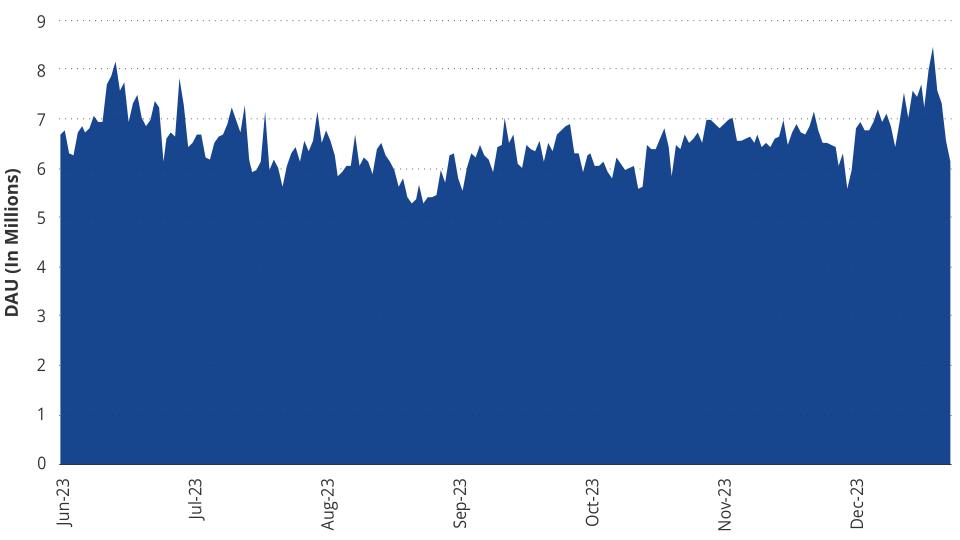

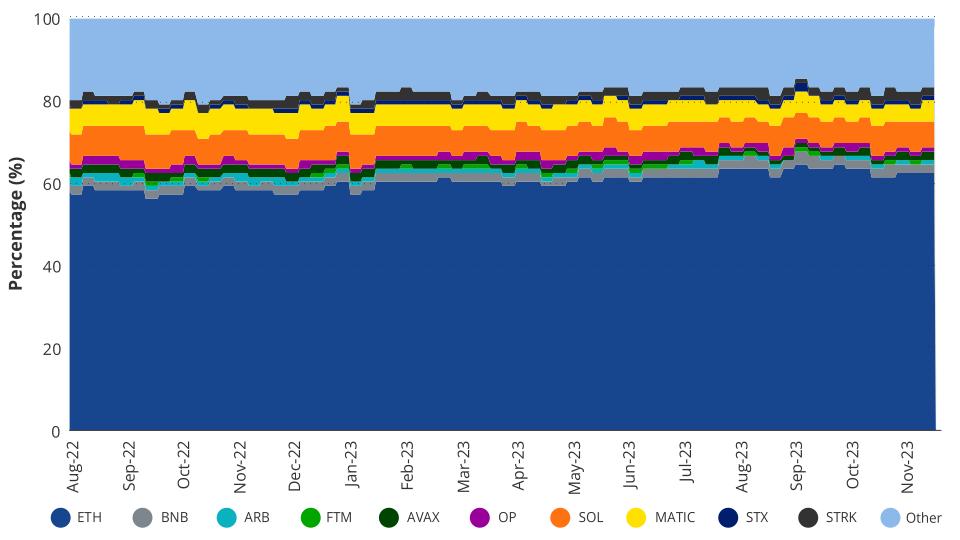

The speculative scramble that gripped the crypto markets in November 2023 continued to unfold in December 2023. The fervor was unbound by fundamentals as speculators focused on memecoins and inscriptions across most smart contract platforms. The consequence of this activity is that L1 tokens ex BTC rose 44% in December. Despite the extremely positive price action, important fundamental metrics like daily active users and stablecoins did not increase in the aggregate. While usership is roughly flat compared to six months ago, stablecoins on-chain are up only +2% from six months ago and down -6% from a year ago. It is also difficult to attribute this broader rally to any new applications or killer use cases despite incrementally positive developments in DePIN and useability. But crypto prices are highly reflexive, and the rockets of mooning tokens often shine light on projects that were overlooked during negative price periods. It is also important to note that higher prices create positive feedback loops not only because they bring in new users looking to speculate or utilize crypto apps but also because they give teams the financial firepower to build the vision of their projects. In crypto, if enough people believe in something and are willing to financially back their beliefs, far-flung ideas can blossom into functioning, widely-used applications.

