VanEck Crypto Monthly Recap for January 2024

26 February 2024

Bitcoin's volatility surged with $30B cumulative volumes in new US ETFs, countered by dwindling futures and ETN outflows, suggesting potential market growth amid varied sector performance.

Bitcoin's volatility surged with $30B cumulative volumes in new US ETFs, countered by dwindling futures and ETN outflows, suggesting potential market growth amid varied sector performance.

Please note that VanEck may have a position(s) in the digital asset(s) described below.

Bitcoin’s 30-day volatility reached its highest level since April 2023 in January after the approval and listing of 10 new spot bitcoin ETFs in the US, which attracted more than $30B in cumulative volumes and $1.5B+ in net inflows as of month-end. It has been gratifying to observe the bid/ask spread and the premium/discount to NAV of these ETFs trend lower such that these products can often be purchased at 1bps spreads and less than 30bps premium or discount to NAV. Such liquidity proves the use case of ETFs which we believe will drive transaction costs lower and thus take some market share from centralized exchanges.

Offsetting these US ETF inflows, however, futures activity (OI) on the CME dropped by $2B from an early January peak to $4.4B at the end of the month, while European bitcoin ETNs also experienced modest outflows, as investors “sold the news.” The consequence of this tug-of-war between futures and spot is that funding costs to hold futures and other leveraged positions fell dramatically in January. For example, the cost to hold a perpetual bitcoin futures position on Binance reached 21% on January 1st before falling sharply to 6% by month-end. We believe such a collapse in demand for leverage may set the market up for another leg higher if ETF inflows continue at the current pace, which exceeds the new Bitcoin supply.

Amidst the sideways bitcoin price, large-caps (+1%) outperformed small-caps (-9%), Ethereum (flat) outperformed Layer 1s (-6%), while Coinbase (-26%) and Bitcoin miners (-28%) lagged.

| January | 1 Year | |

| Coinbase | -26% | 91% |

| Bitcoin | 2% | 82% |

| MarketVector Infrastructure Application Leaders Index | -9% | 58% |

| MarketVector Smart Contract Leaders Index | -6% | 57% |

| Ethereum | 0% | 41% |

| Nasdaq Index | 1% | 28% |

| MarketVector Decentralized Finance Leaders Index | -7% | 19% |

| S&P 500 Index | 2% | 18% |

| MarketVector Centralized Exchanges Index | -4% | -2% |

| MarketVector Media & Entertainment Leaders Index | -16% | -49% |

Source: Bloomberg, as of 1/31/2024. Past performance is no guarantee of future results. Not intended as a recommendation to buy or sell any securities named herein.

Smart Contract Platforms

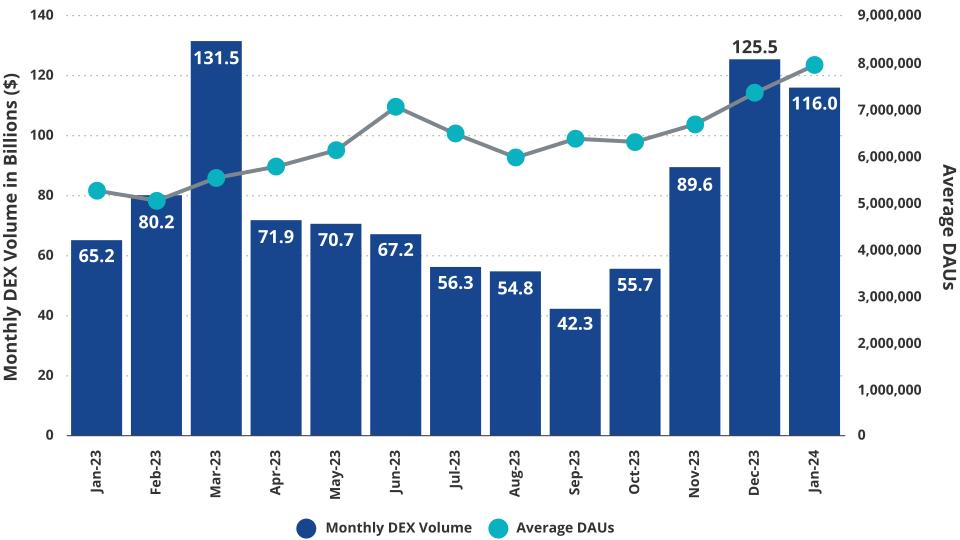

Monthly DEX Volume vs. Average DAUs

Source: XYZ as of 1/31/2024. Past performance is no guarantee of future results. Not intended as a recommendation to buy or sell any securities named herein.

