The NFT Game That’s Almost 5% of DraftKings’ Earnings

02 September 2023

TLDR:

- Over the next four quarters, we estimate DraftKing’s Reignmakers franchise (an NFT-based fantasy sports game on Polygon) can generate $70M+ in high-margin revenues, accounting for 3% of DraftKing’s top line and 5% of 2022 full-year profits.

- In their inaugural year, NFL, PGA, and UFC Reignmakers games collectively generated $52 million in revenue for DraftKings, representing 2% of DKNG's top line over the same period.

- DraftKings' Reignmakers introduced their 2023 NFL collection on August 8th, marking the second year of production.

- Reignmakers' success showcases the advantages of minimizing blockchain components within a game, enabling developers to target wider audiences while optimizing economic factors, such as marketplace fees.

- DraftKings strategically prioritized fantasy sports, leveraging existing user passion to enhance game enjoyment and user benefits without the need for extensive creation of valuable IP.

Intro

As enthusiasts and developers eagerly anticipated the marriage of blockchain technology with gaming, the initial results have left many questioning its feasibility. Concerns surrounding scalability, user experience, and the complexities of integrating blockchain have cast shadows over the potential success of Web3 games. However, amidst this atmosphere of uncertainty, DraftKings Reignmakers has emerged as an example that not only navigates these challenges but also redefines the path to success. With over 2 million unique monthly paying customers, DraftKings utilizes its platform to streamline sports bettors and avid fantasy sports fans into seasonal Reignmakers gaming products. By removing direct blockchain interaction, DraftKings made it exceptionally easy for their growing user base to participate in their new, NFT-enabled fantasy sports games.What is Reignmakers?

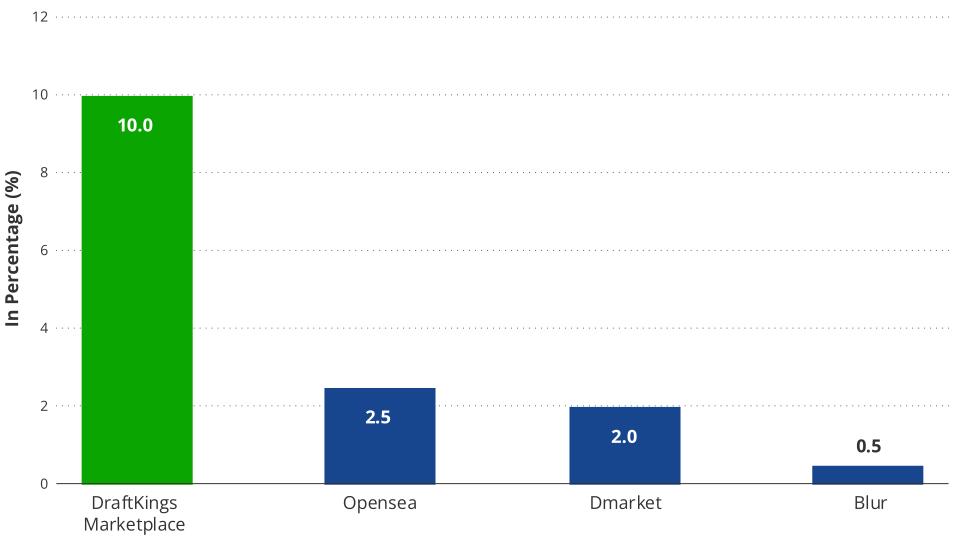

Reignmakers by DraftKings merges card collecting with fantasy sports, using NFTs on the Polygon blockchain. While the DraftKings website does provide info on what NFTs are and how to send them to your Web3 wallet, there is no mention of blockchains, NFTs, or any other crypto jargon in their advertising. Cards are acquired via purchasing packs or on the DraftKings Marketplace and used to create athlete lineups, competing for rewards. Reignmakers’ NFL variant has outperformed their UFC and PGA versions due to a consistent schedule and broader card selection, fostering diverse contests and an engaged user base. All payments are made with a credit/debit card or DK dollars if the user already has an account, simplifying the purchasing process to just a few familiar clicks. DraftKings offers card packs priced from $20 to $2,999.99, driving revenue through primary sales and a 10% fee levied on marketplace transactions. Reignmakers facilitated about $170 million of secondary sales1 in its first year of operation, generating $17 million in revenue. These secondary sales accounted for ~33% of Reignmakers' total first-year revenue and approximately 0.8% of DKNG top line over the same period.Industry Data

