Education Center

Gain an understanding of Bitcoin and digital assets and their role within a portfolio.

Your Questions Answered

1 - 3 of 14

Natural Resources

October 23, 2024

NLR ETF: Question & Answer

This blog answers commonly asked questions about the NLR ETF and explores how the global shift towards clean energy is impacting the uranium and nuclear energy industries.

Thematic Investing

September 05, 2024

ESPO ETF: Question & Answer

The Q&A blog outlines the criteria for ESPO ETF inclusion, the growth outlook for the video game and eSports sector, potential challenges, projected market expansion, and key trends.

Thematic Investing

July 16, 2024

SMH ETF: Question & Answer

Semiconductors are the unsung conductors orchestrating everything digital. This important sector also boasts an added advantage: the sturdy governmental backing of the U.S.'s CHIPS Act.

Emerging Market Equity

April 16, 2024

GLIN ETF: Question & Answer

VanEck India Growth Leaders ETF (GLIN) seeks to replicate an all-cap index that selects fundamentally strong Indian firms with attractive growth potential at reasonable prices.

Income Investing

August 07, 2023

PFXF ETF Q&A: Understanding Preferred Securities

This blog answers commonly asked questions about the PFXF ETF and explores why Preferred Securities are becoming a preferred alternative income source among investors.

Moat Investing

October 13, 2022

SMOT ETF: Question & Answer

Given the large small- and mid-cap stock universe and lack of analyst coverage, we believe a more selective approach may be a better choice than a broad-market exposure. We explore in this Q&A.

Model Portfolios

September 14, 2022

Inflation Allocation ETF (RAAX): Question & Answer

Allocating to real assets is one way that investors can position their portfolios for a prolonged inflationary environment.

Gold Investing

August 04, 2022

GDX and GDXJ ETF: Question and Answer

Gold mining stocks are one way for investors to gain exposure to gold. We take a closer look at the key considerations around this approach.

Natural Resources

April 05, 2022

MOO ETF: Question & Answer

Demand for food and agricultural products is growing. Here we address frequently asked questions about agribusiness and VanEck’s Agribusiness ETF (MOO).

Natural Resources

February 08, 2022

OIH ETF: Question & Answer

Oil remains crucial to the economy, providing fuel and the core ingredients for petrochemicals. We address frequently asked questions on oil services companies and VanEck’s Oil Services ETF.

Income Investing

February 01, 2022

FLTR ETF: Question & Answer

Unlike other bonds which typically pay a fixed coupon, floating rate notes (or "FRNs") pay a coupon that adjusts periodically with prevailing interest rates.

Emerging Market Equity

December 14, 2021

CNXT ETF: Question & Answer

China’s economy is undergoing a shift to focus more on consumer-driven, "new economy" sectors and reduce its dependence on imports.

Income Investing

December 02, 2021

GRNB ETF: Question & Answer

Green bonds can help investors build sustainable core fixed income portfolios without significantly impacting risk and return.

Income Investing

October 18, 2021

ANGL ETF: Question & Answer

Your frequently asked questions on fallen angel bonds and VanEck's Fallen Angel High Yield Bond ETF (ANGL) answered.

Investment Outlook

18 February 2020

ETF 101: Understanding ETFs In Simple Terms

Investment Outlook

18 February 2020

ETF 102: Why ETFs Layer Up On Liquidity

Investment Outlook

18 February 2020

ETF 103: Does Your ETF Have High Standards?

Investment Outlook

19 February 2020

ETF 104: Trade ETFs Intelligently

Investment Outlook

19 February 2020

ETF 105: Wrap Your Fixed Income in an ETF

Investment Outlook

05 March 2021

ETF 106: Debunking Myths About Fixed Income ETFs

Thematic Investing

13 SEPTEMBER 2022

ETF 107: Passive vs. Active ETFs Explained

Thematic Investing

March 21, 2025

Semiconductor Industry Updates: AI Thrills and Geopolitical Spills

AI-driven growth remains strong for the semiconductor industry, led by NVIDIA, Micron, and Intel. However, geopolitical tensions are reshaping supply chains, as seen in TSMC’s Arizona expansion.

Investment Outlook

January 3, 2025

RSX / RSXJ Liquidation FAQ

Income Investing

January 22, 2025

Elevated Yields Spark Fallen Angels' Appeal

A BDC downgrade last month may be the beginning of a new sector theme, though downgrades in 2025 are largely expected to be idiosyncratic.

Gold Investing

March 6, 2025

Dollar’s Trouble Could Be Gold’s Triumph

Gold continued to make new highs in February; a crisis of confidence in the U.S. dollar may drive gold prices higher than expected.

Moat Investing

March 26, 2025

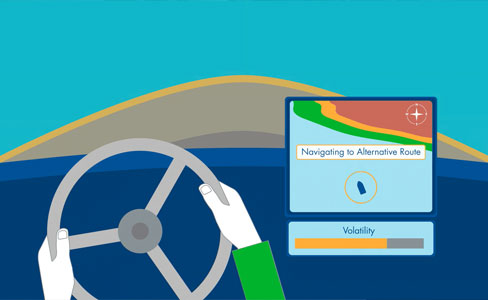

Moat Index Adds Tech as Volatility Reveals Value

Tech headlined the Moat Index’s March review, as six of the nine additions came from the sector, showcasing how volatility can create opportunities to find misvalued, high quality companies.

Upcoming Webinar

Moat Investing

Market Wake-Up Call: Diversify Your Core Equity Exposure

- Current portfolio characteristics that set the moat suite apart in today’s choppy markets

- Moat companies’ investment thesis and current valuations

- Live Q&A with Morningstar’s equity research team

Speakers:

-

Brandon RakszawskiDirector of Product Management

-

Andrew LaneDirector of Equity Research – Morningstar Research Services LLC

Trends with Benefits #132: Unlocking the VC Secondary Market

Explore how VC secondary markets are transforming venture capital, what’s fueling their growth and how they are creating new opportunities for investors.

Get More from VanEck

Don’t settle for the conventional. Dare to be different.

Jan van Eck, CEO

Through forward-looking, intelligently designed active and ETF solutions, VanEck offers value-added exposures to emerging industries, asset classes and markets as well as differentiated approaches to traditional strategies. We think beyond the financial markets to identify the trends—including economic, technological, political and social—that we believe will fuel investable opportunities.