EM - Back to Core Issues

17 April 2023

Read Time 2 MIN

Global Recession Risks

The IMF spring meetings provided a dose of optimism about the global growth outlook, including developed markets (DM). The U.S. economy was deemed more resilient – it might be a sheer coincidence but the U.S. growth forecast for 2023 just got a small upgrade – leaving more room for the U.S. Federal Reserve to hike again in May (the implied probability rose to 85%). As regards other independent global growth drivers, China’s recovery is well underway. China’s Q1 GDP and domestic activity indicators for March (retail sales, industrial production) will be released tonight, and the consensus sees further improvements across the board. Some observers suggested that authorities’ decision to keep the 1-year medium-term lending facility rate unchanged over the weekend (as well as a smaller than expected liquidity injection) was a sign that the growth numbers should look good.

EM Disinflation

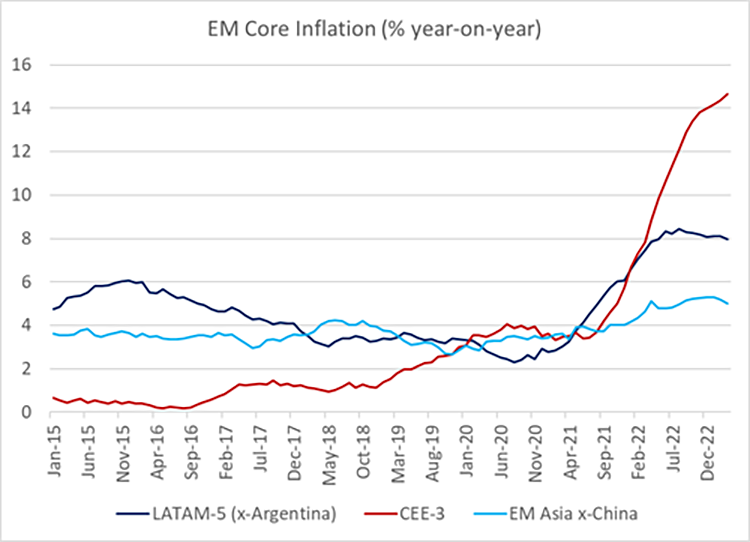

Fewer global growth concerns is a boon to emerging markets (EM), especially to exporters and lower-income economies. The question is whether stronger activity would generate additional price pressures, making it more difficult for various EM central banks to cut rates. Headline disinflation in EM is progressing well – with some notable exceptions like Argentina - but core price pressures are more persistent (see chart below). Today’s core inflation print in Poland – which was above consensus and still accelerating (to 12.3% year-on-year) – is a good example, and our chart shows that this problem is not unique to Central Europe. We think that EMFX strong year-to-date performance – despite market turbulence caused by the mini-banking crisis in DM – should help to alleviate some of these issues going forward. However, we repeatedly heard in country meetings last week that the labor market in many EMs is tight, and it is not uncommon for GDP growth to be above potential. These factors might slow core disinflation, while keeping inflation expectations above central banks’ comfort zone.

EM Rate Cut Prospects

Under these circumstances, the IMF’s message to EMs was clear – do not communicate rate cuts prematurely, and the latest changes in the market expectations show that the message is sinking in. Higher-for-longer real EM rates are not necessarily a bad thing. They provide a safety cushion for EMFX during episodes of market turbulence, and they are also supportive of EM local debt – especially in countries with positive macro and flow stories. Stay tuned!

Chart at a Glance: EM Core Prices – Plateau Rather Than Disinflation

Source: VanEck Research; Bloomberg LP

Related Insights

IMPORTANT DEFINITIONS & DISCLOSURES

This material may only be used outside of the United States.

This is not an offer to buy or sell, or a recommendation of any offer to buy or sell any of the securities mentioned herein. Fund holdings will vary. For a complete list of holdings in VanEck Mutual Funds and VanEck ETFs, please visit our website at www.vaneck.com.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Information provided by third-party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as of the date of this communication and are subject to change without notice. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment in any jurisdiction, nor is it a commitment from Van Eck Associates Corporation or its subsidiaries to participate in any transactions in any companies mentioned herein. This content is published in the United States. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed herein.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.