Airdrops and anticipated airdrops were all the rage in January following the blockbuster releases of the $PYTH ($77M airdropped to 90k wallets) and the $JTO ($165M airdropped to 10k wallets) tokens in November and December. The most anticipated of these airdrops, also on Solana like $PYTH and $JTO, was Jupiter’s $JUP. Jupiter, a DEX aggregator, rewarded its users with 10% of the token supply in the first series of yearly airdrops, achieving a fully diluted market cap of $6B. In the Cosmos blockchain universe, the Dymension airdrop promised to airdrop 70M tokens, 7% of network supply, that are estimated to be worth $280M (~$4 per token) at the time of writing. Another token airdrop that occurred was the former Polkadot privacy project, which turned Ethereum zk L2 $MANTA was worth $156M. This brings us to the key question – what is an airdrop, and why are people getting lots of free money?

An airdrop can be thought of as marketing spend to bootstrap a user base. Rather than laboring over a target market and wading through various mechanisms to incentivize them to use your product, blockchains allow app builders to simply target current or potential users with an ownership share in that application’s network. This is accomplished by giving these target users tokens that accrue value from usage of the application’s service or product. Often, the optimal people to target are the ones who consistently utilize the application. In other cases, applications that want to do an airdrop look for users who would appear to be ideal customers for their businesses. This is easily achieved on the blockchain, where all user activity is perfectly transparent, and customer potential can be quantified. The theory behind these airdrops is simple – incentivize usage by potentially making people who patronize your business rich by giving them a share of the network’s future value in the form of token distributions. In turn, these new token holders each have a financial incentive to remain loyal to that application while also encouraging others to use the application as well.

A more cynical take on airdrops is to view them as unofficial token auctions. This is believed to be true, particularly in cases where user activity of that application, which costs money, may be targeted for retroactive airdrops in the future. This is because the user activity costs fees which accrue to the application and the fees were generated in a base currency, like USDC or ETH, in exchange for an indeterminate amount of future application tokens. As such, a project can effectively offboard tokens of whatever value they choose in exchange for user-generated revenues. Of course, there is a fine line for projects to walk, and being stingy with token allocations could crater their users, while overallocation could mean market dumping of a project’s tokens.

As users have been airdropped massive amounts of money over the past few months, many are looking to future airdrops as a source of return. Some of the most anticipated airdrops include Blast - an NFT-focused Ethereum L2, Starknet – an Ethereum zk roll-up, Magic Eden – a Solana based NFT marketplace, and AltLayer – a decentralized roll-up service. However, the granddaddy of all anticipated airdrops that is driving user behavior is Eigenlayer.

