Bitcoin: Happy Halving

08 May 2020

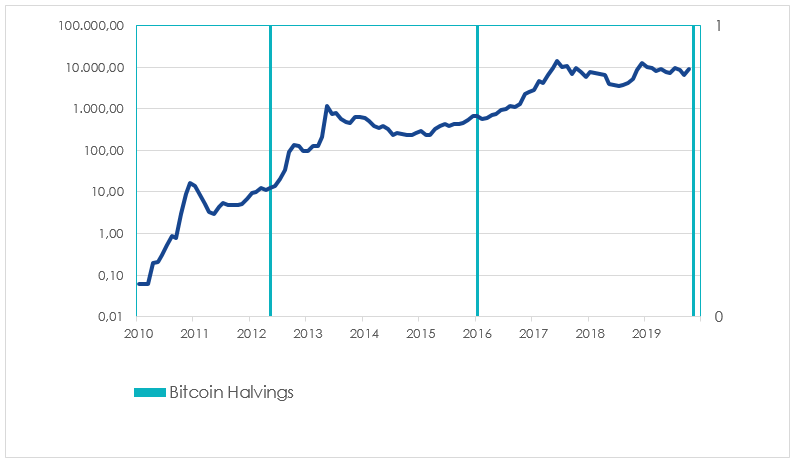

For the third time in its short history, Bitcoin is experiencing a halving of the block subsidy. Since the digital currency’s 2009 inception, bitcoin has already halved the block subsidy – the bitcoin payment that goes to the miner of the most recent block for his work to secure the network – in 2012 and 2016.

The next halving is set to happen at block height (i.e. block number) 630,000, which translates to on or around 12 May 2020. The block subsidy is said to drop from 12.5 BTC per block to 6.25 BTC per block.

The result is a further disinflation of the digital currency at a time when central banks around the globe presumably continue printing fiat currencies at an unprecedented rate in history to prop up their economies.

When the architecture of the Bitcoin network was designed, an initial block subsidy of 50 BTC per block, which would halve every 210,000 blocks, equating to approximately every four years, was set. After 21 million BTC had been issued, there would be no further issuance. The block reward, which includes the block subsidy plus the transaction costs, incentivizes miners to contribute computing power to the Bitcoin network and acts as a subsidy to pay for the miners’ energy and hardware expenses.

Bitcoin Monetary Inflation

Source: VanEck (own calculation).

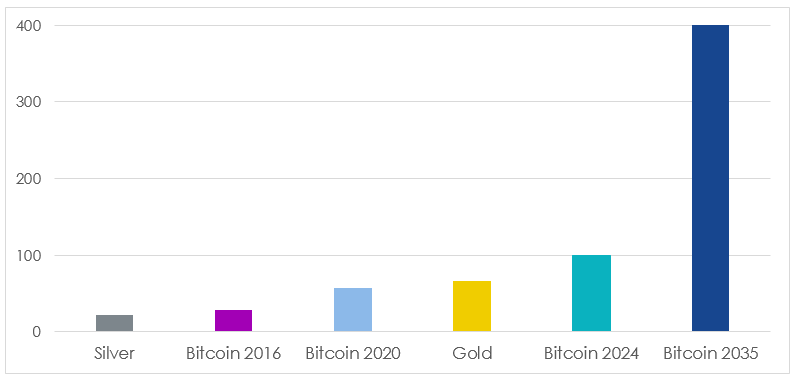

With the upcoming halving, bitcoin will experience disinflation: The annual inflation rate will fall from approximately 3.6% to ca. 1.7%, which is less than the 2% inflation targets set by most of the developed world’s central banks. Curiously, it puts bitcoin also on par with the stock-to-flow ratio of gold, an asset widely perceived to be scarce and valuable. The stock-to-flow ratio, the inverse of the inflation rate, is calculated by dividing the stock of monetary units by its newly created supply.

Stock-to-flow ratios

Source: VanEck (own calculation).

While the Bitcoin creation coincided (probably intentionally) with the 2008-2009 global financial crises, the third halving comes at another time of great economic uncertainty that threatens to become a financial crisis. At a time, when central banks globally are turning on the money printers again to flood their economies with liquidity, the Bitcoin halving shows the digital currencies programmatic robustness and true scarcity.

Federal Reserve Total Assets

Source: Bloomberg.

The explosive growth of the Fed (and other central bank) balance sheet since the outbreak of the Covid-19 pandemic contrasts with the programmatic disinflation of new bitcoin supply. However, the complete inelasticity and known reduction of supply makes valuing bitcoin a challenging task.

Bitcoin / U.S. Dollar, 1M, Bloomberg

Source: Bloomberg, own calculations.

Whether the halving and the macro economic environment will translate into higher prices for bitcoin cannot be certain. And history may not be a reliable guide as bitcoin and digital assets overall are a brand-new asset class. Researchers are just about to understand how these assets fit into classical portfolio construction and valuation models. An example for such a valuation model is the previously mentioned stock-to-flow model for bitcoin, made public by Twitter User @100trillionUSD / PlanB.

Sources: Digitalik; Medium, S2F as the most well-known bitcoin valuation model.

Whatever the impact of the halving on bitcoin’s price may be: bitcoin isn’t dead yet. The network continues to function and blocks will be created reliably every 10 minutes until 21,000,000 blocks have been mined. Indeed, some economists might argue that the properties of bitcoin put it in better shape than many of the world’s rapidly inflating fiat currencies.

Important Disclosure

This is a marketing communication. Please refer to the prospectus of the UCITS and to the KID before making any final investment decisions.

This information originates from VanEck (Europe) GmbH, which has been appointed as distributor of VanEck products in Europe by the Management Company VanEck Asset Management B.V., incorporated under Dutch law and registered with the Dutch Authority for the Financial Markets (AFM). VanEck (Europe) GmbH with registered address at Kreuznacher Str. 30, 60486 Frankfurt, Germany, is a financial services provider regulated by the Federal Financial Supervisory Authority in Germany (BaFin).

The information is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice VanEck (Europe) GmbH, VanEck Switzerland AG, VanEck Securities UK Limited and their associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results. Information provided by third party sources is believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Brokerage or transaction fees may apply.

All performance information is based on historical data and does not predict future returns. Investing is subject to risk, including the possible loss of principal.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH / VanEck Asset Management B.V.

Sign-up for our ETF newsletter

Related Insights

Related Insights

14 March 2025

16 January 2025

27 November 2024

27 November 2024