Tracking Sovereign Adoption of Bitcoin: A Potential Tipping Point?

24 June 2021

VanEck assumes no liability for the content of any linked third-party site, and/or content hosted on external sites.

- El Salvador’s presumptuous bitcoin gambit draws an IMF rebuke

- Mining BTC from volcanos

- Paraguay courts crypto with the lowest power costs in the region

- Context on sovereign defaults: the Neiman Marcus analogy

- Latin America: strong structural setup for digital asset adoption

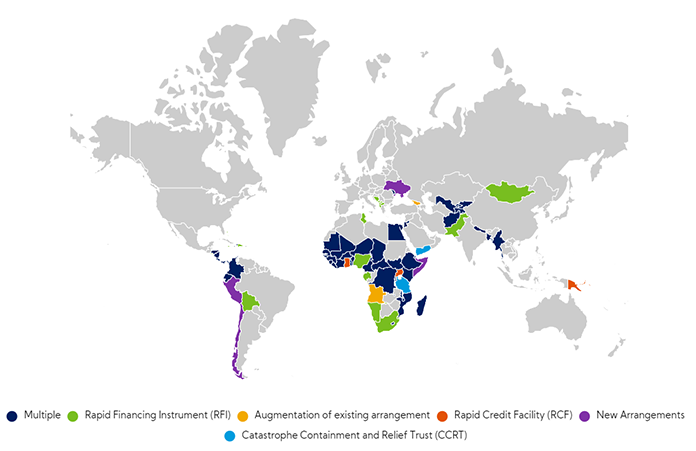

El Salvador has announced a presumptuous attempt to partially de-dollarize itself by accepting bitcoin as legal tender.1 In response, the International Monetary Fund (IMF), in the midst of negotiating a $1B bailout with the heavily indebted Central American nation, declared its opposition.2 The market has since punished President Nayib Bukele for his impudence with higher USD funding costs. With total gross domestic product (GDP) of nations currently borrowing from the IMF at $4.8T, or 5.5% of global GDP3, a potential El Salvadorian default would be an important test case for how vulnerable frontier nations approach monetary sovereignty in the age of bitcoin.

Countries Currently Receiving IMF Assistance and Debt Service Relief

Source: IMF as of 14/6/2021.

