Video Gaming Becomes a Hobby for All Ages

08 October 2024

It’s becoming a pastime across multiple generations, with younger people leading the way. With increasingly powerful narratives and emotionally charged storylines, video games like The Last of Us and Red Dead Redemption 2 show how games rival traditional media in storytelling.

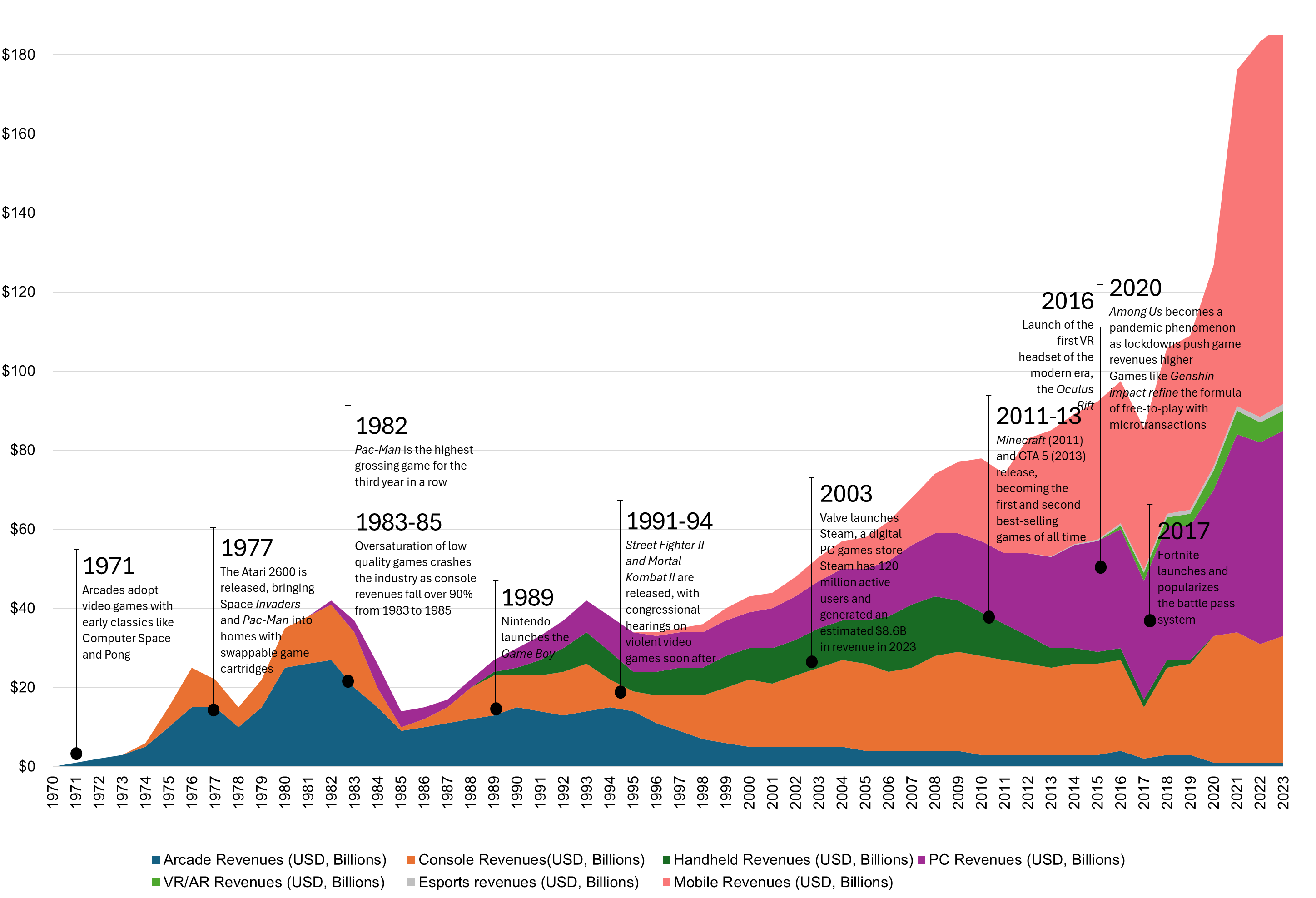

While gaming is vying with other media creatively, its revenues surpass other entertainment sectors like film and music. The industry’s global revenues are projected to reach $187.7 billion in 2024,1 according to the respected Newzoo consultancy. It’s also expected to keep on moving forward over the next few years.

The industry boomed during 2020 as Covid-19 lockdowns confined people to their homes. In search of entertainment and social interaction, they turned to games consoles, PCs and mobiles to play games and watch e-sports. They did so not just to compete but also to meet other gamers. However, after lockdowns were lifted, people's dependence on the virtual world lessened.

Gaming companies' share prices highlight the industry's surge in user base and engagement, followed by a correction, while VanEck’s Video Gaming and eSports UCITS ETF provides a diversified view on the sector's revenue expansion and the accompanying price fluctuations. The ETF also shows how the industry’s fortunes are now looking up once more (see chart below) as it outgrows the rest of the entertainment industry, highlighting a growth theme with potential benefits for investors.

