The Future of Streaming is… TV?

12 September 2022

Share with a Friend

All fields required where indicated (*)Entertainment is a well-established area of our smart homes, but as the number of streaming services increases, the offer has grown too big, too expensive and too complicated to navigate.

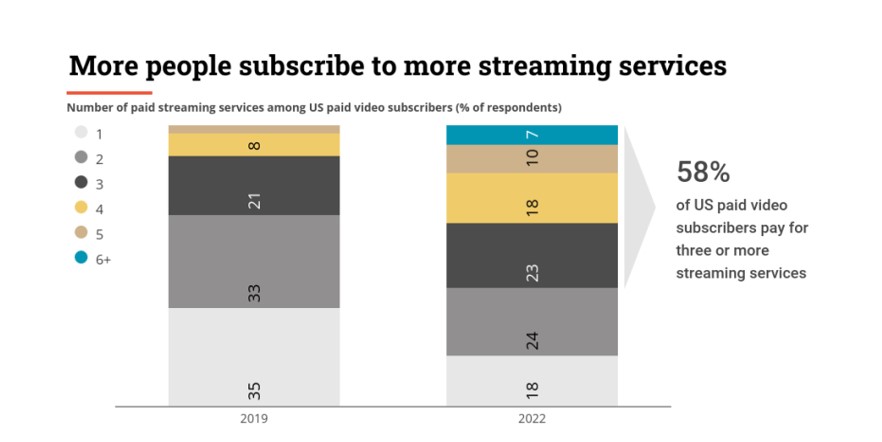

Consumers are already becoming overwhelmed with the growing number of streaming options. In 2019, only 32% of US paid video subscribers paid for three or more services, today it is 58%1. Recent streaming price hikes in combination with rising inflation, however, will have consumers look again at their subscriptions.

Source: Nielsen, April 2022 sourced from eMarketer.

To find a solution to this issue, streaming companies are seeking inspiration in the revenue-generating methods that served the traditional TV business well for decades, such as advertising and bundling. The secret ingredient, however, might be found in recommendation. Who will be able to surprise us with unexpected content that we otherwise might not have found?

Competing for subscribers and advertisers

The growing competition of both global and local streaming players is making it increasingly hard to grow. In response, companies are becoming more conscious of costs. Netflix2, for instance, is cutting costs through layoffs and downscaling in production. Warner Bros. Discovery is also taking a more sensible approach to budgets and has axed several big productions as a result.

In addition, streaming services are considering alternative models. Netflix and Disney+ are now adding advertising to their services, following the example of HBO Max, Peacock, and Hulu who already offered ad-based tiers.

Naturally, advertisers are pleased, since they will finally be able to reach those previously inaccessible viewers. Competition in the overall streaming market, however, will only increase. In addition to YouTube, subscription services will have to face free ad-supported streaming television (FAST) such as Paramount’s Pluto, Comcast’s Xumo, Fox’s Tubi, and Amazon’s Freevee.

Subscription services, however, will have to walk a fine line to ensure that their ad-based tiers will not cannibalize too many higher-tier customers, while still reaching enough people to attract quality advertisers. To keep the experience as entertaining as possible, subscription services might be able to push advertisers to invent new ad forms that are as entertaining as the content the streaming services already serve, instead of reusing the existing 30-second ad.

Distributing bundles with more than content

In addition to cheaper ad-based tiers, a streaming bundle with an aggregated discount might also be a reason to keep subscribing. Disney already offers such a bundle of streaming channels with Disney+, Hulu, and ESPN. Netflix, meanwhile, has expanded into games, although less than 1% of their subscribers are playing them3.

A bundle, however, doesn’t have to be limited to content. The traditional distributors – cable companies such as Liberty Global, Comcast or Charter – have always sold bundles of video content as part of a broader service that included internet and telephony. Their existing presence in people’s homes gives them a key advantage to regain their position.

Amazon, Apple and Google offer even broader bundles. Amazon Prime consists of fast shipping, exclusive access to sales, and entertainment services that include music, games, photos and books in addition to video. Apple One includes TV, games, music and cloud storage.

Recommending surprising content

With advertising and bundling, the industry might be able to give people more value for their money. Nevertheless, it doesn’t address the most challenging issue: how to navigate the ever-increasing amount of content.

Today, most streaming services use their own complicated algorithms to point us to content we might like based on what we watched before combined with the personal details they learned from us.

What would happen, however, if they could also take into account how we feel, what we’ve done during the day or plan to do the next day, or what happens in our social network. For instance, which movies a good friend of mine recently watched and recommended.

Some services already offer elements of such recommendations. Spotify, for instance, allows us to follow people we know or celebrities we admire, while Tiktok has created a lean-back experience. So far, however, the secret code has not been cracked.

Good recommendation should be able to point us to content that drives discussions at the watercooler, but also to content that we otherwise we never would have come across. Ideally, it combines the lean-forward experience of actively searching for specific content with the lean-back posture of the channel-surfing couch potato.

The service that cracks the recommendation code might surprise us. It could be a streaming service or a distributor, a retailer or a device manufacturer or perhaps it will be an integral part of another smart home service that we haven’t even imagined yet.

Informations importantes

À des fins d’information et de publicité uniquement.

Ces informations proviennent de VanEck (Europe) GmbH qui a été désignée comme distributeur des produits VanEck en Europe par la société de gestion VanEck Asset Management B.V., de droit néerlandais et enregistrée auprès de l’Autorité néerlandaise des marchés financiers (AFM). VanEck (Europe) GmbH, dont le siège social est situé Kreuznacher Str. 30, 60486 Francfort, Allemagne, est un prestataire de services financiers réglementé par l’Autorité fédérale de surveillance financière en Allemagne (BaFin). Les informations sont uniquement destinées à fournir des informations générales et préliminaires aux investisseurs et ne doivent pas être interprétées comme des conseils d’investissement, juridiques ou fiscaux. VanEck (Europe) GmbH et ses sociétés associées et affiliées (ensemble « VanEck ») n’assument aucune responsabilité en ce qui concerne toute décision d’investissement, de cession ou de rétention prise par l’investisseur sur la base de ces informations. Les points de vue et opinions exprimés sont ceux du ou des auteurs, mais pas nécessairement ceux de VanEck. Les avis sont à jour à la date de publication et sont susceptibles d’être modifiés en fonction des conditions du marché. Certains énoncés contenus dans les présentes peuvent constituer des projections, des prévisions et d’autres énoncés prospectifs qui ne reflètent pas les résultats réels. Les informations fournies par des sources tierces sont considérées comme fiables et n’ont pas été vérifiées de manière indépendante pour leur exactitude ou leur exhaustivité et ne peuvent être garanties. Tous les indices mentionnés sont des mesures des secteurs et des performances du marché commun. Il n’est pas possible d’investir directement dans un indice.

Toutes les informations sur le rendement sont historiques et ne garantissent pas les résultats futurs. L’investissement est soumis à des risques, y compris la perte possible du capital. Vous devez lire le Prospectus et le DICI avant d’investir.

Aucune partie de ce matériel ne peut être reproduite sous quelque forme que ce soit, ou mentionnée dans toute autre publication, sans l’autorisation écrite expresse de VanEck.

© VanEck (Europe) GmbH

Inscrivez-vous maintenant à notre newsletter

Related Insights

Related Insights

15 mai 2024

12 mars 2024

05 juin 2024

15 mai 2024

10 avril 2024

12 mars 2024

09 février 2024