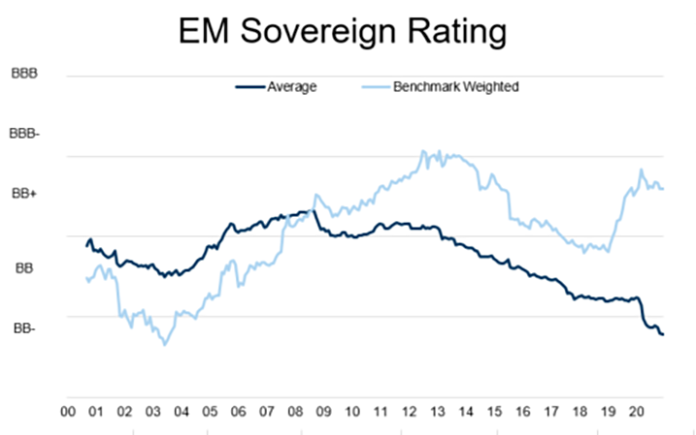

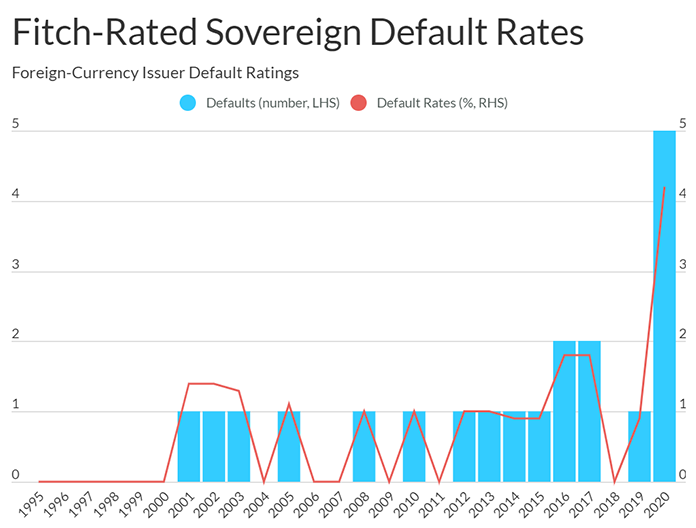

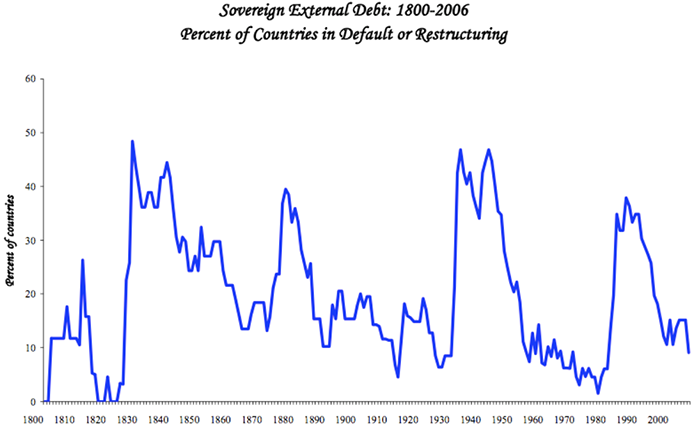

But while the headlines and initial price action as shown in the chart above may read negative, El Salvador’s gambit is a fascinating test of game theory that bitcoin bulls have long predicted. With the Biden administration more explicitly tying its foreign policy to “human rights” than did President Trump, and China’s newfound focus on climate change pushing bitcoin miners overseas, cryptocurrencies may be an increasingly attractive hedge for populist leaders on the fringes of the “Washington Consensus”.4 There is also concern that the fringes are fraying: according to an IMF blog published late last year by Reinhard & Rogoff “[t]here is brewing in the background a growing need for debt restructurings in numbers not seen since the debt crisis of the 1980s.” Currently 5% of sovereign issuers are in default.5 The comparable 1980s ratio was 40%.6 A U.S. Federal Reserve (Fed) taper, should it occur, may increase the cost of capital for the world’s more vulnerable borrowers.

Source: Goldman Sachs. A sovereign credit rating is an independent assessment of the creditworthiness of a country or sovereign entity.

Source: Fitch.

Source: Harvard University, Ken Rogoff.

