How Will the U.S. Election Impact Your Portfolio?

02 November 2020

All eyes are on the election, what the result will be and what will happen in its aftermath. According to analysis from our partners at Ned Davis Research, since 1952, the incumbent party has not won when there was either a 20% decline in the market or a recession in the election year—both of which happened in 2020.

Incumbents Struggle to Retain White House When 20% Market Decline or Recession

| 20% Decline or Recession | |||

| Since 1900, Incumbent Party: | Yes | No | |

| Win | 5 | 13 | |

| Lose | 9 | 3 | |

| Since 1952, Incumbent Party: | Yes | No | |

| Win | 0 | 8 | |

| Lose | 6 | 3 | |

20% Decline based on Dow Jones Industrial Average. Recession dates from National Bureau of Economic Research.

Copyright 2020, Ned Davis Research, Inc. Further distribution prohibited without prior permission. All Rights Reserved.

See NDR Disclaimer at www.ndr.com/copyright.html. For data vendor disclaimers refer to www.ndr.com/vendorinfo/.

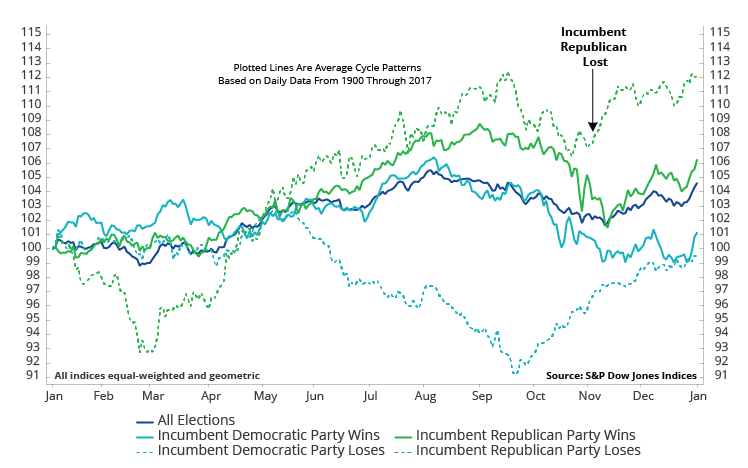

Historically, although an incumbent Republican loss does not typically result in a favorable outcome for the market for the rest of the election year, markets have had their strongest performances in the following year.

Incumbent Weakness Reverses in Post-Election Year

Copyright 2020, Ned Davis Research, Inc. Further distribution prohibited without prior permission. All Rights Reserved.

See NDR Disclaimer at www.ndr.com/copyright.html. For data vendor disclaimers refer to www.ndr.com/vendorinfo/.

While we can look to these historical trends for some insight, 2020 has also been far from typical. Against this uncertainty, investors may be looking to understand the potential impact on their investment portfolios.

CEO Jan van Eck often reminds investors that it is hard to invest according to politics, so they should ignore the political noise and determine if there is going to be a policy change before moving assets around. In our view, regardless of who is elected, the Federal Reserve (Fed) is unlikely to make a major policy shift. We also believe a high degree of confidence in the economic recovery would have to be in place before a fiscal shock like a significant tax increase becomes a possibility.

To provide investors further guidance on how to manage their portfolios through the remainder of the year, we spoke to a group of our experienced investment professionals to gather their insights on what to look out for in their respective asset classes.

What issues around the election will have the biggest impact on your outlook?

Joe Foster, Portfolio Manager, Gold Strategy: The election doesn’t materially change our outlook for a strong gold bull market driven by extraordinary levels of systemic, financial and economic risks. No matter who is in office, the challenges of the pandemic, monumental debt levels, economic weakness and social disorder will be overwhelming. However, a Democratic sweep might bring those risks forward. Democrats tend to raise taxes, increase regulations, and increase deficit spending beyond what Republicans might bring. This would create an additional drag on economic growth.

David Semple, Portfolio Manager, Emerging Markets Equity Strategy: For emerging markets, the two most important issues would be the potential change in U.S.-China relations and the potential impact of higher stimuli and/or election result uncertainty on the dollar. For the former, our base case is that a Biden-led administration may initially be more China friendly, simply due to a more multilateral and predictable approach to policy. We also expect more focus on human rights. For the latter, we can clearly see the long end of the U.S. bond market moving to accommodate expectations of Democratic wins, but we think the most palpable impact on emerging markets equity is likely the continued recent trend of a weaker dollar. One of the reasons for relative lack of enthusiasm for emerging markets equities has been the alternative attractions of the tech-led U.S. equity market. If Democrats raise corporate taxes, discourage buy backs and work to curtail big tech dominance, emerging markets equities may appear relatively more attractive.

