VBTC & VETH: Setting the Bar High in Crypto Liquidity & Cost-Efficiency

09 January 2024

- VBTC, the 2nd most liquid Bitcoin ETN on Xetra, boasts impressive volume: 20-day average of 1.8mio EUR and 3M average of 1.3mio EUR.

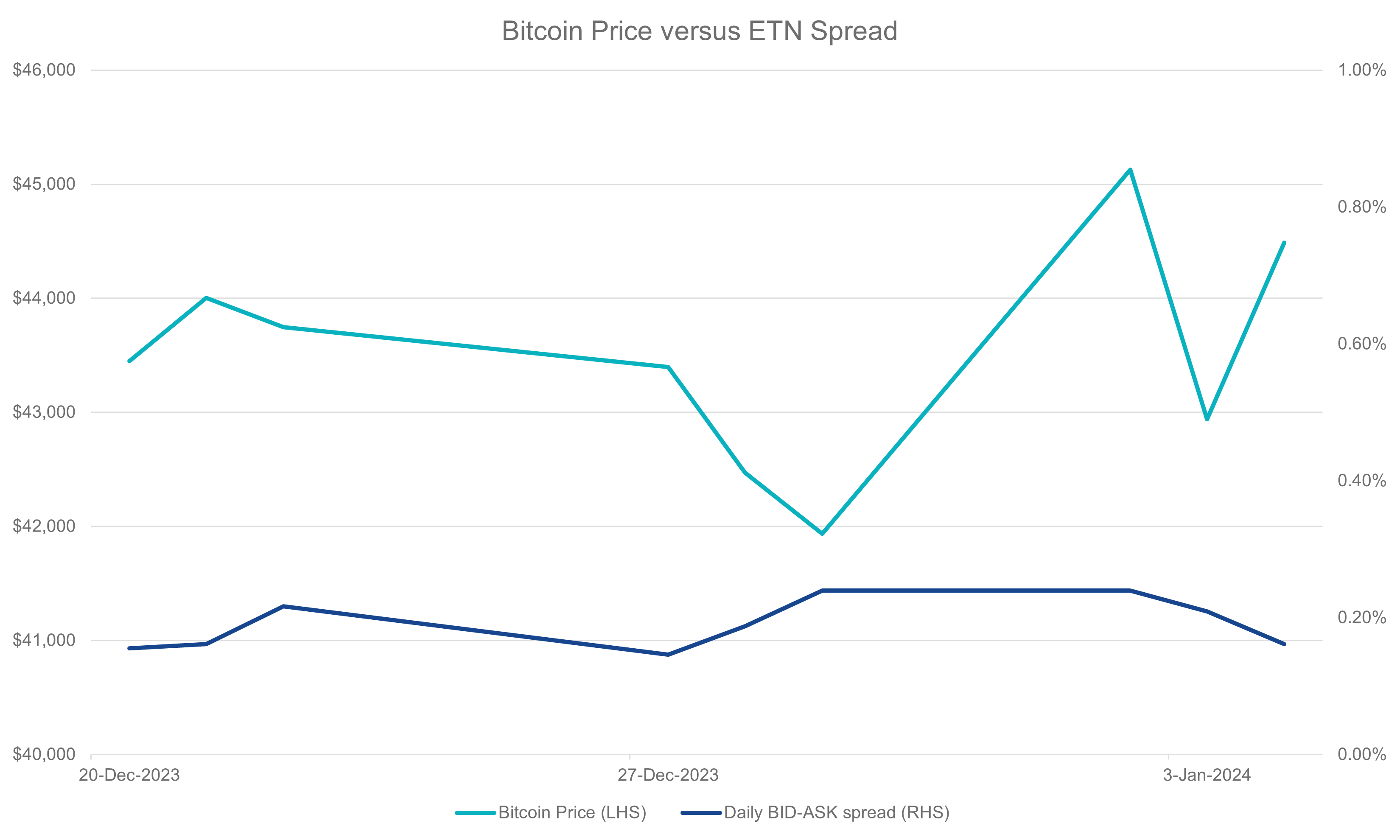

- VBTC's 20-day average spread has narrowed down to 18bps, aligning with industry leaders, despite recent market volatility. Plus, it features significantly lower management fees compared to competitors.

