Bitcoin Price Approaches All-Time-Highs as Demand Surges

03 December 2020

The price of bitcoin is undergoing a parabolic price rally. As bitcoin nears its all-time high—$19,800, reached on 17 December 2017—we took a closer look at how the current rally compares to the days leading up to its previous peak, and we believe that there are notable differences. While the 2017 bitcoin rally was driven by higher volumes, likely due to retail demand, the 2020 price rally so far has been driven by lower volume. We believe the 2020 rally is driven more by institutional allocation and that investing in bitcoin has become less speculative in nature, which indicates bitcoin’s increasing status as a store of value and suggests further potential adoption.

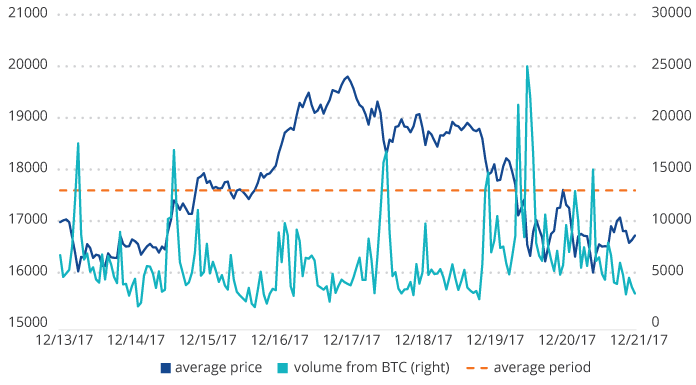

Bitcoin Price’s All-Time High—2017 and Now

We believe that an analytical framework focusing on volume-weighted average price is a good way to study past and future all-time-highs for bitcoin. We studied the hourly volume-weighted average prices four days before and four days after bitcoin reached its all-time-high of $19,800. The average price with the four-day buffer was $17,595.

Bitcoin Price Around 2017 Rally

Source: CryptoCompare. Data as of 24 November 2020.

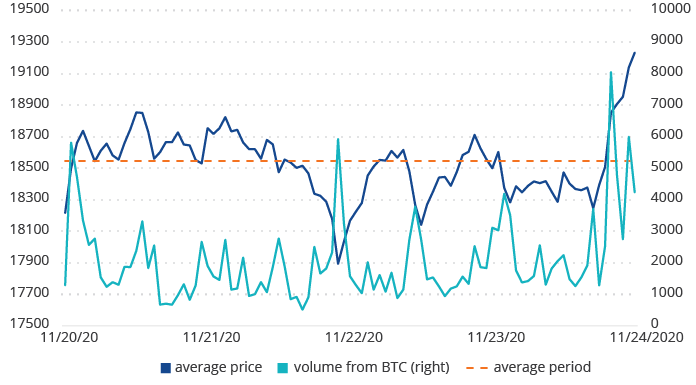

We then created a similar chart for 2020 using bitcoin price data for 24 November and the four days preceding. While bitcoin is getting close to its all-time-high, we remark that the four-day average price of $18,547 has already surpassed the comparable 2017 average of $17,595. While the volumes so far seem somewhat lower than in 2017, we believe that one may consider the 2020 November four-day average price a new all-time-high.

Bitcoin Price in Its 2020 Rally

Source: CryptoCompare. Data as of 24 November 2020.

We further note that in 2017, there were many trading platform outages around the all-time-high, and trading platforms were less scalable and mature. Therefore, we believe that the four-day average period approach is a suitable way to determine an all-time-high. In 2020, trading platforms, market integrity and execution capacity have generally evolved due to institutions entering the asset class and demanding higher quality services.

This Time Is Different: An Institutional Bitcoin Rally

We believe that the 2020 bitcoin price rally is likely more institutionally driven. There have been several significant institutional developments and adoption in bitcoin this year:

- On the regulatory front, the Office of the Comptroller of the Currency (OCC) published a letter in late July, clarifying the authority of national banks and federal savings associations to provide cryptocurrency custody services for customers. The OCC letter significantly de-risks interaction with digital assets for banks and institutions.1

- On the treasury front, a number of public and private companies started investing in bitcoin as an alternative to holding cash on their balance sheet. Microstrategy announced the purchase of 21,454 bitcoins at an aggregate purchase price of $250 million on 11 August 2020.2 On 8 October 2020, Square announced that it has purchased approximately 4,709 bitcoins at an aggregate purchase price of $50 million.3

- On the payments front, we note that the current rally is supported by PayPal’s launch of a new service enabling bitcoin and digital asset buying and selling to its network. PayPal services 26 million merchants and 346 million clients globally. SoFi, Robinhood and other major financial companies offer similar solutions. Banks are also looking to offer bitcoin exposure to compete with fintech offerings in order to retain and grow client-base.4

To conclude, we believe that the 2020 bitcoin price rally is institutional, rather than retail, driven. In our view, investing in bitcoin is now less speculative due to its increasing status as a store of value, and we believe that there is potential for further adoption.

We would like to thank Quynh Tran-Thanh and Jimena Leon from CryptoCompare for the data and discussion on the matter.

1Source: https://www.occ.gov/news-issuances/news-releases/2020/nr-occ-2020-98.html

3Source: https://squareup.com/us/en/press/2020-bitcoin-investment

Important Disclosure

For informational and advertising purposes only.

This information originates from VanEck (Europe) GmbH, Kreuznacher Straße 30, 60486 Frankfurt am Main. It is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice. VanEck (Europe) GmbH and its associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. Views and opinions expressed are current as of the date of this information and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. VanEck makes no representation or warranty, express or implied regarding the advisability of investing in securities or digital assets generally or in the product mentioned in this information (the “Product”) or the ability of the underlying Index to track the performance of the relevant digital assets market.

The underlying Index is the exclusive property of MV Index Solutions GmbH, which has contracted with CryptoCompare Data Limited to maintain and calculate the Index. CryptoCompare Data Limited uses its best efforts to ensure that the Index is calculated correctly. Irrespective of its obligations towards the MV Index Solutions GmbH, CryptoCompare Data Limited has no obligation to point out errors in the Index to third parties.

Investing is subject to risk, including the possible loss of principal up to the entire invested amount. You must read the prospectus and KID before investing. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

Investments into the Product bear the risk of loss up to the total loss.

© VanEck (Europe) GmbH.

Important Disclosure

This is a marketing communication. Please refer to the prospectus of the UCITS and to the KID before making any final investment decisions.

This information originates from VanEck (Europe) GmbH, which has been appointed as distributor of VanEck products in Europe by the Management Company VanEck Asset Management B.V., incorporated under Dutch law and registered with the Dutch Authority for the Financial Markets (AFM). VanEck (Europe) GmbH with registered address at Kreuznacher Str. 30, 60486 Frankfurt, Germany, is a financial services provider regulated by the Federal Financial Supervisory Authority in Germany (BaFin).

The information is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice VanEck (Europe) GmbH, VanEck Switzerland AG, VanEck Securities UK Limited and their associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results. Information provided by third party sources is believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Brokerage or transaction fees may apply.

All performance information is based on historical data and does not predict future returns. Investing is subject to risk, including the possible loss of principal.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH / VanEck Asset Management B.V.

Sign-up for our ETF newsletter

Related Insights

Related Insights

27 November 2024

27 November 2024

07 November 2024

05 November 2024