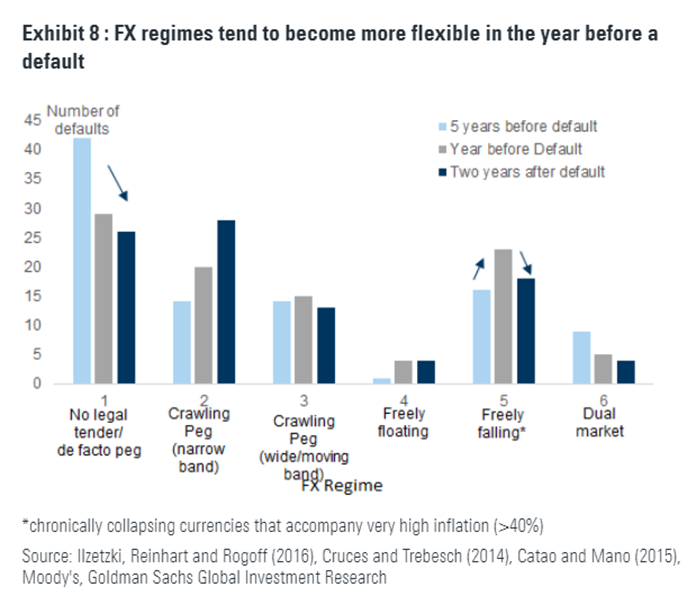

Sovereign defaults is a failure by a government in repayment of its country’s debts. No legal tender/de facto peg: No own sovereign currency. Example El Salvador using USD. Crawling Peg (narrow band): Is when a currency steadily depreciated or appreciates at an almost constant rate against another currency, with the exchange rate following a simple trend. Crawling Peg (wide band): Same as above. Wider band means the constant rate against another currency is wider than a narrow band. Freely Float: A currency’s value is allowed to fluctuate in response to foreign-exchange market mechanisms without government intervention. Freely falling: already defined in chart. Dual market: Dual exchange rate setup where a currency has a fixed official exchange rate and a separate floating rate applied to specific goods, sectors or trading conditions.

(We should note: VanEck’s emerging markets debt team emphasizes that that any defaults are best predicted and analyzed on a case-by-case basis. “Waves” of defaults are not part of our baseline. In other words, being selective and analyzing each credit on its own merits is a better response than avoiding EM debt because some countries might get into trouble. In addition, a lot of these more vulnerable bond markets trade with these concerns already priced-in, in our view.)

So What Happened in El Salvador?