Smart Contract Platform + Bitcoin Daily Active Users

Source: Artemis XYZ as of 12/28/2023. Past performance is no guarantee of future results. Not intended as a recommendation to buy or sell any securities named herein.

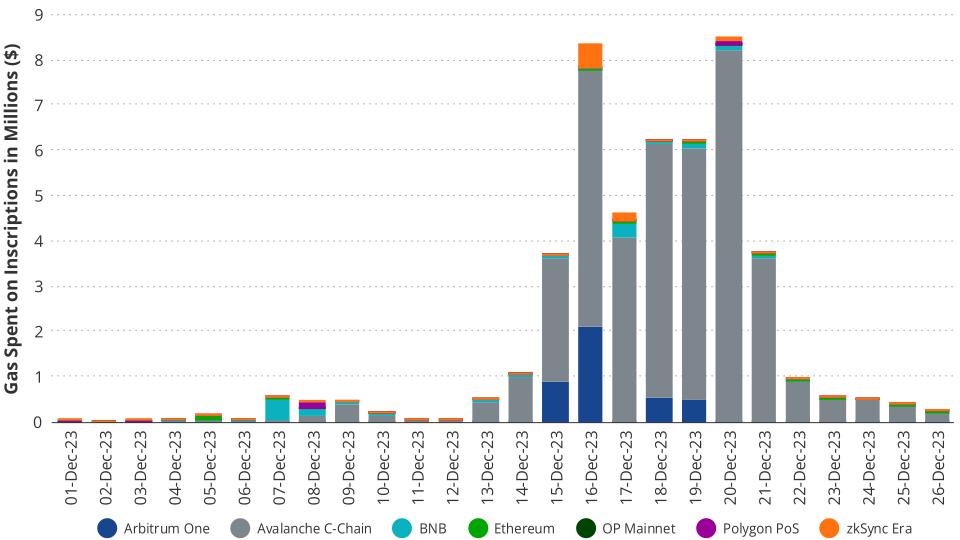

Memecoins drove price action in early December, particularly on Solana, but they mostly crested in mid-December. However, the butterfly wings of memecoin activity on Solana led to a hurricane of inscriptions that raged on Bitcoin and popped up elsewhere. In tandem with Bitcoin, many other chains also saw a squall of inscriptions that caused a massive increase in fees and congestion. Arbitrum was a notable casualty on Friday, December 15th when its sequencer down for several hours. Inscriptions are a mini hack within blockchain transactions that allow users to write any data within on top of a transaction that will be committed to the blockchain forever. The result is that images and other data pieces that could be considered collectible have been inscribed and this has spurned users to create and speculate on the inscriptions. The smart contract platform most affected by inscription activity, in terms of fee generation, was Avalanche where inscription activity resulted in a total of $39.9M spent on gas. That figure represents 76% of all the Avalanche fees in December. As a result of inscriptions activity, Avalanche’s AVAX token was one of the top performers in December, +79%.

Daily Amount of Gas Spent on Inscriptions by Blockchain

Source: Dune @ hildobby as of 12/28/2023. Past performance is no guarantee of future results. Not intended as a recommendation to buy or sell any securities named herein.

Of course, no chain matched Bitcoin’s inscriptions activity which is estimated to have resulted in in transaction fees for Bitcoin in December 2023. As a result of inscriptions activity on Bitcoin, the project $ORDI reached $1.6B in market cap at its peak on December 25th. At the same time, congestion clogging the Bitcoin network has spurred interest in scaling solutions such as Stacks whose STX token had an exceptional December (+81%). Because of spillover from activity on Bitcoin to Stacks, fees on Stacks exploded in December moving from a daily average of $261 to $15,640 per day. With the stand-up of Stack’s Neon testnet which enable 5-second block times, Stacks may continue to be a beneficiary of Bitcoin congestion since it is one of top Bitcoin L2s. Curiously, the massive pick-up in activity on the Bitcoin network has even spurred a team called GFX to fork and Uniswap V3 onto Bitcoin scaling solution RootStock to trade inscriptions and other memecoins within Bitcoin.