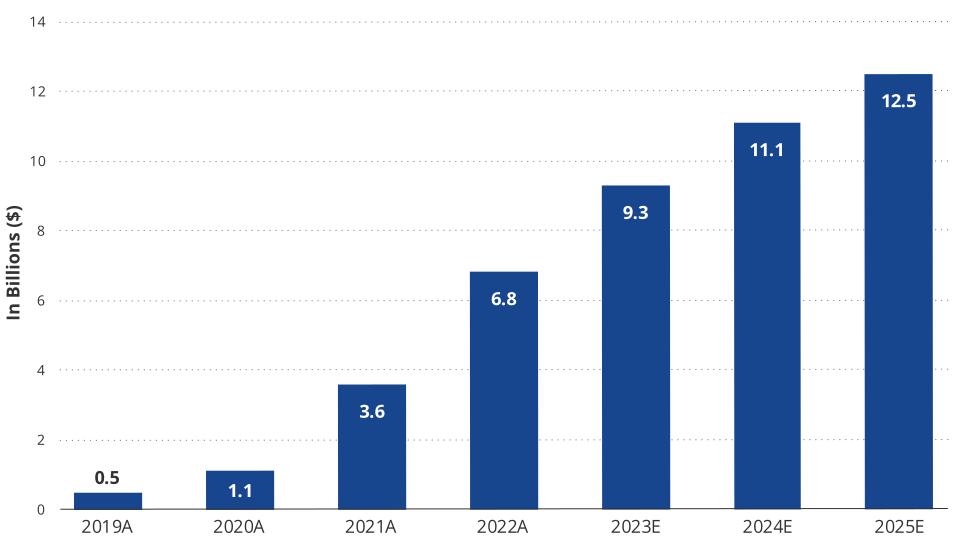

The U.S. online sports betting (OSB) gross gaming revenue grew from $0.5 billion in 2019 to $6.8 billion in 2022, representing a 139% CAGR2. Despite the massive growth, in-game betting has only achieved ~15-35% penetration in U.S. markets versus the 70-80% average in European markets3. Under a bullish scenario, penetration of in-game OSB within the United States could reach ~50% over the coming years, driving an estimated 25% increase in the OSB TAM2. The expected increase can be attributed to the frequent breaks in action during popular American sports like Football and Basketball, providing a favorable environment for in-game betting opportunities2. The increasing prevalence of in-game betting augurs favorably for Draftkings’ Reignmakers, enabling them to harness this flourishing market by introducing in-game contests and innovative betting options centered around player inventories.U.S. Online Sports Betting Gross Gaming Revenue

Source: Stifel Research as of 1/23/2023.

As the #2 player in the U.S. by gross gaming revenue, with an existing user base of over 6 million paying customers through its sportsbook, casino, and daily fantasy sports verticals2, we see DraftKings as well-positioned to re-invest some of their scale advantage into a new, NFT-based business line that is likely accretive to DKNG’s gross margins, which have declined 500bps to 39% since the company went public. Additionally, Reignmakers contests are purposefully designed so that they aren’t pay-to-win. While more expensive cards can allow players to enter more contests or higher-paying contests, winning is still mainly dependent upon the player's knowledge of sports and their skill in choosing successful lineups for each contest. This ensures that the user experience for casual players isn’t significantly affected by the fact that they aren’t willing to spend as much as power users.