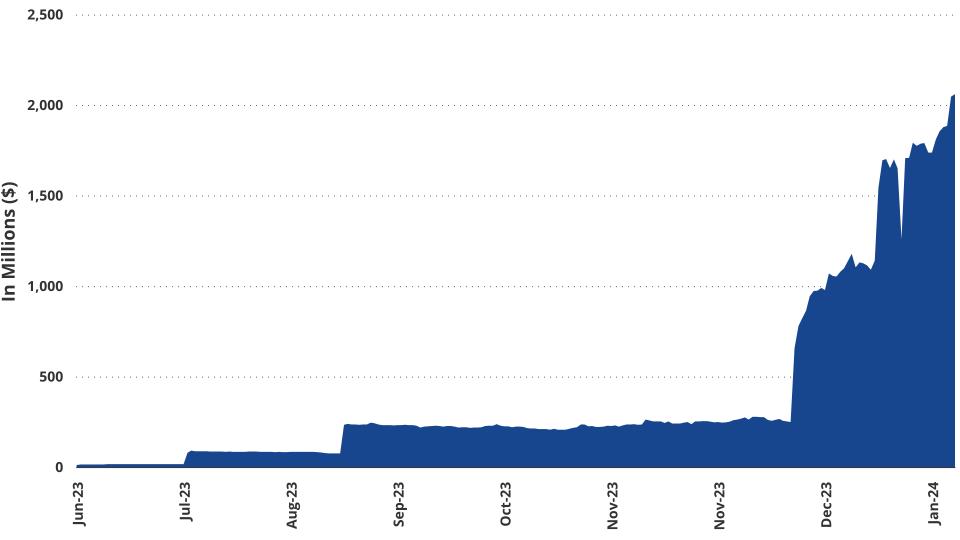

Eigenlayer TVL

Source: Defillama as of 1/31/2024. Past performance is no guarantee of future results. Not intended as a recommendation to buy or sell any securities named herein.

Anticipation has been building for months about the upcoming launch of Eigenlayer. Eigenlayer can be thought of as a service that escrows liquid staking tokens (LSTs), redeemable/tradable certificates of deposits for staked ETH, and leases out the value of those in exchange for fees. In essence, Eigenlayer is similar to a bank that lends out ETH LSTs that other applications can use to back faith in their business services. In exchange for the “repo” of this ETH, these collateralized services remit ETH, or other tokens as rewards. Eigenlayer is a middleman in this operation that will facilitate and standardize these agreements while also enforcing the contractual obligations of the agreements. The business services that may need this collateral ETH include Oracles, other blockchains, bridges and businesses that must post an economic bond that can compensate users if those businesses’ services fail. The consequence of all this is that Eigenlayer unlocks new business types for blockchain while also allowing ETH holders additional yield on ETH by supplying it to Eigenlayer.

Eigenlayer and some of the initial businesses that will use Eigenlayer have promised uncertain rewards to users that “re-stake” ETH LSTs by supplying them to Eigenlayer. The result is that there has been a mad dash by less cautious users to “ape” Eigenlayer to garner these potential rewards. On the other end, businesses have cropped up that allow users to speculate on the value of potential rewards or offer new LSTs with the promise of even more rewards. As there is enormous uncertainty with the outcomes of Eigenlayer rewards and the ecosystem surrounding it, many ETH users have been betting according to their views of the value of these potential rewards. One of these re-staking protocol, EtherFi, reached over 100K of ETH deposits by mid-January.

Ethereum’s January price action was characterized by concern over initial drops in the percentage of ETH supply being staked. The validator queue for Ethereum actually turned net negative early in the month as Figment and Celsius withdrew stake. The result was that over several days, ETH stake figures declined from 28.7M to 28.5M. Despite this initial setback, Ethereum ended the month with over 28.8M in staked ETH. While this displays the confidence investors have in Ethereum’s future, the yield for staking ETH reached an all-time low of around 3.47% APY, not accounting for the expected boost from Eigenlayer re-staking activity.

Source: as of 1/31/2024. Past performance is no guarantee of future results. Not intended as a recommendation to buy or sell any securities named herein.