One of the most interesting occurrences in December was the continued momentum of the Blur-related L2 chain Blast. While there is no mainnet, no testnet and Blast consists of a series of smart contracts that re-stake user deposited funds, it has been able to attract $1.14B in TVL. Most alarmingly, the developer, known only as Pacman, has access to move all the funds that users deposit. This puzzling phenomenon is attributed almost entirely to the notoriety of Pacman who is considered one of the most capable programmers in the blockchain space and the supposition that Blast will be dispersing high value token rewards. Others are so bold as to speculate that this type of model where user funds are re-hypothecated to earn yield while locked, will be replicated by other emerging Layer-2 blockchains.

Another big winner on TVL in December was Eigenlayer who increased the maximum of its re-staking contract to 500k ETH. As a result, Eigenlayer’s TVL increased from 114.5k ETH to 452k ETH (~$1B) in 10 days.

In December, many Ethereum L2 projects reported noteworthy news items amid speculation of airdrops and partnership deals. Starkware, who will release its token on January 22, 2024, that 10% of fees generated on chain will go to developers of Starkware dApps as well as Starkware’s team (80% to dApps, 20% to Starkware). Protocol-shared revenue is nothing new -- Canto has experimented with it since late 2022 -- but the topic is still contentious as some suppose this incentivizes developers to create less efficient contracts. Polygon, who is building towards an L2 chain of chains employing zero-knowledge tech, announced that it will be using Celestia for (DA). This move by Polygon is intriguing given that Polygon recently spun out of its company a DA project called Avail. Polygon has also announced that Immutable X, who is building a Polygon zk L2 chain using the Polygon CDK, will be launching which will allow users to port both assets and identities across many different blockchain-based games. Arbitrum, a strong competitor in the L2 space, has also announced that its L3 program called Orbit will be utilizing Celestia for DA. Manta network, a privacy-focused former Polkadot project, also announced it will be using Celestia for Data Availability.

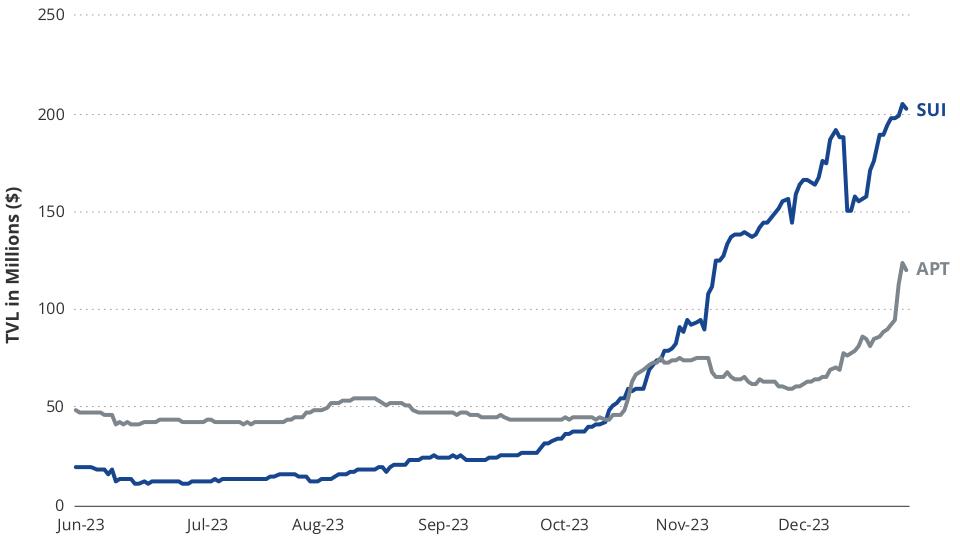

TVL of Sui and Aptos

Source: Artemis XYZ as of 12/28/2023. Past performance is no guarantee of future results. Not intended as a recommendation to buy or sell any securities named herein.

