EM Policy Rates – Asia Catching Up Fast

14 July 2022

Read Time 2 MIN

Aggressive Frontloading of Hikes in EM Asia

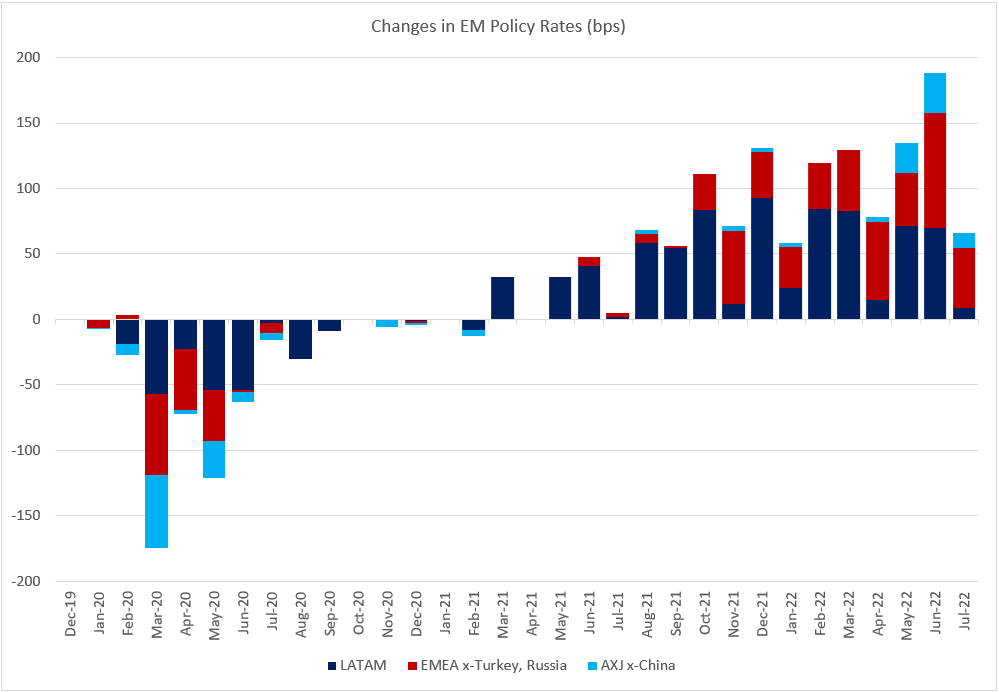

Sometimes it is good to be a latecomer – one can learn from others’ mistakes. It looks like central banks in EM Asia noticed that a proactive response (frontloading of rate hikes) to rising inflation pressures (like in Brazil) is much better than policy procrastination (like in Poland). This definitely explains a wave of inter-meeting tightening in the region. India started the trend with a 40bps “emergency” rate hike back in May. The Philippines surprised yesterday with a sizable 75bps inter-meeting move. And Singapore’s monetary authority followed up with the second off-cycle upward re-centering of its policy band. Asia’s role in emerging markets (EM) overall tightening is getting more prominent these days (see chart below), as some trailblazers like Brazil are gradually winding down their cycles.

Market Expectation of Larger Fed Hikes

Some commentators are wondering whether a greater sense of urgency in EM Asia is related to the market expectation of larger rate hikes in the U.S., following a big upside inflation surprise in June. The Fed Funds Futures now almost fully “digested” a 100bps hike in July, followed by 75bps more in September. One thing that is unchanged is that the U.S. Federal Reserve (Fed) is expected to finish its tightening cycle in December and start cutting rates in 2023 – presumably due to a growing risk of recession. Timely frontloading/liftoff in EM Asia leaves room for a slower pace of rate hikes later on, but it is hard to see tightening cycles in the region be over in 5-6 months (in sync with the Fed).

Some EM Hikes Underwhelm

Today’s “shock and awe” policy move in the Philippines underscores once again that not all rate hikes of the same magnitude are created equal. The central bank of Chile also raised its policy rate by 75bps yesterday, but the market reaction was more like “it could have been worse at +50bps”. It was definitely not enough to stabilize the currency, which opened about 250bps weaker against the U.S. dollar this morning. And the central bank better deliver on its guidance to continue tightening in the coming months. The next important policy milestones in EM are rate-setting meetings in the Czech Republic and Thailand. The Czech National Bank’s departing hawks delivered a super-sized “goodbye” hike in June, and the local swap curve prices in no additional tightening in the next 3 months. Thailand’s central bank meets in August about 1 week after the inflation release – what are the chances of a “mega” 75bps liftoff if headline inflation moves above 8% year-on-year? Stay tuned!

Chart at a Glance: EM Asia - Frontloading Hikes To Avoid Policy Mistakes

Source: VanEck Research; Bloomberg LP

Related Insights

IMPORTANT DEFINITIONS & DISCLOSURES

This material may only be used outside of the United States.

This is not an offer to buy or sell, or a recommendation of any offer to buy or sell any of the securities mentioned herein. Fund holdings will vary. For a complete list of holdings in VanEck Mutual Funds and VanEck ETFs, please visit our website at www.vaneck.com.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Information provided by third-party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as of the date of this communication and are subject to change without notice. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment in any jurisdiction, nor is it a commitment from Van Eck Associates Corporation or its subsidiaries to participate in any transactions in any companies mentioned herein. This content is published in the United States. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed herein.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.