Investing in the AEX

The AEX® is the main index of the Dutch stock exchange. You can invest in the 25 stocks on the AEX by buying them individually. You can also invest in the AEX with a single purchase through an ETF or index tracker.

What is the AEX Index?

The AEX® is the Dutch stock exchange index. The 25 companies on the AEX® are all listed on the Amsterdam Stock Exchange. The composition of the AEX® is based on the trading turnover of the stocks (the number of shares traded multiplied by the price) and on market capitalisation (how much the company is worth on the stock exchange). The larger the company, the greater the AEX® weighting. Shell, Unilever and ASML, for example, are so large compared to other AEX® stocks that they respectively accounted for 18%, 15% and 14% of the AEX® on 31 May 2022.1

AEX investing

In this video, Bouke van den Berg, Co-Head EMEA at VanEck, explains what the AEX Index is and how you can easily invest in the 25 constituent stocks of the index with an ETF.

Why invest in the AEX®?

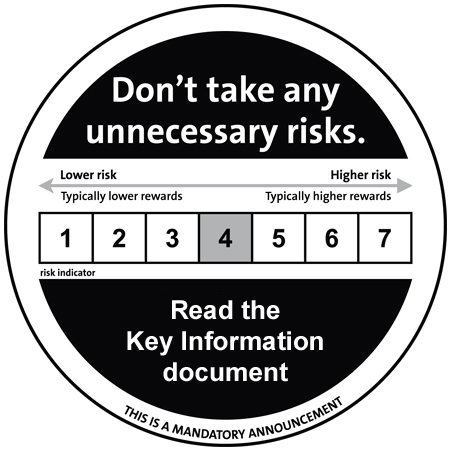

There are several reasons to consider investing in the AEX®. The most important one is that if you want to reduce unnecessary risk, you need to ensure a good spread. The advantage of investing in the AEX® compared to buying an individual stock is that you have a much better spread. After all, you are investing in 25 stocks, instead of a single stock. Investors who invested €10,000 in AEX® company ING Group stock on 3 January 2000 had €11,291 left on 31 May 2022. Investors who invested their money in Imtech saw it almost completely evaporate. However, investors who opted to invest in the AEX®2 as a whole had capital of €21,750 on their account on 31 May 2022. NB: Past results are not a reliable indicator of future results.

Investing in the AEX® means investing primarily in Dutch stocks.

The majority of AEX® companies have their head office in the Netherlands. In addition, by investing in the AEX® you have a stake in a large number of companies that you know well and are familiar with. KPN, ING and Philips are some examples. The advantage of investing in the AEX® is also that you know which companies you have invested your capital in. Although you do not have a global spread when investing in the AEX®, most AEX® companies derive a large part of their turnover from all over the world.

AEX ETF

The best way to invest in the AEX is by buying an ETF that follows the AEX. An ETF is an exchange traded fund that tracks a specific index. Because no expensive fund managers are involved, the costs of investing in the AEX® are low, but you can be certain that you will get almost the same return as the AEX®, including dividends. With the VanEck AEX UCITS ETF, you invest directly in the AEX with the additional advantage that dividend leakage can be prevented. This advantage only applies to investors who pay tax in the Netherlands. For more information, click the link below. We recommend that you read the Key Investor Information and the prospectus for this product first, before investing in it.

Performance VanEck AEX ETF

Investing in the AMX

If you are interested in our VanEck AEX UCITS ETF, you may also be interested in our VanEck AMX UCITS ETF. The AMX Index offers positions in the 25 most traded stocks on Euronext Amsterdam, after the AEX. These are the somewhat smaller companies, which is why the AMX is also known as the Midcap index. Dividend leakage can also be prevented here. This advantage only applies to investors who pay tax in the Netherlands. For more information, click the link below. We recommend that you read the Key Investor Information and the prospectus for this product first, before investing in it.

1Source: Euronext.

2Source: VanEck analysis. Returns include dividends and assume that dividend tax has been recovered or offset. Past returns are not a reliable indicator of future returns. Returns may be reduced due to transaction or management fees. Euronext N.V. or its subsidiaries owns all (intellectual) property rights with regard to the AEX® Index. Euronext N.V. or its subsidiaries does not sponsor, endorse or have any other involvement in issuing the product or ensuring its availability. Euronext N.V. and its subsidiaries disclaim any liability for any inaccuracies in the data on which the Index is based, for any errors, oversights or omissions in the calculation and/or distribution of the Index, and for the way in which it is used when issued and made available. "AEX®" is a registered trademark of Euronext N.V. or its subsidiaries. The information on this web page and website does not constitute legal, tax or investment advice.