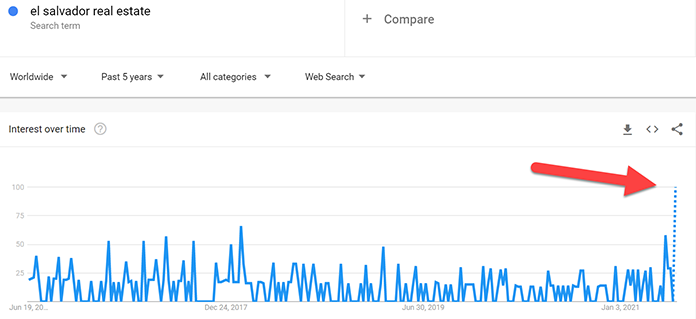

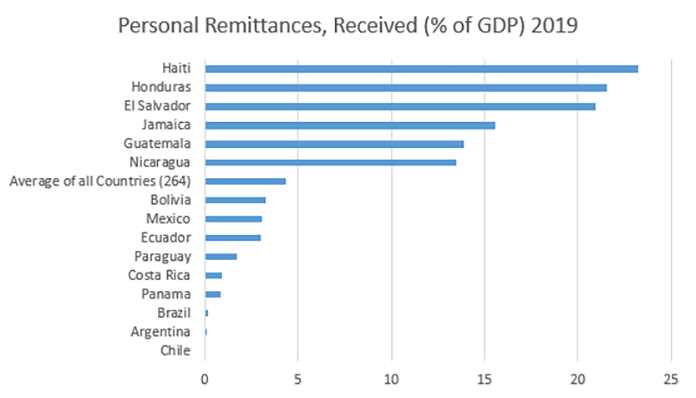

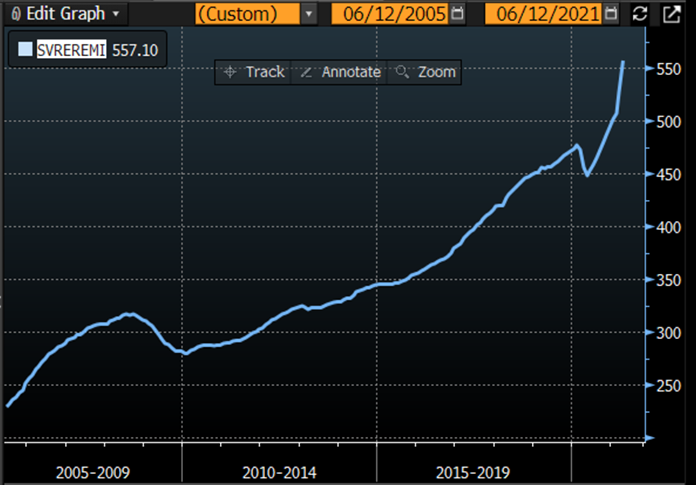

The Bitcoin law passed El Salvador’s congress last week, and President Bukele shortly thereafter advertised his plan to power bitcoin mining from renewable geothermal power.7 The CEO of U.S. bitcoin miner Marathon Digital (ticker: MARA, with a market capitalization of $2.6B8) chimed in with a request to collaborate.9 Google searches for El Salvador real estate reached an all-time high, particularly of bitcoin-friendly “El Zonte”, or "Bitcoin Beach" as it is now known, a $200 million tourist development an hour’s drive from the country’s capital, San Salvador.10 This has attracted significant Chinese funding in recent years according to Global Times, including $35 million in funding for a sewage and wastewater treatment plan as part of a recently expanded “without conditions” $500 million Chinese pledge to El Salvador.11 (Sugar exports to China rose 105% year-on-year in 2020, Torino Economics reported on June 11, 2021. With President Biden and President Bukele trading diplomatic snubs over Mr. Bukele’s summary firing of most of the country’s Supreme Court after sweeping to power in 2019, and IMF aid on El Salvador’s $3B in debt due in 2022 now in jeopardy thanks to the Bitcoin law, Mr. Bukele has marshalled his 90% domestic approval rating into a test case for potential sovereign defaulters who may be looking to play the U.S. and China off against each other.12

Source: Google Trends.

Source: World Bank.

El Salvador Trailing 12-Month Remittances (Millions of USD)

Source: Bloomberg, VanEck.

Argentina: High Inflation and Distorted Energy Prices Encourage Mainstream Bitcoin Use

Bitcoin is already in widespread use among Argentinians who have decades of experience with volatile inflation and unreliable money, and enjoy distortive state-subsidized power costs that makes even household bitcoin mining attractive, according to this South China Morning Post piece. (As an aside, my NYC barber lives in a $900 rent-stabilized apartment with utilities included and his brother mines crypto in there.13 “That room is hot!” he told me. “We have to blast the AC.” Taxpayer funded bitcoin is not exclusively a Latin American phenomenon!)

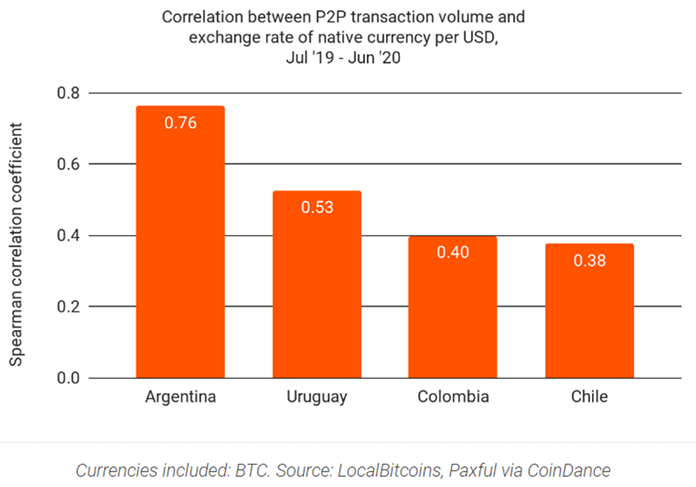

In addition, stranded power in Patagonia also makes Argentina attractive for industrial miners: Canadian crypto miner Bitfarms (BITF CN, market cap of $700M14) announced in April it was acquiring a 60MW site with plans to scale to 210MW at a cost of $0.02 MW/Hr.15 But there is still considerable uncertainty whether Argentina will continue its hands-off regulatory approach to crypto: on June 11 the Central Bank announced an investigation into nine domestic fintech companies suspected of “using crypto assets as a channel for savings, to determine if they are conducting unauthorized financial intermediation.”16 Still, according to Chainalysis, a blockchain researcher, Argentina sports the highest correlation between local currency movements and peer-to-peer crypto transactions among Latin American countries. With the Consumer Price Index (CPI) currently running at 46% in Argentina, a “hard-money” alternative such as bitcoin would seem intuitively attractive.17

