China Growth Back on Track

09 April 2021

China has been a major contributor to global growth, and its economic activity tends to have significant repercussions for the global economy. To understand where the Chinese economy is in its growth cycle, we highlight several key charts below, which may also provide context for the impact of the coronavirus. China remains an important economic bellwether for countries that have started to reopen following the COVID-19 epidemic.

China’s latest activity gauges should lay to rest any remaining doubts about the post-pandemic recovery. The March numbers looked really good. Yes, this was in part due to the Lunar New Year seasonality, but the slump associated with the virus’s winter resurgence appears to be over. The end of the lockdowns gave an extra boost to the manufacturing purchasing managers index (PMI)1—it bounced more than expected to 51.9—and especially to the services PMI, which soared to 56.3. The latter was a welcome sign that the recovery is becoming more balanced.

Chinese Economy Health Check: PMIs

Source: Bloomberg. Data as of 31/3/2021. Past performance is no guarantee of future results. Chart is for illustrative purposes only.

Details also looked reassuring, including new orders, employment and new export orders. The small companies’ PMI was back in expansion zone, albeit authorities are not taking anything for granted here, expanding certain kinds of tax relief for small and medium-sized enterprises (SMEs) until the end of the year. This is a smart move in our view, given that the funding costs for private enterprises are still painfully high, despite some improvement in the past months.

Understanding the Credit Cycle

Source: UBS. Data as of 23/3/2021. Past performance is no guarantee of future results. Chart is for illustrative purposes only. Spreads are measured relative to average yield of 1, 3, 5, and 10 year bonds issued by the China Development Bank.

The general industry consensus now expects the Chinese economy to grow 8.5% this year in real terms.2 This is much more optimistic than the official target of over 6%.3 What to make of this discrepancy?

The most obvious conclusion is that authorities will continue to withdraw the policy stimulus. The continuation of the SME tax relief, however, suggest that the withdrawal will be just as targeted as the stimulus itself, without too many sharp turns.

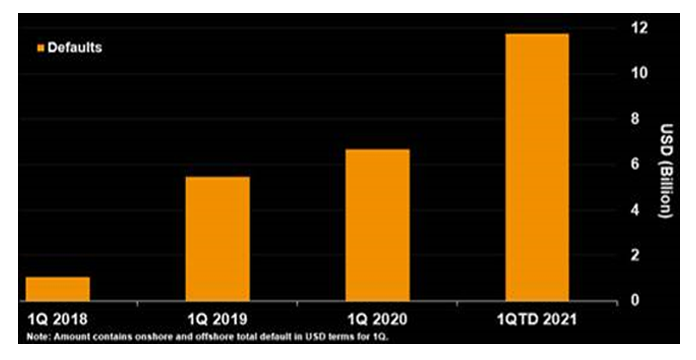

Stronger than expected growth can further embolden authorities to tighten regulations in some areas (such as environmental and green issues and overheating sectors like real estate) and decrease moral hazard by allowing more corporate defaults, including by state-owned enterprises. China’s Q1 corporate default statistics is quite telling in this regard, as defaults continued to increase despite economic headwinds from COVID’s winter resurgence. We realize that corporate defaults might be associated with higher credit risks, but they can also be a sign of a more mature system that does not want to coddle individual economic agents forever.

China Corporate Defaults Continued to Increase in Q1

Source: Bloomberg LP

1Purchasing managers index (PMI) is an economic indicator derived from monthly surveys of private sector companies. A reading above 50 indicates expansion, and a reading below 50 indicates contraction. We believe PMIs are a better indicator of the health of the Chinese economy than the gross domestic product (GDP) number, which is politicized and is a composite in any case. The manufacturing and non-manufacturing, or service, PMIs have been separated in order to understand the different sectors of the economy. These days, we believe the manufacturing PMI is the number to watch for cyclicality.

2Source: Bloomberg

3Source: https://www.wsj.com/articles/china-sets-2021-gdp-growth-target-at-over-6-11614907661

Informations importantes

À des fins d’information et de publicité uniquement.

Ces informations proviennent de VanEck (Europe) GmbH qui a été désignée comme distributeur des produits VanEck en Europe par la société de gestion VanEck Asset Management B.V., de droit néerlandais et enregistrée auprès de l’Autorité néerlandaise des marchés financiers (AFM). VanEck (Europe) GmbH, dont le siège social est situé Kreuznacher Str. 30, 60486 Francfort, Allemagne, est un prestataire de services financiers réglementé par l’Autorité fédérale de surveillance financière en Allemagne (BaFin). Les informations sont uniquement destinées à fournir des informations générales et préliminaires aux investisseurs et ne doivent pas être interprétées comme des conseils d’investissement, juridiques ou fiscaux. VanEck (Europe) GmbH et ses sociétés associées et affiliées (ensemble « VanEck ») n’assument aucune responsabilité en ce qui concerne toute décision d’investissement, de cession ou de rétention prise par l’investisseur sur la base de ces informations. Les points de vue et opinions exprimés sont ceux du ou des auteurs, mais pas nécessairement ceux de VanEck. Les avis sont à jour à la date de publication et sont susceptibles d’être modifiés en fonction des conditions du marché. Certains énoncés contenus dans les présentes peuvent constituer des projections, des prévisions et d’autres énoncés prospectifs qui ne reflètent pas les résultats réels. Les informations fournies par des sources tierces sont considérées comme fiables et n’ont pas été vérifiées de manière indépendante pour leur exactitude ou leur exhaustivité et ne peuvent être garanties. Tous les indices mentionnés sont des mesures des secteurs et des performances du marché commun. Il n’est pas possible d’investir directement dans un indice.

Toutes les informations sur le rendement sont historiques et ne garantissent pas les résultats futurs. L’investissement est soumis à des risques, y compris la perte possible du capital. Vous devez lire le Prospectus et le DICI avant d’investir.

Aucune partie de ce matériel ne peut être reproduite sous quelque forme que ce soit, ou mentionnée dans toute autre publication, sans l’autorisation écrite expresse de VanEck.

© VanEck (Europe) GmbH

Inscrivez-vous maintenant à notre newsletter

Related Insights

Related Insights

13 décembre 2024

13 août 2024

06 août 2024

01 mai 2024

13 décembre 2024

06 août 2024

01 mai 2024

08 décembre 2023