EM Rate Hikes – Success?

05 April 2023

Read Time 2 MIN

Case for EM Bonds

Emerging markets (EM) central banks’ independence and early (credible) responses to the post-pandemic inflation spike boosted EM real yields and carry, supporting the fundamental case for EM bonds and helping to shield them from recent market turbulence in developed markets (DM). EM’s disinflation progress keeps the pivot hopes alive, but for now most central banks prefer to stay vigilant. And often this means an extended pause – like in the case of the Chilean central bank yesterday (higher rates for longer), or Poland’s national bank this morning.

EM Disinflation

The latest inflation prints in Mexico, Colombia and the Philippines show why many central banks are cautious – even though headline inflation has clearly peaked, core price pressures are much more persistent. Mexico’s core inflation slowed less than expected in March – staying above 8% year-on-year – and services inflation continued to accelerate. Core inflation in Colombia and the Philippines was also in “lift-off” mode – the latter reached a new high since March 1999, leaving room for a small “farewell” rate hike. The market expects to have more clarity on these issues in three to six months, which explains the timing of priced-in “inaugural” EM rate cuts. A comment from Poland’s central bank Governor Adam Glapinski also drew attention to the disinflationary impact of stronger EM currencies, which might help to bring easing forward in some countries.

Global Growth Outlook

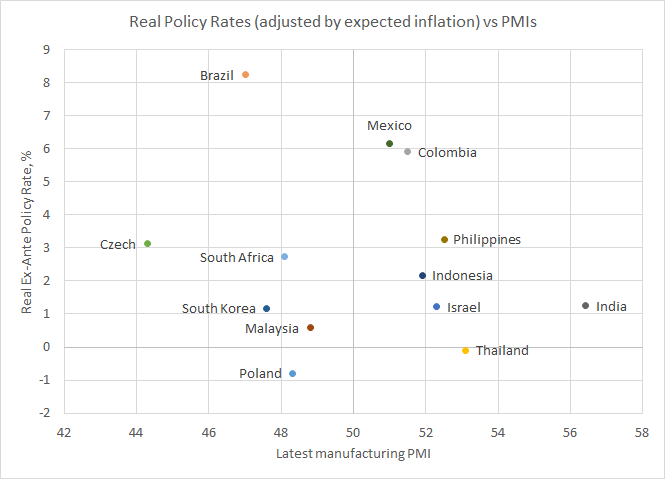

As more EMs are exiting their tightening cycle, the attention is shifting to the impact of high real interest rates on growth. The chart below plots real policy rates against the latest activity gauges – and it shows that bringing inflation down can come at a price, as domestic demand slows. The updated World Economic Outlook – released by the IMF this morning – reminded that there are additional considerations here, such as the increasingly complicated global backdrop. The report talks about the impact of geopolitical tensions and geo-economic fragmentations, which can “reshape the geography of foreign direct investments”, especially in strategic sectors. Some EMs will be winners in this brave new world – but some can become more vulnerable. Stay tuned!

Chart at a Glance: EM Rate Hikes and Domestic Activity Gauges

Source: Bloomberg LP.

Related Insights

IMPORTANT DEFINITIONS & DISCLOSURES

This material may only be used outside of the United States.

This is not an offer to buy or sell, or a recommendation of any offer to buy or sell any of the securities mentioned herein. Fund holdings will vary. For a complete list of holdings in VanEck Mutual Funds and VanEck ETFs, please visit our website at www.vaneck.com.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Information provided by third-party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as of the date of this communication and are subject to change without notice. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment in any jurisdiction, nor is it a commitment from Van Eck Associates Corporation or its subsidiaries to participate in any transactions in any companies mentioned herein. This content is published in the United States. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed herein.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.