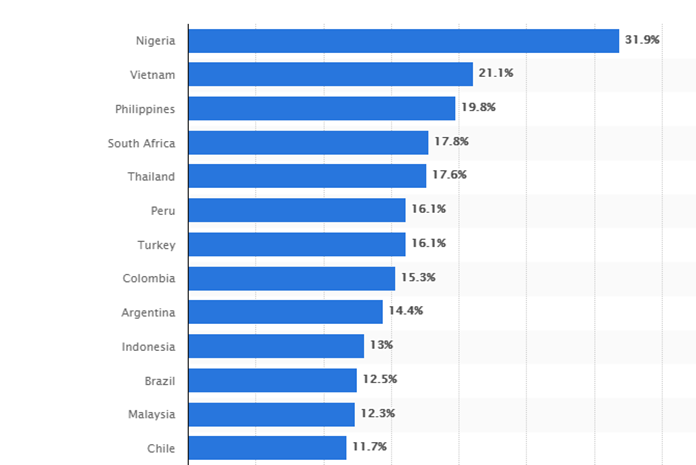

Share Who Owned/Used Cryptocurrencies in 2020

Source: Statista.

Source: Chainalysis blog. Correlation is a statistic that measures the degree to which two entities move in relation to each other.

Source: Bloomberg. CPI is defined as the Consumer Price Index, which is a measure that examines the prices of a basket of consumer goods and services.

Do Argentina and El Salvador share any other similarities? The VanEck Emerging Markets Bond Strategy’s team chimes in:

"We believe crypto is naturally appealing to emerging markets savers. At the level of the voting public, there is memory of inflationary and banking crisis outcomes from monetary and fiscal indiscipline that makes them very receptive to private money. And governability concerns are prevalent in emerging markets, especially in Latam. Loss of trust in government and government money is clearly a “thing” in Latam that predates crypto, so in our view, its take-up makes sense. But how can we begin to think about EM economies and crypto in an organized way? We believe that their underlying debt dynamic could be one good lens to use in thinking about the kinds of countries that might be especially attracted to crypto.

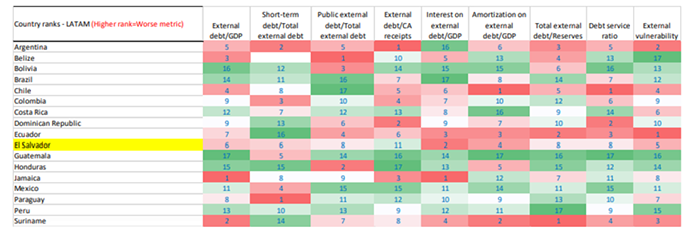

Unsustainable high external debt and debt service may create a “why not default” attitude. If you look at the heat maps for the selected EM countries in the table below, you’ll notice that El Salvador and Argentina have high levels of government external debt and/or high levels of external debt service. If debt and debt service are too high to be realistically serviced, it may become a “why not, because I’m never gaining market access anyway.” Argentina might never be able to repay the more than $60B it owes to the IMF, so why try hard to repay it? El Salvador has over $3B in debt payments due next year, which it cannot repay without an IMF agreement and the market access that provides. We believe if it’s not going to get an IMF deal, why not default, and take a chance with a new money system? We are not recommending it, as defaults are very painful and risky. We are simply explaining the story behind it.

The table below gives you a sense of the types of debt pressures different EM countries are experiencing, as a lens on which countries may be likelier to move to crypto. As you would expect, a big question like the one we are asking cannot be answered with a simple table—there are subjective factors, and even contradictions (such as large liabilities not being a problem due to large credibility). Anyway, as the crypto world expands, this is a possible formal lens.”

