Moat Stocks: Poised for a Comeback?

12 November 2020

As the markets work through the turmoil that has accompanied this U.S. election season, I’m reminded of a research paper published this spring by Andrew Lane of Morningstar. The paper looked at the Morningstar® Wide Moat Focus IndexSM (the “Index”) and its excess returns relative to the broad equity markets following months with both significant and modest market drawdowns. We highlighted his findings here several months ago. The key takeaway is that the Index has, on average, posted impressive excess returns in the one- and three-year periods following months in which the market had sold-off. However, in looking at the data, they also show that the Index outperforms, on average, following months when the market performed well.

With talk of excess returns, it’s important to address the elephant in the room. Since late June, the Index has underperformed the S&P 500 Index. Underperformance was primarily concentrated in June, July and August, and returns bounced back in line with the S&P 500 in September and October. But, the summer months have certainly left their mark on the Index. Through October, year-to-date total return for the Index was -2.90% versus 2.77% for the S&P 500.

Stock Selection: In Good Times and Bad

Stock selection has historically been the driver of excess returns in good times, and it has also been the driving force behind this short period of underperformance. Though the Index shifted its exposure further away from big tech and into select value opportunities, stock selection within the industrials and information technology sectors—and not the underweight to information technology—contributed the most to the Index’s underperformance through the summer months.

The Index allocated to industrials firm Boeing (BA) in March and June at historically low valuations. As uncertainty around the global pandemic grew, the aerospace and defense firm’s shares slid through the summer months, but Morningstar remains confident that secular forces driving air travel will return in a post-pandemic world. Additionally, regulatory steps have progressed toward receiving an airworthiness directive from the FAA, which Morningstar expects Boeing to receive this quarter. It may take time to realize any potential benefit of the Boeing allocation in the Index, but in the interim Morningstar believes its substantial cash and short-term investment portfolio will allow the firm to weather the storm until the macro environment stabilizes.

Within the tech sector, exposure to Blackbaud (BLKB), Intel (INTC) and Guidewire Software (GWRE) detracted from performance relative the S&P 500.

Blackbaud offers a suite of software solutions for the “social good” community, including nonprofits, foundations, corporations, education institutions, healthcare institutions and individual activists. Morningstar believes Blackbaud is deeply entrenched in the social good community, and its wide economic moat is rooted in high customer switching costs and intangible assets. However, the company remains vulnerable to adverse macroeconomic conditions as its customer base faces continued budget pressure. According to Morningstar, there may be no near-term catalyst, but shares are attractive for patient investors.

Intel reported mixed Q3 results in late October, highlighting several offsetting benefits and detractors brought on by pandemic-accelerated trends. While Intel has benefited from expedited digital transformation boosting cloud and notebook PC demand to support working and learning from home, Morningstar highlights the negative impact to Internet of Things, among other offsetting pressures. With its shares trading at nearly 40% of fair value, Morningstar views the long-term prospects as promising.

Guidewire is a leading software provider for the property and casualty insurance industry that has been transitioning from downloaded software to cloud-based solutions. Its wide economic moat is rooted in customer switching costs as is common in the software industry. Its shift to the software as a service (SaaS) model was driven by the firm’s belief that the pricing opportunity for a SaaS transition is two to three times that of an on-premise installation model, according to Morningstar. Shares remain approximately 15% undervalued relative to Morningstar’s fair value estimate.

Moat Index Outperformance Historically Follows Underperformance

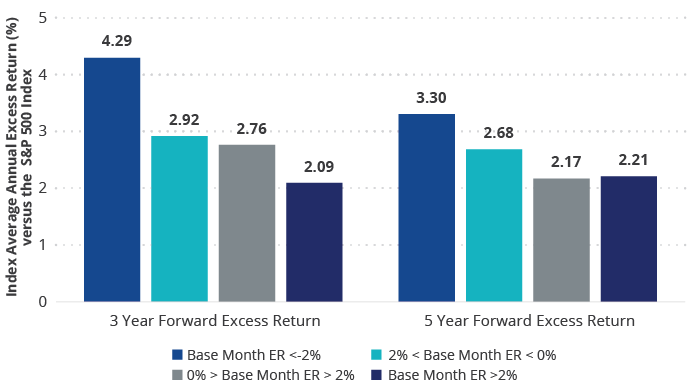

Despite evidence of the Index’s long-term success relative to the S&P 500, periods of underperformance certainly catch one’s attention. Looking at previous periods of underperformance can be informative. The chart below compares the average excess returns of the Index versus the S&P 500 following months in which the Index underperformed and outperformed the S&P 500 to varying degrees. We can see that the Index has generated stronger annualized excess returns, on average, in periods following months of underperformance than outperformance of the S&P 500. The largest average excess returns has come after the Index experienced a month with greater than 2% underperformance. This summer, the Index underperformed the S&P 500 by 1.6% in June, 3.2% in July and 1.1% in August.

Moat Index Outperformance Strongest Following Underperformance

28/2/2007 – 31/10/2020

Source: Morningstar. Data as of 31/10/2020. Chart illustrates the excess returns of the Morningstar Wide Moat Focus Index vs. S&P 500 Index in 3- and 5-year periods following months in which the Morningstar Wide Moat Focus Index underperformed or outperformed the S&P 500 Index to various degrees. Performance data quoted represents past performance. Past performance is not a guarantee of future results. Index performance is not illustrative of fund performance. Prior to 16/10/2015, VanEck Morningstar US Wide Moat UCITS ETF had no operating history. For fund performance current to the most recent month-end, visit vaneck.com.

VanEck Morningstar US Wide Moat UCITS ETF (MOAT) seeks to replicate as closely as possible, before fees and expenses the price and yield performance of the Morningstar Wide Moat Focus Index.

Important Disclosure

Sign-up for our ETF newsletter