- Excellent liquidity and volume for VBTC at only 1% TER

- VBTC showed incredible performance during 2023, ending the year with a return of +153.35%

- VETH is the most liquid Ethereum ETN on Xetra, with a 20-day average volume of 909k EUR and a 3M average of 635k EUR.

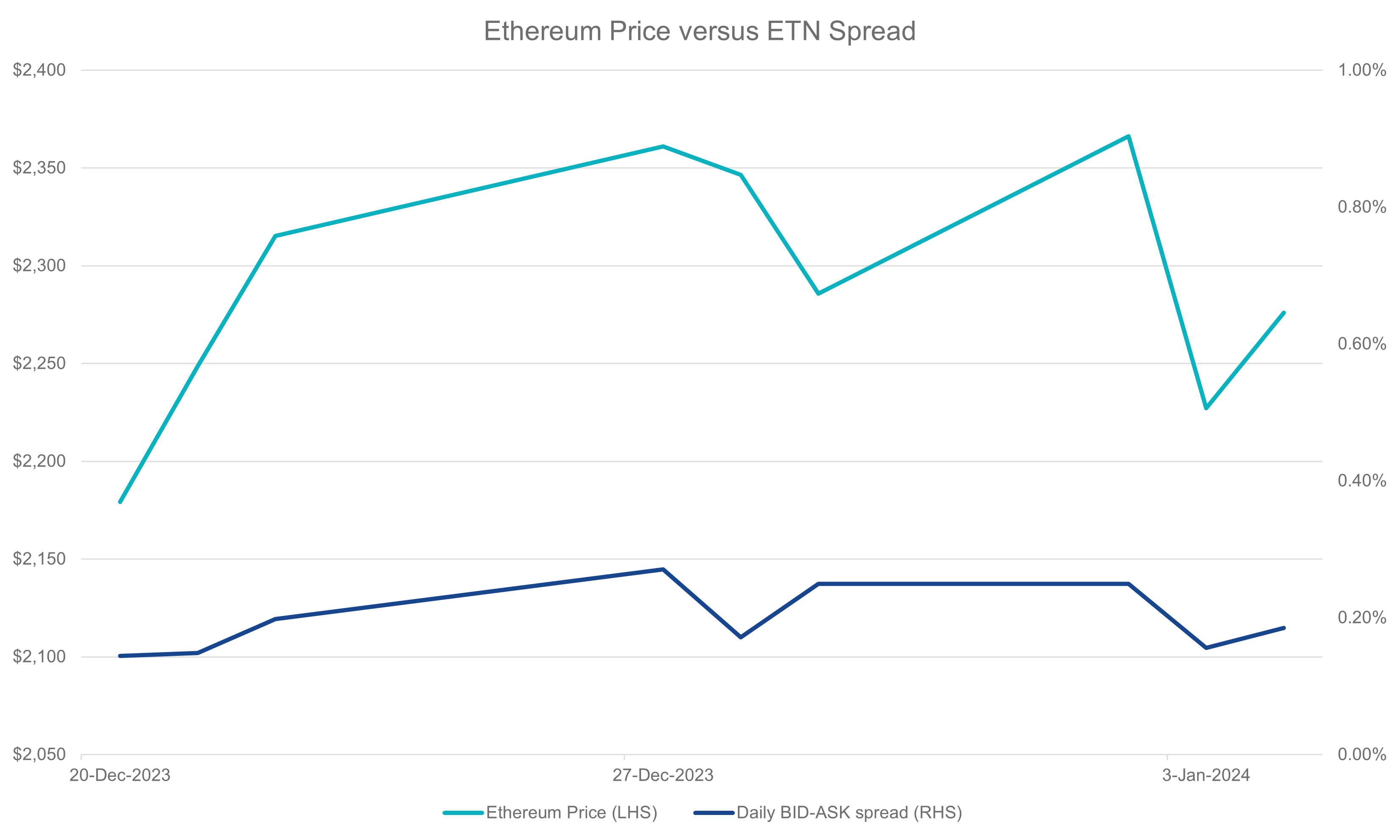

- VETH stands out with the tightest spread on Xetra at 22bps, with ongoing efforts to further reduce spreads.