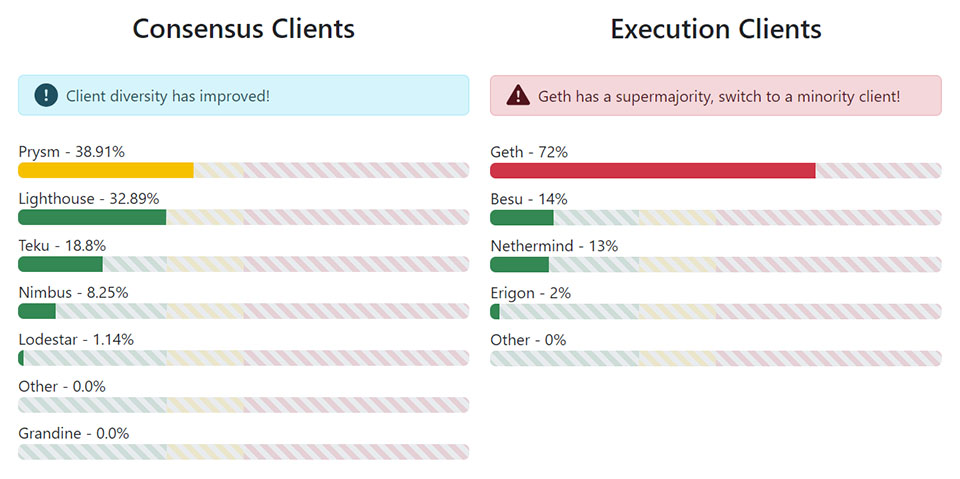

Another catalyst for Ethereum price action was the debate over the distribution of validators who run various versions of Ethereum’s core software. Ethereum validators run two types of software, an execution client and a consensus client. While there are 5 major consensus clients with a somewhat even distribution across them, there are 4 major execution clients and one client, GETH, is run by 78% of all validators. As Ethereum seeks to be a reliable smart contract platform with 100% uptime, this presents an issue because a bug in GETH could cause the network to have downtime. Worse yet, the consensus mechanism of Ethereum might treat a GETH bug as indistinguishable from a coordinated attack, meaning that non-responsive validators could see their ETH slashed until 66% of the network’s ETH staked is responsive. That could be catastrophic. While this GETH dominance has been an ongoing issue, it came to a head in January when a bug in the Nethermind client caused 8% of Ethereum’s validator set to go offline. While Ethereum did not have any issues as a result, it raised concerns in the Ethereum community. Some proposed solutions to add economic incentives and penalties to get more validators to use different clients but at the time of writing, there was no concrete solution to the dilemma.

Solana (-4%) held up relatively well vs. other high beta L1s in January, thanks to a series of exciting announcements and improving fundamentals. Among the most exciting was news that Solana would be unveiling a new phone called Saga 2. 30k preorders for the phone, to be priced at $450, were recorded in the first 30 hours. Solana also released “extensions” for the SPL token standard. The SPL token standard is a library of code that projects can use to create coins. The new upgrade - called “extensions” - will allow new transaction types such as confidential transfers, augmented token interactions, token fees for transferred tokens, interest-earning tokens, and more. These customizations should help projects make novel products and better monetize existing ones. One early adopter is Japanese fintech GMO Payments (3769 JP, mkt cap $5B), who just announced two new stablecoins, the first regulated Japanese Yen stablecoin and a USD stablecoin, both on the Solana network. These stablecoins will use transfer hooks and permanent delegate authority, new extension features. Lastly, the Jupiter airdrop for Solana was successful, as more than 368k wallets claimed tokens, and Solana did not suffer an outage.

To round out the news for the month, Binance completed its monthly token burn worth $636M of BNB tokens. Binance does quarterly token burns as a consequence of usage to reduce BNB supply. Meanwhile, Monad, a parallelized EVM blockchain, announced it will use LayerZero for bridging. Aevo, a burgeoning options L2 on Ethereum recently declared it will be using Celestia for Data Availability. NEAR Foundation, which recently pushed into becoming a Data Availability layer, confirmed that it would lay off 40% of its workforce. In the Cosmos, the Cosmos Hub is considering liquidity incentive campaign to compel users to stake ATOM in exchange for voting rights to direct the Cosmos Hub’s future. Also in the Cosmos, Berachain is launching its much-anticipated EVM testnet which will employ the novel “Proof of Liquidity” consensus mechanism.