Rounding out the Alt-L1 chains, Solana’s SOL token had another impressive month by increasing (+56%). Amid the flurry of speculation on Solana including memecoins involving dogs with hats and dogs being bonked by bats, there were several important developments from more savory projects. Dominant re-staking and MEV project Jito airdropped tokens worth $160M to just under 10k users while DEX aggregator with 80% market share Jupiter its $JUP token airdrop for January 2024. Additionally, Trezor announced support for Solana and the SPL token. Also notable in December was that Solana’s mobile phone Saga sold out its initial run of 20k units. The move-language based systems, Sui and Aptos, have also been performing well in attracting TVL as Sui broke $200M in TVL while Aptos has surged to $120M. NEAR’s token also had a solid December (+90%) as NEAR partnered with Eigenlayer to create a finality layer for Ethereum L2s. This will be accomplished by transitioning the NEAR-Ethereum Rainbow bridge into an Eigenlayer actively validated service that will rely upon re-staked Ethereum for security. In concert with this new capability, NEAR is also targeting Ethereum L2s by unveiling its layer to attract Ethereum L2 transaction data. NEAR’s DA project already boasts an impressive assortment of rollups including Fluent, Movement Labs, Caldera and Dymension. NEAR claims that its DA layer will be 8000x cheaper than Ethereum and combined with its new finality layer, may pose a challenge to Ethereum’s settlement business model going forward.

Notable Winner

OP (+111%)

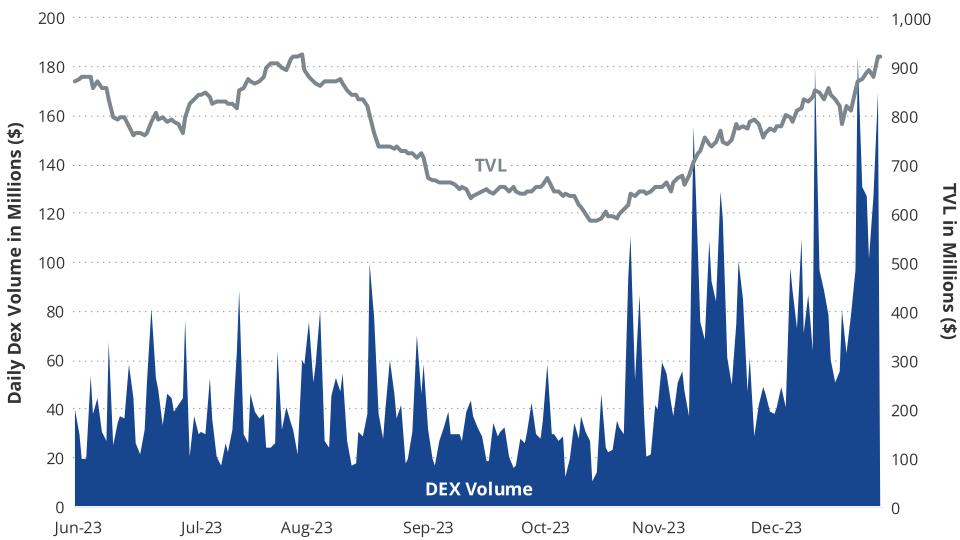

Optimism DEX Volume vs. TVL

Source: Artemis XYZ as of 12/28/2023. Past performance is no guarantee of future results. Not intended as a recommendation to buy or sell any securities named herein.

The best performing smart contract platform token for the month of December was OP token that governs the Optimism layer-2 blockchain. Optimism’s outperformance does not appear to be caused by the improvement of fundamental metrics as these were relatively weak for Optimism. Though fees generated by Optimism increased (+54%) month-to-month, TVL only increased +20%, and users were actually down -20.4%. This compares to chief competitor Arbitrum showing fees, TVL and usership changes of (+98.2%), (+17.2%) and (-9.7%) respectively. Earlier in the month, however, Optimism finished voting for its public good funding which has typically been a price catalyst in the past as users vie to gain access to some of the funding. Also, Optimism was able to gain adherents to its superchain in December with legacy project LISK announcing it will be building an Optimism chain. Another positive development is the release of Clearpool’s KYC pool on Optimism Mainnet which aims to bring private credit markets on-chain. Kraken also enabled the transfer of Tether USDT to Optimism and the upcoming post-Bedrock upgrade called Canyon. The release improves gas efficiency on chain under high transaction loads while also addressing many minor bugs that plagued Optimism. Though fundamental metrics of Optimism’s adoption look weak at the moment, Worldcoin who is building on Optimism, has its World ID 2.0 “proof of personhood” with Shopify, Minecraft, Telegram and Reddit. World ID may spur usership on Optimism as it enables the companies that integrate it to add an identification layer that will separate real active users from bots. Bot activity alongside scams, have plagued social networks and video games and Worldcoin ID may offer a tangible solution to substantially curbing bot activity. This solution may become particularly important once AI bot start to make it difficult to distinguish real users from fakes ones.