Eric Fine, Portfolio Manager, Emerging Markets Bond Strategy: The most important election-related issue for emerging markets debt is its impact on U.S. fiscal policy. Most election outcomes are expected to result in a post-election stimulus program, and we tend to agree. A fiscal stimulus would have the effect of supporting global economic growth and risk sentiment, at least in the near-term. One risk to stimulus, though, would be a Biden victory with the Senate remaining Republican, as budget reconciliation in the Senate could stymie the big stimulus markets want. The other big election-related issue is the U.S. relationship with China, where any change may be in tone only, given the broadening national security dimension to that relationship. Also, our market will be looking to the possibility of new sanctions on Turkey or Russia in a Biden victory, and the possibility that human rights issues could rise in prominence for other bilateral relationships.

Fran Rodilosso, CFA, Head of Fixed Income ETF Portfolio Management: For interest rates the biggest question is likely the election’s impact on the likelihood for a big fiscal stimulus in 2021. In that sense a “blue wave” that covers the Presidency and the Senate will likely spur higher rates and a steeper curve. A split result or a red sweep would likely keep rates lower in the near term as the market waits for more information. For credit markets the election may matter less than the impact of a COVID-19 surge, and news around vaccine development and rollout timing. Of course, a heavily disputed election will hurt credit, keep downward pressure on rates and might help maintain the recent trend of dollar weakness. That would be mixed news for emerging markets debt.

Shawn Reynolds, Portfolio Manager, Natural Resources Equity Strategy: Tax, regulatory, and trade policies underpinning healthy and sustainable economic growth will have the biggest impact on the outlook for natural resources and commodities. Robust underlying economic activity still relies on government fortifying conditions conducive to growth. Despite lingering global trade tensions, we believe the irrepressible forces of globalization continue to reveal themselves in the resilient pricing for such commodities as iron ore, soybeans and crude oil. Energy transition incentives will remain a key theme.

What do you view as the biggest risks and opportunities through the end of the year?

SEMPLE: Progress on a vaccine and the outcome of the U.S. election are common factors for all asset classes. China’s ongoing recovery and near normalization may be better appreciated if the focus in the U.S. is on domestic issues. Continued signs of reviving mobility—with or without improving medical news—bode quite well for a number of emerging markets countries.

FOSTER: The biggest risk is a close, contested election that might further divide the country and cause a further deterioration in the U.S.’s standing in the international community. The dollar might be vulnerable to a sell-off. The biggest opportunity is the weakness in the gold price as it consolidates below its all-time highs. We believe the risks outlined above will allow gold to rise to new highs in 2021.

REYNOLDS: Continued short-term pandemic recovery and stimulus programs could be beneficial. However, many drivers of positive growth are already in place and may continue to support demand growth of basic resources. New stimulus that is not precisely targeted could be critically damaging to budget deficits. One concern is that the underinvestment that's been going on in traditional energy, oil and gas, has been so substantial that as we get to the back half of 2021, we might have an imbalance the other way where supply is not meeting a rebounding demand.

RODILOSSO: Better than anticipated global growth conditions may spark a more sustained rally in emerging markets. These are places where there is more risk priced in vs developed markets, with regards to both rates and credit spreads. The biggest risk lying ahead may be the market realization that 2020 has brought about not just an expansion of central bank balance sheets but of corporate borrowers as well. The part of the Fed response to conditions this year that sought to calm credit markets has also led to an aggressive spate of new issuance. Corporations have added access to liquidity that they badly needed, but they will emerge with higher leverage on average, and that adds to the risks of course, especially if growth conditions turn downward again.

FINE: The biggest risk through year-end remains the second COVID-19 wave. The related hit to global growth and risk sentiment comes when many of our asset prices are at post-COVID highs. The context for this risk is that almost all countries increased debts and deficits, and growth had exhibited a V-shaped recovery until recent weeks. The opportunity is that this will be a second wave of something the market has already dealt with, so it would be wrong to expect a repeat of the market’s initial reaction to COVID. Also, before year-end, we appear set to get positive vaccine headlines, which should be very positively received by the economy and markets (however complex and lengthy the ultimate delivery to emerging markets populations). We see emerging markets local currencies benefitting especially from U.S. fiscal stimulus combined with eventual vaccine headlines, with Mexico and South Africa being higher-beta beneficiaries. We also see many winners in a diverse array of emerging markets hard-currency debt.

What may investors consider in their portfolio now?