Past Performance of hypothetical $100 investment

Performance quoted represents past performance. Current performance may be lower or higher than average annual returns shown. Performance data for the Irish domiciled ETFs is displayed on a Net Asset Value basis, in Base Currency terms, with net income reinvested, net of fees. Returns may increase or decrease as a result of currency fluctuations.

Investors must be aware that, due to market fluctuations and other factors, the performance of the ETFs may vary over time and should consider a medium/long-term perspective when evaluating the performance of ETFs.

A Return to Growth?

Source: Vantage Market Research, Pelham Smithers.

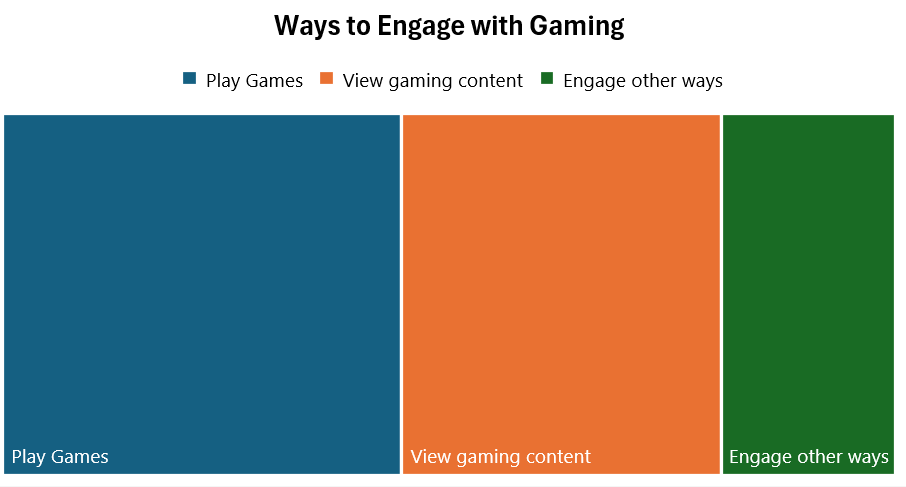

The latest industry forecasts confirm this return to growth. Newzoo estimates that the global gamer community is also expected to grow 4.5% in 2024, according to the report, reaching 3.42 billion people while lifting revenues by 2.1%. That means nearly one in three people globally are playing video games. Further, 85% of global consumers are engaging with gaming in some form, either by playing or viewing content.

Source: Newzoo Global Gamer Study 2024, How consumers engage with gamers today.

Within video gaming, esports is steadily transitioning from a niche interest to a significant part of the landscape. While its popularity continues to rise, drawing millions of viewers to international tournaments, there are still challenges related to infrastructure, regulation, and long-term sustainability. Nevertheless, esports has growing support from major sporting organizations and has the potential for expansion.

In July, the International Olympic Committee2 voted to create the Olympic Esports Games, marking a significant milestone. The first games are scheduled for 2025 in Saudi Arabia. Saudi Arabia has already hosted major international tournaments, including the inaugural eSports World Cup, which brought together over 1,700 elite players from more than 80 countries and attracted nearly 4 million live spectators, with an additional 1.3 billion viewers tuning in via global streaming platforms.

From 2022 to 2027, Newzoo thinks video gaming’s revenues will have a steady compound annualized growth rate of 3.1%, reaching $213.3 billion3. In other words, the gaming industry is expected to continue expanding at a faster pace than many other entertainment sectors, driven by growth in mobile and PC gaming.

Will AI Cut Costs?

To give a sense of the work that goes into blockbuster games, Grand Theft Auto (GTA) 6, set for release in autumn 2025, is rumored to have a production budget of approximately $2 billion4, greater than the total budget of blockbuster films. For comparison, Pirates of the Caribbean: On Stranger Tides is reportedly the most expensive film ever made, with a budget of $378.5 million.

For anyone interested in investing in the gaming sector, the combination of ongoing revenue growth and the possibility of improving efficiencies is encouraging. Remember, though, that video gaming is a specific theme and while you can gain stock level diversification through a vehicle like our ETF, there’s no way of guarding against the type of unusual volatility seen in the aftermath of the pandemic.

There is no denying that video gaming has grown from a niche teenage activity to a hobby embraced by people of all ages, but its continued success will depend on evolving trends and consumer preferences.

1 Newzoo’s Global Games Market Report 2024.

2 IOC press release 12th July 2024.

3 The Global Games Market Report 2024 – Newzoo's.

4 GTA 6: Grand Theft Auto VI could smash revenue records-BBC.

IMPORTANT INFORMATION

This is a marketing communication. Please refer to the prospectus of the UCITS and to the KID before making any final investment decisions.