Optimism, despite its performance, is still far away from its goals of decentralization. Vitalik Buterin, co- founder of Ethereum, has classified the stages of decentralization for Ethereum L2s and Optimism currently sits at the lowest level. Optimism is a Stage 0 rollup which means there is no validity proof system on Optimism chains nor a decentralized security committee to override potential chain issues. In practice, Optimism is still highly centralized with its founding team governing core functions and running its sequencer. This amounts to users of Optimism’s blockchain trusting Optimism’s team with user funds and hoping that Optimism’s team does not act maliciously. Though Optimism’s team is working diligently to reach Stage 1, it has not indicated when that threshold will be reached. Instead, Optimism focused on building the OP stack and Bedrock to enable others to build OP chains to join Optimism’s superchain. While uncertainty over decentralization is far from ideal, it is also a potential set of catalysts that could bring positive price action to the $OP in the future.

December’s Notable Laggard

Ethereum (+10%)

With the exception of Tron’s TRX, ETH was outperformed by every major smart contract platform’s token in December. The bear case for Ethereum is not new, but it is convincing and December’s price action demonstrates that many crypto investors are allocating away from ETH. Many have asserted that Ethereum’s roadmap has become divorced from the needs of Ethereum’s everyday users as the Ethereum Foundation focuses on esoteric concerns that do not scale Ethereum. Another common criticism is that Ethereum is discarding its primary use-case and business model, execution of user transactions, and moving towards the unproven and uncertain data availability and settlement “businesses.” To ETH bears, Ethereum’s new focus is a poor financial decision that pulls Ethereum away from blockchain’s most compelling value accrual mechanisms – execution of user transactions and MEV (ordering of those transactions). As a result, ETH has been plagued with sagging performance throughout the year. For example, ETH is down 24% against Bitcoin’s performance in 2023 and -80% versus Solana’s. To air more grievances, another concern is the growing threat to Ethereum’s credible neutrality posed by validators, blockbuilders and relays sanctioning certain addresses. In December, relay provider bloXroute noted that it will start rejecting non-OFAC compliant transactions. The accumulation of issues surrounding validators, blockbuilders and relays potentially throttling transactions is extremely concerning if we are to suppose that Ethereum is credibly neutral, and that ETH is truly a permissionless asset.

Ethereum also underperformed in December due to comparatively lukewarm fundamentals. Average daily active users on Ethereum were up +10%, Solana and Avalanche usership was up +102% and +68.1% respectively. While Ethereum average daily fees were up 49% month-to-month, Ethereum’s fee growth ranks 11th of the 22 major blockchains we track and this ranking puts Ethereum behind fee growth of four of its own L2 blockchains. For monthly DEX volume growth, Ethereum was 15th, TVL growth has Ethereum placing 16th, and in stablecoin growth Ethereum ranks 11th.

Despite the demoralizing price action of ETH, we think Ethereum and ETH’s future is bright. ETH’s use cases are expanding with many more L2s being spun up that will require ETH for gas. Additionally, Eigenlayer is set to export ETH’s security to enable a flood of novel crypto services. Likewise, EIP 4844 and a host of other upgrades could prove material to Ethereum’s usage as a DA platform. Ethereum also retains the largest development and research community of any blockchain, and has grown their share of active developers from 38% in August 2022 to 50% at the end of December 2023. Ethereum intellectual leader Vitalik has also recently directed the discussion towards needed improvements to scale Ethereum’s execution environment. Finally, there is serious discussion about an ETH ETF on the horizon and the high-growth tech asset with yield narrative could prove convincing to many non-crypto investors.

Smart Contract Platform Developer Count

Source: Artemis XYZ as of 12/28/2023. Past performance is no guarantee of future results. Not intended as a recommendation to buy or sell any securities named herein.

