How Many Baskets For Your Eggs?

12 May 2020

Do not put all your eggs in one basket, as the saying goes. In other words: do not invest all your money in a single stock (or single bond), but diversify it over a broader portfolio. That brings up the question: how many securities is enough to diversify? The question is all the more relevant in the current volatile market environment. Should it be five stocks, 20, 100 or 2,000?

In academia often the rule of thumb is given that one needs no more than 30 stocks in a portfolio, provided that they are well diversified over countries and sectors. But not everyone agrees.

The proof of the pudding is in the eating, so let’s test it ourselves. As a universe, we take all the 250 stocks that are in our VanEck Global Equal Weight UCITS ETF. We will then analyze how the volatility of a portfolio evolves, based on the number of stocks taken from that universe.

But first let’s define volatility. Basically it is a risk measure that shows how much percent a portfolio moved up or down per year in the past1.

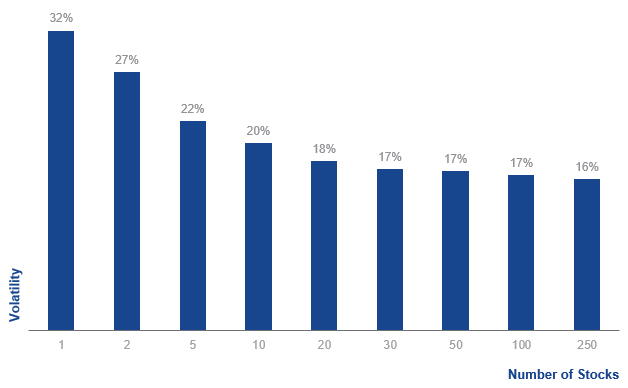

In the following figure we plot on the horizontal axis the number of stocks in the portfolio and on the vertical axis the volatility. What can be seen is that going from one stock to two stocks strongly reduces volatility. The same holds for going from two to five stocks. However, from five to ten the impact reduces. Eventually, the curve flattens at 30 stocks, meaning that adding still more stocks to a portfolio hardly brings any benefits from a diversification point of view. So the academics are right!

Figure 1 – Volatility falls as the number of stocks rises

Historical returns are not a reliable indicator for future returns. Source: VanEck analysis. Each data point if based on the full universe of the VanEck Global Equal Weight UCITS ETF. I.e., the average volatility of 32% for a one-stock portfolio is the median volatility of all 250 stocks in the universe. The average volatility of 27% for a two-stock portfolio is the median volatility of 124 combinations in the universe, etc. Data for the period 1/1/2000 - 28/4/2020.

So how can you reduce your volatility still further? Add bonds! Bonds are far less volatile than stocks and their prices tend to move in the opposite direction of share prices. As a result, they allow to reduce the overall portfolio’s volatility further.

We can see the results in figure 2. The horizontal axis plots the share of bonds in a portfolio. Everything else is invested in stocks. So, when bonds are zero, then the portfolio consists entirely of stocks. The resulting graph confirms the diversifying effect of bonds.

Figure 2 – Adding bonds cuts volatility even more

Historical returns are not a reliable indicator for future returns. Source: VanEck analysis. Stocks are represented by the VanEck Global Equal Weight UCITS ETF. Bonds are represented by the VanEck iBoxx EUR Sovereign Diversified 1-10 UCITS ETF. Data for the period 1/1/2012 - 28/4/2020.

For those who prefer not to spend too much time on counting stocks, they can simply invest in our ETFs. The following table shows that all our regional equal weight equity ETFs are well diversified:

| ETF | Number of Stocks |

| VanEck Global Equal Weight UCITS ETF | 250 |

| VanEck Sustainable World Equal Weight UCITS ETF | 250 |

| VanEck European Equal Weight UCITS ETF | 100 |

| VanEck Morningstar North America Equal Weight UCITS ETF | 100 |

And for those who prefer not to figure out the optimal mix between stocks, bonds and other asset classes, we provide the VanEck Multi-Asset Allocation ETFs. These invest in equities, sovereign bonds, corporate bonds and real estate stocks. You can choose from conservative, balanced and growth variants, depending on how much risk you want to take. Both volatility and return are lower for the conservative version and higher for the growth version, as the table below shows.

| ETF | Asset Mix | Volatility | Annualized Return |

| VanEck Multi-Asset Conservative Allocation UCITS ETF | 25% equities 5% real estate stocks 35% corporate bonds 35% sovereign bonds |

5.6% | 3.4% |

| VanEck Multi-Asset Balanced Allocation UCITS ETF | 40% equities 10% real estate stocks 25% corporate bonds 25% sovereign bonds |

9.7% | 4.0% |

| VanEck Multi-Asset Growth Allocation UCITS ETF | 60% equities 10% real estate stocks 15% corporate bonds 15% sovereign bonds |

14.1% | 4.5% |

Historical returns are no reliable indicator for future returns. Returns are total returns based on gross dividends reinvested. Source: VanEck. Data since inception of the ETFs (14/12/2009) – 27/4/2020.

