Is the Space Industry at an Inflection Point?

12 February 2025

What seemed to many the realms of science fiction just a few years ago is no longer so far-fetched. Propelled by a powerful blend of disruptive innovation, huge capital expenditure and ambition, the space economy is real and growing fast.

The US billionaires leading the new space race are shooting for the Moon, if you’ll forgive the pun. Blue Origin, owned by Amazon founder Jeff Bezos, blasted its first rocket into orbit in January. He’s pitted against Elon Musk, whose SpaceX has pioneered reusable rockets, slashing the cost of access to space.

Compounding the excitement, President Trump tantalized the public’s imagination in his inaugural address when he included space in his promise of a “golden age” for America. “We will pursue our destiny into the stars, launching American astronauts to plant the Stars and Stripes on the Planet Mars,” he enthused.

Innovation Sparks Fast Growth

Is today an inflection point for the space industry? Certainly, the technological achievements that are transforming its economics are proving a game changer. They are stimulating an upsurge in commercial and government activity – not just in the United States but also in Europe, Asia and the Middle East.

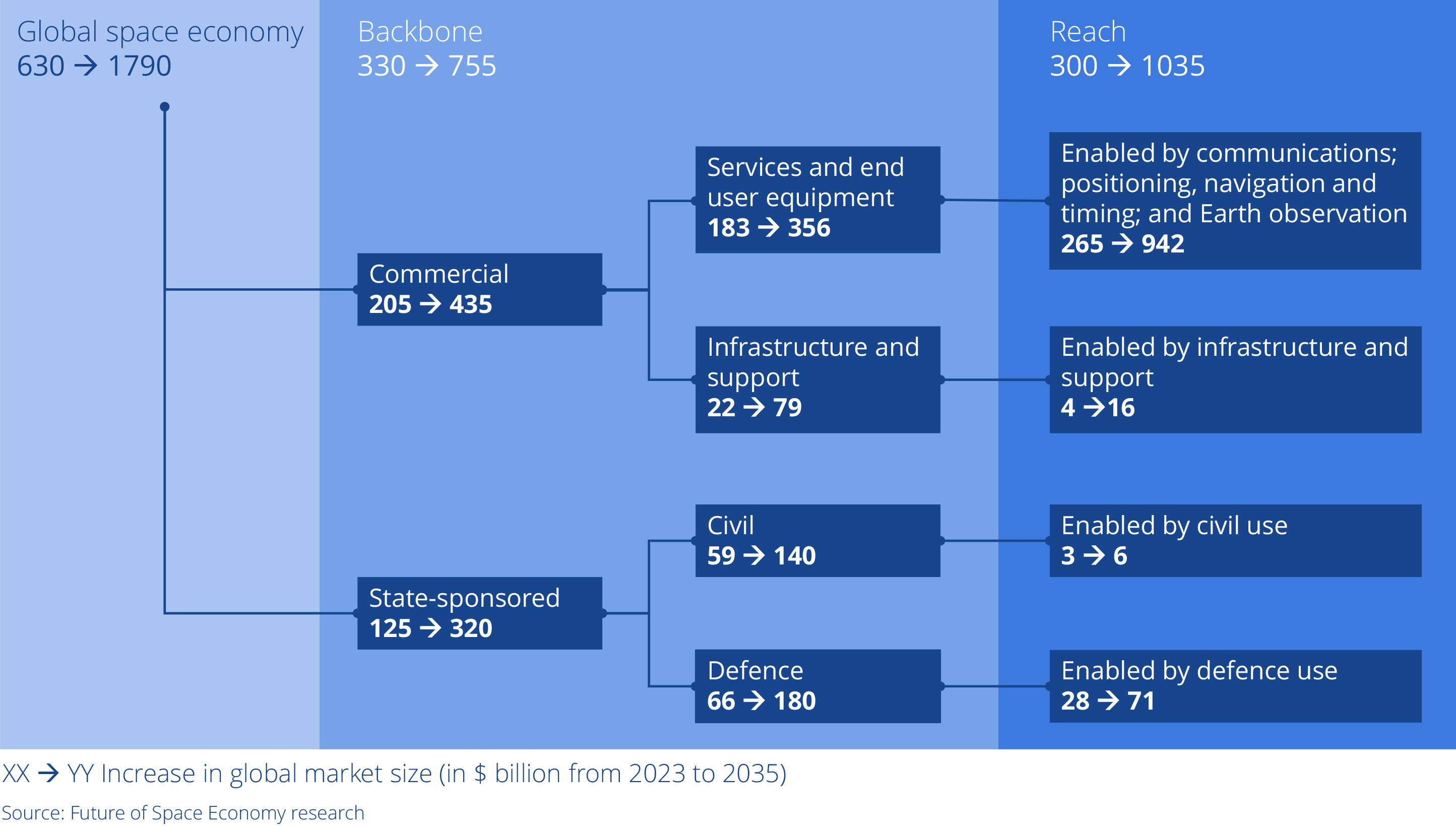

The space industry is quickly evolving into a ubiquitous enabler as satellites connect and change many other sectors. It is forecast to grow at a rate of 9% a year over the next 10 years, far above global gross domestic product growth, according to a report from the World Economic Forum (WEF) and McKinsey & Company.1 The report estimates that the space industry will reach $1.8 trillion in size by 2035, up from $630 billion in 2023.