DeFi

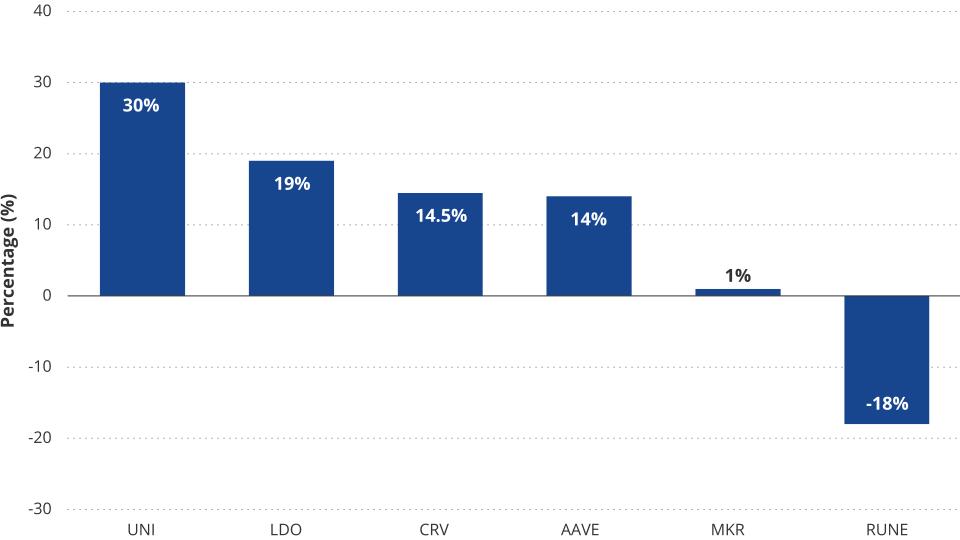

The MarketVector Decentralized Finance Leaders index (MVDFLE) returned 11% in December, slightly underperforming $ETH due to the large drawdown in $RUNE, which fell 18% following its massive rally in previous months. Of the index components, $UNI showed the most strength in December returning an impressive 30% as investors sought to get more exposure to the largest decentralized exchange. The majority of the index performed more or less in-line with major tokens with $LDO, $AAVE, and $CRV returning 19%, 14%, and 15%, respectively. $MKR underperformed $ETH and $BTC, only rising 1% potentially due to investors favoring pure crypto exposure as the market has turned risk-on and MakerDAO’s decision to acquire real world assets (RWA) has limited its exposure to crypto assets.

Ethereum DeFi Returns

Source: Coingecko as of 12/29/23. Past performance is no guarantee of future results. Not intended as a recommendation to buy or sell any securities named herein.

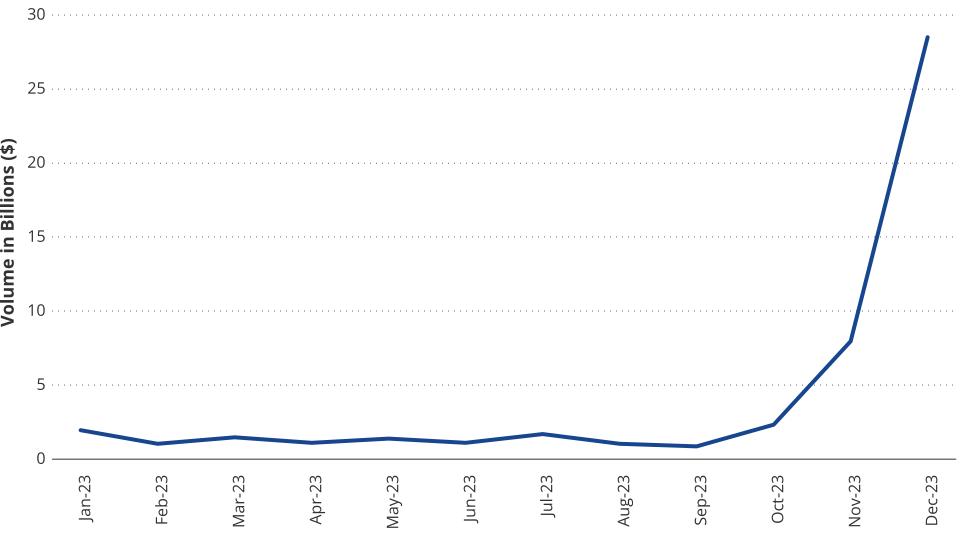

DeFi activity accelerated in December as the crypto rally continued, with decentralized exchange (DEX) volume rising 25%, thanks to the massive increase in activity on Solana. DEXs on Solana facilitated $29B of volume, representing a 256% increase from November, and established Solana as the second most active blockchain by DEX volume according to DefiLlama. The boost for Solana DeFi came as a result of $SOL’s outperformance and on-chain users seeking to participate in the many upcoming airdrops expected for DeFi protocols on Solana that have not yet released a token. This activity was catalyzed by the $JITO airdrop which saw the second largest liquid staking protocol on Solana distribute 90 million of its governance tokens to early users, worth over $200 million at time of writing.