January’s Notable Performer

Sui (+105.9%)

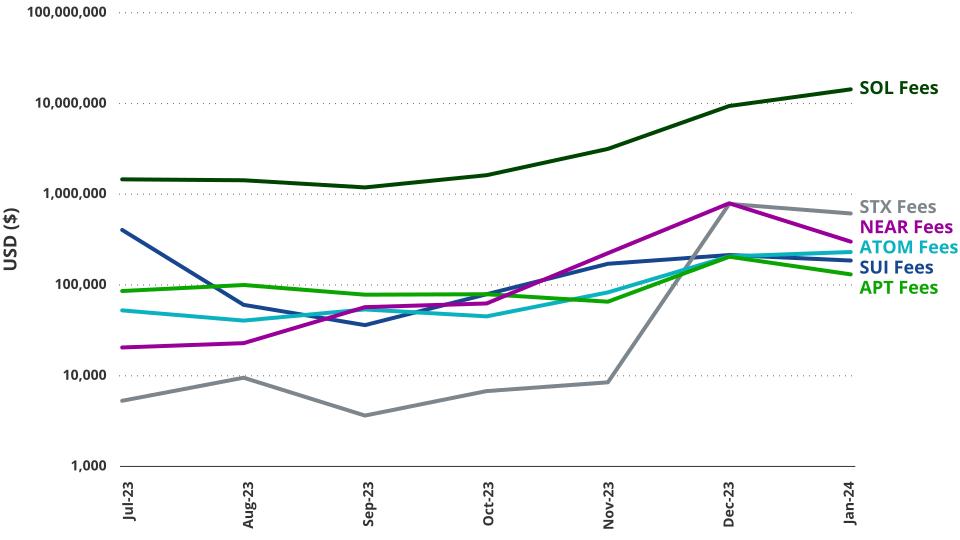

Monthly Fees Generated

Source: XYZ as of 1/31/2024. Past performance is no guarantee of future results. Not intended as a recommendation to buy or sell any securities named herein.

Sui was the top performer among smart contract platforms, as it more than doubled its price over the course of a month. Though month-to-month daily active user count was down (-11%), Sui saw a monstrous (+66.7%) uptick in TVL to reach $444M in total value locked and an (+88.8%) increase in DEX volume. Sui’s DEX volume and TVL in January ranked ahead of Coinbase’s Base blockchain’s metrics. Sui is a fascinating, relatively new entrant to the alternate layer-1 blockchain race that saw its Mainnet go live in May 2023. Created by former Facebook blockchain project Diem developers and built around Diem’s cutting-edge Move blockchain language, Sui boasts an impressive set of capabilities. We find Sui to be a compelling project because:

- Attractive Developer Funnel

- Faster developer time – projects claim 1/5th of developer time versus similar Solana project; one-half of the coding lines to accomplish the same task

- Language that prevents errors while making mental overhead for developers lower

- Assets on chain are treated intuitively as “objects” that can be owned, shared and mutated

- Vastly Improve User Experience

- Using zkLogin, users can permissionlessly control their funds using a Google or Facebook sign in

- Object-based programming language and account abstraction allows users to understanding in plain English what each transaction they sign will accomplish

- Blockchain Safety

- Bytecode verifier rejects faulty or unsafe smart contract when loaded onto Sui

- Object-based coding language system that prevents many types of blockchain attacks

- Ownership

- High Throughput (how many txs are processed per second)

- Recorded a record 65M transactions in one day

- Unique modular architecture for scaling that allows workers servers to be added to increase throughput rather than validators having to buy a better server

- Transactions can perform up to 2048 different functions at once; the equivalent on Solana is 64

- Fast Latency (how fast a user gets confirmation of a transaction being recorded)

- Soft confirmations as quick as 30ms

- Full finality as fast as 2 network roundtrips (300ms) for “owned objects”

- Full finality for “shared objects” as fast as (600ms)

- Talented Developer Team

- Blockchain architected from the ground up to take advantage of the Move language

While Sui has quite a bit of potential, it is very nascent and has not found a core identity or a very differentiated application ecosystem. Having a culture and a community often stems from personalities within the broader team. While Sui’s team is exceptionally bright, they have yet to assert a positive online presence to resemble that of successful chains like Ethereum or Solana. Social capital is very important in crypto, as is building an interesting community that appeals to the typical crypto user. While projects like Aftermath Finance have begun a grassroots movement of culture on Sui, it’s too early to tell if it can become sticky. Also, Sui’s daily active user count is low, putting it in the usership size cohorts with projects like MultiverseX, Fantom, and the Cosmos Hub, which each have far lower valuations than Sui. Finally, it is likely that much of the activity on Sui relates to the high level of rewards offered within Sui DeFI.