FOSTER: We are living in an extraordinary era of heightened risks. Since the Tech bust in 2000, financial risks have been growing. Geopolitical risks have been growing since 9/11, and since the Russians invaded Crimea and the Chinese began occupying the South China Sea. There have been rising levels of social risks brought on by income disparity since the financial crisis and racial unrest. Gold responds to widespread systemic risks—risks that adversely impact the financial system, economy and overall well-being. We don’t see these risks abating anytime soon, and we believe these risks will drive gold to new highs in the coming years. We expect gold stocks to significantly outperform gold when the gold price rises as gold companies carry earnings leverage to gold. We believe the miners are financially solid with strong cash flows and increasing dividend payouts.

SEMPLE: Emerging markets appear underowned and underappreciated. Bifurcation between the countries with large scale and/or innovation will continue, but overall, recovery is solidifying. Many areas look cheap versus alternative asset classes both domestically and internationally. A better U.S.-China relationship and lack of alternatives may put a fire under cheap emerging markets equities and currencies for 2021.

FINE: Most investor scenarios going out a few years involve low interest rates in the developed markets. You can’t really get high nominal or real yields there. You know where you can find high nominal and real yields? In the emerging markets. The yield on USD denominated J.P. Morgan Emerging Markets Bond Index Global Diversified is 4.19%, and the yield on the more volatile EMFX-denominated J.P. Morgan Government Bond Index Global Diversified is 4.44%.1 Both USD- and EMFX-denominated bonds give a substantial pickup in a yield-starved world. Many emerging markets economies, moreover, have stronger fundamentals than you might think, with much lower government debt-to-GDP, for example.

REYNOLDS: The current and probable additional massive monetary and fiscal stimulus programs around the world have several potential outcomes that we believe suggest exposure to natural resources may be beneficial at this time. First, if these stimulus programs serve to revive economic activity to pre-pandemic levels, we would expect demand for basic resources to accelerate. Importantly, the markets for many of these commodities remain solid despite the demand response from the crisis suggesting that supply rationalization has also occurred. Thus, a rebound in demand could tighten these markets significantly. Second, it is clear, in our view, that governments are prepared to add further stimulus and support if the crisis lingers. We believe such exponential increases in the supply of money creates a giant coiled spring of inflation that could be released as the dampening effects of the pandemic are alleviated. Finally, in our opinion, many of the companies and industries we invest in are poised to benefit from multi-year restructuring programs that have created compelling investment potential. In quite a few of these, they have established an extremely resilient strategy that is leading to very large and sustainable cash generation which is being returned to shareholders, making these companies/industries among the best in the market regarding dividend yields.

RODILOSSO: The search for yield appears to be in place for a while still. At current levels for Treasuries, and with about $14 trillion worth of bonds yielding less than 0% globally, demand for higher yielding assets is likely to remain robust. The volatility earlier this year is a stern reminder of the risk that comes along with higher spreads. But patiently adding to risk asset classes within the fixed income universe has generally been a good approach over the past decade. We see further opportunities in coming months amid COVID-19 and U.S. election related volatility to tactically add to high yield and emerging markets—hard and local currency—allocations. We have recently seen increased attention paid to Chinese government, policy bank and high quality corporate bonds. With local yields more than 230 basis points above the U.S. curve, and with China leading the early global economic recovery, the carry and currency prospects both support the case for an allocation. And within high yield we continue to believe that fallen angel strategies are relatively attractive due to a mix of quality (i.e., high BB rating allocation) and opportunistic buying (of recently downgraded fallen angel bonds) that has worked well relative to other high yield strategies year-to-date.

1Source: JP Morgan. Data as of 30/9/2020. J.P. Morgan Emerging Markets Bond Index Global Diversified tracks total returns for U.S. dollar denominated debt instruments issued by emerging market sovereign and quasi-sovereign entities. J.P. Morgan Government Bond Index Global Diversified (GBI-EM GD) tracks local currency bonds issued by emerging markets governments.

Important Disclosure

This is a marketing communication. Please refer to the prospectus of the UCITS and to the KID before making any final investment decisions.

This information originates from VanEck (Europe) GmbH, which has been appointed as distributor of VanEck products in Europe by the Management Company VanEck Asset Management B.V., incorporated under Dutch law and registered with the Dutch Authority for the Financial Markets (AFM). VanEck (Europe) GmbH with registered address at Kreuznacher Str. 30, 60486 Frankfurt, Germany, is a financial services provider regulated by the Federal Financial Supervisory Authority in Germany (BaFin).

The information is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice VanEck (Europe) GmbH, VanEck Switzerland AG, VanEck Securities UK Limited and their associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results. Information provided by third party sources is believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Brokerage or transaction fees may apply.

All performance information is based on historical data and does not predict future returns. Investing is subject to risk, including the possible loss of principal.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH / VanEck Asset Management B.V.

Sign-up for our ETF newsletter

Related Insights

Related Insights

13 December 2024

06 August 2024

01 May 2024

12 February 2024