At the core of this is the traditional space economy: satellites, rocket launchers and global positioning systems. But the WEF/ McKinsey estimate’s scope is far wider, taking in activities connected by the satellite-based internet; navigation and positioning services; emerging AI-based intelligence for disaster response or insurance.

Components of a Fast-Growing Space Economy

Governments are also spending significant amounts, whether to boost their domestic tech industries, enhance internet access or for defense. The major space powers – notably the Americans and Chinese – are vying for a strategic head start as space exploration opens up.

To give some examples of mounting activity, the European Union and European Space Agency signed the €10.6 billion Iris satellite deal at the end of 2024 to develop a secure satellite communication network. Further, the race is on to claim the Moon’s airwaves, as more than 50 applications have been filed since 2010 with the International Telecommunication Union to use radio spectrum on the rocky celestial body.

Answering the Question

For investors, all this amounts to an exciting ride. While many leading space companies are privately held, some rocket makers and satellite companies are listed on public markets. Amid excitement about the possibility of more favorable regulations under a Trump administration and concrete improvements in companies’ earnings, some of their shares performed well in 2024.

As anyone who follows my blog will know, space is a fascination of mine. In 2023, I wrote that spacefaring dreams may soon be a reality, highlighting the industry’s amazing progress and prospects. Just over a year later, the industry has powerful momentum as it becomes a key area of technological competition.

Returning to the question in the title, I think that space is indeed at an inflection point. Far from being the stuff of science fiction, it’s becoming essential for some of the fastest-growing parts of the modern economy.

Anyone wanting to invest should do so in the knowledge that, like any young sector, individual stocks will likely be volatile. For that reason, it’s prudent to remain diversified and think long term. The VanEck Space Innovators UCITS ETF is currently the only space ETF available in Europe. It tracks the MVIS® Global Space Industry ESG Index and is currently invested in 25 of the largest and most liquid companies in the global space industry. Investing in this ETFs carries risks, including the risk of capital loss and sector concentration risk. For full information on the risks, please read the prospectus and the KID/KIID before investing.

The space industry is no longer the stuff of dreams. It’s real, substantial and expanding fast.

1 Space: The $1.8 Trillion Opportunity for Global Economic Growth. April 2024. World Economic Forum and McKinsey & Company.

IMPORTANT INFORMATION

This is a marketing communication. Please refer to the prospectus of the UCITS and to the KID before making any final investment decisions. This information originates from VanEck (Europe) GmbH, which has been appointed as distributor of VanEck products in Europe by the Management Company VanEck Asset Management B.V., incorporated under Dutch law and registered with the Dutch Authority for the Financial Markets (AFM). VanEck (Europe) GmbH with registered address at Kreuznacher Str. 30, 60486 Frankfurt, Germany, is a financial services provider regulated by the Federal Financial Supervisory Authority in Germany (BaFin).

The information is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice VanEck (Europe) GmbH and its associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results. Information provided by third party sources is believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Brokerage or transaction fees may apply.

VanEck Asset Management B.V., the management company of VanEck Space Innovators UCITS ETF (the "ETF"), a sub-fund of VanEck UCITS ETFs plc, is a UCITS management company incorporated under Dutch law registered with the Dutch Authority for the Financial Markets (AFM). The ETF is registered with the Central Bank of Ireland, passively managed and tracks an equity index. Investing in the ETF should be interpreted as acquiring shares of the ETF and not the underlying assets.

Investors must read the sales prospectus and key investor information before investing in a fund. These are available in English and the KIIDs/KIDs in certain other languages as applicable and can be obtained free of charge at www.vaneck.com, from the Management Company or from the following local information agents:

Austria - Facility Agent: Erste Bank der oesterreichischen Sparkassen AG

Germany - Facility Agent: VanEck (Europe) GmbH

Spain - Facility Agent: VanEck (Europe) GmbH

Sweden - Paying Agent: Skandinaviska Enskilda Banken AB (publ)

France - Facility Agent: VanEck (Europe) GmbH

Portugal - Paying Agent: BEST – Banco Eletrónico de Serviço Total, S.A.

Luxembourg - Facility Agent: VanEck (Europe) GmbH

All performance information is based on historical data and does not predict future returns. Investing is subject to risk, including the possible loss of principal.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH

Important Disclosure

This is a marketing communication. Please refer to the prospectus of the UCITS and to the KID before making any final investment decisions.

This information originates from VanEck (Europe) GmbH, which has been appointed as distributor of VanEck products in Europe by the Management Company VanEck Asset Management B.V., incorporated under Dutch law and registered with the Dutch Authority for the Financial Markets (AFM). VanEck (Europe) GmbH with registered address at Kreuznacher Str. 30, 60486 Frankfurt, Germany, is a financial services provider regulated by the Federal Financial Supervisory Authority in Germany (BaFin).

The information is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice VanEck (Europe) GmbH, VanEck Switzerland AG, VanEck Securities UK Limited and their associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results. Information provided by third party sources is believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Brokerage or transaction fees may apply.

All performance information is based on historical data and does not predict future returns. Investing is subject to risk, including the possible loss of principal.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH / VanEck Asset Management B.V.

Sign-up for our ETF newsletter

Related Insights

Related Insights

07 January 2019

Investors can bet on future trends. The European ETF market in particular promises enormous growth potential. Special areas such as e-sports, ESG and cryptocurrencies as well as smart beta offer investors interesting investment opportunities.