Solana DEX Volume

Source: DefiLlama as of 12/31/23. Past performance is no guarantee of future results. Not intended as a recommendation to buy or sell any securities named herein.

Metaverse Tokens Outperform

Metaverse and gaming tokens had a strong month, with the MarketVector Media and Entertainment Leaders index (MVMELE) rising 26%, significantly outperforming $ETH and $BTC. $AXS and $SAND drove the index’s performance with each appreciating 43% and 40%, respectively. The massive returns these tokens experienced can be attributed to rising investor sentiment that blockchain gaming will have a breakout year in 2024 and that Axie Infinity and The Sandbox have established themselves as leaders in the space. Despite blockchain gaming’s low usership, these projects could see an increase in traffic as the rising crypto market gains the attention of the broader public.

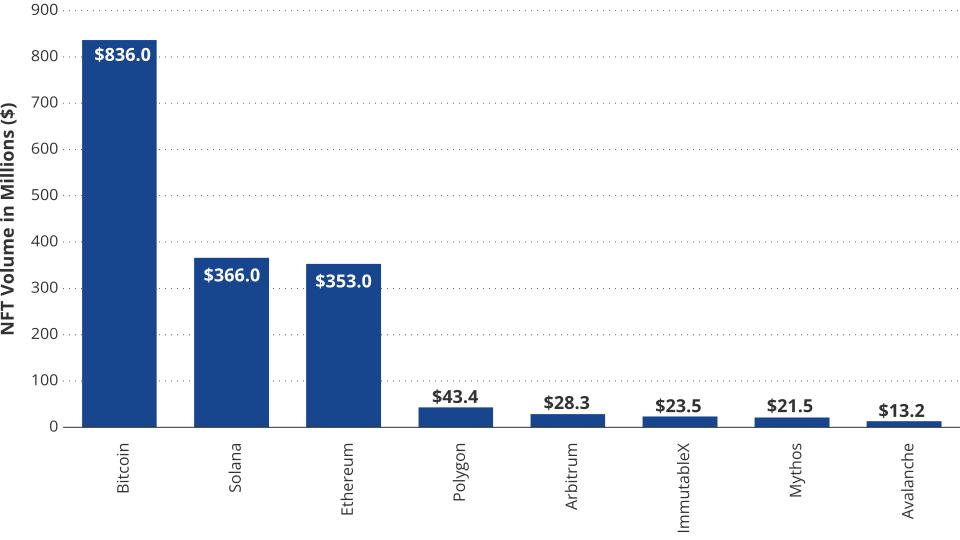

NFT Market Speculation Increasing

NFT volume in December rose a staggering 81%, mainly due to rising BRC-20 trading on Bitcoin and a 328% increase in NFT volume on Solana, according to Cryptoslam!. Solana’s massive increase in NFT volume is representative of how drastically investor sentiment in the Solana ecosystem has shifted. In fact, December was the first month where Solana NFT volume exceeded that of Ethereum. Similar to the increase in DeFi activity on Solana, on-chain investors are hoping that acquiring the leading Solana NFT collections could result in them being included in future airdrops that occur. Additionally, since Solana NFTs are priced in $SOL, investors are hoping to generate increased returns by purchasing the most coveted collections, such as Mad Lads and Tensorians, which could outperform the market significantly if Solana’s momentum continues.

Despite the impressive growth in Bitcoin and Solana NFTs, Ethereum NFT volume only rose 1% in December. Blur maintained its position as the leading NFT exchange on Ethereum by volume, facilitating 74% of NFT volume on the chain. Blur’s governance token, $BLUR, underperformed the market significantly, falling 3% while the amount of $BLUR tokens staked rose to 373 million, representing 12.4% of the total supply. Deposits to Blur’s upcoming layer 2 network, Blast, continued to rise and the Blast contract achieved a TVL exceeding $1 billion this month. In a hypothetical scenario where the network is operational, it would rank as the second-largest Ethereum layer 2 platform by value locked. However, it is likely that a significant portion of this capital will be withdrawn following the $BLAST airdrop and the launch of the network as airdrop farmers collect their rewards and seek other opportunities.