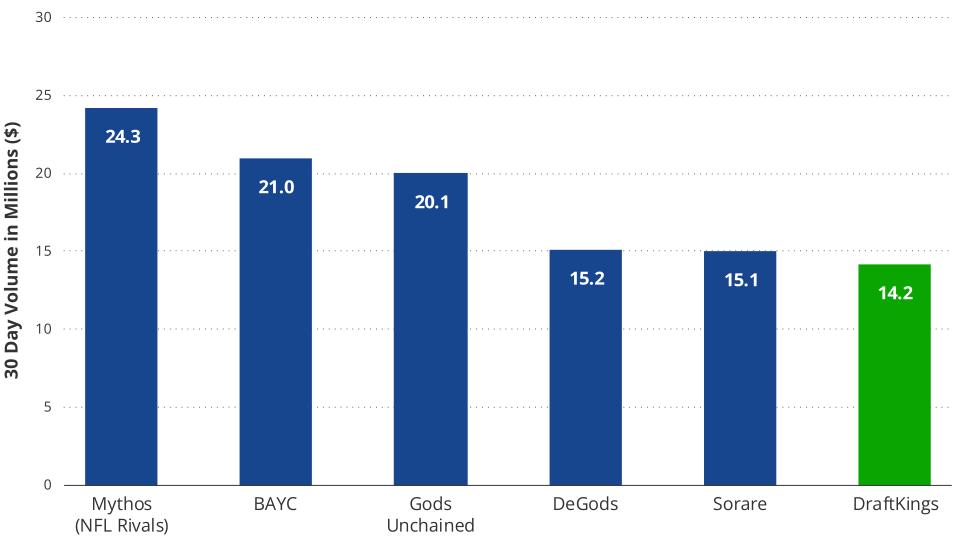

In contrast to other games and the broader NFT market, Reignmakers uniquely benefits from an inherent value proposition tied to its cards. Users can readily assess the value of these cards based on their potential to enhance competitive outcomes. This intrinsic link between card utility and competition success sets Reignmakers apart, facilitating a more tangible understanding of NFT worth. Notably, sports-oriented NFTs consistently maintain high standings in NFT collection sales rankings on Cryptoslam!. Unlike games that require novel storylines to entice players, Reignmakers, Sorare, and NFL Rivals leverage established sports interests, resonating with a broader audience. Partnering with existing, evergreen IP derived from live sports eliminates the challenge of generating interest from scratch, ensuring relevance and appeal.

Sports NFTs Represent 50% of Top 6 Collections by 30 Day Sales

Source: VanEck Research, Cryptoslam! as of 8/18/23.

NFT Marketplace Fees

Source: VanEck Research as of 8/24/2023.

Revenue & Impact to Top-Line

DraftKings generates revenue from Reignmakers through both primary sales and a 10% fee on secondary transactions. While this fee is higher compared to OpenSea and Blur's 2.5% and 0.5% fees, its impact is mitigated by Reignmakers' distinct nature. Unlike speculative NFT assets, Reignmakers serve a dual purpose as NFTs are used for competitive endeavors, such as vying for cash prizes. This sets it apart from traditional NFT trading, where speculation and profit are paramount, forcing marketplace fee compression. This difference in utility renders marketplace fees less profound, as the focus remains on enhancing the competitiveness of fantasy teams.Furthermore, Reignmakers' design caters to mainstream sports enthusiasts, not crypto-savvy individuals. This strategic alignment allowed DraftKings to build its platform to target the 63 million global fantasy sports players4 and avoid competition with the on-chain low-fee NFT marketplaces. This approach contrasts with the 5 million on-chain users that most Web3 games end up targeting due to including too many blockchain elements.

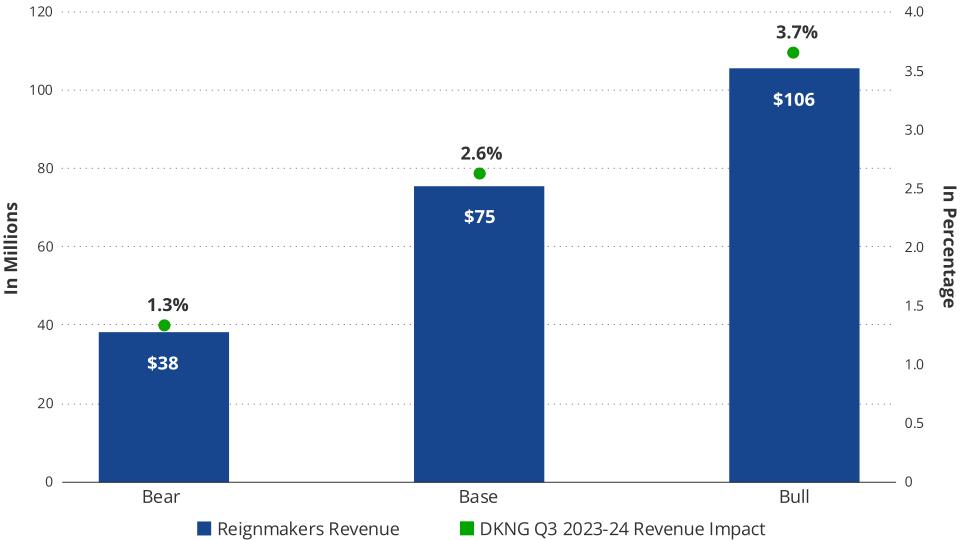

2023 Reignmakers Revenue Estimate

Source: VanEck Research as of 8/24/2023.

According to our base case, from Q3 ‘23 to Q3 ‘24, we estimate that DKNG’s Reignmakers franchise could generate over $75m in revenue. In our model, we assume Reignmakers sells all play-action card packs for each sport and generates $50m/$300m/$500m in secondary transaction volume for the bear/base/bull scenarios. With DraftKings taking a 10% fee on all secondary transactions, our base case indicates that Reignmakers’ revenue could drive just over 3% of DKNG’s top line. While we don’t have access to the data showing the cost of this revenue, we assume the margins to be about 90% as there is basically no cost of production, and customer acquisition costs can be mitigated via cross-selling opportunities. In our base case, we estimate that the profits from the Reignmakers business line could boost DKNG EPS by ~$0.15, representing 5% of their 2022 EPS of -$3.16.

