ETF Academy Dividends

Video: Dividends

Ahmet Dagli

Dividends are the cornerstone of stock market investing. Most of the companies listed on stock exchanges reward investors by paying a share of profits in the form of dividends. While their magnitude might seem far less than a share’s capital return in the short run, they become the most important part of stock performance over time.

What are they?

The dividend is the share of a company’s profit that is distributed to shareholders. Most firms only pay a part of their earnings in the form of these distributions. Retained earnings are used to invest for future growth.

Importance of dividends

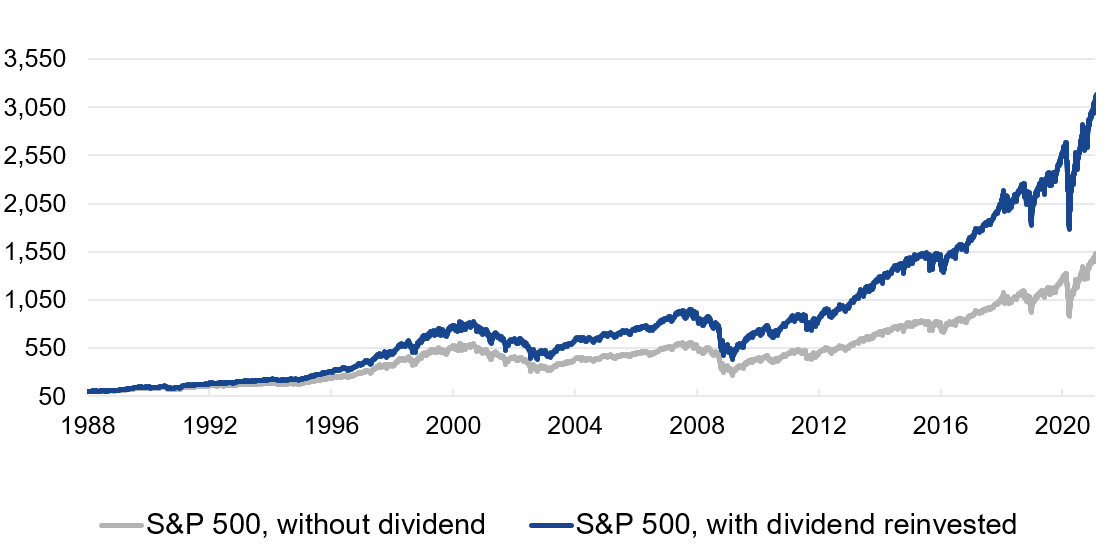

Over time, the dividend becomes the main contributor to investment performance, assuming it’s reinvested. Why? Because if every dividend that is paid is reinvested it will start generating more performance. This is what’s known as "compound interest". The graph below shows how great the effect of reinvesting them could have been on the U.S. stock market’s S&P 500 index, comparing the return with dividends reinvested and without.

The effect of compound interest

Past performance is not a reliable indicator of future performance. Source: VanEck, Bloomberg. Data as of 4/1/1988 - 30/6/2021.

Dividends as a source of income

Many investors use them as a source of additional income. Often retired people use these for their annual income, while keeping the capital they have invested intact.

High-dividend stocks

High-dividend stocks pay higher dividends than average. This might be because a company has lower growth prospects than its peers and, therefore, is prepared to distribute a larger share of its earnings to shareholders. Alternatively, the firm’s share price might have dropped, meaning that the dividend equates to a higher yield compared with the value of the share. Be careful — a price drop could mean that the market is expecting a drop in future payouts.

High-dividend ETFs

High-dividend ETFs invest in stocks with an above average dividend yield. They are useful investments for savers who want to invest for income. However, the higher yield may carry higher risks as some high dividend shares such as those in oil and tobacco companies have major questions over their future growth. The diversification of an ETF can help to spread that risk.

VanEck proposes a high-dividend ETF.

Dividend taxes

It’s important to take dividend taxes into account when investing. Some countries tax those received by investors. Investing in ETFs can reduce the effort for investors.

Withholding taxes

Many countries levy what is known as a withholding tax on the dividends paid by a company. This is an arcane tax and not widely known to the larger public. In some countries, the withholding tax might be 15%, but other countries charge more than 30%. Double-taxation treaties might allow you to recuperate a portion of these dividend withholding taxes. If affected, you should ask your tax adviser for advice.

Accumulating ETFs

Accumulating ETFs do not pay dividends; they reinvest them automatically. Hence, they go towards "compound interest". These ETFs are suited to investors looking to build capital over a long period, rather than investors looking for income.

Distributing ETFs

Distributing ETFs pay out all dividends they receive. They are most suited to investors who are investing for regular income. Learn more about VanEck Dividend ETF and possible profits of investing in stocks that pay them.

VanEck Dividend ETF