Why the Power of Interest Rates is Influencing Your Investments

10 June 2024

It’s not a secret that market dynamics have lately been influenced primarily by expectations surrounding interest rates. For the past two years, cuts in policy rates by central banks have been highly anticipated. Sentiment about when policymakers will reduce rates from the highs needed to quell the post-Covid 19 spike in inflation has fluctuated almost weekly, causing stocks and bonds to rise and fall.

For this reason, it was no surprise that the European Central Bank’s move to cut its key deposit rate by 25 basis points to 3.75% on June 6 was such big news. It did so ahead of the US Federal Reserve which is waiting for stubborn inflationary pressures to subside before easing the monetary policy.

For much of 2024 and 2023, markets have been overly eager for interest rate cuts. Time and again, stock and bond prices have risen only to be disappointed by data showing that inflation is not falling as fast as hoped, meaning that rates must stay ‘higher for longer’. Central bankers and markets alike expect them to fall in future, though, as the below chart shows for the key US secured overnight financing rate (SOFR).

Note, though, that the US Federal Reserve’s Open Markets Committee members are more optimistic than financial markets, as shown by contrasting the ‘dot plot’ with the forward rates curve.

The market expects US rates to come down gently

Source: Bloomberg, FOMC as of 26 May 2024.

Actual numbers will differ from estimates. Markets might develop differently in the future.

It’s About the Price of Money

Why are interest rates so important? The answer is that interest rates determine the opportunity cost of holding money and, therefore, the value of assets. If rates are low, then investors are not so well rewarded for putting their money on deposit and more willing to invest with varying degrees of risk, whether bonds, equities or real estate in order to earn higher returns.

Mathematically, investments are often valued by calculating the present value of their expected future cashflows. The present value is arrived at by using a projected discount rate that is related to an assumed risk-free rate, such as the SOFR in the chart. The higher the projected discount rate, the lower the value of an investment.

This means that instruments whose cash-flows are projected to occur further in the future will react the most to the changes in the interest rates and explains why some types of investments are more sensitive to rate movements than others. For instance, tech and green energy stocks tend to be highly sensitive because they are often valued on the assumption that earnings will grow rapidly in years to come. In the bond market, investment grade bonds are more sensitive than high yield bonds simply because a higher proportion of their cash flows is tilted further into the future. At the same time, assets that do not generate cash flows (e.g. gold) would normally rise in value, because the opportunity cost of investing in them compared to earning deposit rate would become lower.