January’s Notable Laggard

Polygon (-17.4%)

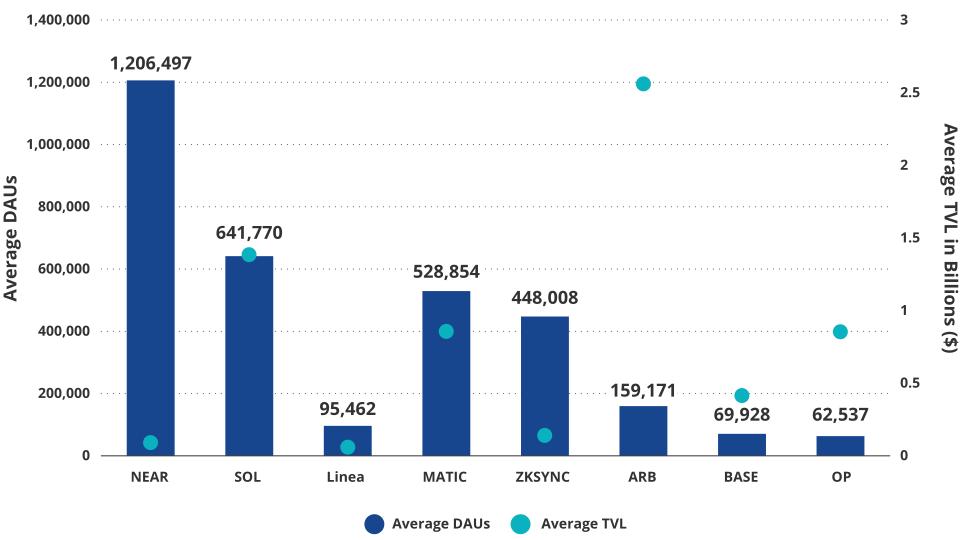

Average DAUs vs. Average TVL, Last 30 Days

Source: XYZ as of 1/31/2024. Past performance is no guarantee of future results. Not intended as a recommendation to buy or sell any securities named herein.

Polygon’s MATIC token price once again had a very discouraging month. Though usership like daily active users was positive on the month, up (+39.2%) compared to December, the more important fundamental indicators of activity like DEX Volume and TVL were down (-21%) and (-1.8%) month to month. From a fee standpoint, MATIC was also down (-55.3%) in January compared to December. One catalyst for the negative price action is that Polygon is accused of intentionally misallocating 400M in tokens that were supposedly reserved for staking rewards. Instead, some claim that those tokens were on Binance to generate funds for Polygon. While it is not unusual for projects to change token tokenomics, typically they do so in an open, transparent manner. All else equal, this token shifting, especially when done almost 3 years ago, is considered an issue but not a price killer. However, Polygon suffers from a somewhat unfair reputation for making dubious claims. Generally, market sentiment for Polygon is weak due to a confusion about Polygon’s long-term vision, its differentiation from other L2s, and the allocation of its tokens business partnerships, many of which have yet to generate meaningful fees on-chain.

However, there is ample reason to think Polygon is underpriced relative to its potential. Polygon still has the 7th largest DAU base in all crypto, ~571k over the last 30 days, and this usership is nearly 4x is that of the closest L2 blockchain competitors. Additionally, there are many interesting differentiated projects building on Polygon including a game focused blockchain called ImmutableX, a automotive data project called Dimo and GPS improvement entity called GEODNET. Most importantly, Polygon has a fascinating zk scaling approach and is moving towards becoming an aggregation layer for L2 blockchains.

In their vision, Polygon would earn revenue by operating a proving systems as well as a settlement layer for zk rollup blockchains built using the Polygon CDK. This would enable Polygon to connect these chains through trustless bridging, a major pain point for L2s, to unite siloed liquidity while earning fee revenue. Additionally, Polygon recently announced an interesting partnership with Fox Corporation to launch Verify which will enable Fox to post proofs of authenticity of its media content to Polygon’s blockchain. Like anything else in crypto, Polygon’s MATIC token will likely be the beneficiary of a narrative. In Polygon’s case that market story will likely revolve around difficulties of bridging funds between L2s and other pain points associated with non-zk roll ups L2s. While there is no certainty of if or when that positive narrative will form for Polygon, what is certain is that its aggregation layer is launching in February, and many will be watching to see how it performs.