December NFT Volume by Blockchain

Source: CryptoSlam! As of 12/31/23. Past performance is no guarantee of future results. Not intended as a recommendation to buy or sell any securities named herein.

Links to third party websites are provided as a convenience and the inclusion of such links does not imply any endorsement, approval, investigation, verification or monitoring by us of any content or information contained within or accessible from the linked sites. By clicking on the link to a non-VanEck webpage, you acknowledge that you are entering a third-party website subject to its own terms and conditions. VanEck disclaims responsibility for content, legality of access or suitability of the third-party websites.

To receive more Digital Assets insights, subscribe for our Crypto Newsletter

Important Information

This is not financial research but the opinion of the author of the article. We publish this information to inform and educate about recent market developments and technological updates, not to give any recommendation for certain products or projects. The selection of articles should therefore not be understood as financial advice or recommendation for any specific product and/or digital asset. We may occasionally include analysis of past market, network performance expectations and/or on-chain performance. Historical performance is not indicative for future returns.

For informational and advertising purposes only.

This information originates from VanEck (Europe) GmbH, Kreuznacher Straße 30, 60486 Frankfurt am Main. It is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice. VanEck (Europe) GmbH and its associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. Views and opinions expressed are current as of the date of this information and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. VanEck makes no representation or warranty, express or implied regarding the advisability of investing in securities or digital assets generally or in the product mentioned in this information (the “Product”) or the ability of the underlying Index to track the performance of the relevant digital assets market.

The underlying Index is the exclusive property of MarketVector Indexes GmbH, which has contracted with CryptoCompare Data Limited to maintain and calculate the Index. CryptoCompare Data Limited uses its best efforts to ensure that the Index is calculated correctly. Irrespective of its obligations towards the MarketVector Indexes GmbH, CryptoCompare Data Limited has no obligation to point out errors in the Index to third parties.

Investing is subject to risk, including the possible loss of principal up to the entire invested amount and the extreme volatility that ETNs experience. You must read the prospectus and KID before investing, in order to fully understand the potential risks and rewards associated with the decision to invest in the Product. The approved Prospectus is available at www.vaneck.com . Please note that the approval of the prospectus should not be understood as an endorsement of the Products offered or admitted to trading on a regulated market.

Performance quoted represents past performance, which is no guarantee of future results and which may be lower or higher than current performance.

Current performance may be lower or higher than average annual returns shown. Performance shows 12 month performance to the most recent Quarter end for each of the last 5yrs where available. E.g. '1st year' shows the most recent of these 12-month periods and '2nd year' shows the previous 12 month period and so on. Performance data is displayed in Base Currency terms, with net income reinvested, net of fees. Brokerage or transaction fees will apply. Investment return and the principal value of an investment will fluctuate. Notes may be worth more or less than their original cost when redeemed.

Index returns are not ETN returns and do not reflect any management fees or brokerage expenses. An index’s performance is not illustrative of the ETN’s performance. Investors cannot invest directly in the Index. Indices are not securities in which investments can be made.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH

Important Disclosure

This is a marketing communication. Please refer to the prospectus of the UCITS and to the KID before making any final investment decisions.

This information originates from VanEck (Europe) GmbH, which has been appointed as distributor of VanEck products in Europe by the Management Company VanEck Asset Management B.V., incorporated under Dutch law and registered with the Dutch Authority for the Financial Markets (AFM). VanEck (Europe) GmbH with registered address at Kreuznacher Str. 30, 60486 Frankfurt, Germany, is a financial services provider regulated by the Federal Financial Supervisory Authority in Germany (BaFin).

The information is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice VanEck (Europe) GmbH, VanEck Switzerland AG, VanEck Securities UK Limited and their associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results. Information provided by third party sources is believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Brokerage or transaction fees may apply.

All performance information is based on historical data and does not predict future returns. Investing is subject to risk, including the possible loss of principal.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH / VanEck Asset Management B.V.

Sign-up for our ETF newsletter

Related Insights

Related Insights

14 March 2025

16 January 2025

27 November 2024

27 November 2024