Source: VanEck.

Paraguay: Looking to Exploit Cheap Energy

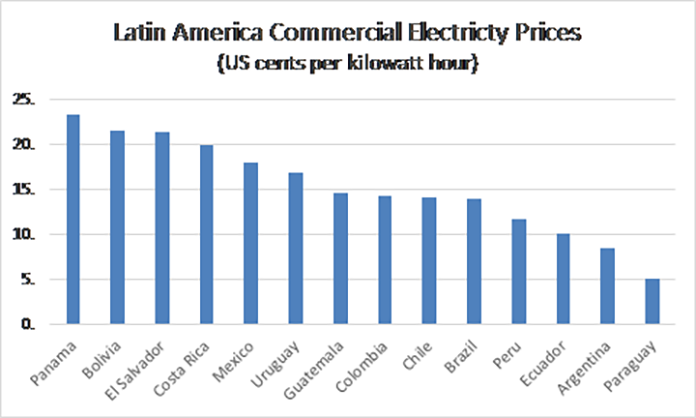

Paraguayan congressman Carlitos Rejala tweeted a response to El Salvador President Bukele: “Our country needs to advance hand in hand with the new generation. The moment has come, our moment. This week we start with an important project to innovate Paraguay in front of the world! The real one to the moon 🚀#btc & #paypal.”18 The CEO of Paraguayan bitcoin mining company Bitcoin.com.py then told Coindesk TV that Paraguay is “an attractive country to crypto investors" because mining in Paraguay only requires registration and payment of taxes, which he classified as lower than in the rest of the region (10% business income tax, 10% VAT and 10% personal income tax). Paraguay offers no restrictions on foreign capital flows and the payment of dividends abroad and also sports the lowest power electricity costs in the region. At the Itati hydroelectric plant, for example, shared with Brazil, Paraguay only takes 26% of the 6,067 megawatts19 it is entitled to monthly, submitting the rest to the neighboring country, according to congressman Rejala. “We have a lot of energy that we sell to Argentina and Brazil almost for free because we can only sell to our neighbors,” said Bitcoin.com.py CEO Benitez-Rickmann, who added that he spoke to a number of mining pool operators from China who asked for 100 megawatts of space, according to Coindesk.

Latin America Commercial Electricity Prices

(US cents per kilowatt hour)

Source: Statista. Data as of 24/9/2020.

Panama: No Tax Treaty with U.S.

Panamanian congressman Gabriel Silva tweeted in response to Bukele: "This is important. And Panama cannot be left behind. If we want to be a true technology and entrepreneurship hub, we have to support cryptocurrencies. We will be preparing a proposal to present at the Assembly. If you are interested in building it, you can contact me."20 Panama taxes capital gains at 10% and income at a max of 25% for residents and 15% for non-residents, according to Greenback Expat Tax Services, a consultancy. The country has no tax treaty with the U.S.

Mexico and Brazil: Modest Steps in Latam’s Two Largest Economies

Mexican senator Eduardo Hinojoso changed his Twitter profile to laser eyes on June 8 and wrote on the social media platform that he would be “promoting and proposing a legal framework for crypto coins” while adding the hashtag #btc.21 “We are going to lead the shift to crypto and fintech in Mexico,” said Hinojosa. Mexican senator Indira Kempis Martinez also went laser eyes on Twitter.22 Meanwhile in Latam’s largest economy, Brazilian congressman Gilson Marques added laser eyes to his Twitter profile with the comment “tax is theft”.23 While such sentiment may be far from mainstream, it is worth noting that the Brazilian SEC approved a bitcoin ETF last month that will trade on the São Paulo bourse.24

Nicaragua, Cuba and Guatemala: Looking for Leverage

Ahead of Nicaragua’s election on 7 November, Nicaraguan President Daniel Ortega has arrested four presidential hopefuls, a senior businessman, two opposition leaders and issued an arrest warrant for the president of the American Chamber of Commerce, a former central bank governor, who is in hiding.