Conclusion

While Reignmakers doesn't fully embody the decentralized values crypto-enthusiasts desire from Web3 games, we think it’s a step closer to finding the happy medium for blockchain integration in games. Suppose Web3-enabled games continue to burden users with interacting with the blockchain. In that case, they will continue to appeal to only crypto users, with a small chance of capturing a significant portion of traditional gamers. However, if game developers focus on building Web3-integrated games for existing fanbases (such as sports) and utilize platforms where all blockchain interaction is entirely abstracted, Web3 games could drive many users on-chain without them knowing. In its current form, Reignmakers isn't likely to drive significant on-chain activity due to its limited interaction with the blockchain. This ensures that the underlying tech doesn’t complicate user experience and also opens the door for deeper integration with decentralized systems as the user experience on blockchains improves. If Reignmakers moved more of their game mechanics to the blockchain, such as requiring contest lineups to be posted to the chain before starting, it could materially impact gas usage over time.To receive more Digital Assets insights, subscribe for our Crypto Newsletter

Important Information

This is not financial research but the opinion of the author of the article. We publish this information to inform and educate about recent market developments and technological updates, not to give any recommendation for certain products or projects. The selection of articles should therefore not be understood as financial advice or recommendation for any specific product and/or digital asset. We may occasionally include analysis of past market, network performance expectations and/or on-chain performance. Historical performance is not indicative for future returns.

For informational and advertising purposes only.

This information originates from VanEck (Europe) GmbH, Kreuznacher Straße 30, 60486 Frankfurt am Main. It is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice. VanEck (Europe) GmbH and its associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. Views and opinions expressed are current as of the date of this information and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. VanEck makes no representation or warranty, express or implied regarding the advisability of investing in securities or digital assets generally or in the product mentioned in this information (the “Product”) or the ability of the underlying Index to track the performance of the relevant digital assets market.

The underlying Index is the exclusive property of MarketVector Indexes GmbH, which has contracted with CryptoCompare Data Limited to maintain and calculate the Index. CryptoCompare Data Limited uses its best efforts to ensure that the Index is calculated correctly. Irrespective of its obligations towards the MarketVector Indexes GmbH, CryptoCompare Data Limited has no obligation to point out errors in the Index to third parties.

Investing is subject to risk, including the possible loss of principal up to the entire invested amount and the extreme volatility that ETNs experience. You must read the prospectus and KID before investing, in order to fully understand the potential risks and rewards associated with the decision to invest in the Product. The approved Prospectus is available at www.vaneck.com . Please note that the approval of the prospectus should not be understood as an endorsement of the Products offered or admitted to trading on a regulated market.

Performance quoted represents past performance, which is no guarantee of future results and which may be lower or higher than current performance.

Current performance may be lower or higher than average annual returns shown. Performance shows 12 month performance to the most recent Quarter end for each of the last 5yrs where available. E.g. '1st year' shows the most recent of these 12-month periods and '2nd year' shows the previous 12 month period and so on. Performance data is displayed in Base Currency terms, with net income reinvested, net of fees. Brokerage or transaction fees will apply. Investment return and the principal value of an investment will fluctuate. Notes may be worth more or less than their original cost when redeemed.

Index returns are not ETN returns and do not reflect any management fees or brokerage expenses. An index’s performance is not illustrative of the ETN’s performance. Investors cannot invest directly in the Index. Indices are not securities in which investments can be made.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH

Important Disclosure

This is a marketing communication. Please refer to the prospectus of the UCITS and to the KID before making any final investment decisions.

This information originates from VanEck (Europe) GmbH, which has been appointed as distributor of VanEck products in Europe by the Management Company VanEck Asset Management B.V., incorporated under Dutch law and registered with the Dutch Authority for the Financial Markets (AFM). VanEck (Europe) GmbH with registered address at Kreuznacher Str. 30, 60486 Frankfurt, Germany, is a financial services provider regulated by the Federal Financial Supervisory Authority in Germany (BaFin).

The information is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice VanEck (Europe) GmbH, VanEck Switzerland AG, VanEck Securities UK Limited and their associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results. Information provided by third party sources is believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Brokerage or transaction fees may apply.

All performance information is based on historical data and does not predict future returns. Investing is subject to risk, including the possible loss of principal.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH / VanEck Asset Management B.V.

Sign-up for our ETF newsletter

Related Insights

16 January 2025

27 November 2024

27 November 2024

07 November 2024