- Exceptional liquidity with VETH coming out on top among the available options with one of the lowest fees at 1% TER.

- VETH has been incredibly resilient during market downturns, ending the year of 2023 with a return +91.19%

VBTC and VETH - Key Features:

- First fully collateralized Bitcoin and Ethereum ETNs in custody of an EU licensed bank.

- Among the products with the lowest fees in the market.

- 100% backed by Bitcoin or Ethereum, stored securely in cold storage.

- Tradeable like ETFs on regulated stock exchanges.

- No lending risks

Risk Factors

Cryptocurrencies are a highly volatile asset class. The full extent of their underlying risks is not yet well known. Please read the risk factors of each respective ETN to understand the risks of investing in cryptocurrencies.

- Regulatory risk: Digital assets were only introduced within the past decade and regulatory clarity remains elusive in many jurisdictions.

- Risk of a total loss: Due to hacking risk and counterparty risk, no guarantee can be made regarding the custody of the digital assets.

- Risk of extreme volatility: The trading prices of many digital assets have experienced extreme volatility in recent periods and may well continue to do so.

Important Information

For informational and advertising purposes only.

This information originates from VanEck (Europe) GmbH, Kreuznacher Straße 30, 60486 Frankfurt am Main. It is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice. VanEck (Europe) GmbH and its associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. Views and opinions expressed are current as of the date of this information and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. VanEck makes no representation or warranty, express or implied regarding the advisability of investing in securities or digital assets generally or in the product mentioned in this information (the “Product”) or the ability of the underlying Index to track the performance of the relevant digital assets market.

The underlying Index is the exclusive property of MarketVector Indexes GmbH, which has contracted with CryptoCompare Data Limited to maintain and calculate the Index. CryptoCompare Data Limited uses its best efforts to ensure that the Index is calculated correctly. Irrespective of its obligations towards the MarketVector Indexes GmbH, CryptoCompare Data Limited has no obligation to point out errors in the Index to third parties.

Investing is subject to risk, including the possible loss of principal up to the entire invested amount and the extreme volatility that ETNs experience. You must read the prospectus and KID before investing, in order to fully understand the potential risks and rewards associated with the decision to invest in the Product. The approved Prospectus is available at www.vaneck.com . Please note that the approval of the prospectus should not be understood as an endorsement of the Products offered or admitted to trading on a regulated market.

Performance quoted represents past performance, which is no guarantee of future results and which may be lower or higher than current performance.

Current performance may be lower or higher than average annual returns shown. Performance shows 12 month performance to the most recent Quarter end for each of the last 5yrs where available. E.g. '1st year' shows the most recent of these 12-month periods and '2nd year' shows the previous 12 month period and so on. Performance data is displayed in Base Currency terms, with net income reinvested, net of fees. Brokerage or transaction fees will apply. Investment return and the principal value of an investment will fluctuate. Notes may be worth more or less than their original cost when redeemed.

Index returns are not ETN returns and do not reflect any management fees or brokerage expenses. An index’s performance is not illustrative of the ETN’s performance. Investors cannot invest directly in the Index. Indices are not securities in which investments can be made.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH

Important Disclosure

This is a marketing communication. Please refer to the prospectus of the UCITS and to the KID before making any final investment decisions.

This information originates from VanEck (Europe) GmbH, which has been appointed as distributor of VanEck products in Europe by the Management Company VanEck Asset Management B.V., incorporated under Dutch law and registered with the Dutch Authority for the Financial Markets (AFM). VanEck (Europe) GmbH with registered address at Kreuznacher Str. 30, 60486 Frankfurt, Germany, is a financial services provider regulated by the Federal Financial Supervisory Authority in Germany (BaFin).

The information is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice VanEck (Europe) GmbH, VanEck Switzerland AG, VanEck Securities UK Limited and their associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results. Information provided by third party sources is believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Brokerage or transaction fees may apply.

All performance information is based on historical data and does not predict future returns. Investing is subject to risk, including the possible loss of principal.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH / VanEck Asset Management B.V.

Sign-up for our ETF newsletter

Related Insights

Related Insights

14 March 2025

16 January 2025

27 November 2024

27 November 2024