Last weekend Cuba suspended U.S. dollar deposits in Cuban banks in a bid to evade U.S. sanctions.25 One should expect Cuba and Nicaragua to remain financially isolated, making bitcoin adoption an obvious temptation, in our view. Meanwhile Guatemala is currently locked in a high-stakes negotiation with the Biden administration over a $4B aid package meant to stem a migrant crisis at the U.S. border.26 But President Alejandro Giammattei just abolished a leading anti-corruption unit, claiming leftist bias.27 U.S. Secretary of State Antony Blinken in turn expressed “deep concern”. One can easily imagine bitcoin making an appearance in some of these diplomatic cables as a point of negotiation.

Context on Sovereign Defaults

There is currently $147B in outstanding IMF debt, of which El Salvador accounts for just $389 million, or 22 bps.28 And yet a potential El Salvadoran default carries enormous implications. Specifically, if the country defaults on its U.S. dollar debt, can creditors seize the assets (“attach”, in legal terminology) of the debtor nation’s crypto flows? Typically, in a default, this is the source of creditor power. Any flow of money to accounts owned by the “deadbeat” can be attached and put in escrow until a debt deal is agreed. So, the money flows stop, which is why countries have historically tried to reach voluntary agreements to reschedule debt. El Salvador may be the first test case of whether crypto could be seized.

As a potential corporate parallel, we might consider the case of Neiman Marcus, which carved out its online site MyTheresa during bankruptcy last year in an attempt to shield the fast-growing business from creditors. The desperate bondholders were to be left with just the company’s brick and mortar stores.29 “It’s like someone takes your wallet out of your back pocket on the subway and stares at you right in the face while doing it,” said the hedge fund manager and Neiman creditor Dan Kamensky, who became so alarmed by the prospect that he broke the law attempting to interfere and is now headed for six months in prison. Bitcoin bulls certainly hope that the IMF and the U.S. don’t become similarly “undone” should El Salvador’s potential end-run around their dollar liabilities gain more traction in the region and beyond.30

(For its part, MyTheresa spun out from Neiman and raised $407M in a January IPO. The company is valued at $2.7B. Neiman Marcus on the other hand emerged from bankruptcy last year as a private company. Its bonds are rated CCC+ by S&P.)

Source: Bloomberg.

Conclusion

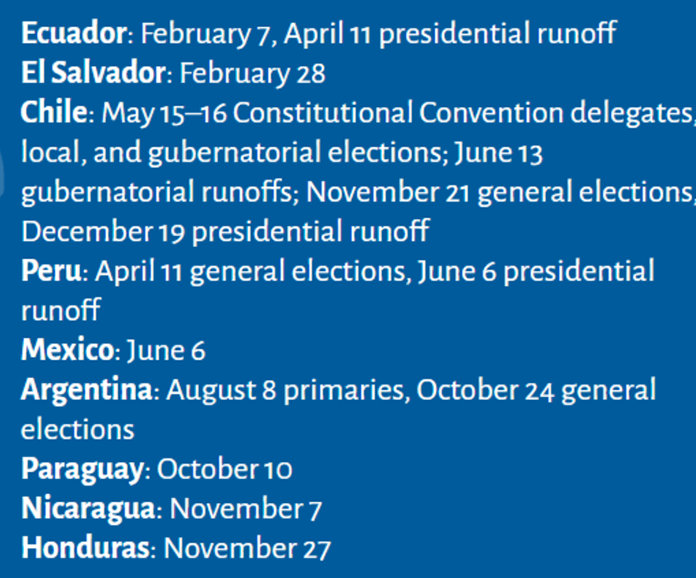

Macro and digital assets investors should be laser-focused on the busy political calendar in Latin America this year.31 Though the region is no stranger to political polarization and regulatory volatility, El Salvador’s bitcoin ploy may be the beginning of an anti-Washington consensus to adopt a monetary alternative that can be manufactured with stranded CO2. You can expect a cost curve on volcano bitcoin mining from VanEck soon enough.

