Boeing and Bank of America Headline March Review

25 March 2020

Boeing and Bank of America Headline March Review

The Morningstar® Wide Moat Focus IndexTM (the “Index”) completed its quarterly rebalance and reconstitution on Friday, 20 March 2020. The Index has a new look after assessing valuation opportunities among U.S. wide moat companies. The Index’s long-standing health care overweight was pared back while financials now take a more prominent place in the Index following that sector’s outsized participation in the recent market slide. One notable addition to the portfolio last week was Boeing Co. (BA).

Boeing Valuations Hard to Overlook

Boeing finished last week’s trading at just under $100 per share after beginning the year above $300 per share. Its decline leaves the aerospace and defense firm trading at a discount of approximately 70% to Morningstar’s fair value estimate. On 18 March 2020, Morningstar reduced its fair value estimate 5%, to $328 per share, citing lower near-term production and a longer 737 MAX grounding, which Morningstar feels could last into late 2020.

Despite the recently reduced fair value estimate, Boeing’s significant sell-off still puts the company at a discount to fair value far below any level seen since coverage was initiated by Morningstar in 2002. The unique rebalance feature of the Index will allow it to allocate to Boeing at these extreme valuations and, if the market recognizes the current mispricing, participate in its recovery. That is a big “if”, but the Index strategy is built for the long term and some allocations take longer than others to play out.

In an 18 March 2020 update, Morningstar analyst Burkett Huey noted “Ultimately, while we hesitate to recommend that investors catch a falling knife, we think Boeing’s valuation looks attractive at current levels. We remain confident in Boeing’s long-term story of supporting increasing propensity to fly in the emerging market[s] and a developed market[s] replacement cycle.” Further to the long-term story, Morningstar assigns Boeing a wide moat despite its well-documented 737 MAX troubles. Morningstar believes the barriers to entry and the costs and difficulty of switching manufacturers provide Boeing with intangible assets and switching costs that protect its competitive position for years to come.

Banking on Banks

The U.S. Federal Reserve’s (Fed’s) recent cut of the federal funds rate put pressure on financial services firms, in particular, the banking sector. Concerns over net interest income at these rate levels have caused fear for investors. However, in a 15 March 2020 research note, Morningstar analyst Eric Compton provided some perspective: “We remind investors a few bad quarters of earnings are not that important when it comes to the intrinsic value of a firm over its lifetime. When bank stock prices imply that bad times will never end, we think the odds shift in the favor of long-term investors. We believe investors should be seriously watching and considering bank stocks as this plays out.”

To that end, the Index added several financial services firms to its portfolio this quarter including American Express (AXP), US Bancorp (USB) and Bank of America (BAC). The rebalancing process also increased its allocation to Wells Fargo (WFC) and Charles Schwab (SCHW).

Bank of America, last included in the Index in March, 2009, is a compelling addition. It is the second largest money center bank in the U.S. and has undergone a decade-long transformation to streamline its business and cut expenses following its acquisitions of Merrill Lynch, Countrywide Financial and MBNA. Prior to the market impact of the coronavirus, many believed the U.S. banking system to be in strong shape. To witness a bank such as Bank of America trade at current valuations is compelling, to say the least.

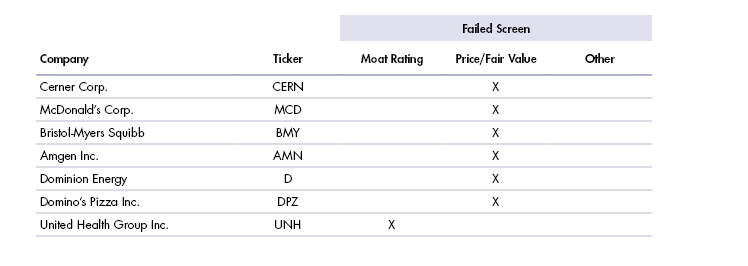

Below is a summary of the stocks added and removed in this quarter’s review.

March 2020 Morningstar® Wide Moat Focus IndexTM Review

Index Additions & Increased Allocations

Index Deletions & Decreased Allocations

Source: Morningstar. Price/fair value data as of 10 March 2020. Past performance is no guarantee of future results. For illustrative purposes only.

VanEck Morningstar US Wide Moat UCITS ETF (MOAT) seeks to replicate as closely as possible, before fees and expenses the price and yield performance of the Morningstar Wide Moat Focus Index.

Important Disclosure

This is a marketing communication. Please refer to the prospectus of the UCITS and to the KID before making any final investment decisions.

This information originates from VanEck (Europe) GmbH, which has been appointed as distributor of VanEck products in Europe by the Management Company VanEck Asset Management B.V., incorporated under Dutch law and registered with the Dutch Authority for the Financial Markets (AFM). VanEck (Europe) GmbH with registered address at Kreuznacher Str. 30, 60486 Frankfurt, Germany, is a financial services provider regulated by the Federal Financial Supervisory Authority in Germany (BaFin).

The information is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice VanEck (Europe) GmbH, VanEck Switzerland AG, VanEck Securities UK Limited and their associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results. Information provided by third party sources is believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Brokerage or transaction fees may apply.

VanEck Asset Management B.V., the management company of VanEck Morningstar US Sustainable Wide Moat UCITS ETF (the "ETF"), a sub-fund of VanEck UCITS ETFs plc, is a UCITS management company under Dutch law registered with the Dutch Authority for the Financial Markets (AFM). The ETF is registered with the Central Bank of Ireland, passively managed and tracks an equity index. Investing in the ETF should be interpreted as acquiring shares of the ETF and not the underlying assets. Investors must read the sales prospectus and key investor information before investing in a fund. These are available in English and the KIIDs/KIDs in certain other languages as applicable and can be obtained free of charge at www.vaneck.com, from the Management Company or from the following local information agents:

UK - Facilities Agent: Computershare Investor Services PLC

Austria - Facility Agent: Erste Bank der oesterreichischen Sparkassen AG

Germany - Facility Agent: VanEck (Europe) GmbH

Spain - Facility Agent: VanEck (Europe) GmbH

Sweden - Paying Agent: Skandinaviska Enskilda Banken AB (publ)

France - Facility Agent: VanEck (Europe) GmbH

Portugal - Paying Agent: BEST – Banco Eletrónico de Serviço Total, S.A.

Luxembourg - Facility Agent: VanEck (Europe) GmbH

Morningstar® US Sustainability Moat Focus Index is a trade mark of Morningstar Inc. and has been licensed for use for certain purposes by VanEck. VanEck Morningstar US Sustainable Wide Moat UCITS ETF is not sponsored, endorsed, sold or promoted by Morningstar and Morningstar makes no representation regarding the advisability in VanEck Morningstar US Sustainable Wide Moat UCITS ETF.

Effective December 17, 2021 the Morningstar® Wide Moat Focus IndexTM has been replaced with the Morningstar® US Sustainability Moat Focus Index.

Effective June 20, 2016, Morningstar implemented several changes to the Morningstar Wide Moat Focus Index construction rules. Among other changes, the index increased its constituent count from 20 stocks to at least 40 stocks and modified its rebalance and reconstitution methodology. These changes may result in more diversified exposure, lower turnover and longer holding periods for index constituents than under the rules in effect prior to this date.

It is not possible to invest directly in an index.

All performance information is based on historical data and does not predict future returns. Investing is subject to risk, including the possible loss of principal.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH / VanEck Asset Management B.V.

Sign-up for our ETF newsletter

Related Insights

Related Insights

14 March 2025

14 February 2025

20 January 2025

15 January 2025

17 December 2024