Gold Reestablishes Its Brilliance

26 June 2019

Breaking Through the Ceiling

We have talked frequently about the fundamental and technical importance of the $1,365 per ounce level for gold, which has roughly been the top of its trading range for the past six years. Last week gold spiked above $1,400/oz—a move driven by a change in the U.S. Federal Reserve's (Fed’s) outlook that increases the chances for a series of rate cuts to stimulate both the economy and inflation.

Gold Price, 2008 to 2019

Source: Bloomberg. Data as of June 2019.

The Fed update came on the heels of the European Central Bank's comments earlier last week indicating that rate cuts are also on the table in Europe. U.S. Treasury rates have fallen to new intermediate-term lows, while the U.S. dollar has also dropped to the low end of its recent trading range.

A New Gold Bull Market?

If gold holds above the $1,400/oz trading level over the course of this week, we believe there is a very good chance that this could mark the beginning of a new gold bull market. In any case, it appears gold has entered a higher trading range.

The shift in central bank policies denotes a change in the macroeconomic environment that brings new levels of risk to the financial system. Central banks see a downturn coming. However, many investors believe they have limited ability to fight a recession with U.S. interest rates already at 2% and European interest rates below 0%. In addition, quantitative easing has lost its efficacy. Layer on global trade and geopolitical tensions, and it is not hard to imagine a "flight to safety" that moves gold much higher.

The U.S. stock market’s blind faith in the Fed's policies is pushing the market back to its highs. This makes the market vulnerable to weak economic news or any signs that indicate the Fed is unable to curtail a downturn. We believe any stock market selloffs should further propel gold as investors move away from risk.

Gold Stocks Regaining Their Luster

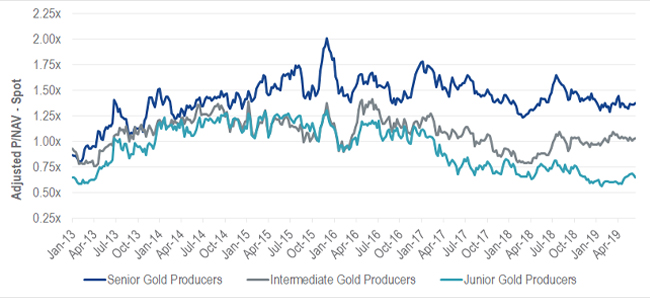

The range-bound gold market of the past six years has brought a lack of interest in gold stocks. As a result, gold stocks are trading at low valuations and many mid-tier and junior stocks are carrying deep discounts. If we are correct in calling for a stronger gold market, we expect the equities to significantly outperform bullion. Gold companies carry earnings leverage to rising gold prices that should receive an additional value boost as positive sentiment returns to the sector.

Price-to-Net-Asset-Value of North American Gold Producers (at Gold Spot Price)

Source: RBC Capital Markets. Data as of June 2019.

Important Disclosure

This is a marketing communication. Please refer to the prospectus of the UCITS and to the KID before making any final investment decisions.

This information originates from VanEck (Europe) GmbH, which has been appointed as distributor of VanEck products in Europe by the Management Company VanEck Asset Management B.V., incorporated under Dutch law and registered with the Dutch Authority for the Financial Markets (AFM). VanEck (Europe) GmbH with registered address at Kreuznacher Str. 30, 60486 Frankfurt, Germany, is a financial services provider regulated by the Federal Financial Supervisory Authority in Germany (BaFin).

The information is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice VanEck (Europe) GmbH, VanEck Switzerland AG, VanEck Securities UK Limited and their associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results. Information provided by third party sources is believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Brokerage or transaction fees may apply.

All performance information is based on historical data and does not predict future returns. Investing is subject to risk, including the possible loss of principal.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH / VanEck Asset Management B.V.

Sign-up for our ETF newsletter

Related Insights

14 February 2025

20 January 2025

18 December 2024

18 November 2024

15 October 2024