This information originates from VanEck (Europe) GmbH, which has been appointed as distributor of VanEck products in Europe by the Management Company VanEck Asset Management B.V., incorporated under Dutch law and registered with the Dutch Authority for the Financial Markets (AFM). VanEck (Europe) GmbH with registered address at Kreuznacher Str. 30, 60486 Frankfurt, Germany, is a financial services provider regulated by the Federal Financial Supervisory Authority in Germany (BaFin).

For investors in Switzerland: VanEck Switzerland AG, with registered office in Genferstrasse 21, 8002 Zurich, Switzerland, has been appointed as distributor of VanEck´s products in Switzerland by the Management Company. A copy of the latest prospectus, the Articles, the Key Information Document, the annual report and semi-annual report can be found on our website www.vaneck.com or can be obtained free of charge from the representative in Switzerland: Zeidler Regulatory Services (Switzerland) AG, Neudtadtgasse 1a, 8400 Winterthur, Switzerland. Swiss paying agent: Helvetische Bank AG, Seefeldstrasse 215, CH-8008 Zürich.

For investors in the UK: This is a marketing communication for professional investors only. Retail clients should not rely on any of the information provided and should seek assistance from an IFA for all investment guidance and advice. VanEck Securities UK Limited (FRN: 1002854) is an Appointed Representative of Sturgeon Ventures LLP (FRN: 452811), who is authorised and regulated by the Financial Conduct Authority (FCA) in the UK, to distribute VanEck´s products to FCA regulated firms such as Independent Financial Advisors (IFAs) and Wealth Managers.

The information is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice. VanEck (Europe) GmbH, VanEck Switzerland AG, VanEck Securities UK Limited and their associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results. Information provided by third party sources is believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Brokerage or transaction fees may apply.

VanEck Asset Management B.V., the management company of VanEck Video Gaming and eSports UCITS ETF (the "ETF"), a sub-fund of VanEck UCITS ETFs plc, is a UCITS management company incorporated under Dutch law and registered with the Dutch Authority for the Financial Markets (AFM). The ETF is registered with the Central Bank of Ireland, passively managed and tracks an equity index. Investing in the ETF should be interpreted as acquiring shares of the ETF and not the underlying assets.

Investors must read the sales prospectus and key investor information before investing in a fund. These are available in English and the KIIDs/KIDs in certain other languages as applicable and can be obtained free of charge at www.vaneck.com, from the Management Company or from the following local information agents:

Denmark, France, Germany, Luxembourg, Spain, Sweden - Facility Agent: VanEck (Europe) GmbH

Austria - Facility Agent: Erste Bank der oesterreichischen Sparkassen AG

Portugal - Paying Agent: BEST – Banco Eletrónico de Serviço Total, S.A.

UK - Facilities Agent: Computershare Investor Services PLC

MarketVector™️ Global Video Gaming & eSports ESG Index is the exclusive property of MarketVector Indexes GmbH (a wholly owned subsidiary of Van Eck Associates Corporation), which has contracted with Solactive AG to maintain and calculate the Index. Solactive AG uses its best efforts to ensure that the Index is calculated correctly. Irrespective of its obligations towards MarketVector Indexes GmbH (“MarketVector”), Solactive AG has no obligation to point out errors in the Index to third parties. The VanEck Video Gaming and eSports UCITS ETF (the “ETF”) is not sponsored, endorsed, sold or promoted by MarketVector and MarketVector makes no representation regarding the advisability of investing in the ETF.

Effective December 16, 2022 the MVIS Global Video Gaming and eSports Index has been replaced with the MarketVector™️ Global Video Gaming & eSports ESG Index.

It is not possible to invest directly in an index.

Performance quoted represents past performance. Current performance may be lower or higher than average annual returns shown.

Performance data for the Irish domiciled ETFs is displayed on a Net Asset Value basis, in Base Currency terms, with net income reinvested, net of fees. Returns may increase or decrease as a result of currency fluctuations.

Investors must be aware that, due to market fluctuations and other factors, the performance of the ETFs may vary over time and should consider a medium/long-term perspective when evaluating the performance of ETFs.

All performance information is based on historical data and does not predict future returns. Investing is subject to risk, including the possible loss of principal.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck

Important Disclosure

This is a marketing communication. Please refer to the prospectus of the UCITS and to the KID before making any final investment decisions.

This information originates from VanEck (Europe) GmbH, which has been appointed as distributor of VanEck products in Europe by the Management Company VanEck Asset Management B.V., incorporated under Dutch law and registered with the Dutch Authority for the Financial Markets (AFM). VanEck (Europe) GmbH with registered address at Kreuznacher Str. 30, 60486 Frankfurt, Germany, is a financial services provider regulated by the Federal Financial Supervisory Authority in Germany (BaFin).

The information is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice VanEck (Europe) GmbH, VanEck Switzerland AG, VanEck Securities UK Limited and their associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results. Information provided by third party sources is believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Brokerage or transaction fees may apply.

All performance information is based on historical data and does not predict future returns. Investing is subject to risk, including the possible loss of principal.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH / VanEck Asset Management B.V.

Sign-up for our ETF newsletter

Related Insights

Related Insights

20 November 2024

14 November 2024