Links to third party websites are provided as a convenience and the inclusion of such links does not imply any endorsement, approval, investigation, verification or monitoring by us of any content or information contained within or accessible from the linked sites. By clicking on the link to a non-VanEck webpage, you acknowledge that you are entering a third-party website subject to its own terms and conditions. VanEck disclaims responsibility for content, legality of access or suitability of the third-party websites.

Important Information

This is not financial research but the opinion of the author of the article. We publish this information to inform and educate about recent market developments and technological updates, not to give any recommendation for certain products or projects. The selection of articles should therefore not be understood as financial advice or recommendation for any specific product and/or digital asset. We may occasionally include analysis of past market, network performance expectations and/or on-chain performance. Historical performance is not indicative for future returns.

For informational and advertising purposes only.

This information originates from VanEck (Europe) GmbH, Kreuznacher Straße 30, 60486 Frankfurt am Main. It is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice. VanEck (Europe) GmbH and its associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. Views and opinions expressed are current as of the date of this information and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. VanEck makes no representation or warranty, express or implied regarding the advisability of investing in securities or digital assets generally or in the product mentioned in this information (the “Product”) or the ability of the underlying Index to track the performance of the relevant digital assets market.

The underlying Index is the exclusive property of MarketVector Indexes GmbH, which has contracted with CryptoCompare Data Limited to maintain and calculate the Index. CryptoCompare Data Limited uses its best efforts to ensure that the Index is calculated correctly. Irrespective of its obligations towards the MarketVector Indexes GmbH, CryptoCompare Data Limited has no obligation to point out errors in the Index to third parties.

Investing is subject to risk, including the possible loss of principal up to the entire invested amount and the extreme volatility that ETNs experience. You must read the prospectus and KID before investing, in order to fully understand the potential risks and rewards associated with the decision to invest in the Product. The approved Prospectus is available at www.vaneck.com . Please note that the approval of the prospectus should not be understood as an endorsement of the Products offered or admitted to trading on a regulated market.

Performance quoted represents past performance, which is no guarantee of future results and which may be lower or higher than current performance.

Current performance may be lower or higher than average annual returns shown. Performance shows 12 month performance to the most recent Quarter end for each of the last 5yrs where available. E.g. '1st year' shows the most recent of these 12-month periods and '2nd year' shows the previous 12 month period and so on. Performance data is displayed in Base Currency terms, with net income reinvested, net of fees. Brokerage or transaction fees will apply. Investment return and the principal value of an investment will fluctuate. Notes may be worth more or less than their original cost when redeemed.

Index returns are not ETN returns and do not reflect any management fees or brokerage expenses. An index’s performance is not illustrative of the ETN’s performance. Investors cannot invest directly in the Index. Indices are not securities in which investments can be made.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH

Important Disclosure

This is a marketing communication. Please refer to the prospectus of the UCITS and to the KID before making any final investment decisions.

This information originates from VanEck (Europe) GmbH, which has been appointed as distributor of VanEck products in Europe by the Management Company VanEck Asset Management B.V., incorporated under Dutch law and registered with the Dutch Authority for the Financial Markets (AFM). VanEck (Europe) GmbH with registered address at Kreuznacher Str. 30, 60486 Frankfurt, Germany, is a financial services provider regulated by the Federal Financial Supervisory Authority in Germany (BaFin).

The information is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice VanEck (Europe) GmbH, VanEck Switzerland AG, VanEck Securities UK Limited and their associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results. Information provided by third party sources is believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Brokerage or transaction fees may apply.

All performance information is based on historical data and does not predict future returns. Investing is subject to risk, including the possible loss of principal.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH / VanEck Asset Management B.V.

Sign-up for our ETF newsletter

Related Insights

Related Insights

16 January 2025

27 November 2024

27 November 2024

07 November 2024