Great Expectations

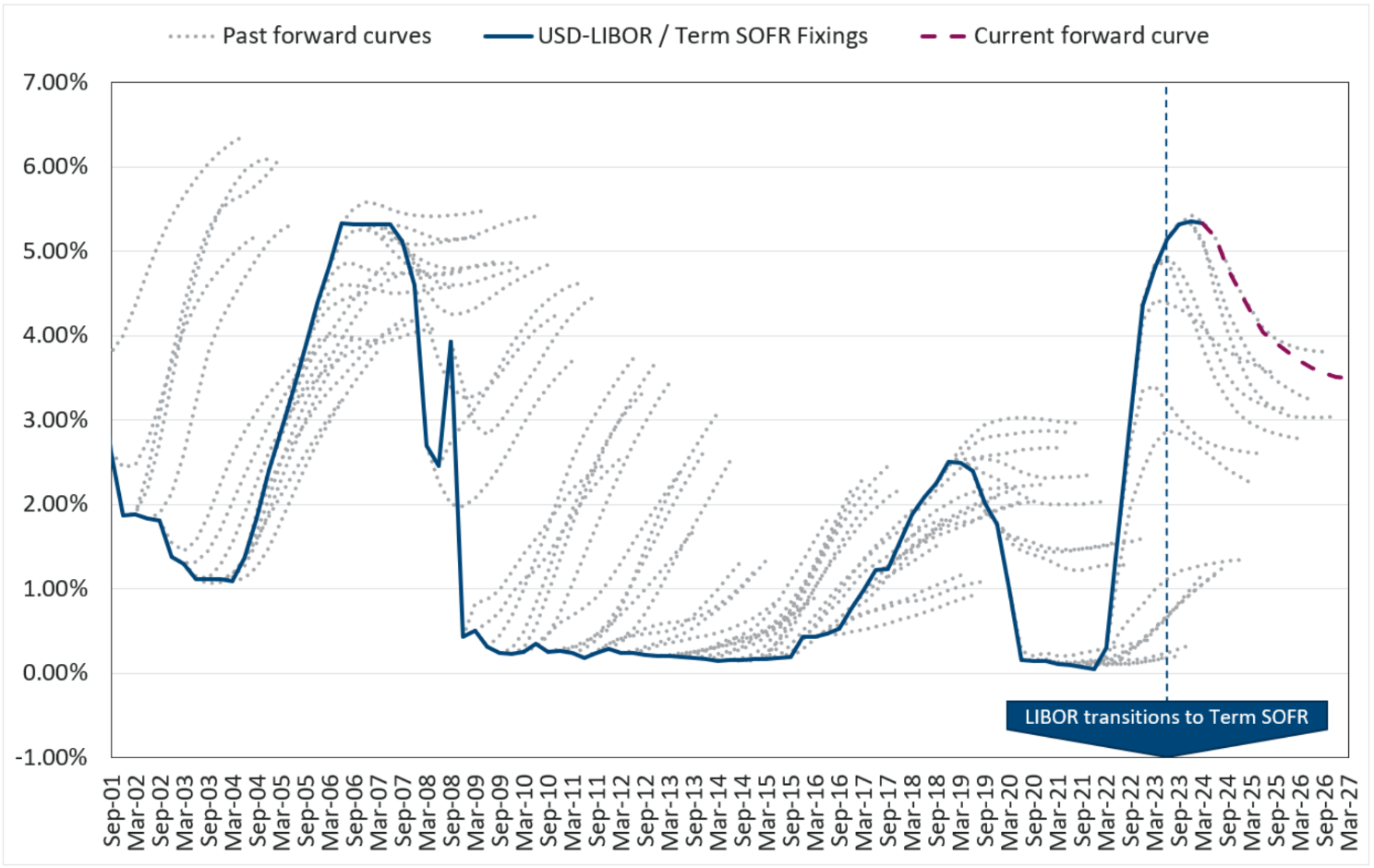

Rather unfortunately, we have not yet invented a crystal ball that can tell us what the interest rates will be in the future, so we have to rely on the next best thing – forward curves that show the interest rates expected by the market participants. However, as one can see from the graph below, where the dotted lines represent market expectations about the rates at a given time, these expectations are more often than not at odds with what happens in reality.

Implied Forward Rate Curves vs. Realized Rates

Source: Chatham Financial, as of 31 March 2024. Actual numbers will differ from estimates. Markets might develop differently in the future.

This also means that the asset prices are determined by the expectations of the interest rates. If the rates follow the path implied by the forward rate curve, the asset prices are unlikely to react significantly, since those rates are already “priced into” the valuations. It’s changes to expectations and interest rate surprises that affect the asset prices, rather than the interest rate level per se.

Of course, in the long run shifting rate expectations are just one factor affecting the value of investments. In the short- and medium-term, though, it’s useful to understand how the price of money affects them. As sentiment ebbs and flows, it can offer useful opportunities to buy and sell.

What’s more, if interest rates are cut significantly over the course of 2024 and 2025 this can potentially support the value of your investment portfolio. That is why rate cuts are the theme of the moment.

IMPORTANT INFORMATION

This is a marketing communication. Please refer to the prospectus of the UCITS and to the KID before making any final investment decisions. This information originates from VanEck (Europe) GmbH, which has been appointed as distributor of VanEck products in Europe by the Management Company VanEck Asset Management B.V., incorporated under Dutch law and registered with the Dutch Authority for the Financial Markets (AFM). VanEck (Europe) GmbH with registered address at Kreuznacher Str. 30, 60486 Frankfurt, Germany, is a financial services provider regulated by the Federal Financial Supervisory Authority in Germany (BaFin).

The information is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice VanEck (Europe) GmbH and its associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results. Information provided by third party sources is believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Brokerage or transaction fees may apply.

All performance information is based on historical data and does not predict future returns. Investing is subject to risk, including the possible loss of principal.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH

Important Disclosure

This is a marketing communication. Please refer to the prospectus of the UCITS and to the KID before making any final investment decisions.

This information originates from VanEck (Europe) GmbH, which has been appointed as distributor of VanEck products in Europe by the Management Company VanEck Asset Management B.V., incorporated under Dutch law and registered with the Dutch Authority for the Financial Markets (AFM). VanEck (Europe) GmbH with registered address at Kreuznacher Str. 30, 60486 Frankfurt, Germany, is a financial services provider regulated by the Federal Financial Supervisory Authority in Germany (BaFin).

The information is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice VanEck (Europe) GmbH, VanEck Switzerland AG, VanEck Securities UK Limited and their associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results. Information provided by third party sources is believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Brokerage or transaction fees may apply.

All performance information is based on historical data and does not predict future returns. Investing is subject to risk, including the possible loss of principal.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH / VanEck Asset Management B.V.

Sign-up for our ETF newsletter

Related Insights

Related Insights

07 March 2025

07 February 2025

07 March 2025

12 February 2025

07 February 2025

16 January 2025

16 January 2025