Of course, if ever there was a time that shows the wisdom of spreading your eggs across many baskets, it’s today. 2020 experienced the fastest fall in equity prices ever as the pandemic spread. But diversification cushioned the falls in portfolios. Looking to the future, there will come a time when today’s crisis no longer dominates headlines. But then, too, diversification will smooth your investment returns.

1To be exact: volatility is defined as the standard deviation of daily returns times the square root of the number of trading days in a year. Provided that historical volatility is a reliable measure for the feature: 68% of future expected returns over a one-year time period should remain within the expected return plus or minus one times the volatility. 95% of future returns should lie within the expected return plus or minus two times the volatility.

Fund-specific Disclosure

The promoted funds (“Funds”) are sub-funds of VanEck ETFs N.V., an investment scheme which is registered in the Netherlands and subject to the European regulation of collective investment schemes under the UCITS Directive. The Funds are registered for distribution in Denmark, Germany, Italy, the Netherlands, Sweden and UK.

The Sales Prospectus, the Key Investor Information Document (KID), the Articles of Association and the latest annual and semi-annual reports are available free of charge from www.vaneck.com or can be obtained from the Management Company VanEck Asset Management B.V. or from the following agents, contact details of whom to be found on www.vaneck.com:

UK (Facilities Agent): Computershare Investor Services PLC

Germany (Information Agent): VanEck (Europe) GmbH

Sweden (Paying Agent): Skandinaviska Enskilda Banken AB (publ)

VanEck Global Equal Weight UCITS ETF, VanEck Sustainable World Equal Weight UCITS ETF, VanEck European Equal Weight UCITS ETF and VanEck Morningstar North America Equal Weight UCITS ETF are registered UCITS funds that track an equity index. The VanEck Multi-Asset Conservative, Balanced and Growth Allocation UCITS ETFs are registered UCITS funds that track a combination of equity and bond indices. VanEck iBoxx EUR Sovereign Diversified 1-10 UCITS ETF is a registered UCITS fund that tracks a bond index. The value of an ETF's assets may fluctuate widely as a result of its investment policy. If the underlying index falls in value, the ETF also falls in value.

Belangrijke kennisgeving

Uitsluitend voor informatie- en advertentiedoeleinden.

Deze informatie is afkomstig van VanEck (Europe) GmbH. VanEck (Europe) GmbH is aangesteld als distributeur van VanEck-producten in Europa door VanEck Asset Management B.V., een beheermaatschappij onder Nederlands recht en geregistreerd bij de Nederlandse Autoriteit Financiële Markten (AFM). VanEck (Europe) GmbH, met als vestigingsadres Kreuznacher Str. 30, 60486 Frankfurt, Duitsland, is een financiële dienstverlener die onder toezicht staat van BaFin, de Duitse toezichthouder voor de financiële markten. De informatie is uitsluitend bedoeld om beleggers te voorzien van algemene en voorlopige informatie en mag niet worden opgevat als beleggings-, juridisch of fiscaal advies. VanEck (Europe) GmbH en de aan VanEck (Europe) GmbH verbonden en gelieerde bedrijven (samen "VanEck") wijzen elke aansprakelijkheid van de hand met betrekking tot beslissingen die de belegger op basis van deze informatie neemt ten aanzien van het kopen, verkopen of aanhouden van beleggingen. De visies en meningen die hier worden gegeven, zijn die van de auteur(s) en komen niet noodzakelijkerwijs overeen met die van VanEck. De meningen zijn actueel op de datum van publicatie en kunnen worden aangepast op basis van veranderende marktomstandigheden. Bepaalde verklaringen in deze bijdrage kunnen ramingen, voorspellingen en andere op de toekomst gerichte verklaringen zijn die niet overeenkomen met de werkelijkheid. Wij achten de informatie die afkomstig is van derden, betrouwbaar. Deze informatie is echter niet onafhankelijk gecontroleerd. De nauwkeurigheid en volledigheid ervan kunnen daarom niet worden gegarandeerd. Alle indices die worden vermeld, zijn maatstaven voor het vergelijken van algemene marktsectoren en rendementen. Het is niet mogelijk om rechtstreeks in een index te beleggen.

Alle rendementsgegevens hebben betrekking op het verleden en bieden geen garantie voor toekomstige resultaten. Beleggen brengt risico's met zich mee, waaronder mogelijk verlies van de hoofdsom. Lees het prospectus en de essentiële beleggersinformatie voordat u gaat beleggen.

Niets in dit materiaal mag in welke vorm dan ook worden verveelvoudigd en er mag ook niet naar worden verwezen in andere publicaties zonder de uitdrukkelijke schriftelijke toestemming van VanEck.

© VanEck (Europe) GmbH

Gerelateerde inzichten

16 januari 2025

16 januari 2025

16 januari 2025

15 januari 2025