Source: AS/COA Guide to Latin America Elections.

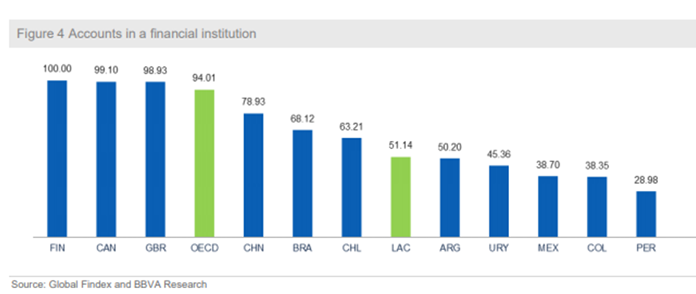

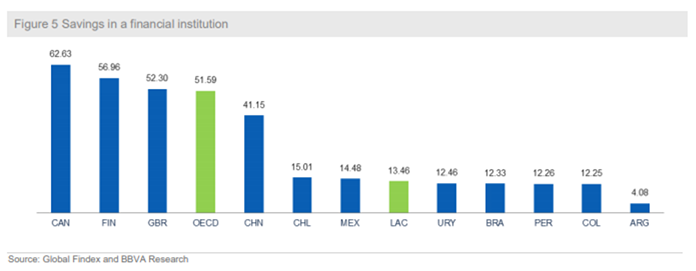

PS: Don’t forget the structural story for digital assets in Latam

Source: BBVA, latest data 2018.

1 Source: Wall Street Journal.

2 Source: Reuters.

3 World Bank, IMF and VanEck.

4 Source: South China Morning Post.

5 Source: Fitch.

6 Source: Harvard University.

7 Source: Twitter.

8 Source: Factset as of 11/6/2021.

9 Source: Twitter.

10 Source: USA Today.

11 Source: Reuters.

12 Source: LA Times, El Salvador Info.

13 Source: Twitter.

14 Source: Factset as of 9/6/2021.

15 Source: Bitfarms.

16 Source: Central Bank of Argentina.

17 Source: Bloomberg.

18 Source: Twitter

19 Source: Coindesk.

20 Source: Twitter.

21 Source: Twitter.

22 Source: Twitter.

23 Source: Twitter.

24 Source: Coindesk.

25 Source: Reuters.

26 Source: Reuters.

27 Source: VOA News.

28 Source: IMF.

29 Source: Wall Street Journal.

30 Source: Wall Street Journal.

31 Source: Twitter.

VanEck assumes no liability for the content of any linked third-party site, and/or content hosted on external sites.

Important Disclosure

This is a marketing communication. Please refer to the prospectus of the UCITS and to the KID before making any final investment decisions.

This information originates from VanEck (Europe) GmbH, which has been appointed as distributor of VanEck products in Europe by the Management Company VanEck Asset Management B.V., incorporated under Dutch law and registered with the Dutch Authority for the Financial Markets (AFM). VanEck (Europe) GmbH with registered address at Kreuznacher Str. 30, 60486 Frankfurt, Germany, is a financial services provider regulated by the Federal Financial Supervisory Authority in Germany (BaFin).

The information is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice VanEck (Europe) GmbH, VanEck Switzerland AG, VanEck Securities UK Limited and their associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results. Information provided by third party sources is believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Brokerage or transaction fees may apply.

All performance information is based on historical data and does not predict future returns. Investing is subject to risk, including the possible loss of principal.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH / VanEck Asset Management B.V.

Sign-up for our ETF newsletter

Related Insights

Related Insights

14 March 2025

16 January 2025

27 November 2024

27 November 2024